National Grid Hits out at Regulator's Proposed Limit on Shareholder Returns

December 18 2018 - 3:57AM

Dow Jones News

By Adam Clark

National Grid PLC (NG.LN) said Tuesday that it was

"disappointed" by U.K. regulatory proposals to cut the rate of

return for investments in electricity and gas networks.

Energy regulator Ofgem said it intends to set baseline returns

to shareholders at 4% for the next regulatory period from 2021,

about half of the previous limit. This is at the bottom end of

previous guidance in March, when the regulator said it would

propose a range of between 4% and 6%.

"We want to cut the cost to consumers for accommodating electric

vehicles, renewables and electricity storage, and make sure that

all consumers benefit from these technologies," Jonathan Brearley,

Ofgem executive director for systems and networks, said. "This will

mean driving a harder bargain with network companies to ensure that

households who need it always have access to safe and secure energy

at a fair price."

Ofgem said it expects the change, along with adjustments to

borrowing costs, to save consumers 6.5 billion pounds ($8.2

billion) overall. Ofgem has launched a consultation on the

proposals which will close in the second quarter of 2019.

"The consultation is a very detailed document which we will need

to work through; however we are disappointed with the proposed

financial package, in particular the cost of equity range as we do

not believe it appropriately reflects the level of risk borne by

transmission networks," National Grid said.

National Grid shares at 0813 GMT were down 3.0% at 810.30 pence,

among the worst performers in the FTSE 100.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

December 18, 2018 03:42 ET (08:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

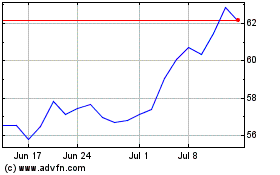

National Grid (NYSE:NGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Grid (NYSE:NGG)

Historical Stock Chart

From Apr 2023 to Apr 2024