Morgan Stanley's Profit Falls but Tops Expectations -- 2nd Update

April 17 2019 - 12:11PM

Dow Jones News

By Liz Hoffman

Morgan Stanley said its first-quarter profit fell 9% from a year

ago, hit by the same trading slump early in the year that hurt

other Wall Street firms.

The bank posted a profit of $2.4 billion, or $1.39 a share, on

revenue of $10.3 billion. Both are lower than the same period a

year earlier, when the firm earned $2.7 billion, or $1.45 a share,

on record quarterly revenue of $11.1 billion.

All three figures were ahead of estimates from analysts polled

by Refinitiv, who had predicted a profit of $1.99 billion, or $1.17

a share, on revenue of $9.93 billion.

Shares rose 2.7% in morning trading. They are down about 18%

from highs last spring.

Morgan Stanley wrapped up a big-banks earnings season that

investors viewed as mostly underwhelming. Big banks such as

JPMorgan Chase & Co. and Bank of America Corp. fared better as

their giant consumer businesses balanced out slower trading and

capital markets activity.

James Gorman, Morgan Stanley's chief executive since 2010, has

rebuilt the firm to be able to do well in all kinds of markets. He

doubled down on wealth management, buying Smith Barney, and fired

25% of bond traders and shed risky assets including real estate and

oil tankers.

Aided by a benign economic backdrop, the effort has mostly

worked, producing steady profits and few of the ugly surprises the

plagued Morgan Stanley in the past.

That makeover was tested in the first quarter, though.

Stock-trading desks were quieted by calm markets. Revenue in

that business, where Morgan Stanley is the largest on Wall Street,

fell 21%, mirroring drops at peers including Goldman Sachs Group

Inc. and JPMorgan.

Merger fees fell 29% as fewer previously announced deals were

completed in the quarter. Morgan Stanley has fallen further behind

rival Goldman in M&A revenue. The gap between the two banks'

trailing-year deal fees has now doubled since late 2017, to $1.5

billion.

Overall, investment-banking revenue, which contributes about 15%

of Morgan Stanley's revenue, fell by one-quarter from a year

earlier.

"There was a little bit of a hangover" from December's market

swoon "and IPO volumes fell off a cliff," Chief Financial Officer

Jonathan Pruzan said in an interview.

He said the firm's pipeline of coming initial public offerings

was healthy. Morgan Stanley has led roles on IPOs for Zoom Video

Communications Inc., which will start trading this week, and Uber

Technologies Inc., expected to hit the markets next month.

The stock-market tumble in late 2018 also shaved tens of

billions of dollars of value off the $1.1 trillion in

wealth-management portfolios on which Morgan Stanley charges flat

fees. Revenue in that business was flat from a year ago, at $4.4

billion.

Asset management, Morgan Stanley's smallest business and one it

has been trying to grow, posted a 12% revenue increase, though

clients pulled about $6 billion in assets.

The firm has been on the hunt for acquisitions, though Mr.

Gorman said Wednesday that he is "not compulsively trying to buy

stuff." Any deal would have to either meaningfully bulk up an

existing business, like its 2010 deal for Smith Barney, or fill a

hole in its existing offering, like a small acquisition in 2018 of

a real-estate investment firm.

"Where we see things that we think are smart and can fit on the

platform, are culturally good fits, we'll go for it," he said.

Return on equity, a closely watched measure of profitability,

was 13.1%, ahead of Mr. Gorman's medium-term top goal of 13%,

though with the help of a lower tax rate.

Morgan Stanley, with a smaller lending book than peers, is less

sensitive to interest-rate surprises and was less rattled by the

Federal Reserve's signals that it wouldn't increase rates this

year. It has been raising deposits and pushing mortgages and other

loans to its wealth-management clients, but is still small in the

lending business. The bank outsources much of its corporate lending

to Mitsubishi UFJ Financial Group, the Japanese bank that is a 20%

shareholder in Morgan Stanley.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

April 17, 2019 11:56 ET (15:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

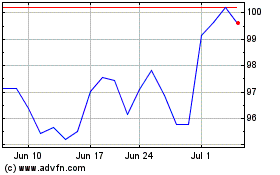

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

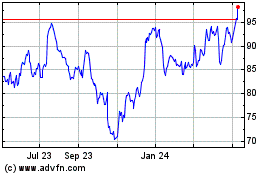

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024