Current Report Filing (8-k)

November 26 2019 - 4:07PM

Edgar (US Regulatory)

false0000912595TN 0000912595 2019-11-26 2019-11-26 0000912595 us-gaap:LimitedPartnerMember 2019-11-26 2019-11-26 0000912595 us-gaap:CommonStockMember 2019-11-26 2019-11-26 0000912595 us-gaap:CumulativePreferredStockMember 2019-11-26 2019-11-26

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 26, 2019

MID-AMERICA APARTMENT COMMUNITIES, INC.

MID-AMERICA APARTMENTS, L.P.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

6815 Poplar Avenue, Suite 500, Germantown, Tennessee

|

|

|

(Address of principal executive offices)

|

|

|

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR 240.14d 2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR 240.13e 4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $.01 per share

(Mid-America

Apartment Communities, Inc.)

|

|

|

|

|

8.50% Series I Cumulative Redeemable Preferred Stock, $.01 par value per share (Mid-America Apartment Communities, Inc.)

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934 (§

240.12b-2

of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

On November 26, 2019,

Mid-America

Apartments, L.P. (the “Operating Partnership”) issued and sold $300 million in aggregate principal amount of its 2.750% Senior Notes due 2030 (the “Notes”). The terms of the Notes are governed by an indenture dated as of May 9, 2017 between the Operating Partnership and U.S. Bank National Association, as trustee, as amended and supplemented by a fourth supplemental indenture dated as of November 26, 2019 (the “Supplemental Indenture”) between the Operating Partnership and U.S. Bank National Association, as trustee.

The Notes bear interest at 2.750% per annum. Interest is payable semi-annually in arrears on each March 15 and September 15, commencing on March 15, 2020. The Notes will mature on March 15, 2030.

At any time prior to December 15, 2029 (three months prior to the maturity date of the Notes), the Operating Partnership will have the right, at its option, to redeem the Notes, in whole or in part, at any time and from time to time, by paying a “make-whole” premium, plus accrued and unpaid interest to, but not including, the date of redemption. In addition, on or after December 15, 2029, the Operating Partnership will have the right, at its option, to redeem the Notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest to, but not including, the date of redemption.

Upon the occurrence of an event of default with respect to the Notes, which includes payment defaults, defaults in the performance of certain covenants, and bankruptcy and insolvency related defaults, the Operating Partnership’s obligations under the Notes may be accelerated, in which case the entire principal amount of the Notes would be immediately due and payable.

The foregoing description of the Notes is qualified in its entirety by the full text of the Supplemental Indenture establishing the terms of the Notes, which is being filed as Exhibit 4.2 to this Current Report on Form

8-K

and is incorporated herein by reference.

|

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover Page Interactive Data File (formatted in Inline eXtensible Business Reporting Language)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MID-AMERICA

APARTMENT COMMUNITIES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Albert M. Campbell, III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

|

|

MID-AMERICA

APARTMENTS, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

By:

Mid-America

Apartment Communities, Inc., its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Albert M. Campbell, III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

|

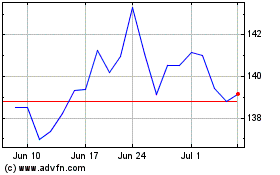

Mid America Apartment Co... (NYSE:MAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

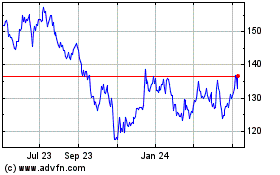

Mid America Apartment Co... (NYSE:MAA)

Historical Stock Chart

From Apr 2023 to Apr 2024