Mesabi Trust Press Release

April 12 2019 - 4:15PM

Business Wire

The Trustees of Mesabi Trust (NYSE: MSB) declared a distribution

of eighty-nine cents ($0.89) per Unit of Beneficial

Interest payable on May 20, 2019 to Mesabi Trust Unitholders of

record at the close of business on April 30, 2019. This

compares to a distribution of forty-five cents ($0.45) per Unit of

Beneficial Interest for the same period last year.

The forty-four cents ($0.44) per Unit increase in the current

distribution, as compared to the same quarter last year, is

primarily attributable to a higher volume of shipments during the

fourth calendar quarter 2018, at higher average iron ore sales

prices, compared to the fourth quarter 2017, and to the Trust’s

receipt of total royalty payments of $12,388,664 on January 30,

2019 from Northshore Mining Company (“Northshore”) which was higher

than the total royalty payments of $6,198,950 received by the Trust

from Northshore during January 2018. The Trust’s announcement today

also reflects the Mesabi Trustees’ determination that Mesabi Trust

presently has sufficient reserves available to make such a

distribution while also maintaining an appropriate level of

unallocated reserve in order for the Trust to be positioned to meet

current and future expenses, and present and future liabilities

(whether fixed or contingent) that may arise in connection with the

current and ongoing challenges in the iron ore and steel industries

generally.

Quarterly royalty payments earned for iron ore shipments made

during the calendar quarter ended March 31, 2019, if any,

payable by Northshore to Mesabi Trust under the royalty agreement,

are due on April 30, 2019, together with the quarterly royalty

report. After receiving the quarterly royalty report, Mesabi

Trust plans to file a summary of the quarterly royalty report with

the Securities and Exchange Commission in a Current Report on Form

8-K.

Other Available

Information

Mesabi Trust’s Annual Report on Form 10-K for the

fiscal year ended January 31, 2019, which includes the

audited financial statements of Mesabi Trust, was filed with the

Securities and Exchange Commission on April 12, 2019. Mesabi

Trust Unitholders may obtain a hard copy of the complete audited

financial statements, which is included as Exhibit 13 to the

Trust’s Annual Report, free of charge upon request to the Trust’s

Corporate Trustee, at:

Mesabi Trustc/o Deutsche Bank Trust Company Americas, Corporate

TrusteeTrust & Securities Services — GDS60 Wall

Street, 16th FloorNew York, NY 10005(904) 271-2520

Unitholders can also directly access the audited financial

statements of Mesabi Trust by navigating to the Mesabi Trust’s

website at www.Mesabi-Trust.com and clicking on the Edgar Filings

(SEC) link under the Menu to the right of the SEC Filings

page by scrolling down to the desired Annual Report on

Form 10-K under Exhibit 13 thereof, beginning on

page F-1 of each such Report.

This press release contains certain forward-looking statements

with respect to iron ore pellet production, iron ore pricing and

adjustments to pricing, shipments by Northshore, royalty (including

bonus royalty) payments, and other matters, which statements are

intended to be made under the safe harbor protections of the

Private Securities Litigation Reform Act of 1995, as amended.

Actual production, prices, price adjustments, and shipments of iron

ore pellets, as well as actual royalty payments (including bonus

royalties) could differ materially from current expectations due to

inherent risks and uncertainties such as general adverse business

and industry economic trends, uncertainties arising from war,

terrorist events and other global events, higher or lower customer

demand for steel and iron ore, volatility of iron ore and steel

prices, decisions by mine operators regarding curtailments or

idling of production lines or entire plants, announcements and

implementation of trade tariffs, environmental compliance

uncertainties, difficulties in obtaining and renewing necessary

operating permits, higher imports of steel and iron ore

substitutes, reduced economic growth in China, processing

difficulties, consolidation and restructuring in the domestic steel

market, price adjustment provisions including indexing features in

Cliffs Pellet Agreements resulting in adjustments to royalties

payable to Mesabi Trust and other factors. Further, substantial

portions of royalties earned by Mesabi Trust are based on estimated

prices that are subject to quarterly and final adjustments, which

can be positive or negative, and are dependent in part on multiple

price and inflation index factors under agreements to which Mesabi

Trust is not a party and that are not known until after the end of

a contract year. Although the Mesabi Trustees believe that any such

forward-looking statements are based on reasonable assumptions,

such statements are subject to risks and uncertainties, which could

cause actual results to differ materially. Additional information

concerning these and other risks and uncertainties is contained in

the Trust’s filings with the Securities and Exchange Commission,

including those described under the caption “Risk Factors” in its

Annual Report on Form 10-K. Mesabi Trust undertakes no obligation

to publicly update or revise any of the forward-looking statements

made herein to reflect events or circumstances after the date

hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190412005388/en/

Mesabi Trust SHR UnitDeutsche Bank Trust Company

Americas904-271-2520

Mesabi (NYSE:MSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

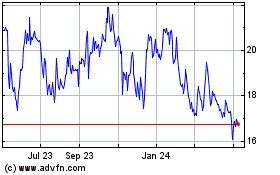

Mesabi (NYSE:MSB)

Historical Stock Chart

From Apr 2023 to Apr 2024