Big Drugmakers Warn About Coronavirus Impact on Business

March 01 2020 - 11:29AM

Dow Jones News

By Jared S. Hopkins

Some of the world's biggest drugmakers have begun warning that

their businesses could be affected by the spread of the

coronavirus.

AstraZeneca PLC, Merck & Co. and Pfizer Inc. are among the

companies that said recently the epidemic could affect supplies for

certain drugs or sales, depending on how long the epidemic

lasts.

To get ahead of any disruptions to supplies from China, some

pharmaceutical companies have begun looking for alternative sources

of drug ingredients and supplies, according to industry officials

and experts.

Drugmakers have begun discussing the potential impact after

saying for weeks they were monitoring their distribution lines and

had sufficient supply. Companies typically avoid discussing their

supply chains, but they have been under pressure from Wall Street

to provide more information as the epidemic spreads, especially

since it started in China, a major source of drug ingredients and a

fast-growing market for medicines.

"Our whole industry is in one way or other way connected with

China, but you would expect us to be much better placed," Mylan NV

President Rajiv Malik said Thursday on a conference call with

analysts and investors.

Some Mylan products could be in short supply if "the situation

persists" for another few months, Mr. Malik said. He said Mylan's

top 25 products don't depend on China, however, and expressed

confidence in the company's ability to employ alternative sources

for drug ingredients.

Pfizer said in a filing on Thursday that the virus could hurt

its operations, including manufacturing and supply chain, and could

negatively impact its financial results but that it depends on

future developments of the outbreak.

Pfizer said the majority of its products and raw materials are

sourced from countries besides China, but some does come from

China, though the company said it hasn't seen a disruption to

supplies so far.

Teva Pharmaceutical Industries Ltd. bases its manufacturing

network for its drug ingredients, known as active pharmaceutical

ingredients or API, out of Europe and India, not China, according

to Chief Executive Kare Schultz.

"We do use some raw materials and APIs that come out of China

[but] in some cases we have dual supply so if we can't get

materials from China we can get them from somewhere else," he said

in a recent interview.

The threat that the novel coronavirus poses for prescriptions

has renewed a cause for concern because of China's role as a big

supplier of drug ingredients.

"There is no such thing as a simple supply chain anymore," said

Steven Lynn, a former FDA official who consults with drugmakers on

quality and compliance. "Things are coming from all over the world.

If one part of that breaks down, then you're scrambling."

The Food and Drug Administration said Thursday a drug has gone

into shortage because of difficulties obtaining an ingredient from

a site affected by the coronavirus. It didn't disclose which drug

or its manufacturer.

How much multinational drugmakers depend on China-sourced

ingredients is unclear. Policy makers often cite a figure that 80%

of drug materials are imported overseas, but the FDA said it can't

track how much is from China.

China has also emerged in recent years as one of the biggest

markets for some major drugmakers. Drug sales in China totaled $137

billion in 2018, and are expected to rise 3% to 6% annually for the

next several years, according to health-care data firm Iqvia.

AstraZeneca generated 21% of its sales in China last year.

Releasing its forecast for 2020 performance, the company said last

month it expects an unfavorable impact from a slower China business

lasting up to a few months due to the novel coronavirus.

Merck said in a securities filing Wednesday its first-quarter

sales will suffer due to the epidemic in China, although not enough

to be material. It said it was unclear if the outbreak will affect

sales for the rest of the year.

Merck also said the epidemic has had a limited effect on its

supplies of raw materials coming from China and ability to ship

medicines into the country.

Joseph Walker and Denise Roland contributed to this article

Write to Jared S. Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

March 01, 2020 11:14 ET (16:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

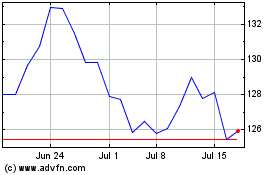

Merck (NYSE:MRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Merck (NYSE:MRK)

Historical Stock Chart

From Apr 2023 to Apr 2024