UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

|

|

Filed by the Registrant

Filed by the Registrant

|

|

☐ Filed by a Party other than the Registrant

|

|

|

|

|

|

Check the appropriate box:

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY

RULE 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

|

(5) Total fee paid:

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

(3) Filing Party:

|

|

|

|

(4) Date Filed:

|

July 29, 2020 8:30 a.m. Central Daylight

Time www.virtualshareholdermeeting.com/MCK2020 McKesson Corporation 2020 Annual Meeting of Shareholders

McKesson Appreciates Your Investment and

Requests Your Support at Our 2020 Annual Meeting of Shareholders 1. Election of 11 Directors for a One-Year Term 2. Ratification of Appointment of the Independent Registered Public Accounting Firm 3. Non-Binding Advisory Vote on Executive

Compensation 4. Shareholder Proposal on Action by Written Consent of Shareholders 5. Shareholder Proposal on Lobbying Activities and Expenditures Items Your Board’s Recommendation FOR FOR FOR AGAINST AGAINST 6. Shareholder Proposal on Business

Roundtable Statement of Purpose of a Corporation AGAINST

Our vision is to improve patient care in

every setting — one product, one partner, one patient at a time McKesson At a Glance Delivering 1/3 of all prescription medicines in North America #1 distributor in community oncology and key specialties 275,000+ SKUs of brand and private

label medical-surgical supplies >12,000 owned and banner pharmacies across Canada and Europe 76,000+ patients enrolled in over 1,600 clinical trials Support 1/3 of all cancer therapies through US Oncology Research More than 150 biopharma

customers served Support over 90% of therapeutic areas Over 400 drug copay and voucher patient savings programs supported 18B+ annual pharmacy transactions processed through RelayHealth Integrated with 700,000+ providers to initiate prior

authorization at point of prescribing Connected to payers representing 94% of U.S. prescription volume Distribution Scale Superior Specialty Assets Manufacturer Services Technology Differentiation

Over the past year, our management team has

made substantial progress on our strategic growth initiatives, which are focused on creating innovative solutions that improve patient care delivery and drive incremental profit growth Gaining Momentum Through Execution Expanded capabilities to

bring them more cohesively into an integrated value proposition for manufacturers Grow our position in future retail and dispensing models Manufacturer Value Proposition Differentiated array of assets with many capabilities Specialty Future Retail

Models Supported by data and analytics capabilities and fueled by enterprise cost savings Our FY20 results, achieved during Brian Tyler’s first year as CEO, highlight our year-over-year growth throughout FY20, and demonstrate that the actions

we have taken have put us on a path to capitalize on future growth opportunities Total revenues of $231.1 billion, reflecting 8% growth Double-digit percentage increase in adjusted earnings per diluted share Strong cash flow performance

Tax-efficient exit from Change Healthcare Signed agreement to create a German pharmaceutical wholesale JV with Walgreens Boots Alliance Selected by the U.S. Department of Veterans Affairs to continue as prime pharmaceutical provider FY 2020

Highlights* *McKesson’s fiscal year ends March 31. Please see Appendix A to McKesson’s 2020 Proxy Statement for an explanation of non-GAAP measures and a reconciliation to GAAP.

As one of the world’s largest

healthcare companies, we have a critical role to play in making medications and supplies available to customers and patients when they need them COVID-19 Response Efforts: Taking Action For Our Stakeholders Trusted Partner Coordinating with the U.S.

Department of Health and Human Services and the Federal Emergency Management Agency of the U.S. Department of Homeland Security in their sourcing and distribution efforts to expedite the shipment and delivery of personal protective equipment (PPE)

and other critical supplies into the U.S. Pharmaceutical Supply Chain Coordinating closely with federal and state agencies in North America and Europe to optimize and expedite sourcing opportunities, and to move products to the front lines of the

fight against the pandemic Medical Supplies Proactive approach to managing inventory and helping our provider partners to obtain needed supplies and medications Actively working with manufacturers, suppliers, industry partners and government

agencies to anticipate shortages and respond to unprecedented demand for supplies, such as PPE Protecting Team McKesson Supporting employees by undertaking measures to provide access to care, including expanded leave policies, telemedicine and

wellness offerings, and expanding our “Taking Care of Our Own Fund” to help with expenses such as childcare, groceries, housing and utilities Awarded ~$30M in special one-time bonus payments to recognize frontline workers and other

non-bonus eligible employees Efforts reflect a $45 million total investment to date Supporting Our Communities Committed $3M to local food banks across the country in communities that McKesson calls home, that have the highest number of

food-insecure people, and where communities of color have been disproportionately hit hardest by COVID-19 The McKesson Foundation will make a $1M investment to fight racism and injustice through the NAACP Legal Defense and Educational Fund,

America’s premier legal organization fighting for criminal and economic justice, education and political participation

We have a strong track record of

shareholder engagement and responsiveness Shareholder Engagement Program We are committed to ensuring shareholder input is integrated into our compensation program and practices Held extensive dialogue with shareholders following a disappointing

level of support for our 2019 say-on-pay proposal in order to understand what actions could be taken to address our shareholders’ concerns Proactively reached out to shareholders representing ~66% of outstanding shares; engaged with

shareholders representing ~50% of outstanding shares Compensation Committee Chair led engagements with shareholders representing ~29% of outstanding shares in order to identify and discuss executive compensation matters Many shareholders reacted

positively to the FY 2020 compensation program changes, which were previewed in last year’s proxy statement Significant driver for votes cast against our 2019 say-on-pay proposal was a lack of support for the separation provisions in our

former CEO’s legacy employment agreement No actively employed participants in supplemental pension plan No current executive officer has an employment agreement Robust Year-Round Engagement Process * Please see pages 11, 35, 37 and 38 of

McKesson’s 2020 Proxy Statement for additional information on compensation changes in response to shareholder feedback.

Topics of Shareholder Concern Changes

Discussed with Shareholders in FY 2020 Executive Compensation Supplemental pension benefits are overly generous No actively employed participants in the Company’s supplemental pension plan General disfavor for legacy employment agreements None

of our current executive officers has an employment agreement and the Company no longer enters into executive employment agreements General disfavor for perquisites CEO assuming the costs of ongoing security monitoring beginning with FY 2021

Clawback policy should be further enhanced Approving adoption of “reputational harm” as a new potential trigger under our Compensation Recoupment Policy Long-term incentive (LTI) program is overly complex Simplifying the LTI program by

discontinuing the use of stock options and the long-term cash incentive, instead using time-based RSUs (40%) and PSUs (60%) Excise tax gross-ups are overly generous to executives Eliminating excise tax gross-ups Corporate Governance Maintaining

board diversity after Chris Jacobs and Marie Knowles indicated they will be leaving the Board no later than the 2021 Annual Meeting Appointing Maria Martinez to the Board in October 2019 and continuing to pay close attention to Board diversity

Planning to implement a modified tenure policy by 2022, which will require continual board refreshment and succession planning Sustainability and HCM Disclosure on the Company’s approach to ESG risk oversight and human capital management

oversight Expanding disclosure on oversight of ESG matters, including how the Board oversees human capital management We report shareholder feedback to our Board on a regular basis, and as a result, we have implemented several enhancements to our

compensation program and governance practices Proactive Response to Shareholder Feedback

Pay Element FY 2020 Metric Weight Rationale

Base Salary -- -- Attracts and retains high-performing executives by providing market-competitive fixed pay Management Incentive Plan Adjusted EPS 50% Rewards operational performance and bottom line profitability; important driver of share price

valuation and shareholder expectations Adjusted Operating Profit 25% Rewards focus on operational performance and profitability Free Cash Flow 25% Rewards generating cash to invest in growth and return capital to shareholders; important valuation

metric Performance Stock Units (60% of LTI) 3-Year Cumulative Adjusted EPS 50% Measures long-term earnings power, drives returns for the Company and directly correlates to share price performance 3-Year Average ROIC 25% Encourages leaders to make

sound investments that generate strong returns for shareholders MCK TSR vs. Comparator Group 25% Rewards share price performance relative to comparator group over time Restricted Stock Units (40% of LTI) -- -- Directly aligns with value delivered to

shareholders The Compensation Committee made several changes to our executive compensation program last year to ensure the structure aligns pay with performance, drives long-term value creation and reflects the views of our shareholders Compensation

Program Simplified for FY 2020 Indicates FY 2020 change. Annual Cash Incentive ADDED Adjusted Operating Profit REPLACED Adjusted OCF with Free Cash Flow Long-Term Incentives ELIMINATED Stock Options ELIMINATED Cash LTIP ADDED Three-year ratable

vesting RSUs Changes Made to FY 2020 Compensation Program * * * *

Edward A. Mueller (Independent Chair)

Retired Chairman of the Board and Chief Executive Officer, Qwest Communications International Inc. Our directors’ diverse backgrounds contribute to an effective and well-balanced Board that is able to provide valuable insight to, and effective

oversight of, our senior executive team and the execution of our strategy Robust, Independent Board Oversight Brian S. Tyler (Chief Executive Officer) Chief Executive Officer, McKesson Corporation Dominic J. Caruso Retired Executive Vice President

and Chief Financial Officer, Johnson & Johnson N. Anthony Coles, M.D. Chairman and Chief Executive Officer, Cerevel Therapeutics, LLC M. Christine Jacobs Retired Chairman of the Board, President and Chief Executive Officer, Theragenics

Corporation Marie L. Knowles Retired Executive Vice President and Chief Financial Officer, Atlantic Ritchfield Company Bradley E. Lerman Senior Vice President, General Counsel and Corporate Secretary, Medtronic plc Maria Martinez Executive Vice

President and Chief Customer Experience Officer, Cisco Systems, Inc. Kenneth E. Washington Chief Technology Officer, Ford Motor Company Susan R. Salka Chief Executive Officer and President, AMN Healthcare Services, Inc. Donald R. Knauss Retired

Executive Chairman of the Board, The Clorox Company

Breadth of Director Skills Balance of

Diverse Perspectives and Experience Our Directors Have a Robust Mix of Skills and Experiences, and Diverse Perspectives Average Director Tenure 6.5 years After our two longest-serving directors, Christine Jacobs and Marie Knowles, indicated that

they intend to complete their service on the Board no later than the 2021 Annual Meeting, we appointed Ken Washington in July 2019 and Maria Martinez in October 2019 to the Board We continue to pay close attention to Board diversity in terms of

gender, ethnicity and skill, among other categories 11 Senior Executive Leadership Other Public Company Board Service (Prior or Current) Business Transformation / M&A Financial / Accounting Healthcare Industry Experience 7 10 8 6 Distribution /

Supply Chain Experience 7 Risk Management and Compliance 7 Cybersecurity / Technology 4 Global / International Experience 7 Marketing / Public Relations / Communications 6

We are committed to continually

assessing our governance policies and structures to incorporate best practices Strong Corporate Governance Practices Key Features of Our Corporate Governance Practices Shareholder Rights Annual elections Majority voting for elections Right to call

special meeting of shareholders (15%) Proxy access No supermajority vote provisions Board of Directors Independent board chair Commitment to adopt director tenure policy by 2022 10 of 11 director nominees are independent Corporate Governance Pay for

performance alignment Enhanced lobbying policy and disclosure Robust senior management succession planning process No poison pill

Our Board and its committees play an

instrumental role in overseeing enterprise risks such as risks related to strategy and reputation, financial reporting, compensation practices, cybersecurity and distribution of controlled substances Board Oversight of Risk Management Committee

Roles in Risk Oversight Audit Committee Assists Board in monitoring integrity of financial statements, independent auditor’s qualifications, independence and performance, performance of the Company’s internal audit function Coordinates

with Compliance Committee in monitoring compliance with legal and regulatory requirements Governance Committee Oversees evaluation of the Board’s performance, Board composition, refreshment and committee leadership Evaluates governance

practices and monitors shareholder feedback Compliance Committee Assists in oversight of compliance programs and management’s evaluation of the Company’s principal legal and regulatory compliance risks Coordinates with Audit Committee in

monitoring compliance with legal and regulatory requirements and the Compensation Committee in incorporating consideration of compliance with laws into compensation decisions Finance Committee Oversees risk assessment and management processes

related to, among other things, credit, capital structure, liquidity and insurance programs Assists Board in oversight of the financial aspects of significant acquisitions and divestitures and other significant transactions of a financial nature

Compensation Committee Oversees risk assessment and management with respect to the Company’s compensation policies and practices

A Culture of Compliance In 2019, our

Board formed a standing Compliance Committee to assist in overseeing the Company’s compliance programs and management’s identification and evaluation of its principal legal and regulatory compliance risks. Recognizing the critical role

fresh perspectives and expertise play in risk oversight, our Board has committed to: Controlled Substance Monitoring Program Highlights* Board Oversight of Compliance Risks 75% of Compliance Committee members who are independent directors and joined

the Board after January 1, 2018 50%+ of Compliance Committee members who have relevant experience in law, compliance, regulatory or government affairs, or healthcare experience Experienced CSMP team Our CSMP team is comprised of >40 diversion and

subject-matter experts with 215+ years of cumulative DEA enforcement experience, including pharmacists, state and local investigators and experts in the retail pharmacy industry, pharmaceutical manufacturing and data analytics Thorough customer due

diligence and ongoing oversight We perform comprehensive analyses on prospective customers before agreeing to supply prescription medications. Process includes gathering specific pharmacy information and validating federal and state regulatory

licensure Advanced customer purchasing analysis Developed system to identify suspicious orders, which establishes the customer’s threshold that limits the quantity of controlled substances a customer may order within a specified period;

analyzes data including customer-specific information and business trends, blocking orders when certain thresholds are met Regular ARCOS reporting We report transactions to the DEA via the DEA's automated ARCOS drug reporting system, which allows

the DEA to monitor the flow of controlled substances from the point of manufacture through commercial distribution channels to the point of sale or pharmaceutical distribution Commitment to Strong Oversight and Compliance Processes Our Board of

Directors is committed to maintaining strong oversight and compliance processes, including forming a Compliance Committee, requiring the Chair of the Audit Committee to serve on the Compliance Committee and creating a dedicated Chief Compliance

Officer position with comprehensive focus on compliance matters across the enterprise * Please see pages 6 and 7 of McKesson’s 2020 Proxy Statement for additional highlights and other information.

New Leadership’s Focus on Winning

As One Team Last year, Brian Tyler launched the Team McKesson corporate culture initiative Focused on being open and candid, how to debate, decide and commit when making decisions within and across business units and the importance of maintaining an

enterprise first mindset Brian personally deployed a multi-month Behavior Sprints campaign for McKesson’s top 600 leaders to learn and practice critical workplace behaviors Team leaders are expected to consistently demonstrate and share these

important behaviors with their respective teams on an ongoing basis Continued and refreshed commitment to our ICARE and ILEAD shared values Our CEO is at the forefront of our Company’s culture initiatives focused on winning as one team and

setting a clear expectation to always do the right thing The Board plays a key role in the oversight of the Company’s culture, setting the tone at the top and holding management accountable for maintaining policies and practices that encourage

ethical and compliant conduct Integrity Customer first Accountability Respect Excellence Inspire Leverage Execute Advance Develop FY 2020 Culture Initiatives

100% on the Human Rights

Campaign’s Corporate Equality Index (of LGBTQ workplace equality) in 2020 Recognized as one of the best employers for diversity by Forbes in 2020 Named as one of the best places to work by the Disability Equality Index® in 2019 Recognized

as a Military Friendly® Employer in 2020 Women and people of color comprise over 50% of our Board of Directors Leveraged headquarters relocation from California to Texas to increase diverse representation for women and people of color in

critical management positions We work to create and maintain an inclusive environment where everyone brings their authentic self to work and enjoys great employee experiences at every touchpoint Inclusion, Diversity, Equality and Culture Source:

McKesson’s Fiscal 2019 Corporate Responsibility Report. Inclusion & Diversity Highlights Our Board of Directors oversees and leads initiatives to integrate inclusion and diversity and pay equity into the Company's business

principles

Establishing new environmental best

practices is a priority across our businesses; we work to capture the metrics most relevant to our lines of business and act on recommendations that lead to a healthier environment Focus on Corporate Responsibility Embracing Sustainability Practices

Increase LED lighting at facilities across the globe Monitor and benchmark energy use Pursue environmental certifications and minimize carbon footprint Reduce movement of inventory through our redistribution center model Recycle and reuse resources

in corporate and warehouse settings Our corporate responsibility strategy focuses on how our business affects society and the environment. We look at each part of the supply chain. 1 2 3 4 5

Item #4: Shareholder Proposal on Action

by Written Consent of Shareholders Given our existing governance structures, which provide shareholders with other effective means to express their views, the Board believes that implementation of this proposal is unnecessary and may deprive

shareholders of the protections afforded by a special meeting We allow shareholders owning 15% or more of shares outstanding to call a special meeting Following our 2018 Annual Meeting of Shareholders, as a response to shareholder feedback, the

Board amended our By-Laws to decrease the ownership threshold required to call a special meeting from 25% to 15% in May 2019 We have demonstrated a commitment to corporate governance best practices and provide shareholders with other effective means

to express their views The Company has a track record of continually evaluating and enhancing its governance practices, including: The adoption of an independent chair structure in 2018 Proxy access rights for our shareholders since 2015 Our

commitment to shareholder engagement and board refreshment Our shareholders have expressed that the right of shareholders to act by written consent is not warranted Our shareholders considered, and rejected, the right to act by written consent on

multiple occasions, including at McKesson’s 2017, 2014 and 2013 Annual Meetings of Shareholders These voting results are consistent with feedback we received directly from a number of shareholders during our engagements YOUR BOARD RECOMMENDS A

VOTE AGAINST ITEM #4

Item #5: Shareholder Proposal on

Lobbying Activities and Expenditures McKesson refined its policy in 2017, 2018, 2019 and 2020, with recent enhancements focused on controlled substances This year, we further enhanced our political contributions and lobbying policy(1): Clarified

that the Board’s oversight includes lobbying efforts and expenditures related to the distribution of controlled substances The Board committed to disclosing the aggregate dollars spent on lobbying activities, policy priorities and material

lobbying efforts in the year, including with respect to laws or regulations governing the distribution of controlled substances Our political engagement policies and robust protocols help ensure political activities are aligned with the

Company’s priorities Our Board provides rigorous oversight of the Company’s political activities Our SVP of Public Affairs provides quarterly updates to the Board on policy issues and political engagements and reports annually on

lobbying activities and corporate political contributions We disclose significant details about our political activities and expenditures, including with respect to trade associations We disclose our policy priorities, processes to align

expenditures with our priorities, and our criteria for evaluating trade associations We are fully compliant with federal and state registration and reporting laws in all jurisdictions where we are active We disclose our memberships in health policy,

industry and trade organizations where our annual payments exceed $50,000 YOUR BOARD RECOMMENDS A VOTE AGAINST ITEM #5 A copy of the policy is available at www.mckesson.com/about-mckesson/public-affairs/political-engagement/ McKesson has refined its

political engagement and lobbying policy in direct response to shareholder feedback every year since 2017 and already discloses significant information on our political contributions and lobbying activities

Our Board reviewed our disclosures and

concluded that they already demonstrate close alignment with the BRT Statement The Board concluded no amendments to our governance and management systems are needed based on the robust nature of the Company’s public disclosures regarding its

practices and commitment to stakeholders as well as its focus on the key areas outlined in the BRT Statement During a regular review of shareholder feedback reported to the Board, management informed the Board that no parties, other than the

proponent, have requested a Board review or report on the BRT Statement YOUR BOARD RECOMMENDS A VOTE AGAINST ITEM #6 Item #6: Shareholder Proposal on BRT Statement of Purpose of a Corporation We endorsed the BRT Statement because it aptly expresses

McKesson’s mission and values. Our Board of Directors oversees the long-term performance and sustainability(1) of our Company for the benefit of all our stakeholders, while continuously creating value for our shareholders Our governance and

management systems already closely align with the BRT Statement and our ICARE (integrity, customer-first, accountability, respect and excellence) principles: For additional information on how our mission and values inform our business practices, see

www.mckesson.com/About-McKesson/Corporate-Citizenship. Supporting the communities in which we work Generating long-term value for shareholders Investing in our employees Dealing fairly and ethically with our suppliers Delivering value to our

customers We operate in accordance with the principles outlined in the Business Roundtable Statement Our multi-faceted response efforts to help support our employees and minimize supply chain disruption during the ongoing COVID-19 global health

crisis reflects our ongoing commitment to our employees, customers, suppliers and local communities Our commitment to all our stakeholders is discussed throughout our proxy statement, on our Corporate Citizenship website, and in our 2019 Corporate

Responsibility Report

McKesson Appreciates Your Investment and

Requests Your Support at Our 2020 Annual Meeting of Shareholders 1. Election of 11 Directors for a One-Year Term 2. Ratification of Appointment of the Independent Registered Public Accounting Firm 3. Non-Binding Advisory Vote on Executive

Compensation 4. Shareholder Proposal on Action by Written Consent of Shareholders 5. Shareholder Proposal on Lobbying Activities and Expenditures Items Your Board’s Recommendation FOR FOR FOR AGAINST AGAINST 6. Shareholder Proposal on Business

Roundtable Statement of Purpose of a Corporation AGAINST

2 The information contained in this

presentation is being provided to shareholders in addition to the proxy statement filed by McKesson Corporation (the “Company”) with the Securities and Exchange Commission (the “SEC”) on June 18, 2020. Please read the

complete proxy statement and accompanying materials carefully before you make a voting decision. Even if voting instructions for your proxy have already been given, you can change your vote at any time before the annual meeting by giving new voting

instructions as described in more detail in the proxy statement. The proxy statement, and any other documents filed by the Company with the SEC, may be obtained free of charge at www.sec.gov and from the Company’s website at

www.investor.mckesson.com under the “SEC Filings” tab. Website addresses and hyperlinks are included for reference only and are not deemed incorporated by reference. Cautionary Statements Except for historical information contained in

this presentation, matters discussed may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that involve risks and uncertainties

that could cause actual results to differ materially from those in those statements. It is not possible to identify all such risks and uncertainties. The reader should not place undue reliance on forward-looking statements, such as financial

performance forecasts, which speak only as of the date they are first made. Except to the extent required by law, the company undertakes no obligation to publicly update forward-looking statements. Forward-looking statements may be identified by

their use of terminology such as “believes”, “expects”, “anticipates”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”,

“plans”, “estimates” or the negative of these words or other comparable terminology. The discussion of financial trends, strategy, plans, assumptions or intentions may also include forward-looking statements. We encourage

investors to read the important risk factors described in the Company’s Form 10-K, Form 10-Q and Form 8-K reports filed with the SEC. GAAP / Non-GAAP Reconciliation In an effort to provide additional and useful information regarding the

Company’s financial results and other financial information as determined by generally accepted accounting principles (GAAP), certain materials in this presentation include non-GAAP information. The Company believes the presentation of

non-GAAP measures provides useful supplemental information to investors with regard to its operating performance as well as comparability of financial results period-over-period. A reconciliation of the non-GAAP information to GAAP, and other

related information is available in the appendix to the Company’s proxy statement, tables accompanying each period’s earnings press release and materials furnished to the SEC, and posted to www.investor.mckesson.com.

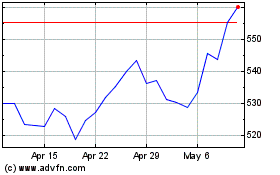

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

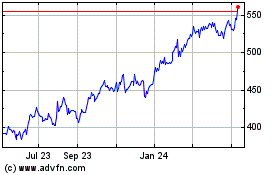

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024