|

2150 Kittredge St. Suite 450

|

www.asyousow.org

|

|

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992

|

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: McKesson Corporation (MCK)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: 2150 Kittredge St. Suite 450, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under

the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

McKesson Corporation (MCK)

Vote Yes: Item #6 – Shareholder Proposal on Statement of a Purpose of a Corporation

Annual Meeting: July 29, 2020

CONTACT: Andrew Behar | abehar@asyousow.org

THE RESOLUTION

Shareholders request our Board review the BRT Statement of the Purpose of

a Corporation signed by our Chairman and Chief Executive Officer and prepare a report discussing options as to how our Company’s

governance and management systems can be altered to better align with the Statement of Purpose. The report may include the Board’s

perspective on benefits and drawbacks if the options considered as well as the Board’s recommendations.

SUMMARY OF THE RESOLUTION

"The Business Roundtable’s statement was a significant

step in the right direction. But for those who signed—and, by extension, for all American corporations—now comes the

hard part: turning this vision into something measurably meaningful."1

The Proposal requests our board of directors, acting as responsible fiduciaries,

conduct a comprehensive review of McKesson Corporation’s implementation of the Business Roundtable Statement of Purpose of

the Corporation signed by our Chairman and Chief Executive Officer, and provide the board’s perspective regarding how our

Company’s governance and management systems should be altered to fully implement the Statement of Purpose. Implementation

may include, at Board discretion, actions including amending the bylaws or articles of incorporation to integrate the new “Purpose,”

establishing new goals or metrics linked to executive or board compensation, providing for representation of stakeholders in governance

of our Company and making recommendations to shareholders regarding logistics for implementation.

_____________________________

1 Tang, Kelly and Wartzman, Rick,

"The Business Roundtable’s Model of Capitalism Does Pay Off," Wsj.com. Oct. 27, 2019. https://www.wsj.com/articles/the-business-roundtables-model-of-capitalism-does-pay-off-11572228120

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

SUPPORT FOR THIS RESOLUTION

IS WARRANTED BECAUSE:

|

|

1.

|

Shareholders require a better understanding, along with other stakeholders, as to the procedures and principles under which

the company will make trade-offs between its stakeholders. Among other things, shareholders need to understand where they “stand

in line” among the firm’s stakeholders.

|

|

|

2.

|

By failing to align with the Statement, McKesson’s actions will continue to expose the

company to regulatory, financial, and legal risks. Recently the Company entered into a $175 million settlement with investors

for failing provide proper oversight of its opioid distribution systems. Additionally, the Company is involved in talks along with

other opioid distributors and manufacturers to settle thousands of ongoing cases of court to the tune of $50 billion. On top of

this, since 1995, McKesson has engaged in 39 legal cases of misconduct (10 ongoing) resulting in over $2.2 billion in legal settlements.2

|

|

|

3.

|

McKesson is exposed to reputational risks as consumer demand for lowered healthcare costs increases. In contrast with

consumer sentiment for more affordable generic drugs, McKesson has been under recent public scrutiny for its alleged involvement

in price-fixing and market-allocation agreements resulting in higher generic-drug prices. McKesson has been a target of prior price-fixing

litigation, causing healthcare consumers to overpay for drugs by billions of dollars.3

|

|

|

4.

|

The Company’s commitment to its stakeholders

is being tested in the pandemic environment. The current pandemic and recovery process elevate the importance of procedures

and principles for transparency and accountability of trade-offs between stakeholders, stockholders, executives and the long-term

viability of the company. The limited responses of federal level health and economic relief and recovery efforts are placing increased

onus on our Company to operate in the highest ethical and transparent manner. Clear principles and processes would safeguard public

perception and shareholder confidence.

|

RESPONSE TO COMPANY OPPOSITION

STATEMENT

The opposition statement by the Company says that the Board has carefully

considered the proposal and believes that the Company already operates in accordance with principles and commitments consistent

with the Business Roundtable’s “Statement on the Purpose of a Corporation” (the “BRT Statement”)

as well as the Company’s own ICARE principles, and that no changes to the Company’s existing governance and management

systems are required. Yet in practice, as set forth below, these policies and practices have led to numerous misalignments with

stakeholder interests. Moreover, it is unclear where shareholders stand in line with other stakeholders, without clarifying amendments

to corporate governance.

_____________________________

2 https://www.contractormisconduct.org/contractors/39/mckesson

3 “Average Wholesale Price (AWP)

Lawsuit: Federal Contractor Misconduct Database.” Pogo.org. www.contractormisconduct.org/misconduct/775/mckesson-awp-first-databank-lawsuits-average-wholesale-price-awp-lawsuit.

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

1. Shareholders require a better

understanding, along with other stakeholders, as to the procedures and principles under which the company will make trade-offs

between its stakeholders.

The Business Roundtable Statement of the Purpose of the Corporation issued

in August 2019 and signed by the CEO of our company, implies a corporate commitment to all the company’s stakeholders, not

just to the stockholders. The statement notes:

While each of our individual companies serves its own corporate purpose, we

share a fundamental commitment to all of our stakeholders.

For instance, the Statement commits companies to “Investing in our

employees. This starts with compensating them fairly and providing important benefits.” It further commits companies

to “Supporting the communities in which we work. We respect the people in our communities and protect the environment

by embracing sustainable practices across our businesses.”

The Business Roundtable’s Statement is touted by the endorsers and materials

accompanying it as going “beyond shareholder primacy.” As such, our CEO’s sign-on to the Statement raises very

important questions for the Company, the board, and its shareholders. To what degree is the corporation responsible to its stakeholders,

beyond its investors? How will it balance these interests and commitments? Is commitment to all the equivalent of accountability

to “none?”

Our Company’s existing governance documents evolved in an environment

of shareholder primacy, but the Statement articulates a new purpose, “mov[ing] away from shareholder primacy,” and

includes commitment to all stakeholders. The Statement, as company policy, may conflict with Delaware law unless integrated into

Company governance documents, including bylaws, Articles of Incorporation, and/or Committee Charters.

By moving away from shareholder primacy, corporations can not only maintain

positive returns for investors, but they can also create a positive impact in society at large. According to McKinsey:

“You can’t create

long-term value by ignoring the needs of your customers, suppliers, and employees. Investing for sustainable growth should and

often does result in stronger economies, higher living standards, and more opportunities for individuals. It should not be surprising,

then, that value-creating capitalism has served to catalyze progress, whether by lifting millions of people out of poverty, contributing

to higher literacy rates, or fostering innovations that improve quality of life and lengthen life expectancy.”4

_____________________________

4 Goedhart, Marc and Koller, Tim,

“The value of value creation,” Mckinsey.com. June 16, 2020. https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-value-of-value-creation?cid=other-eml-alt-mcq-mck&hlkid=5dbb392c6edf468d9cc1f5626e46033a&hctky=11241239&hdpid=0f456427-c440-4f58-8f7b-c7f7eee356b8

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

The potential clash between the practical application of the commitments in

the Statement to “all stakeholders” and the Company’s governance documents and practices rooted in shareholder

primacy trigger a need for review and consideration by the Board. Shareholders have a right to understand how the members of the

Board will approach implementing these new commitments, while maintaining their legal and fiduciary duties to shareholders.

McKinsey sums up the need for corporations to develop a deeper understanding

of value creation in a business environment that demands a long-term approach:

“Particularly at this

time of reflection on the virtues and vices of capitalism, we believe it’s critical that managers and board directors have

a clear understanding of what value creation means. For today’s value-minded executives, creating value cannot be limited

to simply maximizing today’s share price. Rather, the evidence points to a better objective: maximizing a company’s

value to its shareholders, now and in the future.”5

In addition to signing the Business Roundtable Statement, our Company claims

to adhere to our existing set of values laid out in our ICARE shared principles. Under our ICARE principles it is stated:

“Our company-wide

values are the foundation of McKesson’s reputation as a trusted organization that goes the extra mile to advance our customers’

success…McKesson employees make decisions, both big and small, with a focus on what is ethically right. Above all, we are

committed to the greater good—for our company, our customers and the health care industry.”6

While the Statement seems to coincide with our Company’s own internal

governing ICARE principles, developments at the company in recent years seem inconsistent with the intent of both documents. In

a recent example, McKesson reached a $175 million settlement with investors who claimed the board of directors breached their fiduciary

duties with respect to oversight of the Company’s opioid drug operations. According to Bloomberg the settling plaintiffs

had claimed that:

“The directors have failed

to maintain adequate internal systems for spotting suspicious opioid shipments, as the U.S.’s largest drug distributor continues

to grapple with claims it helped fuel a public-health crisis tied to the painkillers.”7

By standing behind the Statement, our

Company has made a fundamental commitment to all of our stakeholders. The first stakeholder listed on the Statement is the

customers, however this recent settlement highlights allegations of nonalignment by failing to provide proper oversight

of the distribution of these drugs.

_____________________________

5 Ibid.

6 https://www.mckesson.com/About-McKesson/McKesson-Values/

7 Feeley,

Jeff, “McKesson Board Agrees to $175 Accord in Opioid Case.” Bloomberg.com. January 23, 2020. https://www.bloomberg.com/news/articles/2020-01-23/mckesson-agrees-to-175-million-settlement-in-opioid-case

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

The second point made in the statement

is a commitment to “Investing in our employees. This starts with compensating them fairly and providing important benefits.”

Yet, as one example of seeming inconsistency, in 2019:

“The company failed

to pay the required prevailing wage rates, overtime rates, and fringe benefits to employees working on a contract with the Centers

for Disease Control.”8

2. McKesson’s actions will

continue to expose the company to regulatory and legal risks.

McKesson continues to face liability

and regulatory risks and is a target of thousands of suits filed by states, cities, and counties accusing the Company of contributing

to the country’s opioid epidemic.

In one recent example McKesson, along

with the two other major opioid distributors and two opioid manufacturers, are pursuing a $50 billion settlement to resolve over

2,000 lawsuits against these companies, before they are brought to trial in 2020.9

3. McKesson is exposed to reputational

risks as consumer demand for lowered healthcare costs increases.

In addition to legal and financial risks,

the Company faces significant reputational risk in an environment where consumer demand for affordable healthcare increases. Despite

knowledge of this consumer sentiment, McKesson continues to be involved with activities that are not only to the detriment of their

customers, but are also in direct contradiction with corporate signatories' stated commitment to suppliers, entailing:

“Dealing fairly and

ethically with our suppliers. We are dedicated to serving as good partners to the other companies, large and small, that help us

meet our missions.”

Generic drugs are meant to increase affordability

for consumers who are unable to pay high prices for name-brand drugs. While the Company provides its customers with these more

affordable drugs, over this past year, McKesson has been involved in a generic drug price-fixing securities fraud suit, in which

according to reporting by Bloomberg:

“The court upheld allegations that

McKesson and its Chief Executive Officer John Hammergren and Chief Financial Officer James Beer violated the Securities Exchange

Act of 1934 by making false or misleading statements regarding McKesson’s business and operations, as well as insider trading

claims against CEO Hammergren for his sale of $287 million worth of McKesson stock. These false statements artificially inflated

McKesson’s stock price and allowed McKesson executives to dump a total of $473 million worth of their own McKesson stock

on unsuspecting investors…

_____________________________

8 https://www.contractormisconduct.org/misconduct/3020/failure-to-pay-required-wages-and-benefits-to-cdc-contract-employees

9 Jeffery, Peter, “A

$50 Billion Opioid Deal Gets Backing From 7 More States.” Bloomberg.com. February 25, 2020. https://news.bloomberglaw.com/pharma-and-life-sciences/mckesson-j-j-opioid-settlement-offer-gains-ground-with-states

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

…In upholding the complaint, the

court found that ‘McKesson was aware of and profited from the illegal agreements’ by generic drug manufacturers to

fix prices and allocate market share in the generic drug market for many years. The conspiracy has led to congressional investigations,

a continuing Department of Justice investigation, guilty pleas by some executives, and lawsuits by 49 Attorneys General. Specifically,

the court upheld allegations that defendants (i) falsely attributed generic drug price inflation – a significant driver of

McKesson profitability and growth – to supply disruptions, when in fact it was due in large part to collusive activity; (ii)

falsely stated that the generic drug market was competitive when it was actually collusive; and (iii) failed to disclose that the

company’s class period financial results were positively impacted by collusive profits.”10

Similarly, a class-action lawsuit against the Company,

alleged the Company entered into a secret agreement to artificially inflate the wholesale price of brand-name drugs, causing consumers

to overpay by billions of dollars. The settlement included an express denial of liability, and a payment by the Company of $350

million.3

By electing to take a short-term approach at value

creation by artificially inflating the wholesale price of name brand drugs, McKesson has abandoned the commitment to its customers

and has jeopardized an opportunity at sustained growth. According to McKinsey:

“A

long-term approach would weigh price, volume, and customer satisfaction to determine a price that creates sustainable value. That

price would have to entice consumers to buy the products—not just once, but multiple times, for different generations of

products. The company might still thrive at a lower price point, but there’s no way to determine whether the value of a lower

price is greater for consumers than the value of a higher price to shareholders, and indeed to all corporate stakeholders, without

taking a long-term view.”11

4. The

Company’s commitment to its stakeholders is being tested in the pandemic environment.

In the current pandemic and in the unusual process

of recovery that will follow, the Company’s commitment to its stakeholders is being put to the test. As a focus on healthcare

continues to be placed at the forefront of this pandemic, public scrutiny of healthcare corporations has never been higher. COVID-19

has exposed the systemic inequities in healthcare which has disproportionately affected black and brown communities across this

nation.

_____________________________

10

“Robbins Geller Defeats Motion to Dismiss in McKesson Generic

Drug Price-Fixing Securities Fraud Suit.” Rgrdlaw.com. October 29, 2019.

https://www.rgrdlaw.com/news-item-Defeats-Motion-to-Dismiss-in-McKesson-Generic-Drug-Price-Fixing-Securities-Fraud.html

11 Goedhart, “Value,”

https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-value-of-value-creation?cid=other-eml-alt-mcq-mck&hlkid=5dbb392c6edf468d9cc1f5626e46033a&hctky=11241239&hdpid=0f456427-c440-4f58-8f7b-c7f7eee356b8

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

The Statement also includes the Company’s commitment to communities:

“Supporting the communities

in which we work. We respect the people in our communities and protect the environment by embracing sustainable practices across

our businesses.”

According to a study conducted by the Substance Abuse and Mental Health Services

Administration (SAMHSA), while much of the attention of the opioid crisis has been focused on suburban white communities:

“From 2011-2016, compared to all other populations, Black/African

Americans had the highest increase in overdose death rate for opioid deaths involving synthetic opioids like fentanyl and fentanyl

analogs.”12

On top of dealing with an opioid crisis that has been contributed to significantly

by the Company’s activities, COVID-19 has placed additional strain on these already impacted communities. By realigning our

actions with the commitments to our stakeholders listed in the Statement, we can begin to address these inequalities that we have

helped perpetuate in the communities in which we operate.

RESPONSE TO McKESSON BOARD

OF DIRECTORS’ STATEMENT IN OPPOSITION

Defining the Statement of Purpose

The August 2019 issuance of the Business Roundtable’s new Statement

on the Purpose of the Corporation has kicked up a cloud of confusion and controversy regarding the public and private purposes

of a corporation. Numerous legal and corporate scholars argue that the Statement itself violates the fiduciary duties of directors,

that it involves misleading communications, and that it unlawfully attempts to supplant shareholder primacy. For instance, an article

in Fiduciary News asked outright, “Did Business Roundtable Just Break a Fiduciary Oath?”13 In this article,

the author asked a question of investment advisors such as the proponent:

“What potential fiduciary liability might an investment

adviser have by knowingly using client assets to purchase shares of companies whose CEOs are on record of subordinating shareholder

interest?”

_____________________________

12 Schmitz-Bechteler, Stephanie, et.

all, “The Opioid Crisis and the Black/African American Population: An Urgent Issue.” Samhsa.gov. 2020. https://store.samhsa.gov/sites/default/files/SAMHSA_Digital_Download/PEP20-05-02-001_508%20Final.pdf

13 Carosa, Christopher, “Did

Business Roundtable Just Break A Fiduciary Oath?”, Fiduciarynews.com. August 27, 2019. http://fiduciarynews.com/2019/08/did-business-roundtable-just-break-a-fiduciary-oath/

|

2020

Proxy Memo

McKesson Corporation | Shareholder Proposal on Statement of a Purpose of a Corporation

|

This same concern about subordination of investor interests was also raised

by an array of respected voices on corporate governance, including the Council of Institutional Investors as reported by Pensions

and Investments:

“In its own statement, the Council of Institutional Investors

— whose pension fund, endowment and foundation members hold a collective $4 trillion in assets — warned the policy

shift would diminish shareholder rights and, in the absence of new mechanisms to assure accountability of boards and management,

would lead to "accountability to no one."

Long-term views and strategies are important, CII officials said, but "if

'stakeholder governance' and 'sustainability' become hiding places for poor management," the economy or pubic equity markets

will suffer.

Since the driving force behind the new Statement appears to be a groundswell

of public and employee sentiment, adding substantive mechanisms seems critical to avoiding "purpose-washing." As reported

in Fortune Magazine a survey of 1,026 adults found that nearly three-quarters (72%) agree that public companies should be “mission

driven” as well as focused on shareholders and customers.

Today, as many Americans (64%) say that a company’s “primary

purpose” should include “making the world better” as say it should include “making money for shareholders.”

But CEOs invariably say the constituency that’s truly driving

their newfound social activism is their employees. Younger workers expect even more from employers on this front.…4 (Emphasis

added).

Company policies should clearly outline how the new purposes will be implemented.

Adopting empty verbiage of stakeholder centricity, while failing to change or clarify policies, may only undermine the company's

reputation with the public and employees. To the extent stakeholder centric policies are adopted, the Company will benefit from

transparency on their extent and impact.

CONCLUSION

Although the Statement of Purpose implies accountability to stakeholders,

without clear mechanisms in place to implement the Purpose, this broadened standard could merely reduce accountability to shareholders

and in effect, ensure accountability to none. Reforms, including increasing transparency and clarity as to how the Statement will

be implemented, as proposed by the proposal, are appropriate to ensure the type of alignment implied by the Statement, reduce controversy,

and further transparency around enactment of the Statement’s purposes.

Vote “Yes” on this Shareholder Proposal requesting that the

Board review the BRT Statement of the Purpose of a Corporation and provide the board’s perspective regarding how McKesson’s

governance and management systems should be altered to fully implement the Statement of Purpose.

--

For questions, please contact Andrew Behar, As You Sow, abehar@asyousow.org

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE,

U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY

ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER.

TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

8

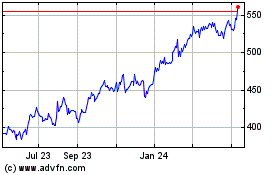

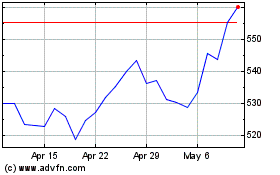

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024