Table of Contents

As filed with the Securities and Exchange Commission on November 8, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

MCEWEN MINING INC.

(Exact name of registrant as specified in its charter)

Colorado

(State or other jurisdiction of incorporation or organization)

84-0796160

(I.R.S. Employer Identification Number)

150 King Street West, Suite 2800

Toronto, ON

Canada M5H 1J9

(866) 441-0690

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Meri Verli, Chief Financial Officer

150 King Street West, Suite 2800

Toronto, ON

Canada M5H 1J9

(866) 441-0690

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

George A. Hagerty, Esq.

David R. Crandall, Esq.

Hogan Lovells US LLP

1601 Wewatta Street, Suite 900

Denver, CO 80202

Telephone: (303) 899-7300

Facsimile: (303) 899-7333

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 of the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

|

|

Emerging growth company o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

|

Amount to be

Registered(1)

|

|

Proposed

maximum

offering price per

share(2)

|

|

Proposed

maximum

aggregate offering

price

|

|

Amount of

registration fee

|

|

|

Common Stock, no par value

|

|

300,000

|

|

$

|

1.67

|

|

$

|

501,000

|

|

$

|

65.03

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This registration statement also relates to such additional common shares of the Registrant as may be issued with respect to such shares of common stock by way of a stock dividend, stock split or similar transaction.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based upon the average high and low per share prices of the Registrant’s common stock as reported on the NYSE on November 7, 2019.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated November 8, 2019

MCEWEN MINING INC.

300,000 Shares of Common Stock

This prospectus relates to the resale of up to 300,000 shares of common stock (the “Shares”) of McEwen Mining Inc. (the “Company”) that may be offered and sold, from time to time, by the selling stockholder identified in this prospectus. The Shares were issued pursuant to an asset purchase agreement among the Company, its indirect, wholly-owned subsidiary, McEwen Mining Nevada Inc., and the selling stockholder, dated August 14, 2019 (the “Asset Purchase Agreement”). The transaction is described in this prospectus under “Selling Stockholder”.

All of the proceeds from the sale of the Shares covered by this prospectus will be received by the selling stockholder. We will not receive any of the proceeds from the sale of those shares. Our registration of the Shares covered by this prospectus does not mean that the selling stockholder will offer or sell any of the Shares. The Shares may be offered and sold from time to time by the selling stockholder through public or private transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. See “Plan of Distribution” for a more complete description of the ways in which the Shares may be sold.

Our common stock is listed on both the New York Stock Exchange (the “NYSE”) and the Toronto Stock Exchange (the “TSX”), both under the symbol “MUX”. On November 7, 2019, the last reported sale price of our common stock on the NYSE and the TSX was $1.66 per share and C$2.18 per share, respectively.

Investing in the shares of our common stock involves risks. See “Risk Factors” beginning on page 3 of this prospectus for factors you should consider before buying shares of our common stock. You should carefully read this prospectus, together with the documents we incorporate by reference, before you invest in the shares of our common stock.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

Table of Contents

TABLE OF CONTENTS

We have not, and the selling stockholder has not, authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or in any supplement to this prospectus or free writing prospectus, and neither we nor the selling stockholder takes any responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

As permitted by the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s web site or at the SEC’s offices described below under the heading “Where You Can Find More Information.” Before investing in our common stock, you should read this prospectus, as well as the additional information described under “Where You Can Find More Information” and “Information Incorporated by Reference.”

In this prospectus, we use the terms “McEwen Mining,” the “Company,” “we,” “us” and “our” to refer to McEwen Mining Inc. and its subsidiaries.

Unless we have indicated otherwise, or the context otherwise requires, references in this prospectus to “$” or “dollar” are to the lawful currency of the United States. We refer to Canadian dollars as C$.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process or continuous registration process. Under this shelf registration process, the selling stockholder may, from time to time, sell the common stock described in this prospectus in one or more offerings. This prospectus provides you with a description of the common stock which may be offered by the selling stockholder. Each time the selling stockholder sells common stock, the selling stockholder may

i

Table of Contents

be required to provide you with this prospectus and, in certain cases, a prospectus supplement containing specific information about the selling stockholder and the terms of the securities being offered. That prospectus supplement may include additional risk factors or other special considerations applicable to those securities. Any prospectus supplement may also add, update or change information in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus and any prospectus supplement together with additional information described under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” before investing in our common stock.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated herein by reference contain or will contain certain references to future expectations and other forward-looking statements and information relating to our financial condition, results of operations and business. These statements include, among others:

· statements about our anticipated exploration results, cost and feasibility of production, receipt of permits or other regulatory or government approvals and plans for the development of our properties;

· statements concerning the benefits or outcomes that we expect will result from our business activities and certain transactions that we contemplate or have completed, such as receipt of proceeds, increased revenues, decreased expenses and avoided expenses and expenditures; and

· statements of our expectations, beliefs, future plans and strategies, anticipated developments and other matters that are not historical facts.

These statements may be made expressly in this document or may be incorporated by reference to other documents that we will file with the SEC. You can find many of these statements by looking for words such as ‘believes”, “expects”, “anticipates”, “estimates”, “will”, “may”, “contemplate”, “intend”, “could”, “plan”, “shall”, “can” or similar expressions used in this prospectus, any accompanying prospectus supplement and the documents incorporated herein by reference.

Forward-looking statements and information are based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, not all of which are known to us. There can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information.

The important factors that could prevent us from achieving our stated goals and objectives include, but are not limited to, those set forth in the “Risk Factors” section in the periodic reports that we file with the SEC from time to time, including Forms 10-K, 10-Q and 8-K and any amendments thereto, and the following:

· our ability to raise funds required for the execution of our business strategy;

ii

Table of Contents

· our ability to secure permits or other regulatory and government approvals needed to operate, develop or explore our mineral properties and projects;

· decisions of foreign countries, banks and courts within those countries;

· unexpected changes in business, economic and political conditions;

· operating results of Minera Santa Cruz S.A.;

· fluctuations in interest rates, inflation rates, currency exchange rates or commodity prices;

· timing and amount of mine production;

· our ability to retain and attract key personnel;

· technological changes in the mining industry;

· changes in operating, exploration or overhead costs;

· access and availability of materials, equipment, supplies, labor and supervision, power and water;

· results of current and future exploration activities;

· results of pending and future feasibility studies or the expansion or commencement of mining operations without feasibility studies having been completed;

· changes in our business strategy;

· interpretation of drill hole results and the geology, grade and continuity of mineralization;

· the uncertainty of reserve estimates and timing of development expenditures;

· litigation or regulatory investigations and procedures affecting us;

· local and community impacts and issues including criminal activity and violent crimes;

· accidents, public health issues and labor disputes;

· our continued listing on a public exchange;

· uncertainty relating to title to mineral properties; and

· changes in relationships with the local communities in the areas in which we operate.

We caution you not to put undue reliance on these statements, which speak only as of the date on which it is made. Further, the information contained in this prospectus, any accompanying prospectus supplement or the documents incorporated herein by reference is a statement of our present intention

iii

Table of Contents

and is based on present facts and assumptions, and may change at any time and without notice, based on changes in such facts or assumptions. Except as required by law, we are not obligated to, and do not undertake to, update any forward-looking statements made herein.

iv

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information about McEwen Mining Inc. and this offering of common stock. This summary does not contain all of the information that may be important to you in making an investment decision. For a more complete understanding of McEwen Mining Inc. you should read carefully this entire prospectus, including the “Risk Factors” section and the other documents we refer to and incorporate by reference. Unless otherwise indicated, “common stock” means our common stock, no par value.

McEwen Mining Inc. Overview

We were organized under the laws of the State of Colorado on July 24, 1979. We are engaged in the exploration for, development of, production and sale of gold and silver and, with the acquisition of the Los Azules project in 2012, exploration for copper. On January 24, 2012, we changed the name of the Company from U.S. Gold Corporation to McEwen Mining Inc. after the completion of the acquisition of Minera Andes Inc. by way of a statutory plan of arrangement under the laws of the Province of Alberta, Canada.

Our principal executive office is located at 150 King Street West, Suite 2800, P.O. Box 24, Toronto, Ontario, Canada M5H 1J9 and our telephone number is (866) 441-0690. We also maintain offices in San Juan, Argentina; Guamuchil, Mexico; Elko and Reno, Nevada. Our website is mcewenmining.com. We make available our periodic reports and news releases on our website. The information contained in, or that can be accessed through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus or part of any prospectus supplement.

1

Table of Contents

The Offering

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of our common stock, see “Description of Common Stock.”

|

Shares Offered by the Selling Stockholder

|

|

300,000 shares of common stock.

|

|

|

|

|

|

Common Stock Outstanding

|

|

362,528,425 shares of common stock as of November 4, 2019. This number excludes 8,064,516 shares of common stock issuable upon the exercise of outstanding warrants and 5,593,994 shares of common stock issuable upon the exercise of outstanding options under our Equity Incentive Plan as of November 4, 2019.

|

|

|

|

|

|

Use of Proceeds

|

|

The proceeds from the sale of the common stock covered by this prospectus will be received by the selling stockholder. The Company will not receive any of the proceeds from any sale by any selling stockholder of the common stock covered by this prospectus. See “Use of Proceeds.”

|

|

|

|

|

|

Market for our Common Stock

|

|

Our common stock is listed on both the New York Stock Exchange (the “NYSE”) and the Toronto Stock Exchange (the “TSX”), both under the symbol “MUX”. On November 7, 2019, the last reported sale price of our common stock on the NYSE and the TSX was $1.66 per share and C$2.18 per share, respectively.

|

|

|

|

|

|

Plan of Distribution

|

|

The Shares being offered hereby may be offered and sold from time to time by the selling stockholder named herein through public or private transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. See “Plan of Distribution.”

|

|

|

|

|

|

Risk Factors

|

|

See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in our securities.

|

2

Table of Contents

RISK FACTORS

Investing in our common shares involves a high degree of risk. You should carefully consider and evaluate the risk factors included in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q that we file with the SEC, which are incorporated herein by reference, together with the risk factors and other information contained in or incorporated by reference into any prospectus supplement, before making an investment decision. The occurrence of any of these risks and uncertainties could harm our business, financial condition, results of operations or growth prospects. As a result, the trading price of our common shares could decline, and you could lose all or part of your investment.

The future issuances of our common stock will dilute current shareholders and may reduce the market price of our common stock.

Under certain circumstances, our board of directors has the authority to authorize the offer and sale of additional securities without the vote of or notice to existing shareholders. We may issue equity in the future in connection with acquisitions, strategic transactions or for other purposes. Based on the need for additional capital to fund expected growth, it is likely that we will issue additional securities to provide such capital and that such additional issuances may involve a significant number of shares of our common stock. Issuance of additional securities in the future will dilute the percentage interest of existing shareholders and may reduce the market price of our common stock and any other outstanding securities. Furthermore, the sale of a significant amount of our common stock by any selling security holders, including Mr. McEwen, may depress the price of our common stock. As a result, you may lose all or a portion of your investment.

Future offerings of debt or preferred equity securities, which would rank senior to our common stock, may adversely affect the market price of our common stock.

If, in the future, we decide to issue debt or preferred equity securities that may rank senior to our common stock, it is likely that such securities will be governed by an indenture or other instrument containing covenants restricting our operating flexibility. Any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of our common shares and may result in dilution to owners of our common stock. We and, indirectly, our shareholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, holders of our common stock will bear the risk of our future offerings reducing the market price of our common stock and diluting the value of their stock holdings in us.

3

Table of Contents

USE OF PROCEEDS

This prospectus relates to the Shares that may be offered and sold from time to time by the selling stockholder. We will not receive any of the proceeds resulting from the sale of the Shares by the selling stockholder. The selling stockholder will receive all of the proceeds from this offering.

4

Table of Contents

SELLING STOCKHOLDER

The selling stockholder, Fremont Gold Ltd., is offering, from time to time, up to an aggregate of 300,000 of our common shares under this prospectus.

The Shares were issued pursuant to the Asset Purchase Agreement, dated August 14, 2019 (the “Asset Purchase Agreement”), among the Company, McEwen Mining Nevada Inc., a Delaware corporation and an indirect, wholly-owned subsidiary of the Company (“McEwen Nevada”), Intermont Exploration Corp., a Nevada corporation (formerly Intermont Exploration, LLC) (“Intermont”) and Fremont Gold Ltd., a British Columbia corporation (“Fremont” and, together with Intermont, “Seller”). Pursuant to the Asset Purchase Agreement, the Seller transferred its interest in the Gold Canyon Option Agreement, dated December 29, 2017, as amended, and certain unpatented mining claims in Eureka County, Nevada, to McEwen Nevada in exchange for the issuance by the Company of the Shares to Fremont, which Shares were issued on August 27, 2019. In addition, the Company agreed to use commercially reasonable efforts to file the registration statement of which this prospectus forms a part with the SEC in order to register the Shares for resale by the selling stockholder.

The securities issued with respect to the Asset Purchase Agreement were issued in reliance upon an exemption from registration under Regulation S of the Securities Act based on representations and warranties contained in the Asset Purchase Agreement.

Shares Covered by this Prospectus

We are registering the shares to permit the selling stockholder and its pledgees, donees, transferees and other successors-in-interest that receive their shares from the selling stockholder as a gift, partnership distribution or other non-sale related transfer after the date of this prospectus to resell the shares when and as they deem appropriate.

The following table sets forth:

· the name of the selling stockholder;

· the number and percent of shares of our common stock that the selling stockholder beneficially owns prior to the offering for resale of the shares under this prospectus;

· the number of shares of our common stock that may be offered for resale for the account of the selling stockholder under this prospectus; and

· the number and percent of shares of our common stock to be beneficially owned by the selling stockholder after the offering of the resale shares (assuming all of the offered resale shares are sold by the selling stockholder).

The number of shares in the column “Number of Shares Being Offered” represents all of the shares that the selling stockholder may offer under this prospectus. We do not know how long the selling stockholder will hold the shares before selling them or how many shares the selling stockholder will sell and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the resale shares. The shares offered by this prospectus may be offered from time to time by the selling stockholder listed below.

5

Table of Contents

This table is prepared solely based on information supplied to us by the listed selling stockholder, any Schedules 13D or 13G and Forms 3 and 4, and other public documents filed with the SEC, and assumes the sale of all of the resale shares. The applicable percentages of beneficial ownership are based on an aggregate of 362,528,425 shares of our common stock outstanding on November 4, 2019. This number excludes 8,064,516 shares of common stock issuable upon the exercise of outstanding warrants and 5,593,994 shares of common stock issuable upon the exercise of outstanding options under our Equity Incentive Plan as of November 4, 2019.

|

Name of Selling

Stockholder

|

|

Shares Beneficially Owned Prior

to Offering

|

|

Number of

Shares Being

|

|

Shares Beneficially

Owned After

Offering

|

|

|

|

|

Number

|

|

%

|

|

Offered(1)

|

|

Number

|

|

%

|

|

|

Fremont Gold Ltd.(2)

|

|

300,000

|

(3)

|

*

|

|

300,000

|

|

0

|

|

—

|

|

* Represents less than 1%.

(1) Assumes that the selling stockholder sells all of the Shares which are being registered under the registration statement of which this prospectus forms a part.

(2) Fremont Gold Ltd. is a corporation incorporated under the laws of the Province of British Columbia. Mr. Dennis Moore, M.Eng. is the President of Fremont Gold Ltd.

(3) As of November 7, 2019, Fremont Gold Ltd. beneficially owned 300,000 shares of our common stock, which shares were issued to Fremont Gold Ltd. on August 27, 2019 pursuant to the Asset Purchase Agreement.

PLAN OF DISTRIBUTION

The selling stockholder, which term includes its transferees, pledgees or donees or its successors-in-interest, may sell the Shares being offered from time to time in one or more transactions:

· on the NYSE, TSX or otherwise;

· in ordinary brokers’ transactions, which may include long or short sales;

· in transactions involving cross or block trades or otherwise in the over-the-counter market;

· through broker-dealers, who may act as agents or principals;

· in “at the market” offerings to or through market makers into an existing market for the Shares;

· in other ways not involving market makers or established markets, including direct sales to purchasers in negotiated transactions;

· through a bidding or auction process;

· through one or more underwriters on a firm commitment or best efforts basis;

· through the writing of options, swaps or other derivatives, whether listed on an exchange or otherwise; or

· through a combination of such methods of sale or by any other legally available means.

6

Table of Contents

In addition, subject to compliance with applicable law, the selling stockholder may enter into option, derivative or hedging transactions with broker-dealers who may engage in short sales of common stock in the course of hedging the positions they assume with the selling stockholder, and any related offers or sales of Shares may be made under this prospectus. In some circumstances, for example, the selling stockholder may write call options, put options or other derivative instruments with respect to the Shares, which the selling stockholder settles through delivery of the Shares. These option, derivative and hedging transactions may require the delivery to a broker, dealer or other financial institution of Shares offered under this prospectus, and that broker, dealer or other financial institution may resell those Shares under this prospectus.

The selling stockholder may sell the Shares at market prices prevailing at the time of sale, at prices related to those market prices, at negotiated prices or at fixed prices, which may be changed from time to time. The selling stockholder also may sell the Shares pursuant to Rule 144 or other available exemptions adopted under the Securities Act. The selling stockholder may effect transactions by selling Shares directly to purchasers or to or through broker-dealers. The broker-dealers may act as agents or principals. Broker-dealers, underwriters or agents may receive compensation in the form of discounts, concessions or commissions from the selling stockholder or the purchasers of the Shares, or both. The compensation of any particular broker-dealer, underwriter or agent may be in excess of customary commissions.

The selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. If the selling stockholder or any broker-dealer that participates with the selling stockholder in the distribution of Shares is deemed to be an “underwriter” within the meaning of the Securities Act, the selling stockholder and such broker-dealer may be subject to the prospectus delivery requirements of the Securities Act.

The selling stockholder may donate, pledge or otherwise transfer its Shares in a non-sale related transaction to any person so long as the transfer complies with applicable securities laws. As a result, donees, pledgees, transferees and other successors in interest that receive such Shares as a gift, distribution or other non-sale related transfer may offer shares of common stock under this prospectus.

The selling stockholder has advised us that it has not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of its securities. There is no underwriter or coordinating broker acting in connection with the proposed sale of Shares by the selling stockholder.

The Shares will be sold through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states the Shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), any person engaged in the distribution of the Shares may not simultaneously engage in market making activities with respect to our common stock for a period of two business days prior to

7

Table of Contents

the commencement of such distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the associated rules and regulations under the Exchange Act, including Regulation M, which provisions may limit the timing of purchases and sales of Shares of our common stock by the selling stockholder. Certain persons participating in an offering may engage in over-allotment, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act that stabilize, maintain or otherwise affect the price of the offered securities. If any such activities may occur, they will be described in an applicable prospectus supplement or a document incorporated by reference to the extent required. We will make copies of this prospectus available to the selling stockholder and have informed the selling stockholder that if it is deemed to be an underwriter, the selling stockholder will need to deliver copies of this prospectus to purchasers at or prior to the time of any sale of the Shares.

We will receive no proceeds from the sale of Shares by selling stockholder pursuant to this prospectus. We will bear all costs, expenses and fees in connection with the registration of the Shares, except that the selling stockholder will bear all commissions and discounts, if any, attributable to the sales of the Shares. We will indemnify the selling stockholder, and the selling stockholder will indemnify us, and may agree to indemnify any underwriter, broker-dealer or agent that participates in transactions involving sales of the Shares, against certain liabilities, including liabilities arising under the Securities Act.

Upon notification to us by the selling stockholder that any material arrangement has been entered into with a broker-dealer or other agent for the sale or purchase of Shares, including through a block trade, special offering, exchange distribution, secondary distribution, or purchase by a broker or dealer, we will file a supplement to this prospectus, if required, disclosing:

· the name of the participating broker-dealers;

· the number of Shares involved;

· the price at which such Shares were sold;

· the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable;

· that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus; and

· other facts material to the transaction.

A prospectus supplement or document incorporated by reference may be filed to disclose additional information with respect to any sale or other distribution of the Shares.

DESCRIPTION OF COMMON STOCK

We are authorized to issue up to 500,000,000 shares of common stock, no par value. As of November 4, 2019, there were a total of 362,528,425 shares of our common stock issued and outstanding. This number excludes 8,064,516 shares of common stock issuable upon the exercise of outstanding warrants and 5,593,994 shares of common stock issuable upon the exercise of outstanding options under our Equity Incentive Plan as of November 4, 2019.

8

Table of Contents

The following discussion summarizes the rights and privileges of our outstanding common stock and is qualified by reference to the relevant provisions of the laws of the State of Colorado and our Amended and Restated Articles of Incorporation (our “Articles of Incorporation”) and Bylaws which have been filed with the SEC and are incorporated by reference into the registration statement of which this prospectus is a part.

The holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the shareholders, including the election of directors. Cumulative voting for directors is not permitted. Subject to preferences that may be applicable to any then outstanding preferred stock, holders of common stock are entitled to receive ratably those dividends, if any, as may be declared by our board of directors out of legally available funds. Upon our liquidation, dissolution or winding up, the holders of common stock will be entitled to share ratably in the net assets legally available for distribution to shareholders after the payment of all of our debts and other liabilities of our Company, subject to the prior rights of any preferred stock then outstanding. Holders of common stock have no preemptive or conversion rights or other subscription rights and there are no redemption or sinking funds provisions applicable to the common stock. There are no restrictions on the alienability of our common stock and there are no provisions discriminating against any existing or prospective holder of our common stock as a result of such holder owning a substantial amount of the Company’s securities. We refer you to the “Anti-Takeover Provisions” subsection below for information regarding provisions that would delay, defer or prevent a change in control of our Company.

Anti-Takeover Provisions

Our Articles of Incorporation and our Bylaws include certain provisions that could delay, defer or prevent a change in control of our Company. Among other things, our Articles of Incorporation and Bylaws:

· provide that the authorized number of directors may be fixed from time to time by our Board of Directors; provided, however, that the authorized number of directors shall not be less than three nor more than nine;

· do not provide for cumulative voting rights (therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose); and

· provide that special meetings of our shareholders may be called only by our president, the chairman of the Board of Directors, the Board of Directors, or the holders of not less than 10% of all shares entitled to vote at the meeting.

Moreover, pursuant to the laws of the State of Colorado, certain significant transactions would require the affirmative vote of a majority of the shares eligible to vote at a meeting of shareholders, which requirement could result in delays to or greater cost associated with a change in control of McEwen Mining.

Exchange Listings

Our common stock is listed on the NYSE and on the TSX, each under the symbol “MUX.”

9

Table of Contents

Transfer Agent

Computershare Trust Company, N.A. is the transfer agent for our common stock. The principal office of Computershare Trust Company, N.A. is located at 250 Royall Street, Canton, MA 02021 and its telephone number is (303) 262-0600.

LEGAL MATTERS

Hogan Lovells US LLP, our independent legal counsel, has provided an opinion on the validity of the Shares that are the subject of this prospectus.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial consolidated balance sheets as of December 31, 2018 and 2017, the related consolidated statements of operations and comprehensive (loss) income, shareholders’ equity and cash flows for each of the three years in the period ended December 31, 2018, and the related notes, included in our annual report on Form 10-K for the year ended December 31, 2018, and the effectiveness of our internal control over financial reporting as of December 31, 2018, as set forth in their reports, which are incorporated by reference in this prospectus and elsewhere in the registration statement. Such financial statements are incorporated by reference in reliance upon Ernst & Young LLP’s reports, given on their authority as experts in accounting and auditing.

The financial statements of Minera Santa Cruz S.A. appearing in our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2018 have been audited by Pistrelli, Henry Martin y Asociados S.R.L., member of Ernst & Young Global, independent auditors, as set forth in their report thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Estimates of reserves for Minera Santa Cruz S.A. have been incorporated by reference in this prospectus in reliance upon the report of P&E Mining Consultants Inc. Such estimates and related information have been so included in reliance upon the authority of P&E Mining Consultants Inc. as experts in such matters.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus forms part of a registration statement on Form S-3 filed by us with the SEC under the Securities Act. As permitted by the SEC, this prospectus does not contain all the information set forth in the registration statement filed with the SEC. For a more complete understanding of this offering, you should refer to the complete registration statement, including the exhibits thereto, on Form S-3 that may be obtained as described below. Statements contained or incorporated by reference in this prospectus or any prospectus supplement about the contents of any contract or other document are not necessarily complete. If we have filed any contract or other document as an exhibit to the registration statement or any other document incorporated by reference in the registration statement of which this prospectus forms a part, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract or other document is qualified in its entirety by reference to the actual document.

10

Table of Contents

We file annual, quarterly and special reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial retrieval services and at the website maintained by the SEC at www.sec.gov. The reports and other information filed by us with the SEC are also available at our website. The address of the Company’s website is mcewenmining.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” in this prospectus certain information we file with the SEC, which means that we may disclose important information in this prospectus by referring you to the document that contains the information. The information incorporated by reference is considered to be a part of this prospectus, and the information we file later with the SEC will automatically update and supersede the information filed earlier. We incorporate by reference the documents listed below and any filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of the initial filing of the registration statement that contains this prospectus and prior to the effectiveness of the registration statement and all such documents that we file with the SEC after the date of this prospectus and before the termination of the offering of the securities covered by this prospectus; provided, however, that we are not incorporating by reference any additional documents or information furnished and not filed with the SEC:

· our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 that we filed with the SEC on February 20, 2019, and as amended by the Form 10-K/A that we filed with the SEC on June 19, 2019;

· the portions of our definitive proxy statement on Schedule 14A filed April 10, 2019 specifically incorporated by reference in Part III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018;

· our Quarterly Reports on Form 10-Q for our fiscal quarters ended March 31, 2019, June 30, 2019 and September 30, 2019, which we filed with the SEC on April 30, 2019, July 30, 2019 and October 30, 2019, respectively;

· our Current Reports on Form 8-K that we filed with the SEC on March 13, 2019, March 29, 2019, May 9, 2019, May 29, 2019, and September 6, 2019 (except that any portions thereof which are furnished and not filed shall not be deemed incorporated); and

· The description of our common stock contained in our registration statement on Form 8-A, filed with the SEC on October 28, 2010, and any amendment or report filed with the SEC for the purpose of updating the description.

11

Table of Contents

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. We will provide this information, at no cost to the requester, upon written or oral request at the following address or telephone number:

McEwen Mining Inc.,

150 King Street West, Suite 2800, P.O. Box 24,

Toronto, ON

Canada M5H 1J9

Attention: Investor Relations

(866) 441-0690

12

Table of Contents

PART II INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following is a list of the expenses to be incurred by us in connection with the preparation and filing of this registration statement. All amounts shown are estimates except for the SEC registration fee:

|

SEC Registration Fee

|

|

$

|

65

|

|

|

|

|

|

|

|

Accounting fees and expenses

|

|

$

|

8,000

|

|

|

|

|

|

|

|

Legal fees and expenses

|

|

$

|

8,000

|

|

|

|

|

|

|

|

Miscellaneous

|

|

$

|

1,938

|

|

|

|

|

|

|

|

Total:

|

|

$

|

18,003

|

|

We are paying all expenses of the offering listed above. No portion of these expenses will be borne by the selling stockholder. The selling stockholder, however, will pay any other expenses incurred in selling the Shares, including any brokerage or underwriting discounts or commissions paid by the selling stockholder to broker-dealers in connection with the sale of the Shares.

Item 15. Indemnification of Officers and Directors

We have entered into indemnification agreements with each of our executive officers and directors which provide that we must indemnify, to the fullest extent permitted by the laws of the State of Colorado, but subject to certain exceptions, any of our directors or officers who are made or threatened to be made a party to a proceeding, by reason of the person serving or having served in their capacity as an executive officer or director with us. We may also be required to advance expenses of defending any proceeding brought against them while serving in such capacity.

Our Articles of Incorporation and Bylaws provide that we must indemnify, to the fullest extent permitted by the laws of the State of Colorado, any of our directors, officers, employees or agents made or threatened to be made a party to a proceeding, by reason of the person serving or having served in a capacity as such, against judgments, penalties, fines, settlements and reasonable expenses incurred by the person in connection with the proceeding if certain standards are met.

The Colorado Business Corporation Act (“CBCA”) allows indemnification of directors, officers, employees and agents of a company against liabilities incurred in any proceeding in which an individual is made a party because he or she was a director, officer, employee or agent of the company if such person conducted himself in good faith and reasonably believed his actions were in, or not opposed to, the best interests of the company, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. A person must be found to be entitled to indemnification under this statutory standard by procedures designed to assure that disinterested members of the board of directors have approved

II-1

Table of Contents

indemnification or that, absent the ability to obtain sufficient numbers of disinterested directors, independent counsel or shareholders have approved the indemnification based on a finding that the person has met the standard. Indemnification is limited to reasonable expenses.

Our Articles of Incorporation limit the liability of our directors to the fullest extent permitted by the CBCA. Specifically, our directors will not be personally liable for monetary damages for breach of fiduciary duty as directors, except for:

· any breach of the duty of loyalty to us or our shareholders;

· acts or omissions not in good faith or that involved intentional misconduct or a knowing violation of law;

· dividends or other distributions of corporate assets that are in contravention of certain statutory or contractual restrictions;

· violations of certain laws; or

· any transaction from which the director derives an improper personal benefit.

Liability under federal securities law is not limited by our Articles of Incorporation.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the United States Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being

Item 16. Exhibits

II-2

Table of Contents

|

4.3

|

|

Amended and Restated Bylaws of the Company (incorporated by reference from the Current Report on Form 8-K filed with the SEC on March 12, 2012, Exhibit 3.2, File No. 001-33190)

|

|

|

|

|

|

5.1*

|

|

Legal Opinion of Hogan Lovells US LLP

|

|

|

|

|

|

23.1*

|

|

Consent of Ernst & Young LLP, Toronto, Canada

|

|

|

|

|

|

23.2*

|

|

Consent of Pistrelli, Henry Martin y Asociados S.R.L., member of Ernst & Young Global, Buenos Aires, Argentina

|

|

|

|

|

|

23.3*

|

|

Consent of Hogan Lovells US LLP (included in Exhibit 5.1)

|

|

|

|

|

|

23.4*

|

|

Consent of P&E Mining Consultants Inc.

|

|

|

|

|

|

23.5*

|

|

Consent of Independent Mining Consultants, Inc.

|

|

|

|

|

|

24.1*

|

|

Powers of Attorney (included on signature page hereto)

|

* Filed herewith.

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(i) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(1) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(2) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(3) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that the undertakings set forth in paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports

II-3

Table of Contents

filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement;

(ii) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(iii) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(iv) That, for the purpose of determining liability under the Securities Act to any purchaser:

(1) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(2) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(v) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities: the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

II-4

Table of Contents

(1) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(2) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(3) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(4) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

II-5

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Toronto, Province of Ontario, Canada, on November 8, 2019.

|

|

MCEWEN MINING INC.

|

|

|

|

|

|

/s/ Robert R. McEwen

|

|

|

Name:

|

Robert R. McEwen

|

|

|

Title:

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Robert R. McEwen as his attorney-in-fact, with the power of substitution, for them in any and all capacities, to sign any amendments to this registration statement, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, hereby ratifying and confirming all that said attorneys-in-fact, or their substitute or substitutes, may do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Robert R. McEwen

|

|

Chairman of the Board of Directors

and Chief Executive Officer

(Principal Executive Officer)

|

|

November 8, 2019

|

|

Robert R. McEwen

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Meri Verli

|

|

Chief Financial Officer (Principal

Financial and Accounting Officer)

|

|

November 8, 2019

|

|

Meri Verli

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Allen V. Ambrose

|

|

Director

|

|

November 8, 2019

|

|

Allen V. Ambrose

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Michele L. Ashby

|

|

Director

|

|

November 8, 2019

|

|

Michele L. Ashby

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Leanne M. Baker

|

|

Director

|

|

November 8, 2019

|

|

Leanne M. Baker

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Richard W. Brissenden

|

|

Director

|

|

November 8, 2019

|

|

Richard W. Brissenden

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Robin Dunbar

|

|

Director

|

|

November 8, 2019

|

|

Robin Dunbar

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Gregory P. Fauquier

|

|

Director

|

|

November 8, 2019

|

|

Gregory P. Fauquier

|

|

|

|

|

|

|

|

|

|

|

II-6

Table of Contents

|

/s/ Donald R. M. Quick

|

|

Director

|

|

November 8, 2019

|

|

Donald R. M. Quick

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Michael L. Stein

|

|

Director

|

|

November 8, 2019

|

|

Michael L. Stein

|

|

|

|

|

II-7

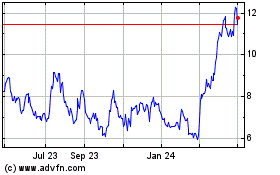

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

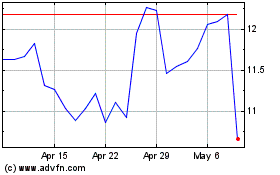

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024