McEwen Mining Inc. (NYSE: MUX) (TSX: MUX)

announces its results for the third quarter ended September 30,

2019 (“

Q3”). Total production during Q3 was

35,042 gold ounces and

947,145

silver ounces, or

45,930 gold equivalent

ounces(1)(“GEOs”) using the average gold:silver price ratio for Q3

of 87:1. Our four producing mines generated Earnings From Mining

Operations of

$9.4 million(2)(3) during the

quarter. We continued to invest in exploration and development,

spending

$15.8 million on advanced projects during

Q3, which contributed to our consolidated net loss of

$11.5

million, or

$0.03 per share.

Q4 2019 and 2020 Outlook

During Q4 2019, we expect to produce between

42,000-46,000 GEOs, placing us near the midpoint

of our guidance range for the year. Cash costs and AISC(1)(2) will

be elevated at Gold Bar due to improvements and repairs to the

conveying systems and process plant. Cash costs at Black Fox are

expected to return to the levels we guided for the year, and AISC

is expected to remain above guidance due to additional sustaining

capital expenditures.

For 2020, we expect an overall improvement in

GEOs produced and our global cost per GEO compared to 2019, as Gold

Bar is forecast to produce 65,000-70,000 gold

ounces during the year. Production and cost guidance for 2020 will

be provided with our Q4 results.

Operations Update

San José Mine, Argentina (49%

Interest)

The mine is on-track to achieving our full year

guidance for 2019 of 49,000 gold ounces and

3,225,000 silver ounces. Our attributable

production from San José in Q3 was 13,575 gold

ounces and 943,037 silver ounces, for a total of

24,415 GEOs, compared to 21,676 GEOs in 2018. Cash

costs and all-in sustaining costs (AISC) were $915

and $1,204 per GEO, respectively, in line with our

guidance for the year. During Q3 we received $2

million, and subsequent to the end of the quarter we

received a further $3 million, in dividends from

our interest in the San José Mine.

Black Fox Mine, Canada (100% Interest)

In Q3, Black Fox produced 7,427

gold ounces, compared to 11,618 gold ounces in 2018. Cash costs and

AISC were $941 and $1,363,

respectively. AISC was above our guidance primarily due to lower

than expected gold production.

Our 2019 exploration budget for the Black Fox

Complex is $18 million. For detailed

information about our ongoing exploration at the Black Fox Complex,

refer to our news release dated July 10th & 25th, September

4th, 10th & 30th, and Oct. 28th.

Gold Bar Mine, USA (100%

Interest)

Q3 was the first full quarter of commercial

production at Gold Bar. Production during Q3 was

11,030 gold ounces. Cash costs and AISC were above

guidance at $1,088 and $1,235 per

GEO, respectively, primarily due to operational challenges during

the first half of the year.

Our 2019 exploration budget for the Gold Bar

property is $5 million. Drilling focused on

Gold Bar South in order to advance permitting, with the objective

of having development begin in late 2020. We also drilled two deep

holes to test the potential of the property for Carlin-type gold

deposits. For detailed information about our Nevada exploration

program, refer to our news releases date August 20th, and October

15th.

El Gallo Mine, Mexico (100%

Interest)

The mine is on-track to achieving our full year

production guidance for 2019 of 16,000 gold

ounces. During Q3, the mine produced 3,057 gold

equivalent ounces. Cash costs and AISC were $1,153

and $1,177 per GEO, respectively. Production from

residual leaching decreased due to depletion of the leachable gold

content and the normal impact of the wet season. We are evaluating

several methods of enhancing and extending the existing

operation.

Work on the Fenix Project feasibility study and

permitting is progressing. During Q3 environmental permits were

received for Phase 1 plant development and in-pit tailings

storage.

Los Azules Project, Argentina (100%

Interest)

During Q3, we continued to advance permitting efforts,

preliminary engineering and cost estimating for the proposed low

altitude all year access route.

Table 1 below provides production and cost

results for Q1, Q2 and Q3 2019 and comparative results from 2018

along with production and cost guidance for the full year 2019.

Table 1: Production and

Costs

|

|

Q1 |

Q2 |

Q3 |

Full Year2019 Guidance |

|

2018 |

2019 |

2018 |

2019 |

2018 |

2019 |

| Total

Production |

|

|

|

|

|

|

|

| Gold (oz) |

35,068 |

26,938 |

36,959 |

36,216 |

33,806 |

35,042 |

131,000-138,000 |

| Silver (oz) |

695,651 |

703,219 |

772,432 |

850,525 |

745,172 |

947,145 |

3,225,000 |

| GEOs(1) |

44,344 |

36,315 |

47,258 |

45,881 |

43,742 |

45,930 |

169,000-176,000 |

| San José Mine, Argentina (49%)(4) |

|

|

|

|

|

|

|

| Gold (oz) |

10,822 |

10,559 |

12,139 |

13,518 |

11,768 |

13,575 |

49,000 |

| Silver (oz) |

692,052 |

701,341 |

769,197 |

848,268 |

743,100 |

943,037 |

3,225,000 |

| GEOs(1) |

20,049 |

19,910 |

22,395 |

23,157 |

21,676 |

24,415 |

87,000 |

| Cash Costs ($/GEO)(1)(2) |

934 |

749 |

806 |

960 |

856 |

915 |

860 |

| AISC

($/GEO)(1)(2) |

1,148 |

1,115 |

1,065 |

1,207 |

1,028 |

1,204 |

1,120 |

| El Gallo Mine, Mexico |

|

|

|

|

|

|

|

| GEOs(1) |

12,217 |

5,432 |

10,808 |

5,354 |

10,448 |

3,057 |

16,000 |

| Cash Costs ($/GEO)(1)(2) |

691 |

967 |

783 |

926 |

671 |

1,153 |

875 |

| AISC

($/GEO)(1)(2) |

753 |

989 |

816 |

939 |

683 |

1,177 |

915 |

| Black Fox Mine, Canada |

|

|

|

|

|

|

|

| GEOs(1) |

12,078 |

8,943 |

14,055 |

9,430 |

11,618 |

7,427 |

36,000-40,000 |

| Cash Costs ($/GEO)(1)(2) |

849 |

805 |

771 |

837 |

932 |

941 |

905 |

| AISC

($/GEO)(1)(2) |

1,188 |

1,454 |

1,056 |

1,196 |

1,285 |

1,363 |

1,080 |

| Gold Bar Mine, Nevada |

|

|

|

|

|

|

|

| GEOs(1) |

- |

2,030(5) |

- |

7,940(5) |

- |

11,030 |

30,000-33,000 |

| Cash Costs ($/GEO)(1)(2) |

- |

- |

- |

901 |

- |

1,088 |

930 |

| AISC

($/GEO)(1)(2) |

- |

- |

- |

1,088 |

- |

1,235 |

975 |

Notes:

- 'Gold Equivalent Ounces' are calculated based on a 75:1 gold to

silver price ratio for periods up to and including Q1 2019, 88:1

for Q2 2019, and 87:1 for Q3. 2019 GEO and costs guidance is stated

using a 85:1 ratio.

- Earnings from mining operations, cash costs per ounce, all-in

sustaining costs (AISC) per ounce, and liquid assets are non-GAAP

financial performance measures with no standardized definition

under U.S. GAAP. See “Cautionary Note Regarding Non-GAAP Measures”

for additional information, including definitions of these

terms.

- All amounts are reported in US dollars unless otherwise

stated.

- Represents the portion attributable to us from our 49% interest

in the San José Mine.

- Pre-commercial production at Gold Bar during Q1 2019 was 2,030

GEOs, cash costs and AISC were not reported. Gold Bar started

commercial production on May 23, 2019.

Table 2 below provides financial highlights for

Q3 and Q3 YTD 2019 and comparative results from 2018.

Table 2: Financial Highlights

|

|

Q3 2018 |

Q3 2019 |

Q3 YTD 2018 |

Q3 YTD 2019 |

| Treasury |

|

|

|

|

| Liquid Assets ($

millions)(2) |

54.0 |

18.5 |

54.0 |

18.5 |

| Working Capital ($ millions) |

37.9 |

16.5 |

37.9 |

16.5 |

| Debt (Term loan) ($

millions) |

50.0 |

50.0 |

50.0 |

50.0 |

| Earnings (Loss) from Mining Operations(2) |

|

|

|

|

| Black Fox Mine ($ millions) |

(0.3) |

0.1 |

6.9 |

1.9 |

| San José Mine (49%) ($ millions) |

(1.7) |

6.4 |

3.7 |

9.6 |

| El Gallo Mine ($ millions) |

6.8 |

1.1 |

24.5 |

4.9 |

| Gold Bar Mine ($

millions) |

- |

1.8 |

- |

3.9 |

| Consolidated Net Income |

|

|

|

|

| Net (Loss) ($ millions) |

(13.3) |

(11.5) |

(23.9) |

(34.6) |

| Net (Loss) per Share

($) |

(0.04) |

(0.03) |

(0.07) |

(0.10) |

| Cash Flow |

|

|

|

|

| Cash Provided By (Used

In) Operating Activities ($ millions) |

(1.4) |

(12.8) |

(0.8) |

(21.9) |

For the SEC Form 10-Q Financial Statements and MD&A refer

to:

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000314203

Conference Call and Webcast

We invite you to join our conference call, where

management will discuss our Q3 financial results and project

developments and follow with a question and answer session.

Questions can be asked directly by participants during the webcast.

The webcast will be archived on the McEwen website following the

call.

|

Wednesday, October 30, 2019 11:00 am

EDT |

Toll Free US & Canada: |

1 (866) 211-4128 |

|

Outside US & Canada: |

1 (647) 689-6724 |

|

Conference ID Number: |

3788346 |

|

Webcast Link: |

Click Here |

Management will reference slides from this presentation

during the conference call:

http://mcewenmining.com/files/doc_presentations/20191030_q3_conf_call.pdf

ABOUT MCEWEN MINING

McEwen Mining is a diversified gold and silver

producer and explorer with operating mines in Nevada, Canada,

Mexico and Argentina. It also owns a large copper deposit in

Argentina. McEwen’s goal is to create a profitable gold and silver

producer focused in the Americas.

McEwen has approximately 362 million shares

outstanding. Rob McEwen, Chairman and Chief Owner, owns 22% of the

shares.

Reliability of Information Regarding San

JoséMinera Santa Cruz S.A., the owner of the San José

Mine, is responsible for and has supplied to the Company all

reported results from the San José Mine. McEwen Mining’s joint

venture partner, a subsidiary of Hochschild Mining plc, and its

affiliates other than MSC do not accept responsibility for the use

of project data or the adequacy or accuracy of this release.

Technical InformationThe

technical contents of this news release has been reviewed and

approved by Chris Stewart, P.Eng., President & COO of McEwen

Mining and a Qualified Person as defined by Canadian Securities

Administrators National Instrument 43-101 "Standards of Disclosure

for Mineral Projects."

CAUTIONARY NOTE REGARDING NON-GAAP

MEASURESIn this report, we have provided information

prepared or calculated according to U.S. GAAP, as well as provided

some non-U.S. GAAP ("non-GAAP") performance measures. Because the

non-GAAP performance measures do not have any standardized meaning

prescribed by U.S. GAAP, they may not be comparable to similar

measures presented by other companies.

Cash Costs and All-in Sustaining CostsCash costs

consist of mining, processing, on-site general and administrative

costs, community and permitting costs related to current

operations, royalty costs, refining and treatment charges (for both

doré and concentrate products), sales costs, export taxes and

operational stripping costs, and exclude depreciation and

depletion. All-in sustaining costs consist of cash costs (as

described above), plus environmental rehabilitation costs,

amortization of the asset retirement costs related to operating

sites, sustaining exploration and development costs, sustaining

capital expenditures, and sustaining lease payments. Both cash

costs and all-in sustaining costs are divided by the gold

equivalent ounces sold to determine cash costs and all-in

sustaining costs on a per ounce basis. For both cash costs and

all-in sustaining costs we exclude our attributable share of cash

costs from operations where we hold less than a 100% economic share

in the production, such as MSC, where we hold a 49% interest. We

use and report these measures to provide additional information

regarding operational efficiencies both on a consolidated and an

individual mine basis, and believe that these measures provide

investors and analysts with useful information about our underlying

costs of operations. A reconciliation to the nearest U.S. GAAP

measure is provided in McEwen Mining's Quarterly Report on Form

10-Q for the quarter ended September 30, 2019.

Earnings from mining operationsThe term earnings

from mining operations is a Non-GAAP financial measure. We use and

report this metric because we believe it provides investors and

analysts with a useful measure of the underlying earnings from our

mining operations. We define earnings from mining operations as

revenue from gold and silver sales from our El Gallo Project, Gold

Bar mine, Black Fox mine, and our 49% attributable share of the San

José mine’s revenues from gold and silver sales, less their

respective production costs applicable to sales and depreciation

and depletion. To the extent that depreciation and depletion may

include depreciation and amortization expense related to the fair

value increments on historical business acquisitions (fair value

paid in excess of the carrying value of the underlying assets and

liabilities assumed on the date of acquisition), we exclude this

expense in order to arrive at depreciation and depletion that only

includes depreciation and amortization expense incurred at the mine

site level. A reconciliation to the nearest US GAAP measure,

revenue from gold and silver sales, production costs applicable to

sales and depreciation and depletion is provided in the Quarterly

Report on Form 10-Q for the quarter ended September 30, 2019.

Liquid assetsThe term liquid assets used in this

report is a non‑GAAP financial measure. We report this measure to

better understand our liquidity in each reporting period. Liquid

assets is calculated as the sum of cash and cash equivalents,

restricted cash, investments, trade receivable and ounces of doré

held in precious metals inventories, with precious metals valued at

the London PM Fix spot price at the corresponding period. A

reconciliation to the most directly comparable U.S. GAAP measure is

provided in McEwen Mining's Quarterly Report on Form 10-Q for the

quarter ended September 30, 2019.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTSThis news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, factors associated with fluctuations in the market

price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2018 and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not accept

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management of McEwen

Mining Inc.

|

CONTACT INFORMATION: |

|

Investor Relations:(866)-441-0690 Toll Free(647)-258-0395

Christina McCarthy ext. 390Mihaela

Iancu ext. 320 info@mcewenmining.com |

Website: www.mcewenmining.com

Facebook:

facebook.com/mcewenminingFacebook:

facebook.com/mcewenrob Twitter:

twitter.com/mcewenminingTwitter:

twitter.com/robmcewenmux Instagram:

instagram.com/mcewenmining |

150 King Street WestSuite 2800, P.O. Box 24Toronto, ON, CanadaM5H

1J9 |

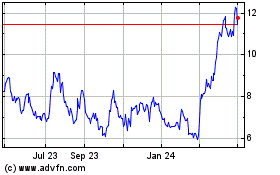

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

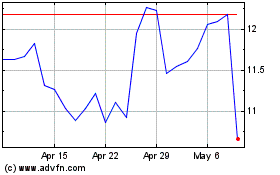

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024