McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report

positive exploration drilling results from its 147NE zone within

the Grey Fox deposit. This deposit is part of the Black Fox

Complex, which is located in the prolific Timmins gold district in

Canada

(see Figure 1). Highlights of the new

results are shown below in

Table 1. While the

assay values are good, management continues to work on resolving

production delays at our Gold Bar and Black Fox mines.

“I am delighted with the exploration

assay results we are generating this year. The geological potential

of the Black Fox Complex is being clearly demonstrated. Our big

exploration push has allowed us to see the opportunity to develop

three new sources of production on our properties.

While exploration is giving me a big

smile, and production at our operations in Argentina and Mexico

(representing 60% of our guidance) are delivering as planned,

production at Gold Bar and Black Fox has been a big disappointment.

Unanticipated natural and operational issues coupled with startup

delays at Gold Bar have pushed some of its production from 2019

into 2020. At Black Fox, production has been adversely impacted by

slower than planned underground development. However, site

management has been making steady progress towards resolving these

production issues,” said Rob McEwen, Chairman and Chief

Owner.

The objectives of the ongoing exploration drill

program at the 147NE zone are to infill and extend the

mineralization, which was discovered in 2018. New drill results are

confirming the continuity of the high-grade mineralization, and

indicate an extension of the main zone (mineralized shoot) down

plunge by approximately 100 m (330 ft) (see Figure

2).

Table 1 – Selected Drill

Results from the 147NE Zone

|

HOLE-ID |

From (m) |

To (m) |

CoreLength(m) |

EstimatedTrue Width(m) |

GoldGrade(g/t) |

GoldGrade(opt) |

|

19GF-1121 |

168.00 |

170.00 |

2.00 |

1.56 |

78.58 |

2.53 |

|

Including |

168.70 |

169.30 |

0.60 |

0.47 |

261.00 |

8.39 |

|

19GF-1134 |

241.00 |

250.00 |

9.00 |

6.90 |

4.79 |

0.15 |

|

And |

256.70 |

269.12 |

12.42 |

9.49 |

3.64 |

0.12 |

|

And |

371.36 |

373.36 |

2.00 |

1.53 |

13.66 |

0.44 |

|

And* |

466.00 |

481.50 |

15.50 |

11.71 |

6.98 |

0.22 |

|

Including |

466.00 |

470.00 |

4.00 |

3.02 |

9.35 |

0.30 |

|

And Including |

474.24 |

481.50 |

7.26 |

5.49 |

9.57 |

0.31 |

|

19GF-1146* |

97.00 |

111.00 |

14.00 |

10.37 |

4.68 |

0.15 |

|

Including |

97.00 |

100.40 |

3.40 |

2.52 |

16.98 |

0.55 |

|

19GF-1151* |

229.80 |

243.00 |

13.20 |

9.56 |

10.04 |

0.32 |

|

Including |

231.00 |

242.00 |

10.90 |

7.89 |

11.87 |

0.38 |

|

And Including |

237.80 |

239.78 |

1.98 |

1.43 |

15.59 |

0.50 |

|

19GF-1155 |

205.40 |

211.24 |

5.84 |

4.52 |

9.66 |

0.31 |

|

19GF-1159* |

112.00 |

116.00 |

4.00 |

3.26 |

6.43 |

0.21 |

|

Including |

112.00 |

114.00 |

2.00 |

1.63 |

12.08 |

0.39 |

|

19GF-1161 |

170.00 |

172.00 |

2.00 |

1.46 |

20.66 |

0.66 |

|

19GF-1164 |

292.61 |

300.00 |

7.39 |

5.33 |

5.71 |

0.18 |

|

And |

308.61 |

315.00 |

6.39 |

4.61 |

5.20 |

0.17 |

|

19GF-1167 |

241.00 |

246.00 |

5.00 |

3.38 |

6.05 |

0.19 |

|

And* |

250.00 |

264.89 |

14.89 |

10.06 |

5.21 |

0.17 |

|

Including |

259.36 |

264.89 |

5.53 |

3.74 |

11.76 |

0.38 |

* Calculated with cut off grade 1.0 g/t Au, minimum length of 3

m, and maximum consecutive internal waste 3 m.

Geological Explanation

At the 147NE zone the highest grades and largest

widths occur at the intersections of NE-SW trending structures and

favorable iron-rich host rocks. This zone starts near surface and

is interpreted to extend to a depth of at least 400 m. Following

the review of past drilling, targets with the same geological

setting have been drilled at the Contact and South zones. While

assay results are pending, this recent drilling intersected visible

gold-bearing quartz-carbonate veins and breccia structures.

Economic Assessment

The current Grey Fox deposit resource estimate

(published in July 2019) is 567,000 gold ounces at

a grade of 7.10 grams per tonne (g/t) in the

Indicated category, with an additional 135,000 gold ounces

at a grade of 6.19 g/t in the Inferred category.

The economic viability of the Grey Fox and

Froome deposits will benefit from their close proximity to the

Black Fox mine and its infrastructure. Preliminary results

regarding the economics and potential development plans for Grey

Fox and Froome and will be presented later this year.

Production Guidance

2019 production guidance for Black Fox and Gold

Bar is being further reduced. Revised production ranges are

36,000-40,000 gold ounces for Black Fox and

30,000-33,000 gold ounces for Gold Bar. Globally

with our two other operations, we now expect to produce

131,000-138,000 gold ounces and

3,225,000 silver ounces, or

169,000-176,000 gold equivalent ounces at an 85:1

gold to silver ratio.

At Black Fox, we have continued to experience

production problems. In 2019, we planned to source production from

both new areas and past production areas (remnant stopes) that make

up part of the mine’s reserves. These remnant stopes are located in

areas of the mine that have been inactive for a number of

years. Prior to being able to extract the ore from these areas

we must make the access safe for our workers, and this

rehabilitation work is taking longer than planned. The delay has

resulted in some higher-grade stopes, planned for extraction in

late 2019, being pushed into 2020.

At Gold Bar, despite the fact that the mine is

now running well, as evidenced by: the tonnage on the heap leach

pad that is currently 115% of the feasibility study design, ore

grades reconciling with our reserve model, and gold recoveries

in-line with our forecast; it was the startup delays that have

pushed some of 2019 planned production into 2020. Gold Bar’s

forecast production for 2020 is 65,000-70,000 gold ounces.

Complete assay results from the latest drilling on the

147NE Zone:

http://mcewenmining.com/files/doc_news/archive/20190910_147ne/20190910_147ne_composites_cog.xlsx

Figure 1 – Black Fox Property

Maphttps://www.globenewswire.com/NewsRoom/AttachmentNg/b37242b8-242a-45e6-aeba-43d869dbf153

Figure 2 – 147NE Exploration

Drilling: Inclined Longitudinal Section Looking

SEhttps://www.globenewswire.com/NewsRoom/AttachmentNg/6d380b9e-6a09-4089-ade1-f35a3a846130

ABOUT MCEWEN MINING

McEwen Mining is a diversified gold and silver

producer and explorer with operating mines in Nevada, Canada,

Mexico and Argentina. It also owns a large copper deposit in

Argentina. McEwen’s goal is to create a profitable gold and silver

producer focused in the Americas.

McEwen has approximately 362 million shares

outstanding. Rob McEwen, Chairman and Chief Owner, owns 22% of the

shares.

QUALIFIED PERSONTechnical

information pertaining to geology and exploration contained in this

news release has been prepared under the supervision of Ken

Tylee, P.Geo. Mr. Tylee is a "qualified person" within the meaning

of NI 43-101.

TECHNICAL INFORMATIONFor a list

of technical terms and their definitions, please consult our mining

glossary: https://www.mcewenmining.com/investor-relations/glossary/default.aspx

Grams per tonne (g/t) converted to Troy ounces

per tonne (opt) at ratio 31.1035 to 1.

All intercept widths are true widths unless

otherwise specified.

Composite criteria unless otherwise stated: Cut

off grade 3 g/t Au, minimum length 2 m, and maximum consecutive

interval waste 3 m. If grade x length > 6 the composite will be

added.

All exploration drill core samples at

the Black Fox Complex were submitted as 1/2 core.

Analyses reported herein were performed by the independent

laboratories: ALS Laboratories, which is ISO

9001/IEC17025 certified, and AGAT Laboratories, which is ISO

9001/IEC17025 certified. McEwen’s quality control program includes

systematic insertion of blanks, standard reference material and

duplicates to ensure laboratory accuracy.

To determine the lengths of significant

mineralized intervals, the following composite criteria was

established: a minimum reportable interval length of 3 m was

determined by establishing a cut-off grade of 3g/t gold for

underground (1 g/t gold for near surface). A consecutive maximum

length of 3 m of internal waste, including sub cut-off grade

material, is allowed and incorporated into the reported

composites. Where an interval of less than 3 m is considered,

if the grade x length calculation is greater than 9 (3 for

surface), it may be reported. There is no top cutting or capping of

assays.

For further details about the Black Fox Complex

project including Grey Fox 147NE target area, please see our NI

43-101 technical report titled "Technical Report for the Black Fox

Complex, Canada" dated April 6th, 2018 with an effective date of

October 31st, 2017 available on SEDAR (www.sedar.com) under our

issuer profile.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTSThis news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, factors associated with fluctuations in the market

price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks. The

Company’s dividend policy will be reviewed periodically by the

Board of Directors and is subject to change based on certain

factors such as the capital needs of the Company and its future

operating results. Readers should not place undue reliance on

forward-looking statements or information included herein, which

speak only as of the date hereof. The Company undertakes no

obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. See McEwen Mining's Annual

Report on Form 10-K for the fiscal year ended December 31, 2018 and

other filings with the Securities and Exchange Commission, under

the caption "Risk Factors", for additional information on risks,

uncertainties and other factors relating to the forward-looking

statements and information regarding the Company. All

forward-looking statements and information made in this news

release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management of McEwen

Mining Inc.

| CONTACT

INFORMATION: |

| |

| Investor Relations:(866)-441-0690

Toll Free(647)-258-0395 Christina McCarthy

ext. 390 info@mcewenmining.com |

Website:

www.mcewenmining.com Facebook:

facebook.com/mcewenminingFacebook:

facebook.com/mcewenrob Twitter:

twitter.com/mcewenminingTwitter:

twitter.com/robmcewenmux Instagram:

instagram.com/mcewenmining |

150 King Street WestSuite 2800,

P.O. Box 24Toronto, ON, CanadaM5H 1J9 |

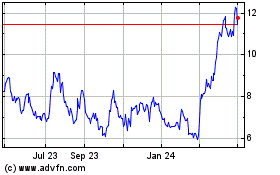

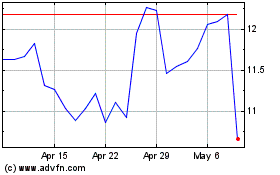

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024