McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to report positive exploration drill results (

see

Table 1) from its 100% owned Stock Property, part of the

Black Fox Complex, near Timmins, Ontario, Canada

(see

Figure 1). Assay results have been received for 27 holes

drilled along a 3 km (1.9 mile) trend that hosts the historical

Stock Mine and Stock East deposit.

Highlights:

- A high-grade drill intersection of

18.0 g/t Au over 9.1 m, including

120 g/t Au over 1.3 m was

encountered 250 m below the deepest intersection from exploration

in 2018, and 650 m below the deepest workings in the Stock

Mine, reinforcing our belief that the gold system

remains strong and open with potential to extend mineralization

below the mine workings (see Figure 2).

- Intersections to the East and West

of the Stock Mine, including 10.9

g/t Au over 5 m, suggest potential for

new mineralized zones along strike of the deposits.

- Drilling is continuing at depth and

along strike during the remainder of the year, and additional

results are expected to be release in Q4.

Table 1 – Selected Drill Results

from Stock Property

|

HOLE-ID |

From (m) |

To (m) |

CoreLength(m) |

EstimatedTrue Width(m) |

GoldGrade(g/t) |

Area |

|

S19-95 |

972.00 |

983.00 |

11.00 |

9.13 |

17.96 |

Deep |

|

Including |

974.40 |

976.00 |

1.60 |

1.33 |

119.98 |

|

|

Including |

974.40 |

975.00 |

0.60 |

0.50 |

311.00 |

|

|

S19-90 |

349.65 |

353.15 |

3.50 |

ND |

4.23 |

West |

|

Including |

349.65 |

351.70 |

2.05 |

ND |

5.72 |

|

|

SEZ19-14 |

55.50 |

57.00 |

1.50 |

1.36 |

9.94 |

East |

|

Including |

55.50 |

55.95 |

0.45 |

0.41 |

23.90 |

|

|

SEZ19-15 |

169.00 |

174.50 |

5.50 |

5.00 |

10.94 |

East |

|

Including |

173.00 |

174.50 |

1.50 |

1.36 |

28.63 |

|

Stock Deep

Exploration drilling by MUX in 2018 and 2019

below the workings of the Stock Mine is testing the potential for

the mineralized system to extend deeper. Production ceased in 2004

at a relatively shallow depth of only 330 m (1,080 ft), and overall

produced 137,000 ounces of gold at an average grade of 5.4 g/t. The

latest intersection in hole S19-95 is the deepest drilled to date

and encountered a very encouraging high-grade result.

In 2018, hole S18-31 intersected multiple

intervals of mineralization up to a depth of 750 m (2,460 ft) below

surface under the mine workings. The best intersections from hole

S18-31 include:

5.58 g/t Au over 3.3

m, including 14.8 g/t Au over 1.0

m; and7.01 g/t Au over 3.8

m, Including 30.1 g/t Au over 0.8

m; and3.76 g/t Au over 4.0

m.

During Q2 2019, hole S19-95 intersected

mineralization 250 m (820 ft) below the positive results

intersected in 2018 in hole S18-31, and 950 m

below surface. Multiple zones of alteration and

mineralization were observed, including visible gold. The best

interval received from this hole is 18.0 g/t Au

over 9.1 m, including 120 g/t Au

over 1.3 m, including 311 g/t Au

over 0.5 m. This high-grade intersection and other

mineralization intersected in holes S19-95 and S18-31 have

reinforced our belief that the gold-hosting system remains open

with high potential at depth. Significant depth potential well

beyond 1,000 m (3,280 ft) is a characteristic of geologically

similar deposits elsewhere in Canada as illustrated in

Figure 3.

Assay results are pending from wedge hole

S19-97W, which was drilled to follow-up on the positive assays from

S19-95. Visually positive mineralized intervals were observed over

49 m, including local occurrences of visible gold, assays are

pending for these portions. Drilling is in progress on additional

holes.

Stock West

Drilling also took place 1.1 km (0.7 miles)

along strike to the West of the Stock Mine and intersected

encouraging alteration and mineralization in hole S19-90, which

returned at 4.2 g/t Au over 3.5

m, including 5.7 g/t Au over 2.1

m (core length). This intersection is near two historical

drill intersections, which returned 23.0 g/t Au

over 1.5 m and 14.5 g/t Au over

3 m, suggesting a potentially new zone of

mineralization (a mineralized ‘shoot’) may occur in this area.

Assays are pending from a follow up hole S19-98,

which was drilled to intersect mineralization beneath S19-90.

Visible gold was noted in multiple quartz veinlets within the

silicified zones of a highly altered ultramafic volcanic.

Stock East

Drilling in early 2018 initially focused on

Stock East, a shallow target that is located 700 m (2,300 ft) from

the Stock Mill. Successful drilling at Stock East quickly led to

the definition of an initial Indicated and Inferred resource

estimate of 1,490 kt @ 1.25 g/t Au for 60 koz Au

and 1,997 kt @ 1.39 g/t for 90 koz Au,

respectively. The initial resource assumed an open pit mining

scenario at Stock East, however recent drilling has encountered

higher-grade mineralization, such as in hole SEZ19-15 that returned

10.9 g/t Au over 5 m. This new

mineralization correlates with positive drill intersections from

2018, such as 4.7 g/t over 2 m,

including 14 g/t over 0.4 m; and

31.8 g/t over 0.4 m.

Property and Geologic

Information

The Stock Property is the site of McEwen’s Stock

Mill, which currently processes ore from the Black Fox Mine.

Previously the mill processed ore from the historical underground

Stock Mine that was in intermittent production from the early 1980s

until 2004.

Known mineralization occurs along the Destor

Porcupine Fault Zone (DPFZ), which crosses the property from West

to East over a strike length of approximately 8 km. A significant

NE-SW trending fault (the Nighthawk Fault) intersects the DPFZ near

the Stock Mine making the area a prime structural setting for gold

mineralization.Gold mineralization at Stock consists of

disseminated sulfides (mostly pyrite) and quartz-carbonate

stockwork and breccia, hosted in sericite-silica-albite and

fuchsite altered mafic and ultramafic volcanic rocks, and in highly

siliceous and albite-rich dykes.

Figure 1: Stock Mine Trend Plan

Viewhttps://www.globenewswire.com/NewsRoom/AttachmentNg/22fb24d9-9054-4e23-a523-279f0d478ffd

Figure 2: Stock Mine Trend

Longitudinal

Sectionhttps://www.globenewswire.com/NewsRoom/AttachmentNg/58883495-2e79-456f-8a5c-a3bd92676c9b

Figure 3: Illustration of Other

Mines in Similar Geological

Settingshttps://www.globenewswire.com/NewsRoom/AttachmentNg/00d84b71-9d6c-48d3-b566-c9a1ca12f88a

Complete assay results from the latest drilling on the

Stock Property:

http://mcewenmining.com/files/doc_news/archive/20190900_stock_pr/20190900_stock_composites_cog_1.xlsx

ABOUT MCEWEN MINING

McEwen Mining is a diversified gold and silver

producer and explorer with operating mines in Nevada, Canada,

Mexico and Argentina. It also owns a large copper deposit in

Argentina. McEwen’s goal is to create a profitable gold and silver

producer focused in the Americas.

McEwen has approximately 362 million shares

outstanding. Rob McEwen, Chairman and Chief Owner, owns 22% of the

shares.

TECHNICAL INFORMATIONTechnical

information pertaining to geology and exploration contained in this

news release has been prepared under the supervision of Ken

Tylee, P.Geo. Mr. Tylee is a "qualified person" within the meaning

of NI 43-101.

Black Fox Complex drilling (including the Stock

Property) was conducted by Major Drilling and Norex Drilling and

supervised by McEwen’s Geology Department. All exploration drill

core samples at the Stock Property were submitted as 1/2 core.

Analyses reported herein were usually performed by

the fire assay method by the independent laboratories:

ALS Laboratories (ISO 9001/IEC17025 certified) and AGAT Labs (ISO

9001/IEC17025 certified). On occasion, a screen metallic

fire assay technique is used to determine coarse and fine gold in

samples and utilises a larger volume of the sample. The plus

fraction is fire assayed for gold and a duplicate assay is

performed on the minus fraction. Size fraction weights, coarse and

fine fraction gold content and total gold content are

reported. McEwen’s quality control program includes

systematic insertion of blanks, standard reference material and

duplicates to ensure laboratory accuracy.

To determine the lengths of significant

mineralized intervals, the following composite criteria was

established: a minimum reportable interval length of 3 m was

determined by establishing a cut-off grade of 1 g/t gold. A

consecutive maximum length of 3 m of internal waste, including sub

cut-off grade material, is allowed and incorporated into the

reported composites. Where an interval of less than 3 m is

considered, if the grade x length calculation is greater than 3, it

may be reported. There is no top cutting or capping of assays.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTSThis news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, factors associated with fluctuations in the market

price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks. The

Company’s dividend policy will be reviewed periodically by the

Board of Directors and is subject to change based on certain

factors such as the capital needs of the Company and its future

operating results. Readers should not place undue reliance on

forward-looking statements or information included herein, which

speak only as of the date hereof. The Company undertakes no

obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. See McEwen Mining's Annual

Report on Form 10-K for the fiscal year ended December 31, 2018 and

other filings with the Securities and Exchange Commission, under

the caption "Risk Factors", for additional information on risks,

uncertainties and other factors relating to the forward-looking

statements and information regarding the Company. All

forward-looking statements and information made in this news

release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management of McEwen

Mining Inc.

| CONTACT

INFORMATION: |

| Investor

Relations:(866)-441-0690 Toll Free(647)-258-0395

Christina McCarthy ext. 390Mihaela

Iancu ext. 320 info@mcewenmining.com |

Website:

www.mcewenmining.com Facebook:

facebook.com/mcewenminingFacebook:

facebook.com/mcewenrob

Twitter:

twitter.com/mcewenminingTwitter: twitter.com/robmcewenmux

Instagram: instagram.com/mcewenmining |

150 King Street WestSuite 2800, P.O. Box 24Toronto, ON,

CanadaM5H 1J9 |

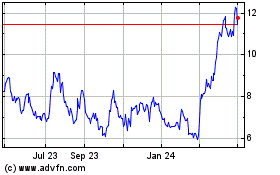

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

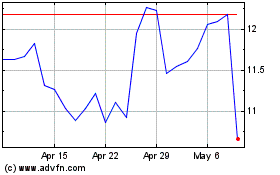

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024