By AnnaMaria Andriotis and Amber Burton

Credit card rewards have typically fallen into two buckets:

aspirational (upgrading to a first-class flight, getting a free

hotel stay) or practical (earning cash back). But what if you could

cover the cost of a trip to space or pay down your student

loan?

Visa Inc., Mastercard Inc. and big banks are revisiting their

rewards programs to cater to younger customers who want to use

their cards to build wealth or get out of debt -- not just rack up

perks. Financial-technology, or fintech, upstarts are offering

niche rewards to better compete against the established

players.

Companies are also re-evaluating travel rewards programs. About

30% of rewards credit-card holders didn't redeem rewards in 2020,

according to Bankrate, leading some issuers to believe there is a

market for more innovative rewards. The pandemic's effects on

travel and dining have only strengthened this push. One day,

intrepid spenders could redeem hundreds of thousands of card points

for a ticket to orbit, according to Visa.

Here are five reward offerings you're likely to see in the

coming years, according to card industry executives and fintech

firms.

Shrink Your Student Loans

With some 45 million Americans owing roughly $1.7 trillion in

student-loan debt, more lenders are considering rewards programs

that would allow cardholders to put cash back toward loan

payments.

Fintech startup Social Finance Inc. in March launched a credit

card that provides up to 2% cash back, which can be converted to

pay down student loans that cardholders have with the company,

among other things.

In the future, similar cards would be pitched to students

graduating college and as a redemption option on existing cards,

says Mladen Vladic, general manager of loyalty at Fidelity National

Information Services Inc., which administers many banks' rewards

programs.

Cover Your Rent

Another big expense for cardholders? Rent. Many landlords don't

accept rent payments by credit card because of the fees charged by

the card issuer and the payment network.

Visa and Mastercard are working on initiatives that they hope

will increase card acceptance for rent payments, but in the past

their efforts haven't gained much traction because of the fees.

Still, some companies are starting to offer rent-related perks.

In the coming months, the fintech company Kairos plans to launch

Bilt, a rewards program that lets consumers pay rent while

generating points that could be used toward a down payment on a

home, according to the company's website. Kairos declined to

comment.

Invest in a Better World

Spend money, save the planet? More card issuers are looking into

rewards programs that incentivize purchases with a smaller carbon

footprint, as young people place a greater emphasis on the social

impact of their financial decisions.

Aspiration Zero, a credit card launched in March, provides up to

1% cash back and says it plants a tree with each purchase. It also

tracks the carbon footprint of the user's purchases and grades

merchants on social issues, including whether they have diverse

workforces or equitable labor practices. Customers get additional

cash back when they shop at companies with higher scores. The

Aspiration community has planted over 5 million trees in Central

and South America, Madagascar, Kenya and the U.S., according to

co-founder Andrei Cherny.

Synchrony Financial, the largest U.S. issuer of store credit

cards, in April will allow customers who have its co-branded credit

card geared at health and wellness expenses the option to redeem

their points toward newly planted trees. The effort is part of a

coalition that Mastercard launched last year along with card

issuers and forest restoration groups to plant 100 million trees

over five years.

Doconomy, a Swedish fintech company, recently launched its DO

credit card in collaboration with Finnish bank Ålandsbanken,

Mastercard and the United Nations Framework Convention on Climate

Change. To promote personal responsibility for climate change, the

card freezes the ability to make purchases when those purchases

reach a carbon footprint limit for the month. The limit, which

can't be overridden, is set based on data from S&P Global,

UNFCCC and Our World in Data in collaboration with researchers from

the University of Oxford measuring the carbon dioxide impact of

every transaction. A corresponding app includes a carbon footprint

calculator for purchases. Doconomy says it has also worked out how

to assess intangible purchases such as medical expenses and

haircuts.

For traditional rewards programs, card companies are also

discussing offering rewards for eco-friendly card purchases, such

as bike rentals and electric-vehicle charging, according to

Visa.

Earn Crypto

More fintechs are launching cryptocurrency-related rewards

programs.

BlockFi, an online lender for investors with crypto assets, says

it will roll out a credit card with a bitcoin rewards program later

this year. The card, which is set to have a $200 annual fee, will

pay out 1.5% in cash back, which the company will convert to

bitcoin, for every dollar spent.

Mobile payments startup Fold Inc. offers a Wheel of

Fortune-style rewards program: Each time cardholders make a

purchase with their Fold debit card, they get to spin a digital

wheel to determine what rewards they get. Options include 1% or

even 100% cash back that is converted to bitcoin and, in much rarer

instances, a full bitcoin, worth around $59,000 on Friday.

Coinbase Global Inc., the largest U.S.-based cryptocurrency

platform, plans to roll out a crypto rewards debit card in the U.S.

that will pay 1% back in bitcoin or 4% in Stellar lumens, another

cryptocurrency. Cardholders can make purchases with bitcoin or one

of more than 50 other assets that Coinbase supports in the U.S.

Coinbase converts the asset into U.S. dollars when it sends the

payment to merchants, which with many assets involves a fee for the

cardholder of 2.49% of the purchase price.

Level Up Your In-Game Purchases

Videogame developers are looking to roll out their own

co-branded rewards cards that would let customers earn points

through gaming and real-world purchases and redeem them for items

within games, such as better weapons or cars, according to people

familiar with the discussions.

Riot Games, which developed League of Legends, is looking to

launch a credit card in the U.S. that doles out points that can be

redeemed for in-game experiences, the people say.

Cardless Inc., a fintech firm that launched last year, is

developing co-branded credit cards tied to sports teams that will

reward users with perks like video chats with former players and

discounted or free sports streaming services.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Amber Burton at Amber.Burton@wsj.com

(END) Dow Jones Newswires

April 03, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

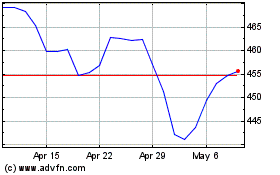

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

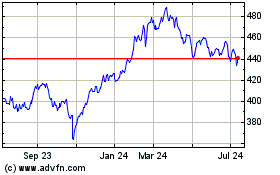

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024