Current Report Filing (8-k)

July 17 2020 - 4:31PM

Edgar (US Regulatory)

FALSE000010177800001017782020-07-172020-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

July 17, 2020

|

Marathon Oil Corporation

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

|

1-1513

|

|

|

|

25-0996816

|

|

_____________________________________________

(State or other jurisdiction

|

|

|

_______________________________

(Commission

|

|

|

|

__________________________________

(I.R.S. Employer

|

|

of incorporation)

|

|

|

File Number)

|

|

|

|

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

5555 San Felipe Street,

|

Houston,

|

Texas

|

|

|

|

|

77056-2723

|

|

____________________________________________________________

(Address of principal executive offices)

|

|

|

|

|

|

|

___________________________________________

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

|

|

|

(713)

|

629-6600

|

|

Not Applicable

________________________________________________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.00

|

|

MRO

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

☐

|

Item 7.01. Regulation FD Disclosure.

On July 17, 2020, Marathon Oil Corporation (the “Company”) announced that the Company had delivered to The Bank of New York Mellon Trust Company, in its capacity as Trustee, and Morgan Stanley & Co. LLC, in its capacity as Remarketing Agent, a Conditional Notice of Conversion of up to $400 million of bonds constituting part of the $1 billion St. John the Baptist, State of Louisiana (the “Issuer”) Revenue Refunding Bonds (“Marathon Oil Corporation Project”) Series 2017 (the “2017 Bonds”) issued by the Company on December 18, 2017 to sub-series B bonds to remarket them (the “Sub-Series 2017B Bonds”). The Company has the right to cancel the conversion of some or all of the $400 million of 2017 Bonds to Sub-Series 2017B Bonds due to market conditions.

Any future material information regarding the Sub-Series 2017B Bonds, the Marathon Oil Corporation Project or the 2017 Bonds will be available on the website of the Municipal Securities Rulemaking Board via its Electronic Municipal Market Access system at www.msrb.org.

This Current Report shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, that address activities that the Company assumes, plans, expects, believes or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward- looking statements are based on the Company’s current beliefs, based on currently available information, as to the outcome and timing of future events, including specifically the statements regarding the conditional notice of conversion of the Sub-Series 2017B Bonds. While the Company believes its assumptions concerning future events are reasonable, a number of factors could cause actual results to differ materially from those projected. Information concerning these risks and other factors can be found in the Company's 2019 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other public filings and press releases, available at www.marathonoil.com. Except as required by law, the Company undertakes no obligation to revise or update any forward-looking statements as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marathon Oil Corporation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July 17, 2020

|

|

By:

|

|

/s/ Gary E. Wilson

|

|

|

|

|

|

|

|

|

|

|

|

Name: Gary E. Wilson

|

|

|

|

|

|

Title: Vice President, Controller and Chief Accounting Officer

|

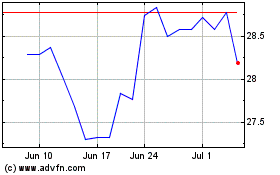

Marathon Oil (NYSE:MRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

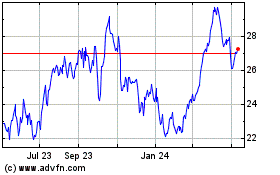

Marathon Oil (NYSE:MRO)

Historical Stock Chart

From Apr 2023 to Apr 2024