Retail's Latest Challenge: Higher Trade Tariffs

May 13 2019 - 8:29AM

Dow Jones News

By Michael Wursthorn

Shares of retailers, buffeted by rising trade tensions in recent

sessions, face a key test this week when Macy's Inc., Walmart Inc.

and others begin reporting quarterly earnings.

The S&P 500 Retailing index fell 3% last week after

President Trump pushed ahead with tariff increases on billions of

dollars of Chinese imports, outpacing the broader benchmark's 2.2%

decline. Shares of Macy's slid 3.4%, while J.C. Penney Co. and

Ralph Lauren shed more than 5% each. Stocks averted deeper declines

after Treasury Secretary Steven Mnuchin said Friday's trade talks

were "constructive" despite ending without a deal.

The slides could worsen this week, once retailers begin

reporting earnings, analysts said. Investors will want details on

how merchants plan to absorb 25% tariffs on more than $40 billion

worth of goods that are imported from China and directly purchased

by U.S. consumers.

The tariffs, which took effect Friday, hit clothing, luggage,

handbags and furniture, among other consumer products. And

retailers have few options: they can absorb the added costs

themselves; spread them across their vendors; or pass them on to

customers.

None of those options is particularly attractive, analysts said,

and retailers' pain could signal broader implications for the U.S.

economy. Initial estimates project the additional tariffs will

shave 0.3% from U.S. growth this year.

"When this tariff conversation started last year, retailers were

in a stronger position," said Simeon Siegel, a senior retail

analyst at Instinet. At the time, economic conditions were better

and retailers were cutting back on inventories. "But now things

have normalized, inventories are up again and retailers can't

really raise prices."

Profit margins are already under pressure, as companies like

Walmart and Target have been spending heavily on upgrading their

digital capabilities and remodeling their stores. Absorbing higher

tariff-related costs would further stifle margin expansion,

analysts added.

In the previous earnings reporting season, both reported slimmer

profit margins, but results were upbeat overall, helping to send

shares higher. Walmart's stock remains up 9.4% this year, while

shares of Target have added 13%.

Consumer discretionary stocks, excluding internet retailers, are

expected to see a 5.2% contraction in first-quarter profit margins

from a year earlier, according to data compiled by Credit Suisse.

Margins among consumer staples, which include stocks like Walmart,

are expected to shrink 5.8%.

That could lead retailers to raise prices in an effort to

protect their margins, analysts said, but companies run the risk of

stifling revenue if customers pull back on spending. Consumers'

pockets appear relatively healthy thanks to a tight labor market

and rising wages. But retail spending has been mixed in recent

months following a weak holiday sales season, a sluggish February

and a bounce back in March, according to Commerce Department

data.

With a 25% tariff on apparel items, retailers would have to

raise prices by 2.3% to maintain their gross margins, according to

analysts at Bank of America. If they can't raise prices, analysts

say the tariffs could compress retail earnings by 39% this

year.

Some companies have been trying to insulate themselves from the

U.S. and China trade spat, which could soften the blow of tariffs,

analysts said. Several companies have been shifting production from

China to other Southeast Asian countries in recent years. Others

had been rushing goods over from China, ahead of the tariffs,

Credit Suisse's retail analysts wrote in a note last week.

Even if the fallout isn't as bad as expected, the market has

reacted harshly to the idea of tariffs. Last year's volatility was

spurred, in part, by President Trump's protectionist policies. And

the S&P 500's 2.2% slide last week -- its biggest weekly loss

of the year -- came after President Trump's initial threat to raise

the levies on Chinese imports.

As long as tariffs remain in place, investors' doubts alone

could be enough to drag retail-stock prices even lower.

"The fear of global trade...deteriorating amid macro fears

during previous U.S./China escalations" had the biggest impact on

stocks over the past six months, Credit Suisse analysts said, even

though costs didn't drastically increase.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

May 13, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

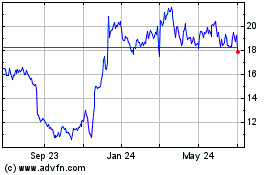

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

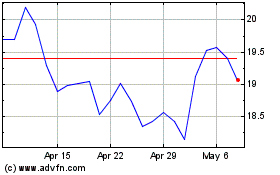

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024