QuickLinks

-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

LyondellBasell Industries N.V.

(Name Of Subject Company (Issuer) And Filing Person (Offeror))

Ordinary Shares, par value €0.04 per share

(Title of Class of Securities)

N53745100

(CUSIP Number of Ordinary Shares)

Jeffrey A. Kaplan

Executive Vice President and Chief Legal Officer

4

th

Floor, One Vine Street

London, W1J0AH

The United Kingdom

+44 (0) 207 220 2600

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

With a copy to:

George Casey

Harald Halbhuber

Derrick Lott

Shearman & Sterling

599 Lexington Avenue

New York, NY 10022-6069

(212) 848-4000

CALCULATION OF FILING FEE

|

|

|

|

|

|

|

|

|

|

Transaction Valuation*

|

|

Amount Of Filing Fee**

|

|

|

|

$3,256,000,000

|

|

$394,627.20

|

|

|

-

*

-

The

transaction value is estimated only for purposes of calculating the filing fee. This amount is based on the offer to purchase up to 37,000,000 shares of the

Ordinary Shares, par value €0.04 per share, at the maximum tender offer price equal to $88.00.

-

**

-

The

amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory #1 for

fiscal year 2019, issued August 24, 2018, by multiplying the transaction valuation by 0.0001212.

-

o

-

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which

the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

|

Amount Previously Paid:

|

|

N/A

|

|

Filing Party:

|

|

N/A

|

|

|

Form or Registration No.:

|

|

N/A

|

|

Date Filed:

|

|

N/A

|

-

o

-

Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

-

o

-

third-party

tender offer subject to Rule 14d-1.

-

ý

-

issuer

tender offer subject to Rule 13e-4.

-

o

-

going-private

transaction subject to Rule 13e-3.

-

o

-

amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer:

o

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

-

o

-

Rule 13e-4(i)

(Cross-Border Issuer Tender Offer)

-

o

-

Rule 14d-1(d)

(Cross-Border Third Party Tender Offer)

SCHEDULE TO

This Tender Offer Statement on Schedule TO relates to the offer by LyondellBasell Industries N.V., a Dutch public company with

limited liability (the "

Company

"), to purchase up to 37,000,000 of its issued and outstanding ordinary shares, par value €0.04 per share

(the "

Shares

"), at a price that is the lesser of (i) a price not greater than $88.00 nor less than $77.00 per Share, and (ii) a price that

equals 110% of the daily per share volume-weighted average price for the Shares on the New York Stock Exchange on the Expiration Date, as defined in the Offer to Purchase (defined below), to the

seller in cash, less any applicable withholding taxes and without interest. The Company's offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated

June 10, 2019 (together with any amendments or supplements thereto, the "

Offer to Purchase

"), the related Letter of Transmittal (together with

any amendments or supplements thereto, the "

Letter of Transmittal

") and other related materials as may be amended or supplemented from time to time

(collectively, with the Offer to Purchase and the Letter of Transmittal, the "

Offer

"). This Tender Offer Statement on Schedule TO is intended to

satisfy the reporting requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934, as amended.

The

information in the Offer to Purchase and the Letter of Transmittal, copies of which are filed with this Schedule TO as Exhibits (a)(1)(A) and (a) (1)(B),

respectively, are incorporated by reference in answer to Items 1 through 11 in this Tender Offer Statement on Schedule TO.

ITEM 1. SUMMARY TERM SHEET

The information set forth in the section captioned "Summary Term Sheet" of the Offer to Purchase, a copy of which is filed with this

Schedule TO as Exhibit (a)(1)(A), is incorporated herein by reference.

ITEM 2. SUBJECT COMPANY INFORMATION

(a)

Name and Address:

The name of the subject company is LyondellBasell Industries N.V., a Dutch public

company with limited liability. The addresses and telephone numbers of its principal executive offices are: Fourth Floor, One Vine Street, London, WIJ 0AH, United Kingdom (telephone number: 44

(0) 207 220 2600); 1221 McKinney St., Suite 300, Houston, Texas, USA 77010 (telephone number: (713) 309 7200); and Delftseplein 27E, 3013 AA, Rotterdam, The

Netherlands (telephone number: 31 (0)10 275 5500). The information set forth in Section 10 ("Certain Information Concerning Us") of the Offer to Purchase is incorporated herein by

reference.

(b)

Securities:

The information set forth in the section of the Offer to Purchase captioned "Introduction" and

in Section 11 ("Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares") of the Offer to Purchase is incorporated herein by reference.

(c)

Trading Market and Price:

The information set forth in the section of the Offer to Purchase captioned

"Introduction" and Section 8 ("Price Range of Shares; Dividends") of the Offer to Purchase is incorporated herein by reference.

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON

(a)

Name and Address:

The name of the filing person is LyondellBasell Industries N.V., a Dutch public

company with limited liability. The addresses and telephone numbers of its principal executive offices are: Fourth Floor, One Vine Street, London, WIJ 0AH, United Kingdom (telephone number: 44

(0) 207 220 2600); 1221 McKinney St., Suite 300, Houston, Texas, USA 77010 (telephone number: (713) 309 7200); and Delftseplein 27E, 3013 AA, Rotterdam, The

Netherlands (telephone number: 31 (0)10 275 5500). The information set forth in Section 10 ("Certain Information Concerning Us") and

Section 11 ("Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares") of the Offer to Purchase and in Schedule I to the Offer to Purchase is

incorporated herein by reference.

ITEM 4. TERMS OF THE TRANSACTION

(a)

Material Terms:

The information set forth in the sections of the Offer to Purchase captioned "Introduction"

and "Summary Term Sheet," and in Section 1 ("Number of Shares; Price; Proration"), Section 2 ("Purpose of the Offer; Certain Effects of the Offer; Plans and Proposals"), Section 3

("Procedures for Tendering Shares"), Section 4 ("Withdrawal Rights"), Section 5 ("Purchase of Shares and Payment of Purchase Price"), Section 6 ("Conditional Tender of Shares"),

Section 7 ("Conditions of the Offer"), Section 9 ("Source and Amount of Funds"), Section 11 ("Interests of Directors and Executive Officers; Transactions and Arrangements

Concerning the Shares"), Section 13 ("Certain Tax Considerations"), Section 14 ("Extension of the Offer; Termination; Amendment") and Section 16 ("Miscellaneous") of the Offer to

Purchase is incorporated herein by reference.

(b)

Purchases:

The information set forth in Section 11 ("Interests of Directors and Executive Officers;

Transactions and Arrangements Concerning the Shares") of the Offer to Purchase is incorporated herein by reference.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS

(a)

Agreements Involving the Subject Company's Securities:

The information set forth in Section 11

("Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares") of the Offer to Purchase is incorporated herein by reference.

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS

(a)

Purposes:

The information set forth in the section of the Offer to Purchase captioned "Summary Term Sheet"

and in Section 2 ("Purpose of the Offer; Certain Effects of the Offer; Plans and Proposals") of the Offer to Purchase is incorporated herein by reference.

(b)

Use of the Securities Acquired:

The information set forth in Section 2 ("Purpose of the Offer;

Certain Effects of the Offer; Plans and Proposals") of the Offer to Purchase is incorporated herein by reference.

(c)

Plans:

The information set forth in Section 2 ("Purpose of the Offer; Certain Effects of the Offer;

Plans and Proposals") of the Offer to Purchase is incorporated herein by reference.

ITEM 7. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

(a)

Source of Funds:

The information set forth in the section of the Offer to Purchase captioned "Summary Term

Sheet" and in Section 9 ("Source and Amount of Funds") of the Offer to Purchase is incorporated herein by reference.

(b)

Conditions:

The information set forth in the section of the Offer to Purchase captioned "Summary Term Sheet"

and in Section 9 ("Source and Amount of Funds") of the Offer to Purchase is incorporated herein by reference.

(c)

Borrowed Funds:

The information set forth in the section of the Offer to Purchase captioned "Summary Term

Sheet" and in Section 9 ("Source and Amount of Funds") of the Offer to Purchase is incorporated herein by reference.

ITEM 8. INTEREST IN SECURITIES OF THE SUBJECT COMPANY

(a)

Securities Ownership:

The information set forth in Section 11 ("Interests of Directors and Executive

Officers; Transactions and Arrangements Concerning the Shares") of the Offer to Purchase is incorporated herein by reference.

(b)

Securities Transactions:

The information set forth in Section 11 ("Interests of Directors and

Executive Officers; Transactions and Arrangements Concerning the Shares") of the Offer to Purchase is incorporated herein by reference.

ITEM 9. PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED

(a)

Solicitations or Recommendations:

The information set forth in Section 15 ("Fees and Expenses") of

the Offer to Purchase is incorporated herein by reference.

ITEM 10. FINANCIAL STATEMENTS

(a) and (b) Not applicable.

ITEM 11. ADDITIONAL INFORMATION

(a)

Agreements, Regulatory Requirements and Legal Proceedings:

The information set forth in Section 2

("Purpose of the Offer; Certain Effects of the Offer; Plans and Proposals"), Section 11 ("Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares")

and Section 12 ("Certain Legal Matters; Regulatory Approvals") of the Offer to Purchase is incorporated herein by reference.

(b)

Other Material Information:

The information in the Offer to Purchase and the Letter of Transmittal, copies

of which are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, is incorporated herein by reference.

ITEM 12. EXHIBIT INDEX

|

|

|

|

|

(a)(1)(A)

|

|

Offer to Purchase, dated June 10, 2019.

|

(a)(1)(B)

|

|

Letter of Transmittal (including IRS Form W-9).

|

(a)(1)(C)

|

|

Notice of Guaranteed Delivery.

|

(a)(1)(D)

|

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees.

|

(a)(1)(E)

|

|

Letter to Clients for Use by Brokers, Dealers, Banks, Trust Companies and Other Nominees.

|

(a)(1)(F)

|

|

Summary Advertisement, dated June 10, 2019.

|

(a)(1)(G)

|

|

Letter to Vested Stock Option Holders.

|

(a)(1)(H)

|

|

Email communication to Employees.

|

(a)(1)(I)

|

|

Letter to Current and Former LyondellBasell Employees who own Shares held on the Solium Shareworks Platform.

|

(a)(1)(J)

|

|

Form of Notice of Withdrawal.

|

(a)(2)

|

|

Not applicable.

|

(a)(3)

|

|

Not applicable.

|

(a)(4)

|

|

Not applicable.

|

(a)(5)(A)

|

|

Press Release, dated June 10, 2019.

|

(b)

|

|

None.

|

(d)(1)

|

|

LyondellBasell U.S. Senior Management Deferral Plan dated effective as of May 1, 2012 (incorporated by reference to

Exhibit 10.1 to the Company's Current Report on Form 8-K filed with the SEC on March 1, 2012).

|

(d)(2)

|

|

First Amendment to the LyondellBasell U.S. Senior Management Deferral Plan dated effective as of January 1, 2013

(incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed with the SEC on April 30, 2013).

|

(d)(3)

|

|

LyondellBasell Executive Severance Plan, Amended & Restated, Effective as of June 1, 2015 and Form of

Participation Agreement (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed with the SEC June 5, 2015).

|

(d)(4)

|

|

2017 Form of Restricted Stock Unit Agreement (incorporated by reference to Exhibit 10.2 to the Company's Current

Report on Form 8-K filed with the SEC on February 23, 2017).

|

(d)(5)

|

|

2017 Form of Performance Share Unit Agreement (incorporated by reference to Exhibit 10.3 to the Company's Current

Report on Form 8-K filed with the SEC on February 23, 2017).

|

(d)(6)

|

|

2017 Form of Non-Qualified Stock Option Agreement (incorporated by reference to Exhibit 10.4 to the Company's Current

Report on Form 8-K filed with the SEC on February 23, 2017).

|

(d)(7)

|

|

LyondellBasell Industries N.V. Global Employee Stock Purchase Plan (as amended and restated effective

October 1, 2018) (incorporated by reference to Appendix B to the Company's definitive proxy statement filed with the SEC on April 11, 2018).

|

(d)(8)

|

|

Form of Officer and Director Indemnification Agreement (incorporated by reference to Exhibit 10.12 to the

Company's Annual Report on Form 10-K filed with the SEC on February 21, 2019).

|

|

|

|

|

|

(d)(9)

|

|

2019 Form of Restricted Stock Unit Agreement (incorporated by reference to Exhibit 10.17 to the Company's Annual

Report on Form 10-K filed with the SEC on February 21, 2019).

|

(d)(10)

|

|

2019 Form of Performance Share Unit Agreement (incorporated by reference to Exhibit 10.18 to the Company's Annual

Report on Form 10-K filed with the SEC on February 21, 2019).

|

(d)(11)

|

|

2019 Form of Non-Qualified Stock Option Agreement (incorporated by reference to Exhibit 10.19 to the Company's

Annual Report on Form 10-K filed with the SEC on February 21, 2019).

|

(d)(12)

|

|

Three-Year Credit Agreement, dated March 29, 2019 among LyondellBasell Industries N.V., as guarantor, and LYB

Americas Finance Company LLC, as borrower, the lender party thereto, and Bank of America, N.A., as administrative agent (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed with the SEC on

March 29, 2019).

|

(d)(13)

|

|

LyondellBasell Industries Long Term Incentive Plan (incorporated by reference to Exhibit 10.1 to the Company's Current Report

on Form 8-K filed with the SEC on May 31, 2019).

|

(g)

|

|

Not applicable.

|

(h)

|

|

Not applicable.

|

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3

Not applicable.

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule TO is true,

complete and correct.

|

|

|

|

|

|

|

|

|

|

|

LYONDELLBASELL INDUSTRIES N.V.

|

Dated: June 10, 2019

|

|

By:

|

|

/s/ JEFFREY A. KAPLAN

|

|

|

|

|

|

Name:

|

|

Jeffrey A. Kaplan

|

|

|

|

|

|

Title:

|

|

Executive Vice President

|

QuickLinks

SCHEDULE TO

SIGNATURES

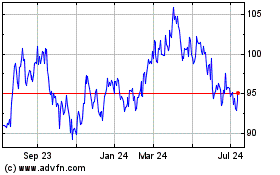

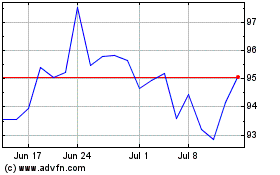

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024