Current Report Filing (8-k)

November 18 2019 - 8:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 18, 2019

Lumber Liquidators Holdings, Inc.

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

(State or Other Jurisdiction

of Incorporation)

|

001-33767

(Commission File Number)

|

27-1310817

(IRS Employer

Identification No.)

|

3000 John Deere Road, Toano, Virginia

23168

(Address of Principal Executive Offices)

(Zip Code)

(757) 259-4280

(Registrant’s telephone number,

including area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Trading Symbol:

|

Name of exchange on which registered:

|

|

Common Stock, par value $0.001 per share

|

LL

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On November 7, 2019, the United States Trade Representative

(“USTR”) ruled on a request made by certain interested parties, including Lumber Liquidators Holdings, Inc. (the “Company”),

and retroactively excluded certain flooring products imported from China from the Section 301 tariffs implemented at 10 percent

beginning in September 2018 and escalating to 25 percent in June 2019. Under this ruling, we believe flooring products now excluded

from the 25 percent Chinese tariffs include specific vinyl and engineered products the Company has sold and continues to sell.

The granted exclusion applies retroactively from the date the tariffs were originally implemented on September 24, 2018 through

August 7, 2020.

The Company is evaluating the details of the USTR exclusion

and determining the potential current and future impact on the Company which are dependent on a number of variables, including,

but not limited to, competitive pricing, vendor relationships, inventory turns, currency changes and other external factors.

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking

statements” within the meanings of the Private Securities Litigation Reform Act of 1995. These statements, which may be identified

by words such as “may,” “will,” “should,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “thinks,” “estimates,” “seeks,” “predicts,”

“could,” “projects,” “potential” and other similar terms and phrases, are based on the beliefs

of the Company’s management, as well as assumptions made by, and information currently available to, the Company’s

management as of the date of such statements. These statements are subject to risks and uncertainties, all of which are difficult

to predict and many of which are beyond the Company’s control. Forward-looking statements in this Current Report on Form

8-K may include, without limitation, statements regarding expectations relating to the tariff exclusion. The Company specifically

disclaims any obligation to update these statements, which speak only as of the dates on which such statements are made, except

as may be required under the federal securities laws. Information regarding additional risks and uncertainties is contained in

the Company’s other reports filed with the Securities and Exchange Commission, including the Item 1A, “Risk Factors,”

section of the Form 10-K for the year ended December 31, 2018 and Item 1A, “Risk Factors,” section of the Form 10-Q

for the quarter ended September 30, 2019.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: November 18, 2019

|

|

LUMBER LIQUIDATORS HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ M. Lee Reeves

|

|

|

|

M. Lee Reeves

|

|

|

|

Chief Legal Officer and Corporate Secretary

|

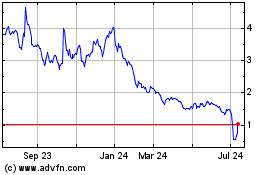

LL Flooring (NYSE:LL)

Historical Stock Chart

From Mar 2024 to Apr 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From Apr 2023 to Apr 2024