Latest Round of Stock Volatility Adds to August Turbulence

August 25 2019 - 9:29AM

Dow Jones News

By Amrith Ramkumar

Stocks enter the final week of August coming off one of their

rockiest stretches of 2019, the latest example of tariff-induced

volatility that has some investors bracing for more

fluctuation.

With the S&P 500's 2.6% drop Friday, the broad equity index

brought its average daily swing above 1% for a third consecutive

week, the longest such streak of the year, according to Dow Jones

Market Data. Stocks averaged a daily move of about 0.5% from

mid-June to early August.

In another sign of investor anxiety, the Cboe Volatility Index,

or VIX, logged a fourth consecutive weekly increase. Wall Street's

"fear gauge" measures expected swings in the S&P 500 and tends

to move inversely to stocks. Commodities including oil and bond

yields have also been volatile, with analysts worried that new

tariffs will further weaken the world economy.

Markets had shown signs of stabilizing before China announced

new tariffs on U.S. imports Friday and President Trump responded by

ordering U.S. companies doing business in China to explore

relocating. The latest developments in the monthslong trade dispute

between the world's two largest economies stoked fresh fears that

an overseas economic slowdown will engulf the U.S. and hurt

consumers.

This week, investors will parse figures on July consumer

spending and another estimate of second-quarter gross domestic

product to gauge whether the U.S. can continue outpacing the rest

of the world. Upbeat July retail sales figures and strong earnings

from companies including Target Corp. and Lowe's Cos. have offered

encouraging signals about the health of the consumer.

Despite recent market swings, some analysts are still hopeful

that lower interest rates and an eventual U.S.-China trade

compromise will improve the outlook for the world economy. While

protectionist trade policies have dented manufacturing activity and

limited business investment, some analysts are confident challenges

to U.S. consumers won't halt spending and economic growth.

"We don't see them actually showing up in the real economy yet,

and for that reason we don't think a recession is imminent," said

Nela Richardson, an investment strategist at Edward Jones, adding

that she expects stocks to perform better than bonds.

At the same time, some analysts fear that the signals from the

bond market and measures of investor confidence could cause more

volatility.

Bond prices, which rise as yields fall, have surged with some

investors seeking safety in Treasurys recently. The movement toward

bonds has pushed longer-term Treasury yields to multiyear lows and

caused one closely watched section of the yield curve, the gap

between two- and 10-year yields, to invert.

Such inversions in which shorter-term yields eclipse longer-term

yields have preceded past recessions, though the timing between

inversions and slowdowns has varied and stocks have often rallied

for months following such a move. One Friday, the 10-year yield

fell below the two-year yield on a closing basis for the first time

since 2007.

Prices for commodities vital to construction and manufacturing

have dropped in August, with investors expecting demand to weaken

alongside economic activity. Copper fell Friday to its lowest level

since May 2017, while a 2.1% decline in oil prices brought crude's

month-to-date decline to 7.5%.

Those moves have prompted traders to increase wagers on lower

interest rates. Federal-funds futures show nearly 90% of investors

expect the Federal Reserve to cut rates at least two more times

this year, CME Group data show. That is up from about 57% a month

ago.

Minutes from the central bank's July meeting published last week

showed officials expected trade uncertainty to continue, though

they were reluctant to say how future adjustments to rate policy

would unfold. Fed Chairman Jerome Powell said early Friday that the

central bank was prepared to provide more stimulus if the

global-growth slowdown spreads to the U.S.

The bets on lower interest rates have pushed some investors

toward shares of companies with more-stable businesses and larger

dividends. The S&P 500 utilities, real-estate and

consumer-staples sectors -- areas typically viewed as safer -- are

the only groups in the index that have risen this month.

Other destinations for safety such as gold outpaced the broader

market on Friday, with the haven metal rising almost 2% to a

six-year high.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

August 25, 2019 09:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

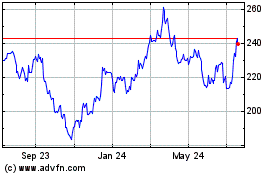

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

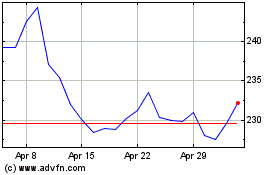

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024