Lockheed Martin Targets Sikorsky Growth -- Update

January 28 2020 - 4:15PM

Dow Jones News

By Doug Cameron

Lockheed Martin Corp. expects its Sikorsky helicopter arm to

double in size over the next dozen years as it pursues two huge

Pentagon contracts worth almost $100 billion.

Sikorsky has emerged as a key growth driver alongside the F-35

combat jet for the world's largest defense company by sales, four

years after it bought the business from United Technologies Corp.

for $9 billion.

Three big Sikorsky programs -- a new presidential helicopter, a

transport chopper for the Marine Corps and a rescue helicopter

fleet for the Air Force -- all reach key production milestones this

year and have secured support in current Pentagon budget planning.

Winning a share of the two big coming contracts would accelerate

growth.

"We could see Sikorsky double in size over the next 12, 13

years," said Lockheed Chief Financial Officer Ken Possenriede in an

interview.

Lockheed Martin on Tuesday reported forecast-beating fourth

quarter earnings and raised guidance for sales, profits and cash

flow in 2020, sending its shares to a record. Mr. Possenriede said

it could end the year with an order backlog worth $148 billion, up

3% from 2019.

Shares rose 1.3% to $437.82 Tuesday afternoon.

Sikorsky had sales of $6.5 billion when it was acquired.

Lockheed Martin had aimed to expand that to $10 billion by 2025.

However, falling sales to companies serving the oil-and-gas

industry dented commercial demand, with helicopters diverted to the

search and rescue and VIP sectors.

Basketball legend Kobe Bryant was killed on Sunday alongside

eight others in the crash of a Sikorsky S-76B helicopter near Los

Angeles. Sikorsky has offered its condolences to those affected and

said it is cooperating with the continuing probe.

While rising F-35 production and output of missiles and

missile-defense systems have been the biggest drivers of sales and

profits, Sikorsky's military pipeline is emerging alongside

hypersonic vehicles as a big source of potential earnings.

The first prize is the U.S. Army's planned refresh of its fleet

of Bell Kiowas and Boeing Co. Apaches with a new scout helicopter.

Sikorsky is teamed with Boeing in the contest, with the Army in

March expected to trim the contestants to two from five for an

initial buy of 476 choppers worth an estimated $15 billion.

Sikorsky is also in both teams pursuing the far larger contract

for a future attack helicopter to replace its own Black Hawks. It

is the junior partner in one camp led by Bell parent Textron Inc.,

and is also working alongside Boeing in a second team for a deal

analysts said could be worth $80 billion. A decision is expected in

2022.

The Army has tried for more than a decade to replace its

helicopters, plans derailed by requirement changes and funding

challenges. The two current programs were accelerated under changes

instituted by Defense Secretary Mark Esper when he led the service,

which included cutting dozens of other programs deemed

unessential.

Similar changes are being rolled out in other parts of the

Pentagon, with more details expected when it unveils its 2021

budget request next month.

However, Mr. Possenriede said Lockheed Martin also remains

interested in acquisitions.

"We're going to have a lot of firepower," he said, though he

noted that valuations of other defense companies are also high.

Lockheed Martin reported profit of $1.5 billion in the December

quarter compared with $1.3 billion a year earlier. Per-share

earnings rose to $5.29 from $4.39, well above the $5.03 consensus

among analysts polled by FactSet.

The company expects sales to rise to $63.5 billion this year,

based on the midpoint of its new guidance, some $1.5 billion above

its prior forecast. Profit is forecast at between $23.65 and $23.95

a share.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

January 28, 2020 16:00 ET (21:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

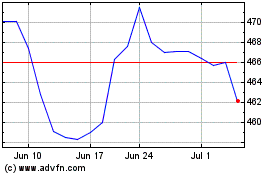

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

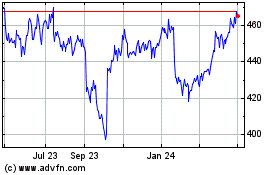

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024