Lincoln AssetEdge® VUL (2020) expands indexed account options,

providing investment flexibility for those seeking significant cash

value growth potential, asset protection and a supplemental income

strategy.

Lincoln Financial Group (NYSE: LNC) announced today that it will

launch the next generation of its Lincoln AssetEdge® Variable

Universal Life (VUL) insurance offering on June 15. As many

investors are faced with the dilemma of staying invested in the

market during a time of elevated volatility, AssetEdge VUL (2020)

features three new indexed accounts that offer policyowners more

ways to help grow their retirement savings with a level of

protection during market downturns.

“When planning for retirement, there are many considerations,

such as lifestyles, wealth transfer, and potential impacts of

market volatility, taxes and longevity – all of which are magnified

in times of economic uncertainty,” said Andy Bucklee, senior vice

president and head of Life & Executive Benefits Distribution

for Lincoln Financial Group. “Life insurance is one of the few

solutions that can help address all of these needs. By working with

a financial professional to understand the different uses of life

insurance, such as those found within the new AssetEdge, clients

can further diversify their retirement portfolios, and incorporate

new strategies for growth, protection and income.”

In a recent survey by LIMRA, financial advisors overwhelmingly

cited market volatility as the top concern they are hearing from

clients during the coronavirus pandemic1. Insurance agents cited

client questions about their current policy coverage with respect

to the virus2, underscoring the importance that clients place in

life insurance.

In addition to an income tax-free death benefit, AssetEdge

offers tax-advantaged assets that offer significant growth

potential that can be accessed later in life to supplement income

for needs such as retirement. AssetEdge includes a wide range of

investment options that can be tailored to a client’s goals for

return potential and downside protection, including:

- Four Indexed accounts tied to the performance of the S&P

500 Index, offering a range of returns and guaranteed floors to

protect against negative returns

- More than 75 market-driven variable investment options for

maximum growth potential

- Multiple risk management funds to minimize the impact in a down

market

- A Fixed account offering predictable growth with a minimum 1%

interest rate and no exposure to market risk

Clients can allocate investments across multiple options and

adjust the allocations over time to align with changing needs,

financial goals or market conditions.

“AssetEdge can help you plan for their future, while protecting

your loved ones and assets - a balancing act many are faced with

today,” said Stafford Thompson, Jr., senior vice president of Life

Product Management at Lincoln. “AssetEdge is designed to provide

the death benefit coverage your family needs today, significant

growth opportunities for tomorrow and a tax-efficient cash resource

when you retire. The new indexed accounts provide even greater

investment flexibility, control and downside protection, so you can

align your investment strategy to your financial objectives and

risk tolerance levels - from accumulation through

distribution.”

Additional AssetEdge Protection

Features

Lincoln AssetEdge VUL is available with optional enhancements to

provide access to tax-advantaged funds to use in the event of an

unexpected chronic or terminal illness or long-term care need.

Included with the base policy is a no lapse provision, which can

potentially provide lapse protection for up to 20 years.

AssetEdge for Businesses

The three new indexed accounts are also now available with the

next generation of Lincoln AssetEdge® Exec VUL, also announced

today. Lincoln AssetEdge Exec VUL is specifically designed to help

businesses fund strategies such as buy-sell planning, key person

protection, and benefit plans for recruitment and retention.

Lincoln AssetEdge VUL 2020 and Lincoln AssetEdge Exec VUL 2020

will be available to Lincoln’s national network of distribution

partners (in states where approved) on June 15.

Disclosures and Important Information

- LIMRA, Coronavirus (COVID-19): Advisor Pulse, April 1,

2020

- LIMRA, Coronavirus (COVID-19): Insurance Agent Pulse, April 23,

2020

The S&P 500 Index is a product of S&P Dow Jones Indices

LLC, a division of S&P Global, or its affiliates (“SPDJI”), and

has been licensed for use by The Lincoln National Life Insurance

Company. Standard & Poor’s® and S&P® are registered

trademarks of Standard & Poor’s Financial Services LLC, a

division of S&P Global (“S&P”); Dow Jones® is a registered

trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and

these trademarks have been licensed for use by SPDJI and

sublicensed for certain purposes by The Lincoln National Life

Insurance Company. The Lincoln National Life Insurance Company’s

product is not sponsored, endorsed, sold or promoted by SPDJI, Dow

Jones, S&P, their respective affiliates, and none of such

parties make any representation regarding the advisability of

investing in such product nor do they have any liability for any

errors, omissions, or interruptions of the S&P 500 Index.

Lincoln AssetEdge® VUL (2020) is issued on policy form

ICC20-VUL688/20-VUL688 and state variations by The Lincoln National

Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln

Financial Distributors, Inc., a broker-dealer. The Lincoln

National Life Insurance Company does not solicit business in the

state of New York, nor is it authorized to do so.

All guarantees and benefits of the insurance policy are

subject to the claims-paying ability of the issuing insurance

company. They are not backed by the broker-dealer and/or

insurance agency selling the policy, or any affiliates of those

entities other than the issuing company affiliates, and none makes

any representations or guarantees regarding the claims-paying

ability of the issuer.

Lincoln variable universal life insurance is sold by

prospectuses. Carefully consider the investment objectives, risks,

and charges and expenses of the policy and its underlying

investment options. This and other important information can be

found in the prospectus for the variable universal life policy and

the prospectus for the underlying investment options. Prospectuses

are available upon request and should be read carefully before

investing or sending money. For current prospectuses, please call

800-444-2363 or go to www.LincolnFinancial.com.

Policy values will fluctuate and are subject to market risk and

to possible loss of principal. Products and features are subject to

availability. Limitations and exclusions may apply.

Distributions are taken through loans and withdrawals, which

reduce a policy’s cash surrender value and death benefit and may

cause the policy to lapse. Loans are not considered income and are

tax-free. Withdrawals and surrenders are tax-free up to the cost

basis, provided the policy is not a modified endowment contract

(MEC). It is possible coverage will expire when either no premiums

are paid following the initial premium, or subsequent premiums are

insufficient to continue coverage.

With any VUL product, certain fees and costs are involved,

including monthly cost of insurance, administrative expense and

premium load charges, as well as daily charges on assets invested

in the variable subaccounts for mortality and expense risk, and

asset management fees. Please consult the prospectus or ask your

financial professional for more detailed information.

About Lincoln Financial Group

Lincoln Financial Group provides advice and solutions that help

empower people to take charge of their financial lives with

confidence and optimism. Today, more than 17 million customers

trust our retirement, insurance and wealth protection expertise to

help address their lifestyle, savings and income goals, as well as

to guard against long-term care expenses. Headquartered in Radnor,

Pennsylvania, Lincoln Financial Group is the marketing name for

Lincoln National Corporation (NYSE:LNC) and its affiliates. The

company had $247 billion in end-of-period account values as of

March 31, 2020. Lincoln Financial Group is a committed corporate

citizen included on major sustainability indices including the Dow

Jones Sustainability Index North America and FTSE4Good. Dedicated

to diversity and inclusion, Lincoln earned perfect 100 percent

scores on the Corporate Equality Index and the Disability Equality

Index. Lincoln has also been recognized in Newsweek’s Most

Responsible Companies and is among Forbes’ World’s Best Employers,

Best Large Employers, Best Employers for Diversity, Best Employers

for Women and ranked on the JUST 100 list. Learn more at:

www.LincolnFinancial.com. Follow us on Facebook, Twitter, LinkedIn,

and Instagram. Sign up for email alerts at

http://newsroom.lfg.com.

LCN: 3115579-060520

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200608005366/en/

Jay Russo Lincoln Financial Group 860-466-1324 E-mail:

jay.russo@lfg.com

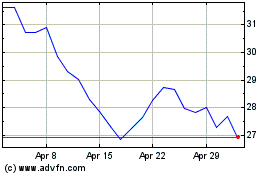

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

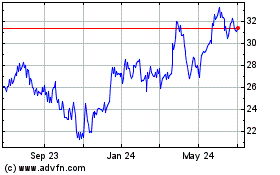

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Apr 2023 to Apr 2024