LIBERTY

ALL-STAR® GROWTH FUND

Period

Ended September 30, 2020 (Unaudited)

Fund

Statistics

|

Net

Asset Value (NAV)

|

|

$6.96

|

|

Market

Price

|

|

$7.11

|

|

Premium

|

|

2.2%

|

|

|

Quarter

|

Year-to-Date

|

|

Distributions*

|

$0.13

|

$0.37

|

|

Market

Price Trading Range

|

$6.28

to $7.70

|

$3.90

to $7.70

|

|

Premium/(Discount)

Range

|

9.2%

to -2.6%

|

11.8%

to -9.5%

|

|

Performance

|

|

|

|

Shares

Valued at NAV with Dividends Reinvested

|

9.19%

|

20.09%

|

|

Shares

Valued at Market Price with Dividends Reinvested

|

15.09%

|

16.83%

|

|

Dow

Jones Industrial Average

|

8.22%

|

-0.91%

|

|

Lipper

Multi-Cap Growth Mutual Fund Average

|

12.17%

|

24.29%

|

|

NASDAQ

Composite Index

|

11.24%

|

25.33%

|

|

Russell

Growth Benchmark

|

10.19%

|

14.89%

|

|

S&P

500® Index

|

8.93%

|

5.57%

|

|

|

*

|

Sources

of distributions to shareholders may include ordinary dividends, long-term capital gains

and return of capital. The final determination of the source of all distributions in

2020 for tax reporting purposes will be made after year end. The actual amounts and sources

of the amounts for tax reporting purposes will depend upon the Fund’s investment

experience during its fiscal year and may be subject to changes based on tax regulations.

Based on current estimates no portion of the distributions consist of a return of capital.

Pursuant to Section 852 of the Internal Revenue Code, the taxability of this distribution

will be reported on Form 1099-DIV for 2020.

|

Performance

returns for the Fund are total returns, which include dividends. Returns are net of management fees and other Fund expenses.

The

returns shown for the Lipper Multi- Cap Growth Mutual Fund Average are based on open-end mutual funds’ total returns, which

include dividends, and are net of fund expenses. Returns for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index,

the Russell Growth Benchmark and the S&P 500® Index are total returns, including dividends. A description of

the Lipper benchmark and the market indices can be found on page 17.

Past

performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower

or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would

pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

Closed-end

funds raise money in an initial public offering and shares are listed and traded on an exchange. Open-end mutual funds continuously

issue and redeem shares at net asset value. Shares of closed-end funds frequently trade at a discount to net asset value. The

price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore,

the Fund cannot predict whether its shares will trade at, below or above net asset value.

|

Liberty

All-Star® Growth Fund

|

President’s

Letter

|

(Unaudited)

|

Fellow

Shareholders:

|

October

2020

|

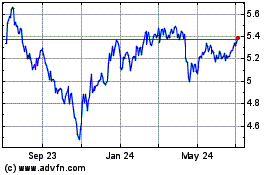

Despite

giving up ground in September, equity markets consolidated exceptional second quarter returns with further gains in the third

quarter. The S&P 500® Index returned 8.93 percent for the quarter, while the Dow Jones Industrial Average (DJIA)

returned 8.22 percent and the NASDAQ Composite Index advanced 11.24 percent.

Through

nine months, the S&P 500® returned 5.57 percent, the DJIA returned -0.91 percent and the NASDAQ Composite returned

25.33 percent. Liberty All-Star Growth Fund’s Russell Growth Benchmark returned 10.19 percent for the third quarter and

14.89 percent for the nine-month period.

Growth

style stocks again outperformed value style issues in the third quarter. The broad market Russell 3000® Growth

Index returned 12.86 percent for the period, while its Value counterpart returned less than half that, just 5.42 percent. Similar

results were found across all capitalization ranges—small-, mid- and large-cap—for both the quarter and the year-to-date

period.

The

third quarter got off to a strong start, with investors believing that economic damage owing to the pandemic would not be as severe

as once feared. This was due to government stimulus programs and a report that employers added 4.8 million jobs in June for the

second straight month of growth. Investors anticipated a sharp contraction in the economy and in latter July the Commerce Department

confirmed their fears with a report that U.S. GDP fell 9.5 percent in the second quarter, the steepest quarterly decline on record.

Nevertheless,

August saw the market’s momentum hold, as the S&P 500® posted six straight days of gains to begin the

month. August also saw the S&P 500® log its first record close in six months, an event that marked the fastest

recovery in history following a bear market. From its February 19 high, the S&P 500® dropped 34 percent by

March 23 only to reach a new record high on August 18. A typical peak-to-peak recovery takes 1,542 trading days on average, according

to Dow Jones Market Data.

August

ended with stocks closing out their best month since April, a gain of 7.19 percent. But just days later, on September 3, the S&P

500® posted its worst day since mid-June. September would go on to see the S&P 500® encounter

its first four-week losing streak in more than a year and that same index came close to a 10 percent decline, which would have

marked correction territory. Among concerns weighing on investors were the rich valuations of certain technology stocks, tensions

between the U.S. and China, election uncertainties and the outlook for the economy in the pandemic age. The inability of the House

and the Senate to come to any agreement on extra unemployment benefits and other economic aid also caused concern. A rebound in

the last few trading days recouped some of the losses, but the S&P 500® still declined -3.80 percent for the

month.

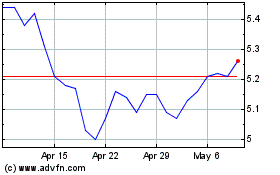

Liberty

All-Star® Growth Fund

Liberty

All-Star Growth Fund posted positive results in the third quarter. The Fund returned 9.19 percent with shares valued at net asset

value (NAV) with dividends reinvested and 15.09 percent with shares valued at market price with dividends reinvested. (Fund returns

are net of expenses.)

On

a relative basis, the Fund’s quarterly NAV return was in-line to modestly trailing key market benchmarks, while the market

price return was ahead of all relevant benchmarks. The Fund’s primary benchmark, the Lipper Multi-Cap Growth Mutual Fund

Average, returned 12.17 percent for the quarter. As noted earlier, respective returns for the S&P 500®, the

DJIA and the NASDAQ Composite were 8.93 percent, 8.22 percent and 11.24 percent, while the Russell Growth Benchmark returned 10.19

percent.

|

Third

Quarter Report (Unaudited) | September 30, 2020

|

1

|

|

Liberty

All-Star® Growth Fund

|

President’s

Letter

|

(Unaudited)

Through

nine months of 2020, the Fund returned 20.09 percent with shares valued at NAV with dividends reinvested and 16.83 percent with

shares valued at market price with dividends reinvested. The Lipper Multi-Cap Growth benchmark returned 24.29 percent for the

same period while the Russell Growth Benchmark returned 14.89 percent. The nine-month return for the S&P 500®

was 5.57 percent, while the DJIA returned -0.91 percent and the NASDAQ Composite returned 25.33 percent.

Unlike

the second quarter, when small- and mid-cap growth stocks delivered moderately better results than large-cap growth stocks, the

latter produced better returns in the first and third quarters. Despite having two-thirds of its assets allocated to small- and

mid-cap growth stocks and one-third to large-cap growth stocks, the Fund benefited from the investment managers’ good stock

selection through the first nine months of the year.

In

the second quarter, the discount at which Fund shares traded relative to their underlying NAV ranged from -2.7 percent to -8.5

percent. This changed dramatically in the third quarter, as shares traded in a range from a 9.2 percent premium to NAV to a -2.6

percent discount.

In

accordance with the Fund’s distribution policy, the Fund paid a distribution of $0.13 to shareholders during the third quarter,

bringing the total distributed to shareholders since 1997, when the distribution policy commenced, to $14.72 per share. The Fund’s

distribution policy is a major component of the Fund’s total return, and we continue to emphasize that shareholders should include

these distributions when determining the total return on their investment in the Fund.

The

Fund remained on track in the third quarter, while the year to date NAV return has outperformed the passive Russell Growth Benchmark

by 5.20 percent. We are also pleased to report that the Fund has outperformed its Lipper benchmark for the trailing three-, five-,

10- and 15-year periods. We at ALPS Advisors will continue to pursue superior risk-adjusted returns and seek to reward shareholders

with a long-term perspective.

Sincerely,

William

R. Parmentier, Jr.

President

and Chief Executive Officer

Liberty

All-Star® Growth Fund, Inc.

The

views expressed in the President’s letter reflect the views of the President as of October 2020 and may not reflect his

views on the date this report is first published or anytime thereafter. These views are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly

from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the

Fund disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment

decisions for the Fund are based on numerous factors, may not be relied on as an indication of trading intent.

|

Liberty

All-Star® Growth Fund

|

Table

of Distributions & Rights Offerings

|

September

30, 2020 (Unaudited)

|

|

|

|

Rights

Offerings

|

|

|

Year

|

Per

Share Distributions

|

Month

Completed

|

Shares

Needed to

Purchase One

Additional Share

|

Subscription

Price

|

|

1997

|

$1.24

|

|

|

|

|

1998

|

1.35

|

July

|

10

|

$12.41

|

|

1999

|

1.23

|

|

|

|

|

2000

|

1.34

|

|

|

|

|

2001

|

0.92

|

September

|

8

|

6.64

|

|

2002

|

0.67

|

|

|

|

|

2003

|

0.58

|

September

|

81

|

5.72

|

|

2004

|

0.63

|

|

|

|

|

2005

|

0.58

|

|

|

|

|

2006

|

0.59

|

|

|

|

|

2007

|

0.61

|

|

|

|

|

2008

|

0.47

|

|

|

|

|

20092

|

0.24

|

|

|

|

|

2010

|

0.25

|

|

|

|

|

2011

|

0.27

|

|

|

|

|

2012

|

0.27

|

|

|

|

|

2013

|

0.31

|

|

|

|

|

2014

|

0.33

|

|

|

|

|

20153

|

0.77

|

|

|

|

|

2016

|

0.36

|

|

|

|

|

2017

|

0.42

|

|

|

|

|

2018

|

0.46

|

November

|

3

|

4.81

|

|

2019

|

0.46

|

|

|

|

|

2020

|

|

|

|

|

|

1st

Quarter

|

0.13

|

March

|

5

|

4.34

|

|

2nd

Quarter

|

0.11

|

|

|

|

|

3rd

Quarter

|

0.13

|

|

|

|

|

Total

|

$14.72

|

|

|

|

|

1

|

The

number of shares offered was increased by an additional 25 percent to cover a portion

of the over-subscription requests.

|

|

2

|

Effective

with the second quarter distribution, the annual distribution rate was changed from 10

percent to 6 percent.

|

|

3

|

Effective

with the second quarter distribution, the annual distribution rate was changed from 6

percent to 8 percent.

|

DISTRIBUTION

POLICY

The

current policy is to pay distributions on its shares totaling approximately 8 percent of its net asset value per year, payable

in four quarterly installments of 2 percent of the Fund’s net asset value at the close of the New York Stock Exchange on

the Friday prior to each quarterly declaration date. Sources of distributions to shareholders may include ordinary dividends,

long-term capital gains and return of capital. The final determination of the source of all distributions in 2020 for tax reporting

purposes will be made after year end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon

the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations.

If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate

of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s

distributions) contained in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary dividends and long-term

capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain

and not distribute capital gains and pay income tax thereon to the extent of such excess.

|

Third

Quarter Report (Unaudited) | September 30, 2020

|

3

|

|

Liberty

All-Star® Growth Fund

|

Investment

Managers/

Portfolio Characteristics

|

September

30, 2020 (Unaudited)

THE

FUND’S THREE GROWTH INVESTMENT MANAGERS AND THE MARKET CAPITALIZATION ON WHICH EACH FOCUSES:

ALPS

Advisors, Inc., the investment advisor to the Fund, has the ultimate authority (subject to oversight by the Board of Directors)

to oversee the investment managers and recommend their hiring, termination and replacement.

MANAGERS’

DIFFERING INVESTMENT STRATEGIES ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The

portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool

for understanding the value of the Fund’s multi-managed portfolio. The characteristics are different for each of the Fund’s

three investment managers. These differences are a reflection of the fact that each has a different capitalization focus and investment

strategy. The shaded column highlights the characteristics of the Fund as a whole, while the first three columns show portfolio

characteristics for the Russell Smallcap, Midcap and Largecap Growth indices. See page 17 for a description of these indices.

PORTFOLIO

CHARACTERISTICS As of September 30, 2020 (Unaudited)

|

|

|

Market

Capitalization Spectrum

|

|

|

|

RUSSELL

GROWTH

|

Small

|

|

Large

|

|

|

|

SMALLCAP

|

MIDCAP

|

LARGECAP

|

|

TOTAL

|

|

|

INDEX

|

INDEX

|

INDEX

|

WEATHERBIE

CONGRESS SUSTAINABLE

|

FUND

|

|

Number

of Holdings

|

1,099

|

341

|

447

|

50

|

40

|

29

|

119

|

|

Percent

of Holdings in Top 10

|

7%

|

12%

|

45%

|

49%

|

33%

|

44%

|

18%

|

|

Weighted

Average Market Capitalization (billions)

|

$3.0

|

$20.5

|

$662.2

|

$5.5

|

$15.8

|

$335.6

|

$121.2

|

|

Average

Five-Year Earnings Per Share Growth

|

13%

|

18%

|

19%

|

22%

|

18%

|

17%

|

18%

|

|

Average

Five-Year Sales Per Share Growth

|

9%

|

13%

|

15%

|

16%

|

11%

|

12%

|

13%

|

|

Price/Earnings

Ratio*

|

29

|

38x

|

38x

|

62x

|

33x

|

43x

|

41x

|

|

|

*

|

Excludes

negative earnings.

|

|

Liberty

All-Star® Growth Fund

|

Top

20 Holdings & Economic Sectors

|

September

30, 2020 (Unaudited)

|

Top

20 Holdings*

|

Percent

of Net Assets

|

|

FirstService

Corp.

|

2.05%

|

|

Chegg,

Inc.

|

1.97

|

|

Paylocity

Holding Corp.

|

1.91

|

|

Nevro

Corp.

|

1.88

|

|

Microsoft

Corp.

|

1.70

|

|

Visa,

Inc.

|

1.67

|

|

Progyny,

Inc.

|

1.58

|

|

Amazon.com,

Inc.

|

1.57

|

|

Insulet

Corp.

|

1.56

|

|

Facebook,

Inc.

|

1.53

|

|

NIKE,

Inc.

|

1.44

|

|

Casella

Waste Systems, Inc.

|

1.43

|

|

Alphabet,

Inc.

|

1.41

|

|

Workday,

Inc.

|

1.36

|

|

Abbott

Laboratories

|

1.34

|

|

FleetCor

Technologies, Inc.

|

1.34

|

|

Generac

Holdings, Inc.

|

1.29

|

|

Ollie’s

Bargain Outlet Holdings, Inc.

|

1.28

|

|

UnitedHealth

Group, Inc.

|

1.24

|

|

PayPal

Holdings, Inc.

|

1.24

|

|

|

30.79%

|

|

Economic

Sectors*

|

Percent

of Net Assets

|

|

Information

Technology

|

29.07%

|

|

Health

Care

|

26.71

|

|

Consumer

Discretionary

|

12.61

|

|

Industrials

|

12.19

|

|

Communication

Services

|

4.39

|

|

Financials

|

4.12

|

|

Real

Estate

|

3.79

|

|

Materials

|

3.02

|

|

Consumer

Staples

|

2.14

|

|

Energy

|

0.29

|

|

Other

Net Assets

|

1.67

|

|

|

100.00%

|

|

*

|

Because

the Fund is actively managed, there can be no guarantee that the Fund will continue to

hold securities of the indicated issuers and sectors in the future.

|

|

Third

Quarter Report (Unaudited) | September 30, 2020

|

5

|

|

Liberty

All-Star® Growth Fund

|

Major

Stock Changes in the Quarter

|

September

30, 2020 (Unaudited)

The

following are the major ($1 million or more) stock changes - both purchases and sales - that were made in the Fund’s portfolio

during the third quarter of 2020.

|

|

Shares

|

|

Security

Name

|

Purchases

(Sales)

|

Held

as of 9/30/20

|

|

Purchases

|

|

|

|

ACADIA

Pharmaceuticals, Inc.

|

33,351

|

83,080

|

|

Core

Laboratories NV

|

51,151

|

54,870

|

|

Natera,

Inc.

|

20,035

|

40,783

|

|

Neurocrine

Biosciences, Inc.

|

16,000

|

16,000

|

|

Ollie’s

Bargain Outlet Holdings, Inc.

|

10,571

|

42,777

|

|

Thermo

Fisher Scientific, Inc.

|

6,719

|

6,719

|

|

Vertex,

Inc.

|

43,959

|

43,959

|

|

Sales

|

|

|

|

Adobe,

Inc.

|

(4,573)

|

0

|

|

Avery

Dennison Corp.

|

(17,500)

|

0

|

|

EPAM

Systems, Inc.

|

(15,038)

|

0

|

|

FirstService

Corp.

|

(9,720)

|

45,353

|

|

salesforce.com,

Inc.

|

(6,861)

|

13,338

|

|

Silk

Road Medical, Inc.

|

(21,095)

|

13,178

|

|

Liberty

All-Star® Growth Fund

|

Schedule

of Investments

|

September

30, 2020 (Unaudited)

|

|

|

SHARES

|

|

|

MARKET

VALUE

|

|

|

COMMON STOCKS (98.33%)

|

|

|

|

|

|

|

|

|

|

COMMUNICATION

SERVICES (4.39%)

|

|

|

|

|

|

|

|

|

|

Entertainment

(0.74%)

|

|

|

|

|

|

|

|

|

|

Take-Two

Interactive Software, Inc.(a)

|

|

|

13,000

|

|

|

$

|

2,147,860

|

|

|

|

|

|

|

|

|

|

|

|

|

Interactive

Media & Services (3.65%)

|

|

|

|

|

|

|

|

|

|

Alphabet,

Inc., Class C(a)

|

|

|

2,790

|

|

|

|

4,100,184

|

|

|

Facebook,

Inc., Class A(a)

|

|

|

17,051

|

|

|

|

4,465,657

|

|

|

Match

Group, Inc.(a)

|

|

|

18,805

|

|

|

|

2,080,781

|

|

|

|

|

|

|

|

|

|

10,646,622

|

|

|

CONSUMER

DISCRETIONARY (12.61%)

|

|

|

|

|

|

|

|

|

|

Distributors

(1.03%)

|

|

|

|

|

|

|

|

|

|

Pool

Corp.

|

|

|

9,000

|

|

|

|

3,010,860

|

|

|

|

|

|

|

|

|

|

|

|

|

Diversified

Consumer Services (1.97%)

|

|

|

|

|

|

|

|

|

|

Chegg,

Inc.(a)

|

|

|

80,446

|

|

|

|

5,747,062

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels,

Restaurants & Leisure (2.22%)

|

|

|

|

|

|

|

|

|

|

Planet

Fitness, Inc., Class A(a)

|

|

|

36,398

|

|

|

|

2,242,845

|

|

|

Wingstop,

Inc.

|

|

|

5,836

|

|

|

|

797,489

|

|

|

Yum!

Brands, Inc.

|

|

|

37,552

|

|

|

|

3,428,498

|

|

|

|

|

|

|

|

|

|

6,468,832

|

|

|

Internet

& Direct Marketing Retail (2.72%)

|

|

|

|

|

|

|

|

|

|

Amazon.com,

Inc.(a)

|

|

|

1,458

|

|

|

|

4,590,849

|

|

|

Etsy,

Inc.(a)

|

|

|

27,500

|

|

|

|

3,344,825

|

|

|

|

|

|

|

|

|

|

7,935,674

|

|

|

Multiline

Retail (1.28%)

|

|

|

|

|

|

|

|

|

|

Ollie’s

Bargain Outlet Holdings, Inc.(a)

|

|

|

42,777

|

|

|

|

3,736,571

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty

Retail (1.76%)

|

|

|

|

|

|

|

|

|

|

Burlington

Stores, Inc.(a)

|

|

|

9,500

|

|

|

|

1,957,855

|

|

|

Williams-Sonoma,

Inc.

|

|

|

35,000

|

|

|

|

3,165,400

|

|

|

|

|

|

|

|

|

|

5,123,255

|

|

|

Textiles,

Apparel & Luxury Goods (1.63%)

|

|

|

|

|

|

|

|

|

|

Canada

Goose Holdings, Inc.(a)(b)

|

|

|

17,287

|

|

|

|

556,123

|

|

|

NIKE,

Inc., Class B

|

|

|

33,362

|

|

|

|

4,188,265

|

|

|

|

|

|

|

|

|

|

4,744,388

|

|

|

CONSUMER

STAPLES (2.14%)

|

|

|

|

|

|

|

|

|

|

Food

Products (1.34%)

|

|

|

|

|

|

|

|

|

|

Lamb

Weston Holdings, Inc.

|

|

|

25,000

|

|

|

|

1,656,750

|

|

|

McCormick

& Co., Inc.

|

|

|

11,500

|

|

|

|

2,232,150

|

|

|

|

|

|

|

|

|

|

3,888,900

|

|

See

Notes to Schedule of Investments.

|

Third Quarter Report (Unaudited)

| September 30, 2020

|

7

|

|

Liberty

All-Star® Growth Fund

|

Schedule of Investments

|

September

30, 2020 (Unaudited)

|

|

|

SHARES

|

|

|

MARKET

VALUE

|

|

|

COMMON STOCKS (continued)

|

|

|

|

|

|

|

|

|

|

Household

Products (0.80%)

|

|

|

|

|

|

|

|

|

|

Church

& Dwight Co., Inc.

|

|

|

25,000

|

|

|

$

|

2,342,750

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY (0.29%)

|

|

|

|

|

|

|

|

|

|

Energy

Equipment & Services (0.29%)

|

|

|

|

|

|

|

|

|

|

Core

Laboratories NV

|

|

|

54,870

|

|

|

|

837,316

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIALS (4.12%)

|

|

|

|

|

|

|

|

|

|

Banks

(1.21%)

|

|

|

|

|

|

|

|

|

|

First

Republic Bank

|

|

|

18,000

|

|

|

|

1,963,080

|

|

|

Signature

Bank

|

|

|

18,937

|

|

|

|

1,571,582

|

|

|

|

|

|

|

|

|

|

3,534,662

|

|

|

Capital

Markets (1.45%)

|

|

|

|

|

|

|

|

|

|

Hamilton

Lane, Inc., Class A

|

|

|

36,022

|

|

|

|

2,326,661

|

|

|

Raymond

James Financial, Inc.

|

|

|

26,000

|

|

|

|

1,891,760

|

|

|

|

|

|

|

|

|

|

4,218,421

|

|

|

Consumer

Finance (0.29%)

|

|

|

|

|

|

|

|

|

|

LendingTree,

Inc.(a)

|

|

|

2,730

|

|

|

|

837,810

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance

(0.67%)

|

|

|

|

|

|

|

|

|

|

eHealth,

Inc.(a)

|

|

|

8,215

|

|

|

|

648,985

|

|

|

Goosehead

Insurance, Inc., Class A

|

|

|

15,120

|

|

|

|

1,309,241

|

|

|

|

|

|

|

|

|

|

1,958,226

|

|

|

Investment

Companies (0.34%)

|

|

|

|

|

|

|

|

|

|

StepStone

Group, Inc.(a)

|

|

|

37,553

|

|

|

|

999,285

|

|

|

|

|

|

|

|

|

|

|

|

|

Thrifts

& Mortgage Finance (0.16%)

|

|

|

|

|

|

|

|

|

|

Axos

Financial, Inc.(a)

|

|

|

20,402

|

|

|

|

475,570

|

|

|

|

|

|

|

|

|

|

|

|

|

HEALTH

CARE (26.71%)

|

|

|

|

|

|

|

|

|

|

Biotechnology

(4.13%)

|

|

|

|

|

|

|

|

|

|

ACADIA

Pharmaceuticals, Inc.(a)

|

|

|

83,080

|

|

|

|

3,427,050

|

|

|

Natera,

Inc.(a)

|

|

|

40,783

|

|

|

|

2,946,164

|

|

|

Neurocrine

Biosciences, Inc.(a)

|

|

|

16,000

|

|

|

|

1,538,560

|

|

|

Puma

Biotechnology, Inc.(a)

|

|

|

134,431

|

|

|

|

1,356,409

|

|

|

Regeneron

Pharmaceuticals, Inc.(a)

|

|

|

3,353

|

|

|

|

1,876,942

|

|

|

Ultragenyx

Pharmaceutical, Inc.(a)

|

|

|

10,826

|

|

|

|

889,789

|

|

|

|

|

|

|

|

|

|

12,034,914

|

|

|

Health

Care Equipment & Supplies (12.51%)

|

|

|

|

|

|

|

|

|

|

Abbott

Laboratories

|

|

|

35,929

|

|

|

|

3,910,153

|

|

|

Becton

Dickinson and Co.

|

|

|

11,165

|

|

|

|

2,597,872

|

|

|

Cooper

Cos., Inc.

|

|

|

6,000

|

|

|

|

2,022,720

|

|

|

Danaher

Corp.

|

|

|

14,883

|

|

|

|

3,204,757

|

|

See

Notes to Schedule of Investments.

|

Liberty All-Star®

Growth Fund

|

Schedule of Investments

|

September

30, 2020 (Unaudited)

|

|

|

SHARES

|

|

|

MARKET

VALUE

|

|

|

COMMON STOCKS (continued)

|

|

|

|

|

|

|

|

|

|

Health

Care Equipment & Supplies (continued)

|

|

|

|

|

|

|

|

|

|

Glaukos

Corp.(a)(b)

|

|

|

31,307

|

|

|

$

|

1,550,323

|

|

|

Insulet

Corp.(a)

|

|

|

19,182

|

|

|

|

4,538,269

|

|

|

Intuitive

Surgical, Inc.(a)

|

|

|

3,554

|

|

|

|

2,521,705

|

|

|

Nevro

Corp.(a)

|

|

|

39,307

|

|

|

|

5,475,465

|

|

|

ResMed,

Inc.

|

|

|

13,000

|

|

|

|

2,228,590

|

|

|

Silk

Road Medical, Inc.(a)

|

|

|

13,178

|

|

|

|

885,693

|

|

|

STERIS

PLC

|

|

|

12,500

|

|

|

|

2,202,375

|

|

|

Varian

Medical Systems, Inc.(a)

|

|

|

15,000

|

|

|

|

2,580,000

|

|

|

West

Pharmaceutical Services, Inc.

|

|

|

10,000

|

|

|

|

2,749,000

|

|

|

|

|

|

|

|

|

|

36,466,922

|

|

|

Health

Care Providers & Services (3.62%)

|

|

|

|

|

|

|

|

|

|

PetIQ,

Inc.(a)

|

|

|

42,045

|

|

|

|

1,384,122

|

|

|

Progyny,

Inc.(a)(b)

|

|

|

156,918

|

|

|

|

4,618,097

|

|

|

UnitedHealth

Group, Inc.

|

|

|

11,607

|

|

|

|

3,618,714

|

|

|

US

Physical Therapy, Inc.

|

|

|

10,709

|

|

|

|

930,398

|

|

|

|

|

|

|

|

|

|

10,551,331

|

|

|

Health

Care Technology (0.71%)

|

|

|

|

|

|

|

|

|

|

Inspire

Medical Systems, Inc.(a)

|

|

|

1,463

|

|

|

|

188,800

|

|

|

Tabula

Rasa HealthCare, Inc.(a)(b)

|

|

|

46,390

|

|

|

|

1,891,321

|

|

|

|

|

|

|

|

|

|

2,080,121

|

|

|

Life

Sciences Tools & Services (4.62%)

|

|

|

|

|

|

|

|

|

|

Charles

River Laboratories International, Inc.(a)

|

|

|

13,500

|

|

|

|

3,057,075

|

|

|

Illumina,

Inc.(a)

|

|

|

8,587

|

|

|

|

2,654,070

|

|

|

Mettler-Toledo

International, Inc.(a)

|

|

|

2,500

|

|

|

|

2,414,375

|

|

|

NeoGenomics,

Inc.(a)

|

|

|

64,769

|

|

|

|

2,389,328

|

|

|

Thermo

Fisher Scientific, Inc.

|

|

|

6,719

|

|

|

|

2,966,573

|

|

|

|

|

|

|

|

|

|

13,481,421

|

|

|

Pharmaceuticals

(1.12%)

|

|

|

|

|

|

|

|

|

|

Aerie

Pharmaceuticals, Inc.(a)

|

|

|

30,000

|

|

|

|

353,100

|

|

|

Horizon

Pharma Plc(a)

|

|

|

37,500

|

|

|

|

2,913,000

|

|

|

|

|

|

|

|

|

|

3,266,100

|

|

|

INDUSTRIALS (12.19%)

|

|

|

|

|

|

|

|

|

|

Aerospace

& Defense (1.52%)

|

|

|

|

|

|

|

|

|

|

Huntington

Ingalls Industries, Inc.

|

|

|

8,300

|

|

|

|

1,168,225

|

|

|

Kratos

Defense & Security Solutions, Inc.(a)

|

|

|

72,993

|

|

|

|

1,407,305

|

|

|

Teledyne

Technologies, Inc.(a)

|

|

|

6,000

|

|

|

|

1,861,260

|

|

|

|

|

|

|

|

|

|

4,436,790

|

|

|

Air

Freight & Logistics (0.43%)

|

|

|

|

|

|

|

|

|

|

XPO

Logistics, Inc.(a)

|

|

|

14,763

|

|

|

|

1,249,836

|

|

See

Notes to Schedule of Investments.

|

Third Quarter Report (Unaudited)

| September 30, 2020

|

9

|

|

Liberty All-Star®

Growth Fund

|

Schedule of Investments

|

September

30, 2020 (Unaudited)

|

|

|

SHARES

|

|

|

MARKET

VALUE

|

|

|

COMMON STOCKS (continued)

|

|

|

|

|

|

|

|

|

|

Building

Products (0.79%)

|

|

|

|

|

|

|

|

|

|

Lennox

International, Inc.

|

|

|

8,500

|

|

|

$

|

2,317,185

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

Services & Supplies (3.42%)

|

|

|

|

|

|

|

|

|

|

Casella

Waste Systems, Inc., Class A(a)

|

|

|

74,819

|

|

|

|

4,178,641

|

|

|

Cintas

Corp.

|

|

|

9,500

|

|

|

|

3,161,885

|

|

|

Copart,

Inc.(a)

|

|

|

25,000

|

|

|

|

2,629,000

|

|

|

|

|

|

|

|

|

|

9,969,526

|

|

|

Electrical

Equipment (1.29%)

|

|

|

|

|

|

|

|

|

|

Generac

Holdings, Inc.(a)

|

|

|

19,500

|

|

|

|

3,775,980

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery

(0.75%)

|

|

|

|

|

|

|

|

|

|

IDEX

Corp.

|

|

|

12,000

|

|

|

|

2,188,920

|

|

|

|

|

|

|

|

|

|

|

|

|

Professional

Services (1.13%)

|

|

|

|

|

|

|

|

|

|

IHS

Markit, Ltd.

|

|

|

42,015

|

|

|

|

3,298,598

|

|

|

|

|

|

|

|

|

|

|

|

|

Road

& Rail (1.12%)

|

|

|

|

|

|

|

|

|

|

Union

Pacific Corp.

|

|

|

16,543

|

|

|

|

3,256,820

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading

Companies & Distributors (1.74%)

|

|

|

|

|

|

|

|

|

|

HD

Supply Holdings, Inc.(a)

|

|

|

60,000

|

|

|

|

2,474,400

|

|

|

SiteOne

Landscape Supply, Inc.(a)

|

|

|

21,254

|

|

|

|

2,591,925

|

|

|

|

|

|

|

|

|

|

5,066,325

|

|

|

INFORMATION

TECHNOLOGY (29.07%)

|

|

|

|

|

|

|

|

|

|

Communications

Equipment (0.55%)

|

|

|

|

|

|

|

|

|

|

Ciena

Corp.(a)

|

|

|

40,000

|

|

|

|

1,587,600

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic

Equipment, Instruments & Components (1.68%)

|

|

|

|

|

|

|

|

|

|

Keysight

Technologies, Inc.(a)

|

|

|

20,000

|

|

|

|

1,975,600

|

|

|

Novanta,

Inc.(a)

|

|

|

6,092

|

|

|

|

641,731

|

|

|

Zebra

Technologies Corp., Class A(a)

|

|

|

9,000

|

|

|

|

2,272,140

|

|

|

|

|

|

|

|

|

|

4,889,471

|

|

|

IT

Services (5.57%)

|

|

|

|

|

|

|

|

|

|

Akamai

Technologies, Inc.(a)

|

|

|

18,000

|

|

|

|

1,989,720

|

|

|

Booz

Allen Hamilton Holding Corp.

|

|

|

23,000

|

|

|

|

1,908,540

|

|

|

FleetCor

Technologies, Inc.(a)

|

|

|

16,353

|

|

|

|

3,893,649

|

|

|

PayPal

Holdings, Inc.(a)

|

|

|

18,307

|

|

|

|

3,607,028

|

|

|

Visa,

Inc., Class A

|

|

|

24,282

|

|

|

|

4,855,672

|

|

|

|

|

|

|

|

|

|

16,254,609

|

|

|

Semiconductors

& Semiconductor Equipment (4.15%)

|

|

|

|

|

|

|

|

|

|

Diodes,

Inc.(a)

|

|

|

44,901

|

|

|

|

2,534,661

|

|

|

Impinj,

Inc.(a)

|

|

|

32,859

|

|

|

|

865,835

|

|

See

Notes to Schedule of Investments.

|

Liberty All-Star®

Growth Fund

|

Schedule of Investments

|

September

30, 2020 (Unaudited)

|

|

|

SHARES

|

|

|

MARKET

VALUE

|

|

|

COMMON

STOCKS (continued)

|

|

|

|

|

|

|

|

|

|

Semiconductors

& Semiconductor Equipment (continued)

|

|

|

|

|

|

|

|

|

|

Monolithic

Power Systems, Inc.

|

|

|

11,500

|

|

|

$

|

3,215,515

|

|

|

Skyworks

Solutions, Inc.

|

|

|

17,500

|

|

|

|

2,546,250

|

|

|

Xilinx,

Inc.

|

|

|

28,307

|

|

|

|

2,950,722

|

|

|

|

|

|

|

|

|

|

12,112,983

|

|

|

Software

(17.12%)

|

|

|

|

|

|

|

|

|

|

Altair

Engineering, Inc., Class A(a)

|

|

|

6,464

|

|

|

|

271,359

|

|

|

Autodesk,

Inc.(a)

|

|

|

12,571

|

|

|

|

2,904,027

|

|

|

Avalara,

Inc.

|

|

|

17,141

|

|

|

|

2,182,735

|

|

|

Bill.com

Holdings, Inc.(a)

|

|

|

4,099

|

|

|

|

411,171

|

|

|

Cerence,

Inc.(a)

|

|

|

33,137

|

|

|

|

1,619,405

|

|

|

Ebix,

Inc.

|

|

|

39,546

|

|

|

|

814,648

|

|

|

Everbridge,

Inc.(a)

|

|

|

27,111

|

|

|

|

3,408,666

|

|

|

Fortinet,

Inc.(a)

|

|

|

15,000

|

|

|

|

1,767,150

|

|

|

Globant

SA(a)

|

|

|

13,052

|

|

|

|

2,339,179

|

|

|

HubSpot,

Inc.(a)

|

|

|

8,216

|

|

|

|

2,400,962

|

|

|

Intuit,

Inc.

|

|

|

6,225

|

|

|

|

2,030,657

|

|

|

LivePerson,

Inc.(a)

|

|

|

4,321

|

|

|

|

224,649

|

|

|

Microsoft

Corp.

|

|

|

23,534

|

|

|

|

4,949,906

|

|

|

Mimecast,

Ltd.(a)

|

|

|

18,622

|

|

|

|

873,744

|

|

|

Paycom

Software, Inc.(a)

|

|

|

7,000

|

|

|

|

2,179,100

|

|

|

Paylocity

Holding Corp.(a)

|

|

|

34,541

|

|

|

|

5,575,608

|

|

|

Pluralsight,

Inc., Class A(a)

|

|

|

65,943

|

|

|

|

1,129,604

|

|

|

Qualys,

Inc.(a)

|

|

|

20,000

|

|

|

|

1,960,200

|

|

|

Rapid7,

Inc.(a)

|

|

|

15,993

|

|

|

|

979,411

|

|

|

salesforce.com,

Inc.(a)

|

|

|

13,338

|

|

|

|

3,352,106

|

|

|

SPS

Commerce, Inc.(a)

|

|

|

14,255

|

|

|

|

1,110,037

|

|

|

Synopsys,

Inc.(a)

|

|

|

11,500

|

|

|

|

2,460,770

|

|

|

Vertex,

Inc.(a)

|

|

|

43,959

|

|

|

|

1,011,057

|

|

|

Workday,

Inc., Class A(a)

|

|

|

18,404

|

|

|

|

3,959,252

|

|

|

|

|

|

|

|

|

|

49,915,403

|

|

|

MATERIALS (3.02%)

|

|

|

|

|

|

|

|

|

|

Chemicals

(1.93%)

|

|

|

|

|

|

|

|

|

|

Ecolab,

Inc.

|

|

|

13,942

|

|

|

|

2,786,169

|

|

|

Linde

PLC

|

|

|

11,984

|

|

|

|

2,853,750

|

|

|

|

|

|

|

|

|

|

5,639,919

|

|

|

Containers

& Packaging (1.09%)

|

|

|

|

|

|

|

|

|

|

Ball

Corp.

|

|

|

38,206

|

|

|

|

3,175,683

|

|

|

|

|

|

|

|

|

|

|

|

|

REAL

ESTATE (3.79%)

|

|

|

|

|

|

|

|

|

|

Equity

Real Estate Investment Trusts (REITs) (1.74%)

|

|

|

|

|

|

|

|

|

|

Equinix,

Inc.

|

|

|

4,188

|

|

|

|

3,183,425

|

|

See

Notes to Schedule of Investments.

|

Third Quarter Report (Unaudited)

| September 30, 2020

|

11

|

|

Liberty All-Star®

Growth Fund

|

Schedule of Investments

|

September

30, 2020 (Unaudited)

|

|

|

SHARES

|

|

|

MARKET

VALUE

|

|

|

COMMON

STOCKS (continued)

|

|

|

|

|

|

|

|

|

|

Equity

Real Estate Investment Trusts (REITs) (continued)

|

|

|

|

|

|

|

|

|

|

Sun

Communities, Inc.

|

|

|

13,500

|

|

|

$

|

1,898,235

|

|

|

|

|

|

|

|

|

|

5,081,660

|

|

|

Real

Estate Management & Development (2.05%)

|

|

|

|

|

|

|

|

|

|

FirstService

Corp.

|

|

|

45,353

|

|

|

|

5,981,607

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

COMMON STOCKS

|

|

|

|

|

|

|

|

|

|

(COST

OF $181,442,692)

|

|

|

|

|

|

|

286,733,788

|

|

|

|

|

|

|

|

|

|

|

|

|

SHORT

TERM INVESTMENTS (2.30%)

|

|

|

|

|

|

|

|

|

|

MONEY

MARKET FUND (1.66%)

|

|

|

|

|

|

|

|

|

|

State

Street Institutional US Government Money Market Fund, 0.024%(c)

|

|

|

|

|

|

|

|

|

|

(COST

OF $4,841,033)

|

|

|

4,841,033

|

|

|

|

4,841,033

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENTS

PURCHASED WITH COLLATERAL FROM SECURITIES LOANED (0.64%)

|

|

|

|

|

|

|

|

|

|

State

Street Navigator Securities Lending Government Money Market Portfolio, 0.09%

|

|

|

|

|

|

|

|

|

|

(COST

OF $1,851,732)

|

|

|

1,851,732

|

|

|

|

1,851,732

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

SHORT TERM INVESTMENTS

|

|

|

|

|

|

|

|

|

|

(COST

OF $6,692,765)

|

|

|

|

|

|

|

6,692,765

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

INVESTMENTS (100.63%)

|

|

|

|

|

|

|

|

|

|

(COST

OF $188,135,457)

|

|

|

|

|

|

|

293,426,553

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES

IN EXCESS OF OTHER ASSETS (-0.63%)

|

|

|

|

|

|

|

(1,834,361

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NET

ASSETS (100.00%)

|

|

|

|

|

|

$

|

291,592,192

|

|

|

|

|

|

|

|

|

|

|

|

|

NET

ASSET VALUE PER SHARE

|

|

|

|

|

|

|

|

|

|

(41,880,857

SHARES OUTSTANDING)

|

|

|

|

|

|

$

|

6.96

|

|

|

(a)

|

Non-income

producing security.

|

|

(b)

|

Security,

or a portion of the security position, is currently on loan. The total market value of

securities on loan is $1,993,382.

|

|

(c)

|

Rate

reflects seven-day effective yield on September 30, 2020.

|

See

Notes to Schedule of Investments.

|

Liberty All-Star®

Growth Fund

|

Notes

to Schedule of Investments

|

September

30, 2020 (Unaudited)

Security

Valuation

Equity

securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities

listed on the NASDAQ Stock Market LLC (“NASDAQ”), which are valued at the NASDAQ official closing price. Unlisted

securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges

or over-the-counter markets.

Cash

collateral from securities lending activity is reinvested in the State Street Navigator Securities Lending Government Money Market

Portfolio (“State Street Navigator”), a registered investment company under the Investment Company Act of 1940 (the

“1940 Act”), which operates as a money market fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered

investment companies are valued daily at that investment company’s net asset value per share.

The

Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities,

at fair value according to procedures adopted by the Fund’s Board of Directors (the “Board”). When market quotations

are not readily available, or in management’s judgment they do not accurately reflect fair value of a security, or an event

occurs after the market close but before the Fund is priced that materially affects the value of a security, the security will

be valued by the Fund’s Valuation Committee, using fair valuation procedures established by the Board. Examples of potentially

significant events that could materially impact a Fund’s net asset value include, but are not limited to: single issuer

events such as corporate actions, reorganizations, mergers, spin-offs, liquidations, acquisitions and buyouts; corporate announcements

on earnings or product offerings; regulatory news; and litigation and multiple issuer events such as governmental actions; natural

disasters or armed conflicts that affect a country or a region; or significant market fluctuations. Potential significant events

are monitored by the Advisor, ALPS Advisors, Inc. (the “Advisor”), Sub-Advisers and/or the Valuation Committee through

independent reviews of market indicators, general news sources and communications from the Fund’s custodian. As of September

30, 2020, the Fund held no securities that were fair valued.

Security

Transactions

Security

transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method

for both financial statement and federal income tax purposes.

Income

Recognition

Interest

income is recorded on the accrual basis. Corporate actions and dividend income are recorded on the ex-date.

The

Fund estimates components of distributions from real estate investment trusts (“REITs”). Distributions received in

excess of income are recorded as a reduction of the cost of the related investments. Once the REIT reports annually the tax character

of its distributions, the Fund revises its estimates. If the Fund no longer owns the applicable securities, any distributions

received in excess of income are recorded as realized gains.

|

Third

Quarter Report (Unaudited) | September 30, 2020

|

13

|

|

Liberty All-Star®

Growth Fund

|

Notes

to Schedule of Investments

|

September

30, 2020 (Unaudited)

Lending

of Portfolio Securities

The

Fund may lend its portfolio securities only to borrowers that are approved by the Fund’s securities lending agent, State

Street Bank & Trust Co. (“SSB”). The Fund will limit such lending to not more than 20% of the value of its total

assets. The borrower pledges and maintains with the Fund

collateral consisting of cash (U.S. Dollar only), securities issued or guaranteed by the U.S. government or its agencies or instrumentalities,

or by irrevocable bank letters of credit issued by a person other than the borrower or an affiliate of the borrower. The initial

collateral received by the Fund is required to have a value of no less than 102% of the market value of the loaned securities

for securities traded on U.S. exchanges and a value of no less than 105% of the market value for all other securities. The collateral

is maintained thereafter, at a market value equal to no less than 100% of the current value of the securities on loan. The market

value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered

to the Fund on the next business day. During the term of the loan, the Fund is entitled to all distributions made on or in respect

of the loaned securities. Loans of securities are terminable at any time and the borrower, after notice, is required to return

borrowed securities within the standard time period for settlement of securities transactions.

Any

cash collateral received is reinvested in State Street Navigator. Non-cash collateral, in the form of securities issued or guaranteed

by the U.S. government or its agencies or instrumentalities, is not disclosed in the Fund’s Schedule of Investments as it

is held by the lending agent on behalf of the Fund, and the Fund does not have the ability to re-hypothecate these securities.

The

following is a summary of the Fund’s securities lending positions and related cash and non-cash collateral received as

of September 30, 2020:

Market Value of

Securities

on Loan

|

|

|

Cash

Collateral Received

|

|

|

Non-Cash

Collateral Received

|

|

|

Total

Collateral Received

|

|

|

$

|

1,993,382

|

|

|

$

|

1,851,732

|

|

|

$

|

165,000

|

|

|

$

|

2,016,732

|

|

The

risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not

return the securities when due. To mitigate these risks, the Fund benefits from a borrower default indemnity provided by SSB.

SSB’s indemnity allows for full replacement of securities lent wherein SSB will purchase the unreturned loaned securities

on the open market by applying the proceeds of the collateral, or to the extent such proceeds are insufficient or the collateral

is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense. However, the Fund could suffer a loss

if the value of the investments purchased with cash collateral falls below the value of the cash collateral received.

Fair

Value Measurements

The

Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to

measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability,

including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants

would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting

entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would

use in pricing the asset or liability that are developed based on the best information available.

|

Liberty All-Star®

Growth Fund

|

Notes

to Schedule of Investments

|

September

30, 2020 (Unaudited)

Valuation

techniques used to value the Fund’s investments by major category are as follows:

Equity

securities that are valued based on unadjusted quoted prices in active markets are categorized as Level 1 in the hierarchy. In

the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most

recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in shares

of registered investment companies are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Various

inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used

fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls

is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated

input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These

inputs are categorized in the following hierarchy under applicable financial accounting standards:

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund

has the ability to access at the measurement date;

|

|

Level 2 –

|

Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other

than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability;

and

|

|

|

Level 3 –

|

Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value

of investments) where there is little or no market activity for the asset or liability at the measurement date.

|

The

following is a summary of the inputs used to value the Fund’s investments as of September 30, 2020:

|

|

|

|

Valuation Inputs

|

|

|

|

|

|

|

Investments in Securities at Value

|

|

|

Level 1

|

|

|

|

Level 2

|

|

|

|

Level 3

|

|

|

|

Total

|

|

|

Common Stocks*

|

|

$

|

286,733,788

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

286,733,788

|

|

|

Short Term Investments

|

|

|

6,692,765

|

|

|

|

—

|

|

|

|

—

|

|

|

|

6,692,765

|

|

|

Total

|

|

$

|

293,426,553

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

293,426,553

|

|

|

*

|

See

Schedule of Investments for industry classifications.

|

The

Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value during the period.

|

Third

Quarter Report (Unaudited) | September 30, 2020

|

15

|

|

Liberty All-Star®

Growth Fund

|

Notes

to Schedule of Investments

|

September

30, 2020 (Unaudited)

Indemnification

In

the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which

provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future

claims against the Fund. Also, under the Fund’s organizational documents and by contract, the Directors and Officers of

the Fund are indemnified against certain liabilities that may arise out of their duties to the Fund. However, based on experience,

the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

Maryland

Statutes

By

resolution of the Board of Directors, the Fund has opted into the Maryland Control Share Acquisition Act and the Maryland Business

Combination Act. In general, the Maryland Control Share Acquisition Act provides that “control shares” of a Maryland

corporation acquired in a control share acquisition may not be voted except to the extent approved by shareholders at a meeting

by a vote of two-thirds of the votes entitled to be cast on the matter (excluding shares owned by the acquirer and by officers

or directors who are employees of the corporation). “Control shares” are voting shares of stock which, if aggregated

with all other shares of stock owned by the acquirer or in respect of which the acquirer is able to exercise or direct the exercise

of voting power (except solely by virtue of a revocable proxy), would entitle the acquirer to exercise voting power in electing

directors within certain statutorily defined ranges (one-tenth but less than one-third, one-third but less than a majority, and

more than a majority of the voting power). In general, the Maryland Business Combination Act prohibits an interested shareholder

(a shareholder that holds 10% or more of the voting power of the outstanding stock of the corporation) of a Maryland corporation

from engaging in a business combination (generally defined to include a merger, consolidation, share exchange, sale of a substantial

amount of assets, a transfer of the corporation’s securities and similar transactions to or with the interested shareholder

or an entity affiliated with the interested shareholder) with the corporation for a period of five years after the most recent

date on which the interested shareholder became an interested shareholder. At the time of adoption, March 19, 2009, the Board

and the Fund were not aware of any shareholder that held control shares or that was an interested shareholder under the statutes.

|

|

Description

of Lipper Benchmark

|

|

Liberty

All-Star® Growth Fund

|

and

Market Indices

|

|

|

September

30, 2020 (Unaudited)

|

Dow

Jones Industrial Average

A

price-weighted measure of 30 U.S. blue-chip companies.

Lipper

Multi-Cap Growth Mutual Fund Average

The

average of funds that, by portfolio practice, invest in a variety of market capitalization ranges without concentrating 75% of

their equity assets in any one market capitalization range over an extended period of time. Multi-Cap growth funds typically have

above-average characteristics compared to the S&P SuperComposite 1500® Index.

NASDAQ

Composite Index

Measures

all NASDAQ domestic and international based common type stocks listed on the NASDAQ Stock Market.

Russell

3000® Growth Index

Measures

the performance of those Russell 3000® companies with lower book-to-price ratios and higher growth values. The Russell 3000®

Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately

98% of the investable U.S. equity market.

Russell

3000® Value Index

Measures

the performance of those Russell 3000® companies with higher book-to-price ratios and lower growth values.

Russell

Top 200® Growth Index

Measures

the performance of those Russell Top 200® companies with lower book-to-price ratios and higher growth values. The

Russell Top 200® Index measures the performance of the 200 largest companies in the Russell 3000®

Index.

Russell

1000® Growth Index (Largecap)

Measures

the performance of those Russell 1000® companies with lower book-to-price ratios and higher growth values. The

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000®

Index.

Russell

Midcap® Growth Index

Measures

the performance of those Russell Midcap® companies with lower book-to-price ratios and higher growth values. The

Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000®

Index.

Russell

2000® Growth Index (Smallcap)

Measures

the performance of those Russell 2000® companies with lower book-to-price ratios and higher growth values. The

Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

Russell

Growth Benchmark

The

average of the Russell Top 200®, Midcap® and 2000® Growth Indices.

S&P

500® Index

A

large cap U.S. equities index that includes 500 leading companies and captures approximately 80% coverage of available market

capitalization.

An

investor cannot invest directly in an index.

|

Third

Quarter Report (Unaudited) | September 30, 2020

|

17

|

Intentionally

Left Blank

Intentionally

Left Blank

Intentionally

Left Blank

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENT

ADVISOR

|

LEGAL

COUNSEL

|

|

|

ALPS Advisors, Inc.

|

K&L Gates LLP

|

|

|

1290 Broadway, Suite 1000

|

1601 K Street, NW

|

|

|

Denver, Colorado 80203

|

Washington, DC 20006

|

|

|

303-623-2577

|

|

|

|

www.all-starfunds.com

|

DIRECTORS

|

|

|

|

|

|

|

Thomas W. Brock*,

Chairman

|

|

|

INDEPENDENT

REGISTERED

|

Edmund J. Burke

|

|

|

PUBLIC

ACCOUNTING FIRM

|

George R. Gaspari*

|

|

|

Deloitte & Touche LLP

|

Milton M. Irvin*

|

|

|

1601 Wewatta Street, Suite 400

|

Dr. John J. Neuhauser*

|

|

|

Denver, Colorado 80202

|

Maureen K. Usifer*

|

|

|