UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

LG Display

Co., Ltd.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| The Republic of Korea |

|

1-32238 |

|

Not applicable |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| LG Twin Towers |

|

|

| 128 Yeoui-daero, Yeongdeungpo-gu

Seoul 150-721, The Republic of Korea |

|

Seoul 150-721 |

| (Address of principal executive offices) |

|

(Zip Code) |

Suk Heo

LG Display Co., Ltd. Investor Relations Team

+82-2-3777-1010

(Name and

telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to

indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| x |

Rule 13p-1 under the Securities and Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

SECTION 1 – CONFLICT MINERALS DISCLOSURE

| Item 1.01: |

Conflict Minerals Disclosure and Report |

A company is required to

file Form SD pursuant to Rule 13p-1 promulgated under the Exchange Act if it manufactures, or contracts to manufacture, products for which certain specified minerals are necessary to the functionality or production of the products. These minerals

consist of columbite-tantalite (also referred to as “coltan”), cassiterite and wolframite (and their derivatives tantalum, tin, and tungsten), and gold and are referred to as “conflict minerals” (also referred to herein as

“3TG minerals”) regardless of the geographic origin of the minerals and whether or not they fund armed conflict.

LG Display

Co., Ltd. (together with its consolidated subsidiaries, also referred to herein as “we” or “our”) manufactures display products for which we have determined that 3TG minerals are necessary to the functionality or production of

those products. Accordingly, we conducted in good faith a reasonable country of origin inquiry (“RCOI”) with respect to 3TG minerals contained in those products manufactured in 2014. We believe our RCOI was reasonably designed to determine

whether any 3TG minerals contained in our display products originated in the Democratic Republic of the Congo or an adjoining country (together, the “Covered Countries”), or are from recycled or scrap sources.

As a result of the RCOI, we determined that a Conflict Minerals Report, which is attached as an exhibit hereto and also publicly available on

our website at www.lgdisplay.com, was required.

A Conflict Minerals Report is attached as Exhibit 1.01 to

this report.

SECTION 2 – EXHIBITS

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 1.01 |

|

Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the duly authorized undersigned.

|

|

|

|

|

|

|

| LG Display Co., Ltd.

(Registrant) |

|

|

|

|

| By: |

|

/S/ DONGSOO

KIM |

|

|

|

Date: June 1, 2015 |

|

|

Dongsoo Kim |

|

|

|

|

|

|

Head of Purchasing Group |

|

|

|

|

3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 1.01 |

|

Conflict Minerals Report |

4

Exhibit 1.01

CONFLICT MINERALS REPORT OF LG DISPLAY CO., LTD.

FOR THE YEAR ENDED DECEMBER 31, 2014

This is the Conflict Minerals Report of LG Display Co., Ltd. for the year ended December 31, 2014 (this “Report”). In this

Report, the terms “we,” “us” and “our” refer to LG Display Co., Ltd. and its consolidated subsidiaries. Capitalized terms in this Report that have not been expressly defined herein have the meanings assigned to them in

Rule 13p-1 (“Rule 13p-1”) under the Exchange Act of 1934, as amended (the “Exchange Act”) and Form SD.

A company is

required to file Form SD with the U.S. Securities and Exchange Commission (“SEC”) pursuant to Rule 13p-1 if it manufactures, or contracts to manufacture, products for which certain specified minerals are necessary to the functionality or

production of the products. These minerals consist of columbite-tantalite (also referred to as “coltan”), cassiterite and wolframite (and their derivatives tantalum, tin, and tungsten), and gold and are referred to as “conflict

minerals” (also referred to as “3TG minerals” in this Report) regardless of the geographic origin of the minerals and whether or not they fund armed conflict. Under certain circumstances as set forth in Rule 13p-1, a company is

further required to file a Conflict Minerals Report as an exhibit to Form SD.

This Report is also publicly available on our website at

www.lgdisplay.com.

This document includes forward-looking statements as defined in the Private Securities Litigation Reform Act of

1995, including (but not limited to) statements about expected future supplier diligence and engagement efforts, development of our systems supporting those efforts and participation in industry supply chain efforts. Many of the forward-looking

statements contained in this document may be identified by the use of words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimate” and “potential,” among

others. These forward-looking statements are based on our expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These risks and

uncertainties are difficult to predict accurately and may be beyond our control, and may include (but are not limited to) the following: regulatory changes and judicial developments relating to conflict minerals disclosure; changes in or

developments related to our products or our supply chain; industry developments relating to supply chain diligence, disclosure and other practices; and cost considerations. Other risks and uncertainties relevant to our forward-looking statements are

discussed in greater detail in the our reports filed with the SEC. Forward-looking statements in this document speak only as of the date made, and we disclaim any obligation to update or revise these statements as a result of new developments or

otherwise.

Company and Product Overview

We are a leading innovator of thin-film transistor liquid crystal display (“TFT-LCD”) technology and other display panel

technologies, including organic light-emitting diode (“OLED”) technology. We manufacture and sell display panels in a broad range of sizes and specifications (collectively, “display products”) primarily to end-brand customers who

incorporate our display panels as component parts in the manufacture and assembly of televisions, notebook computers, desktop monitors, tablet computers and mobile and other application products. 3TG minerals are commonly used in electronic products

in general, and we have determined that they are necessary to the functionality of our display products, which consists of thousands of component parts and raw materials.

For additional information about our business in general, please refer to our most recent annual report on Form 20-F for the year ended 2014

filed with the SEC on April 30, 2015.

Conflict Minerals Policy

As a responsible corporate citizen, we believe in ethical sourcing and have formulated and announced a conflict minerals policy (our

“Policy”), which is to eliminate from our display products the use of 3TG minerals that directly or indirectly finance or benefit armed groups in the Democratic Republic of the Congo (“DRC”) or an adjoining country (together, the

“Covered Countries”). Our current Policy is publicly available on our website at http://www.lgdisplay.com/eng/sustainability/safetyEnvironment/conflictMinerals/policy and serves as a common reference point for all our suppliers and us

internally.

We believe the implementation of our Policy and our efforts in furtherance thereof, as further described below, have

contributed to reducing the risk that 3TG minerals in our supply chain directly or indirectly financed or benefitted armed groups in the Covered Countries. The number of smelters and refiners in our supply chain that were verified as compliant with

the Conflict-Free Smelter Program (“CFSP”) of the Conflict-Free Sourcing Initiative (“CFSI”) in 2014 was more than twice the number in 2013, with the result that a majority of the identified and reported smelters and refiners in

our supply chain as of December 31, 2014 have been verified as compliant with the CFSP’s assessment protocols (“CFSP-compliant”). Based on our source and chain of custody due diligence for the year ended December 31, 2014,

we have not identified any instances in which our sourcing of 3TG minerals necessary to the functionality of our display products directly or indirectly financed or benefitted armed groups in the Covered Countries. In addition, we were able to

confirm that 100% of the tantalum smelters known to be in our supply chain as of December 31, 2014 were CFSP-compliant.

Results of Reasonable

Country of Origin Inquiry

As required under Rule 13p-1, we conducted in good faith a reasonable country of origin inquiry

(“RCOI”) with respect to 3TG minerals contained in our display products manufactured in 2014. We believe our RCOI was reasonably designed to determine whether any 3TG minerals contained in our display products originated in the Covered

Countries or were from recycled or scrap sources.

Based on our RCOI, and as described further below, although we did not find any

indication that the 3TG minerals necessary to the functionality of our display products originated from a Covered Country, we concluded that we had insufficient information to determine that there was no reason to believe that the 3TG minerals

necessary to the functionality of our display products may have originated from a Covered Country or were not from recycled or scrap sources.

2

Source and Chain of Custody Due Diligence

Given the results of our RCOI, we engaged in additional due diligence on the source and chain of custody of the 3TG minerals necessary to the

functionality of our display products. As further described below, our due diligence conformed in all material respects to the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (Second

Edition) and related Supplements (“OECD Guidance”) for downstream companies.

As an integral part of our source and chain of

custody due diligence, we have conducted supply chain surveys by requesting that our suppliers of component parts and raw materials used in our display products (the “Covered Suppliers”) fill out the Conflict Minerals Reporting Template

(“CMRT”) developed by the CFSI, an initiative founded by members of the Electronic Industry Citizenship Coalition and the Global e-Sustainability Initiative. The CFSP of the CFSI uses an independent third-party audit to identify smelters

and refiners that have systems in place to assure sourcing of only minerals not benefitting armed groups in the Covered Countries. Further, we have requested certifications from each Covered Supplier regarding the truthfulness of its CMRT responses.

Company Management System

In 2013, our senior management established a 3TG minerals task force consisting of managerial level employees from our Purchasing Planning

Team, Legal Department and Investor Relations Team along with outside consultants (the “Task Force”) to take the lead in formulating our Policy, implementing our Policy with our suppliers and us internally and conducting due diligence on

our supply chain based on the OECD Guidance.

The Task Force assigned roles and responsibilities to relevant internal teams and

departments to implement our Policy and established a process for monitoring 3TG minerals in our supply chain. In addition, the Task Force engaged with senior management and working level personnel of our Covered Suppliers to raise awareness of

regulations applicable to the sourcing of 3TG minerals and to educate them on our Policy. Over time, we have expanded the scope of our supplier education outreach from our direct suppliers to our second- and third-tier suppliers, and we have shared

policy guidelines and updates on conflict minerals management with our suppliers in an effort to facilitate compliance on their part.

In

2014, further to our efforts to more accurately identify the use of 3TG minerals in our supply chain, we implemented a conflict minerals management system (our “System”) for the overall management and coordination of our processes related

to 3TG minerals, including verification of supplier data, immediate risk assessments and analyses of 3TG minerals usage statistics. The implementation of our System has enabled us to categorize and monitor our 3TG minerals usage by buyer and model,

on a real-time basis, and to track 3TG minerals throughout our supply chain.

3

The expansion of our supplier education efforts and the implementation of our System have also

contributed to the reliability and accuracy of the information we are able to garner from and about our supply chain. In their 2013 CMRT responses, our Covered Suppliers had listed a total of approximately 500 entities as smelters or refiners from

which 3TG minerals were sourced, and we faced many challenges in identifying the smelters and refiners so listed because either we could not locate or otherwise verify the listed entity or the listed entity was located but was found not to be a

smelter or refiner. In 2014, as a result of additional verification efforts by us and our suppliers, including direct communications with listed entities, we were able to narrow the list to 247 smelters and refiners that we believe were operational

and still in our supply chain as of December 31, 2014.

Building upon the CMRT responses we received for the year ended 2013, which

had been provided at a company level, we improved upon our supply chain survey by requesting relevant suppliers to fill out the CMRT on a product-by-product level. We have continued in our efforts to identify and monitor smelters and refiners and

encourage them to receive verification as independently audited under the CFSP of the CFSI. We have also established an action plan to address unaudited smelters and refiners; to improve the integrity and accuracy of the information in our 3TG

minerals database; and to hedge our exposure to operational risks associated with 3TG minerals.

In furtherance of our Policy, we

currently require all of our suppliers to agree to adhere to our Policy. In the case of Covered Suppliers who responded that they do not use 3TG minerals or that they source from CFSP-compliant smelters or refiners, we require that they covenant not

to use 3TG minerals that directly or indirectly finance or benefit armed groups in the Covered Countries. We have also developed a supplier code of conduct and we encourage our suppliers to formulate their own 3TG policies and identify all smelters

and refiners that supply 3TG minerals in their supply chains. To encourage compliance with our Policy, we have also made the reporting center, including the cyber reporting center, of our Administrative Office of Ethics available to our employees,

suppliers and other stakeholders to report any alleged violations of our Policy on a confidential basis.

Supply Chain Risk

Identification and Assessment

In their CMRT responses, our Covered Suppliers identified smelters and refiners that they listed as

sources for the 3TG minerals contained in the component parts and raw materials they supply. We further checked whether any of these smelters or refiners were located in or near Covered Countries or areas suspected of transporting or sourcing 3TG

minerals from Covered Countries. As a result of increased supplier education and additional verification efforts by us and our suppliers, including direct communications with entities listed by our Covered Suppliers for the year ended

December 31, 2014, we were able to more accurately determine the list of smelters and refiners in our supply chain in comparison to the year ended December 31, 2013. We utilized our System to perform immediate risk assessments on our

Covered Suppliers’ 3TG mineral information and informed our Covered Suppliers of applicable risks. We continue to monitor the risk hedging activities of our Covered Suppliers.

4

Based on their CMRT responses, we assessed the risk associated with the Covered Suppliers,

smelters and refiners and categorized each Covered Supplier into one of the following three categories:

| |

• |

|

No Risk: Supplier either (i) reported no 3TG minerals are contained in component parts or raw materials it supplies or (ii) reported it sources 3TG minerals only from CFSP-compliant smelters and refiners, and

confirmed such 3TG minerals do not directly or indirectly finance or benefit armed groups in the Covered Countries. |

| |

• |

|

Low Risk: Supplier reported it sources 3TG minerals only from CFSP-compliant smelters but did not provide separate confirmation that such 3TG minerals do not directly or indirectly finance or benefit armed groups in the

Covered Countries. |

| |

• |

|

High Risk: Supplier reported it sources 3TG minerals from smelters and refiners that were not independently audited under the CFSP. |

Response Strategy to Identified Risk

To address the identified risks, we established a risk hedging plan with respect to suppliers in the High Risk category. Pursuant to the risk

hedging plan, we instructed suppliers within the High Risk category to adhere to the following alternatives:

| |

• |

|

Require the non-compliant smelter or refiner to be independently audited under the CFSP; |

| |

• |

|

Reroute sourcing of 3TG minerals to CFSP-compliant smelters and refiners; |

| |

• |

|

Eliminate from their supply chain smelters or refiners that were not CFSP-compliant; or |

| |

• |

|

Reroute sourcing to up-stream suppliers that source only from CFSP-compliant smelters and refiners. |

In addition, we selected over 20 suppliers (the “Selected Suppliers”), which were in the High Risk category, for additional due

diligence. In selecting these suppliers, we also took into consideration whether the supplier had a 3TG minerals policy of its own, the scope of 3TG minerals usage due diligence conducted by the supplier itself, the geographic location of the

supplier, the geographic location of the smelters and refiners identified by the supplier and the number of smelters and refiners identified by the supplier.

We reviewed the RCOI procedures of the Selected Suppliers as well as their 3TG minerals management level. We engaged in additional training

and education with the Selected Suppliers on how to improve their 3TG minerals management and we assessed their improvements and grievances.

5

Third-party Independent Audit of Supply Chain

As a downstream company, there are many steps in the supply chain separating us from the mines, smelters and refiners that source the 3TG

minerals contained in our display products. With respect to smelters and refiners known to be in our supply chain, we make reference to independent third-party audits used by the CFSP to identify smelters and refiners that have systems in place to

assure sourcing of only minerals not benefitting armed groups in the Covered Countries.

We have not obtained an independent third-party

audit of our own supply chain. If required in the future, we will do so in the manner required by Rule 13p-1. Furthermore, we will continue to support private and public efforts to encourage sourcing of 3TG minerals not benefitting armed groups in

the Covered Countries.

Results of Source and Chain of Custody Due Diligence

Based on the CMRT responses provided by our Covered Suppliers and our further due diligence to confirm the usage of 3TG minerals within our

supply chain, we identified a total of 247 entities as smelters or refiners from which 3TG minerals were sourced. Of the 247 smelters and refiners we identified, 153 were independently audited under the CFSP and designated as “compliant,”

and 35 were progressing towards completion of an independent audit under the CFSP and designated as “active.” The remaining 59 smelters or refiners were not independently audited under the CFSP (“non-participating”).

As a result of our source and chain of custody due diligence for the year ended December 31, 2014, we have not identified any instances

in which our sourcing of 3TG minerals necessary to the functionality of our display products directly or indirectly financed or benefitted armed groups in the Covered Countries. In addition, we were able to confirm that 100% of the tantalum smelters

known to be in our supply chain as of December 31, 2014 were CFSP-compliant.

The following table sets forth the number of smelters

and refiners in our supply chain by CFSP status and type of mineral.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Status of identified smelters and refiners |

|

Tantalum |

|

|

Tin |

|

|

Tungsten |

|

|

Gold |

|

|

Total |

|

|

|

|

|

|

|

| Compliant |

|

|

36 |

|

|

|

36 |

|

|

|

15 |

|

|

|

66 |

|

|

|

153 |

|

| Active |

|

|

— |

|

|

|

13 |

|

|

|

16 |

|

|

|

6 |

|

|

|

35 |

|

| Non-participating |

|

|

— |

|

|

|

25 |

|

|

|

2 |

|

|

|

32 |

|

|

|

59 |

|

| Total |

|

|

36 |

|

|

|

74 |

|

|

|

33 |

|

|

|

104 |

|

|

|

247 |

|

| Total compliant ratio (%) |

|

|

100 |

% |

|

|

49 |

% |

|

|

45 |

% |

|

|

63 |

% |

|

|

62 |

% |

| Total compliant and active ratio (%) |

|

|

100 |

% |

|

|

66 |

% |

|

|

94 |

% |

|

|

69 |

% |

|

|

76 |

% |

6

The number of smelters and refiners in our supply chain that were verified as CFSP-compliant in

2014 was more than twice the number in 2013, with the result that 62% of the identified and reported smelters and refiners in our supply chain as of December 31, 2014 have been verified as CFSP-compliant. As of such date, 76% of the identified

and reported smelters and refiners in our supply chain were either CFSP-compliant or CFSP-active.

With respect to the smelters and

refiners we identified as not independently audited under the CFSP, we have communicated with such processing facilities to request that they participate in the CFSP. Certain of these smelters and refiners who refused to engage in the CFSP process

were subsequently removed from our supply chain.

Based on the information provided by our suppliers and our own due diligence efforts

with known smelters and refiners through December 31, 2014, we believe that the facilities that may have been used to process the 3TG minerals in our products include the smelters and refiners listed in Annex I below.

Future Measures

As a responsible

corporate citizen, in 2015, we will continue to seek to source all 3TG minerals in our supply chain from smelters and refiners that are participating in the CFSP or that have otherwise been verified under an independent third-party audit as sourcing

only minerals not benefitting armed groups in the Covered Countries, and we intend to do so through the following measures:

| |

• |

|

Continue conducting due diligence of our supply chain and educating and training our Covered Suppliers in order to drive proactive measures by such suppliers; |

| |

• |

|

Pursue voluntary participation in the CSFP by more smelters and refiners; |

| |

• |

|

Continue information sharing and collaborative efforts with governmental and non-governmental entities and academia; and |

| |

• |

|

Aim to eliminate from our display products the use of not only 3TG minerals that directly or indirectly finance or benefit armed groups in the Covered Countries, but also minerals from other conflict regions or regions

where human rights violations are occurring. |

7

Annex I

Compliant Smelters and Refiners

|

|

|

|

|

| Mineral |

|

Smelter or Refiner Name |

|

Country |

| Gold |

|

Aida Chemical Industries Co. Ltd. |

|

Japan |

| Gold |

|

Allgemeine Gold-und Silberscheideanstalt A.G. |

|

Germany |

| Gold |

|

AngloGold Ashanti Córrego do Sítio Minerção |

|

Brazil |

| Gold |

|

Argor-Heraeus SA |

|

Switzerland |

| Gold |

|

Asahi Pretec Corp |

|

Japan |

| Gold |

|

Atasay Kuyumculuk Sanayi Ve Ticaret A.S. |

|

Turkey |

| Gold |

|

Aurubis AG |

|

Germany |

| Gold |

|

Boliden AB |

|

Sweden |

| Gold |

|

C. Hafner GmbH + Co. KG |

|

Germany |

| Gold |

|

CCR Refinery – Glencore Canada Corporation |

|

Canada |

| Gold |

|

Chimet S.p.A. |

|

Italy |

| Gold |

|

Dowa |

|

Japan |

| Gold |

|

Eco-System Recycling Co. Ltd. |

|

Japan |

| Gold |

|

Heimerle + Meule GmbH |

|

Germany |

| Gold |

|

Heraeus Ltd. Hong Kong |

|

Hong Kong |

| Gold |

|

Heraeus Precious Metals GmbH & Co. KG |

|

Germany |

| Gold |

|

Ishifuku Metal Industry Co., Ltd. |

|

Japan |

| Gold |

|

Istanbul Gold Refinery |

|

Turkey |

| Gold |

|

Japan Mint |

|

Japan |

| Gold |

|

Johnson Matthey Inc |

|

United States |

| Gold |

|

Johnson Matthey Ltd |

|

Canada |

| Gold |

|

JSC Ekaterinburg Non-Ferrous Metal Processing Plant |

|

Russian Federation |

| Gold |

|

JSC Uralelectromed |

|

Russian Federation |

| Gold |

|

JX Nippon Mining & Metals Co. Ltd. |

|

Japan |

| Gold |

|

Kazzinc Ltd |

|

Kazakhstan |

| Gold |

|

Kennecott Utah Copper LLC |

|

United States |

| Gold |

|

Kojima Chemicals Co. Ltd |

|

Japan |

| Gold |

|

L’ azurde Company For Jewelry |

|

Saudi Arabia |

| Gold |

|

LS-NIKKO Copper Inc. |

|

Korea, Republic of |

| Gold |

|

Materion |

|

United States |

| Gold |

|

Matsuda Sangyo Co. Ltd. |

|

Japan |

| Gold |

|

Metalor Technologies (Hong Kong) Ltd |

|

Hong Kong |

| Gold |

|

Metalor Technologies (Singapore) Pte. Ltd. |

|

Singapore |

| Gold |

|

Metalor Technologies SA |

|

Switzerland |

| Gold |

|

Metalor USA Refining Corporation |

|

United States |

| Gold |

|

Met-Mex Peñoles, S.A. |

|

Mexico |

| Gold |

|

Mistubishi Materials Corporation |

|

Japan |

| Gold |

|

Mitsui Mining and Smelting Co. Ltd. |

|

Japan |

| Gold |

|

Nadir Metal Rafineri San. Ve Tic. A.Ş. |

|

Turkey |

| Gold |

|

Nihon Material Co. LTD |

|

Japan |

| Gold |

|

Ohio Precious Metals LLC |

|

United States |

| Gold |

|

Ohura Precious Metal Industry Co., Ltd |

|

Japan |

| Gold |

|

OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” (OJSC Krastvetmet) |

|

Russian Federation |

| Gold |

|

PAMP SA |

|

Switzerland |

| Gold |

|

PT Aneka Tambang (Persero) Tbk |

|

Indonesia |

| Gold |

|

PX Précinox SA |

|

Switzerland |

| Gold |

|

Rand Refinery (Pty) Ltd |

|

South Africa |

| Gold |

|

Royal Canadian Mint |

|

Canada |

| Gold |

|

Schone Edelmetaal |

|

Netherlands |

| Gold |

|

SEMPSA Joyería Platería SA |

|

Spain |

A-1

|

|

|

|

|

| Gold |

|

Shandong Zhaojin Gold & Silver Refinery Co. Ltd |

|

China |

| Gold |

|

Solar Applied Materials Technology Corp. |

|

Taiwan |

| Gold |

|

Sumitomo Metal Mining Co. Ltd. |

|

Japan |

| Gold |

|

Tanaka Kikinzoku Kogyo K.K. |

|

Japan |

| Gold |

|

The Refinery of Shandong Gold Mining Co. Ltd |

|

China |

| Gold |

|

Tokuriki Honten Co. Ltd |

|

Japan |

| Gold |

|

Umicore Brasil Ltda |

|

Brazil |

| Gold |

|

Umicore SA Business Unit Precious Metals Refining |

|

Belgium |

| Gold |

|

United Precious Metal Refining Inc. |

|

United States |

| Gold |

|

Valcambi SA |

|

Switzerland |

| Gold |

|

Western Australian Mint trading as The Perth Mint |

|

Australia |

| Gold |

|

YAMAMOTO PRECIOUS METAL CO., LTD. |

|

Japan |

| Gold |

|

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

|

China |

| Gold |

|

Zijin Mining Group Co. Ltd |

|

China |

| Gold |

|

Umicore Precious Metals Thailand |

|

Thailand |

| Gold |

|

Singway Technology Co., Ltd. |

|

Taiwan |

| Tantalum |

|

Changsha South Tantalum Niobium Co., Ltd. |

|

China |

| Tantalum |

|

Conghua Tantalum and Niobium Smeltry |

|

China |

| Tantalum |

|

Duoluoshan |

|

China |

| Tantalum |

|

Exotech Inc. |

|

United States |

| Tantalum |

|

F&X Electro-Materials Ltd. |

|

China |

| Tantalum |

|

Guangdong Zhiyuan New Material Co., Ltd. |

|

China |

| Tantalum |

|

Hi-Temp |

|

United States |

| Tantalum |

|

JiuJiang JinXin Nonferrous Metals Co., Ltd. |

|

China |

| Tantalum |

|

Jiujiang Tanbre Co. Ltd. |

|

China |

| Tantalum |

|

LSM Brasil S.A. |

|

Brazil |

| Tantalum |

|

Metallurgical Products India (Pvt.) Ltd. |

|

India |

| Tantalum |

|

Mineração Taboca S.A. |

|

Brazil |

| Tantalum |

|

Mitsui Mining & Smelting |

|

Japan |

| Tantalum |

|

Molycorp Silmet A.S. |

|

Estonia |

| Tantalum |

|

Ningxia Orient Tantalum Industry Co. Ltd. |

|

China |

| Tantalum |

|

QuantumClean |

|

United States |

| Tantalum |

|

RFH Tantalum Smeltry Co., Ltd |

|

China |

| Tantalum |

|

Solikamsk Magnesium Works OAO |

|

Russian Federation |

| Tantalum |

|

Taki Chemicals |

|

Japan |

| Tantalum |

|

Telex |

|

United States |

| Tantalum |

|

Ulba |

|

Kazakhstan |

| Tantalum |

|

Zhuzhou Cement Carbide |

|

China |

| Tantalum |

|

Hengyang King Xing Lifeng New Materials Co., Ltd. |

|

China |

| Tantalum |

|

KEMET Blue Metals |

|

Mexico |

| Tantalum |

|

Plansee SE Liezen |

|

Austria |

| Tantalum |

|

H.C. Starck Co. Ltd. |

|

Thailand |

| Tantalum |

|

H.C. Starck GmbH Goslar |

|

Germany |

| Tantalum |

|

H.C. Starck GmbH Laufenburg |

|

Germany |

| Tantalum |

|

H.C. Starck Hermsdorf GmbH |

|

Germany |

| Tantalum |

|

H.C. Starck Inc. |

|

United States |

| Tantalum |

|

H.C. Starck Ltd. |

|

Japan |

| Tantalum |

|

H.C. Starck Smelting GmbH & Co.KG |

|

Germany |

| Tantalum |

|

Plansee SE Reutte |

|

Austria |

| Tantalum |

|

Global Advanced Metals Boyertown |

|

United States |

| Tantalum |

|

Global Advanced Metals Aizu |

|

Japan |

| Tantalum |

|

KEMET Blue Powder |

|

United States |

| Tin |

|

China Rare Metal Materials Company |

|

China |

A-2

|

|

|

|

|

| Tin |

|

Alpha |

|

United States |

| Tin |

|

Cooper Santa |

|

Brazil |

| Tin |

|

CV United Smelting |

|

Indonesia |

| Tin |

|

Dowa |

|

Japan |

| Tin |

|

EM Vinto |

|

Bolivia |

| Tin |

|

Gejiu Non-Ferrous Metal Processing Co. Ltd. |

|

China |

| Tin |

|

Malaysia Smelting Corporation (MSC) |

|

Malaysia |

| Tin |

|

Metallo Chimique |

|

Belgium |

| Tin |

|

Mineração Taboca S.A. |

|

Brazil |

| Tin |

|

Minsur |

|

Peru |

| Tin |

|

Mitsubishi Materials Corporation |

|

Japan |

| Tin |

|

OMSA |

|

Bolivia |

| Tin |

|

PT Artha Cipta Langgeng |

|

Indonesia |

| Tin |

|

PT Babel Inti Perkasa |

|

Indonesia |

| Tin |

|

PT Bangka Putra Karya |

|

Indonesia |

| Tin |

|

PT Bangka Tin Industry |

|

Indonesia |

| Tin |

|

PT Belitung Industri Sejahtera |

|

Indonesia |

| Tin |

|

PT Bukit Timah |

|

Indonesia |

| Tin |

|

PT DS Jaya Abadi |

|

Indonesia |

| Tin |

|

PT Eunindo Usaha Mandiri |

|

Indonesia |

| Tin |

|

PT Mitra Stania Prima |

|

Indonesia |

| Tin |

|

PT Panca Mega Persada |

|

Indonesia |

| Tin |

|

PT Prima Timah Utama |

|

Indonesia |

| Tin |

|

PT REFINED BANGKA TIN |

|

Indonesia |

| Tin |

|

PT Sariwiguna Binasentosa |

|

Indonesia |

| Tin |

|

PT Stanindo Inti Perkasa |

|

Indonesia |

| Tin |

|

PT Tambang Timah |

|

Indonesia |

| Tin |

|

PT Timah (Persero) Tbk |

|

Indonesia |

| Tin |

|

PT Tinindo Inter Nusa |

|

Indonesia |

| Tin |

|

Thaisarco |

|

Thailand |

| Tin |

|

White Solder Metalurgia e Mineração Ltda. |

|

Brazil |

| Tin |

|

Yunnan Tin Company Ltd. |

|

China |

| Tin |

|

Magnu’s Minerais Metais e Ligas LTDA |

|

Brazil |

| Tin |

|

Melt Metais e Ligas S/A |

|

Brazil |

| Tin |

|

PT ATD Makmur Mandiri Jaya |

|

Indonesia |

| Tungsten |

|

Fujian Jinxin Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Global Tungsten & Powders Corp. |

|

United States |

| Tungsten |

|

Hunan Chunchang Nonferrous Metals Co. Ltd. |

|

China |

| Tungsten |

|

Japan New Metals Co., Ltd. |

|

Japan |

| Tungsten |

|

Ganzhou Huaxing Tungsten Products Co. Ltd. |

|

China |

| Tungsten |

|

Vietnam Youngsun Tungsten Industry Co., Ltd |

|

Vietnam |

| Tungsten |

|

Wolfram Bergbau und Hütten AG |

|

Austria |

| Tungsten |

|

Wolfram Company CJSC |

|

Russian Federation |

| Tungsten |

|

Xiamen Tungsten Co. Ltd. |

|

China |

| Tungsten |

|

Ganzhou Jiangwu Ferrotungsten Co., Ltd. |

|

China |

| Tungsten |

|

Malipo Haiyu Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Xiamen Tungsten (H.C.) Co. Ltd. |

|

China |

| Tungsten |

|

Jiangxi Gan Bei Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Ganzhou Seadragon W & Mo Co. Ltd. |

|

China |

| Tungsten |

|

Chenzhou Diamond Tungsten Products Co., Ltd. |

|

China |

A-3

Active Smelters and Refiners

|

|

|

|

|

| Mineral |

|

Smelter or Refiner Name |

|

Country |

| Gold |

|

Asaka Riken Co Ltd |

|

Japan |

| Gold |

|

Cendres + Métaux SA |

|

Switzerland |

| Gold |

|

Doduco |

|

Germany |

| Gold |

|

SOE Shyolkovsky Factory of Secondary Precious Metals |

|

Russian Federation |

| Gold |

|

Torecom |

|

Korea, Republic of |

| Gold |

|

Yokohama Metal Co Ltd |

|

Japan |

| Tin |

|

CV JusTindo |

|

Indonesia |

| Tin |

|

CV Nurjanah |

|

Indonesia |

| Tin |

|

Fenix Metals |

|

Poland |

| Tin |

|

China Tin Group Co. Ltd. |

|

China |

| Tin |

|

O.M. Manufacturing (Thailand) Co., Ltd. |

|

Thailand |

| Tin |

|

PT BilliTin Makmur Lestari |

|

Indonesia |

| Tin |

|

PT Karimun Mining |

|

Indonesia |

| Tin |

|

PT Sumber Jaya Indah |

|

Indonesia |

| Tin |

|

Rui Da Hung |

|

Taiwan |

| Tin |

|

Soft Metais Ltda. |

|

Brazil |

| Tin |

|

Yunnan Chengfeng Non-ferrous Metals Co.,Ltd. |

|

China |

| Tin |

|

O.M. Manufacturing Philippines, Inc. |

|

Philippines |

| Tin |

|

PT Inti Stania Prima |

|

Indonesia |

| Tungsten |

|

A.L.M.T. Corp. |

|

Japan |

| Tungsten |

|

Kennametal Huntsville |

|

United States |

| Tungsten |

|

Guangdong Xianglu Tungsten Co. Ltd. |

|

China |

| Tungsten |

|

Chongyi Zhangyuan Tungsten Co. Ltd. |

|

China |

| Tungsten |

|

Dayu Weiliang Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Hunan Chenzhou Mining Group Co., Ltd. |

|

China |

| Tungsten |

|

Ganzhou Non-ferrous Metals Smelting Co., Ltd. |

|

China |

| Tungsten |

|

Kennametal Fallon |

|

United States |

| Tungsten |

|

Tejing (Vietnam) Tungsten Co., Ltd. |

|

Vietnam |

| Tungsten |

|

Xinhai Rendan Shaoguan Tungsten Co., Ltd. |

|

China |

| Tungsten |

|

Jiangxi Xinsheng Tungsten Industry Co., Ltd. |

|

China |

| Tungsten |

|

Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. |

|

China |

| Tungsten |

|

H.C. Starck GmbH |

|

Germany |

| Tungsten |

|

H.C. Starck Smelting GmbH & Co.KG |

|

Germany |

| Tungsten |

|

Nui Phao H.C. Starck Tungsten Chemicals Manufacturing LLC |

|

Vietnam |

| Tungsten |

|

Jiangwu H.C. Starck Tungsten Products Co., Ltd. |

|

China |

Non-participating Smelters and Refiners

|

|

|

|

|

| Mineral |

|

Smelter or Refiner Name |

|

Country |

| Gold |

|

Almalyk Mining and Metallurgical Complex (AMMC) |

|

Uzbekistan |

| Gold |

|

Bangko Sentral ng Pilipinas (Central Bank of the Philippines) |

|

Philippines |

| Gold |

|

Bauer Walser AG |

|

Germany |

| Gold |

|

Caridad |

|

Mexico |

| Gold |

|

Yunnan Copper Industry Co Ltd |

|

China |

| Gold |

|

Chugai Mining |

|

Japan |

| Gold |

|

Colt Refining |

|

United States |

| Gold |

|

Daejin Indus Co. Ltd |

|

Korea, Republic of |

A-4

|

|

|

|

|

| Gold |

|

Daye Non-Ferrous Metals Mining Ltd. |

|

China |

| Gold |

|

Do Sung Corporation |

|

Korea, Republic of |

| Gold |

|

FSE Novosibirsk Refinery |

|

Russian Federation |

| Gold |

|

Gansu Seemine Material Hi-Tech Co Ltd |

|

China |

| Gold |

|

Hangzhou Fuchunjiang Smelting Co., Ltd. |

|

China |

| Gold |

|

Hunan Chenzhou Mining Group Co., Ltd. |

|

China |

| Gold |

|

Hwasung CJ Co. Ltd |

|

Korea, Republic of |

| Gold |

|

Inner Mongolia Qiankun Gold and Silver Refinery Share Company Limited |

|

China |

| Gold |

|

Jiangxi Copper Company Limited |

|

China |

| Gold |

|

Korea Metal Co. Ltd |

|

Korea, Republic of |

| Gold |

|

Kyrgyzaltyn JSC |

|

Kyrgyzstan |

| Gold |

|

Lingbao Jinyuan Tonghui Refinery Co. Ltd. |

|

China |

| Gold |

|

Luoyang Zijin Yinhui Metal Smelt Co Ltd |

|

China |

| Gold |

|

Moscow Special Alloys Processing Plant |

|

Russian Federation |

| Gold |

|

Navoi Mining and Metallurgical Combinat |

|

Uzbekistan |

| Gold |

|

OJSC Kolyma Refinery |

|

Russian Federation |

| Gold |

|

Penglai Penggang Gold Industry Co Ltd |

|

China |

| Gold |

|

Prioksky Plant of Non-Ferrous Metals |

|

Russian Federation |

| Gold |

|

Sabin Metal Corp. |

|

United States |

| Gold |

|

SAMWON METALS Corp. |

|

Korea, Republic of |

| Gold |

|

So Accurate Group, Inc. |

|

United States |

| Gold |

|

The Great Wall Gold and Silver Refinery of China |

|

China |

| Gold |

|

Tongling nonferrous Metals Group Co.,Ltd |

|

China |

| Gold |

|

Guangdong Jinding Gold Limited |

|

China |

| Tin |

|

CNMC (Guangxi) PGMA Co. Ltd. |

|

China |

| Tin |

|

CV Gita Pesona |

|

Indonesia |

| Tin |

|

CV Makmur Jaya |

|

Indonesia |

| Tin |

|

CV Serumpun Sebalai |

|

Indonesia |

| Tin |

|

Estanho de Rondônia S.A. |

|

Brazil |

| Tin |

|

Gejiu Zi-Li |

|

China |

| Tin |

|

Huichang Jinshunda Tin Co. Ltd |

|

China |

| Tin |

|

Jiangxi Nanshan |

|

China |

| Tin |

|

Gejiu Kai Meng Industry and Trade LLC |

|

China |

| Tin |

|

Linwu Xianggui Smelter Co |

|

China |

| Tin |

|

Novosibirsk Integrated Tin Works |

|

Russian Federation |

| Tin |

|

PT Alam Lestari Kencana |

|

Indonesia |

| Tin |

|

PT Babel Surya Alam Lestari |

|

Indonesia |

| Tin |

|

PT Bangka Kudai Tin |

|

Indonesia |

| Tin |

|

PT Bangka Timah Utama Sejahtera |

|

Indonesia |

| Tin |

|

PT Fang Di MulTindo |

|

Indonesia |

| Tin |

|

PT HP Metals Indonesia |

|

Indonesia |

| Tin |

|

PT Koba Tin |

|

Indonesia |

| Tin |

|

PT Seirama Tin investment |

|

Indonesia |

| Tin |

|

PT Supra Sukses Trinusa |

|

Indonesia |

| Tin |

|

PT Pelat Timah Nusantara Tbk |

|

Indonesia |

| Tin |

|

PT Tommy Utama |

|

Indonesia |

| Tin |

|

PT Yinchendo Mining Industry |

|

Indonesia |

| Tin |

|

PT HANJAYA PERKASA METALS |

|

Indonesia |

| Tin |

|

Minmetals Ganzhou Tin Co. Ltd. |

|

China |

| Tungsten |

|

Jiangxi Minmetals Gao’an Non-ferrous Metals Co., Ltd. |

|

China |

| Tungsten |

|

Jiangxi Richsea New Materials Co., Ltd. |

|

China |

A-5

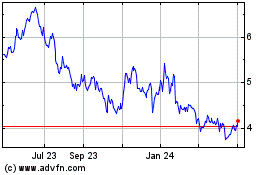

LG Display (NYSE:LPL)

Historical Stock Chart

From Aug 2024 to Sep 2024

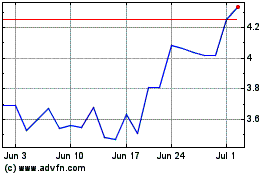

LG Display (NYSE:LPL)

Historical Stock Chart

From Sep 2023 to Sep 2024