By Jacob Bunge and Brent Kendall

Six current and former chicken-industry executives were indicted

on price-fixing charges, expanding the U.S. government's antitrust

prosecutions in the $65 billion poultry industry.

The charges, announced Wednesday, target executives from several

different chicken companies, including Pilgrim's Pride Corp., and

provide new details about the alleged conspiracy. Prosecutors said

the price-fixing took place from 2012 into early 2019, a longer

period than the Justice Department previously had alleged.

Among the individuals charged is Bill Lovette, the former chief

executive of Pilgrim's Pride, who retired in March 2019. Mr.

Lovette declined to comment. Representatives for Pilgrim's, the

second-largest U.S. chicken supplier by sales, didn't respond to

requests for comment.

"Executives who choose collusion over competition will be held

to account for schemes that cheat consumers and corrupt our

competitive markets," said Makan Delrahim, the Justice Department's

top antitrust official, in announcing the new charges. The

department said its investigation continues.

The new charges deepen the department's efforts to address

alleged price-fixing and bid-rigging in an industry that supplies

billions of pounds of chicken nuggets, breast filets and wings to

U.S. restaurant chains and grocery stores annually. Prosecutors in

June announced indictments of four senior industry executives on

similar charges, including the then-chief executive of Pilgrim's,

Jayson Penn. Mr. Penn, who exited the company last month, and the

other charged officials have pleaded not guilty.

Justice attorneys previously alleged that executives of

Pilgrim's and Claxton Poultry Farms, a smaller chicken company,

exchanged prices and other details during the process of bidding on

chicken-supply deals for major restaurant chains. Supermarket and

restaurant chains potentially harmed by the alleged price fixing

included Walmart Inc., Kroger Co., Popeyes Louisiana Kitchen and

Golden Corral, according to court documents filed in July.

Justice Department attorneys in 2019 subpoenaed chicken

companies, seeking information on their activities. After receiving

one, officials at Tyson Foods Inc. found some of its employees were

involved in the efforts alleged by the Justice Department, the

company has said. Tyson, the biggest U.S. chicken company by sales,

disclosed the findings to the government under a federal corporate

leniency program, and is cooperating with the investigation.

The new charges expand the number of companies and chicken

industry employees linked to the alleged activity. Other executives

and employees charged are Timothy Mulrenin, a Perdue Farms Inc.

sales executive who previously worked at Tyson; William Kantola, a

sales executive at Koch Foods Inc.; Jimmie Little, a former

Pilgrim's sales director; Gary Brian Roberts, an employee at Case

Farms who previously worked at Tyson, and Rickie Blake, a former

director and manager at George's Inc.

The defendants could face jail time and considerable fines if

convicted.

Mr. Mulrenin and Mr. Little declined to comment. Messrs.

Kantola, Roberts and Blake didn't respond to requests for

comment.

Representatives for Perdue and George's declined to comment.

Case Farms and Koch Foods didn't respond to requests for

comment.

A Tyson spokesman said the new indictments didn't change the

company's status in its leniency arrangement with the Justice

Department.

The companies are not identified by name in the indictment, but

people familiar with the probe confirmed their identities.

The Justice Department's charges describe friendly relationships

between executives and employees of rival chicken companies, who

allegedly called, emailed and texted one another during competitive

bidding processes.

After a food distributor in May 2016 sought longer terms for

credit lines with chicken suppliers, a Koch employee emailed Mr.

Lovette at Pilgrim's to ask if he had heard about it, according to

the indictment.

"Yes, we told them NO!" Mr. Lovette emailed back.

"OK. Then I am 100 percent on board," the Koch employee wrote

back, the Justice Department said. "If that changes can you please

tell me?"

"Will do," Mr. Lovette responded.

In May 2013, according to the Justice Department's indictment, a

restaurant chain contacted Mr. Little, then at Pilgrim's, as well

as a Tyson employee, asking about prices for frozen chicken. The

Tyson employee later that day called Mr. Little as well as Koch's

Mr. Kantola, speaking to each for a few minutes, according to the

indictment. Afterward, the Justice Department said, Mr. Little told

the restaurant chain that Pilgrim's would require an additional fee

for freezing the meat.

The Tyson employee, who wasn't named in the indictment, told Mr.

Mulrenin and Mr. Roberts, both then at Tyson, the prices Pilgrim's

and Koch planned to charge, the Justice Department said. Tyson

later submitted prices to the restaurant chain that included an

additional 3 cents a pound on top of regular chicken pricing at the

time, according to the indictment.

The indictment suggested yet more industry officials were

involved in the pricing discussions. In 2014, for example, an

unnamed Perdue employee allegedly spoke with a rival company, then

discussed with a colleague information he had gathered on the

pricing plans of two competitors. "Great info," the colleague

responded, according to the indictment.

Antitrust pressure has been growing on the U.S. meat industry,

in which a small number of big companies supply the bulk of the

beef, chicken and pork eaten by U.S. consumers. Major supermarket

chains, including Walmart, Kroger and Albertsons Cos. in recent

years have sued chicken suppliers including Pilgrim's, Tyson and

Sanderson Farms Inc., alleging the companies coordinated production

and price reporting to push up poultry prices.

Chicken companies are contesting those charges, arguing that

chicken prices remain driven by grain prices, export sales and

other market forces.

The Justice Department and the U.S. Agriculture Department are

separately probing major beef packers' cattle-buying activities,

after cattle ranchers saw livestock prices plunge twice over the

past year, following a major processing plant fire in 2019 and

widespread plant closures last spring due to Covid-19 infections

among workers.

Write to Jacob Bunge at jacob.bunge@wsj.com and Brent Kendall at

brent.kendall@wsj.com

(END) Dow Jones Newswires

October 07, 2020 19:04 ET (23:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

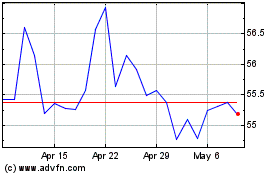

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

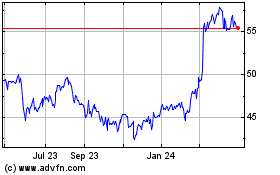

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024