Current Report Filing (8-k)

October 13 2021 - 5:22PM

Edgar (US Regulatory)

0001509991

false

0001509991

2021-10-13

2021-10-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 13, 2021

KOSMOS ENERGY LTD.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-35167

|

|

98-0686001

|

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

8176 Park Lane

|

|

|

|

Dallas, Texas

|

|

75231

|

|

(Address

of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which

registered:

|

|

Common Stock $0.01 par value

|

|

KOS

|

|

New York Stock Exchange

|

|

|

|

|

|

London Stock Exchange

|

Registrant’s telephone number, including

area code: +1 214 445

9600

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement

Issuance of Bridge Notes

In connection with the

completion of the Acquisition (as defined herein), Kosmos Energy Ltd. (“Kosmos,” the “Company” or “we”)

issued $400 million aggregate principal amount of floating rate senior notes due 2022 (the “Notes”) in a private placement

to Barclays Bank PLC and Standard Chartered Bank. The Notes were issued pursuant to the terms of an indenture dated October 13, 2021

(the “Indenture”) among the Company, the guarantors named therein (the “Guarantors”) and Wilmington Trust, National

Association, as trustee, paying agent, transfer agent and registrar.

The Notes mature on

October 13, 2022 and will initially accrue interest at a rate of LIBOR plus 8.00% per year, subject to a 0.50% increase every

three months following the initial issuance thereof. If the Notes have not been repaid in full on or prior to October 13, 2022, then

the full then-outstanding principal amount of Notes shall be exchanged on such date for fixed rate senior notes that mature on June 30,

2027 and will accrue interest at a rate of 12.00% per year. The Notes are guaranteed by the same subsidiaries that guarantee the Company’s

existing senior notes and corporate revolver, which include senior unsecured guarantees by certain subsidiaries owning the Company's

U.S. Gulf of Mexico assets, and subordinated unsecured guarantees by certain subsidiaries that borrow under, or guarantee, the Company’s

commercial debt facility.

The Indenture contains restrictive covenants

and other terms that are substantially similar to the Company’s existing senior notes. In addition, the Company may at any time,

on any one or more occasions, redeem or repurchase all or a part of the Notes at a price equal to 100%, plus any accrued and unpaid interest,

if any, to, but excluding, the date of redemption or repurchase.

Upon the occurrence of a “change of

control triggering event” as defined under the Indenture, the Company will be required to make an offer to repurchase Notes at a

repurchase price equal to 100% of the outstanding principal amount, plus accrued and unpaid interest to, but excluding, the repurchase

date. Additionally, if the Company sells assets, under certain circumstances outlined in the Indenture, it will be required to use the

net proceeds to make an offer to purchase Notes at an offer price in cash in an amount equal to 100% of the principal amount of the Notes,

plus accrued and unpaid interest to, but excluding, the repurchase date.

The Company expects to refinance the Notes

with a future debt financing. The Company can provide no assurance that such a debt financing will be consummated or, if consummated,

that it will be consummated on the terms we currently expect.

The information provided in this Item 1.01

is qualified in its entirety by the terms of the Indenture and Notes. A copy of the Indenture (including the Form of Notes) is filed as

Exhibit 1.1 hereto and incorporated herein by reference.

The information set forth in Item 2.01 of

this Current Report on Form 8-K is incorporated by reference to this Item 1.01.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Completion of Anadarko WCTP Acquisition

On October 13, 2021, Kosmos Energy Ghana

Holdings Limited (“KEGHL”), a wholly-owned subsidiary of the Company, completed its acquisition (the

“Acquisition”) of all of the outstanding shares of Anadarko WCTP Company (“Anadarko WCTP”) for an unadjusted

purchase price of $550.6 million pursuant to a Share Purchase Agreement, dated October 13, 2021 (the “Share Purchase

Agreement”), between KEGHL and Anadarko Offshore Holding Company, LLC, a subsidiary of Occidental Petroleum Corporation.

For purposes of allocating production and expenditures related to the Target Assets (defined below), the effective date of the

Acquisition under the Share Purchase Agreement is April 1, 2021. Anadarko WCTP owns a participating interest in the West Cape Three

Points Block and Deepwater Tano Block offshore Ghana, which includes a 18.0% participating interest in the Jubilee Unit Area and a

11.1% participating interest in the TEN fields (collectively, the “Target Assets”). Following closing of the

Acquisition, Kosmos’ interest in the Jubilee Unit Area increased from 24.1% to 42.1%, and Kosmos’ interest in the TEN

fields increased from 17.0% to 28.1%, in each case subject to adjustment as described below. The Share Purchase Agreement contains

customary representations, warranties and covenants and also includes indemnification provisions under which the parties have agreed

to indemnify each other against certain liabilities.

Under the Deepwater Tano Block License Joint

Operating Agreement, certain joint venture partners have pre-emption rights (the “Pre-Emption Rights”) with respect to the

Target Assets that, if fully exercised, could reduce the Company’s ultimate interest in the Jubilee Unit Area by 3.8% to 38.3%,

and its ultimate interest in the TEN fields by 8.3% to 19.8%. This right is exercisable for a 30-day period beginning October 14, 2021.

If this right is exercised by a joint venture partner, such joint venture partner would compensate the Company for the interest it obtains.

The Company funded the Acquisition with: (i) the Notes (as described

above) and (ii) $75 million of borrowings under the Company’s commercial debt facility (the “Facility”).

The foregoing description of the Share Purchase

Agreement does not purport to be complete and is qualified in its entirety by the terms of the Share Purchase Agreement, a copy of which

is filed as Exhibit 2.1 hereto and incorporated herein by reference.

In connection with the Acquisition, the Company

is filing: the attached audited statements of revenues and direct operating expenses for the oil and gas assets of Anadarko WCTP Company

sold to KEGHL for the years ended December 31, 2020 and 2019; the attached unaudited statements of revenues and direct operating expenses

for the oil and gas assets of Anadarko WCTP Company sold to KEGHL for the six months ended June 30, 2021 and 2020; and the attached unaudited

pro forma condensed combined financial information of Kosmos Energy Ltd. and subsidiaries for the year ended December 31, 2020 and as

of and for the six months ended June 30, 2021.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under “Issuance of Bridge Notes”

in Item 1.01 of this Current Report on Form 8-K is incorporated by reference to this Item 2.03.

Item 7.01 Regulation FD Disclosure.

On October 13, 2021,

the Company issued a press release to announce the completion of the Acquisition, a copy of which is filed as Exhibit 99.4 hereto and

incorporated herein by reference.

Item 8.01 Other Events.

Hurricane Activity in the Gulf of Mexico

Following recent hurricane-related downtime in the U.S. Gulf of Mexico,

production has now returned to pre-hurricane levels for our assets located in the U.S. Gulf of Mexico. The Company expects the impact

of this unplanned downtime on production will be approximately 4,000 barrels of oil equivalent per day in the third quarter (1,000 barrels

of oil equivalent per day annual impact) compared to our previous production forecasts for 2021.

RBL Redetermination

During the September 2021 re-determination of

the Facility borrowing base, the Company’s lending syndicate approved a borrowing base capacity in excess of the facility size

of $1.25 billion. The available borrowing base is approximately $1.24 billion (capped by current facility commitments) with $1.0

billion drawn at the end of the second quarter. The Facility is secured against the Company’s production assets in Ghana and

Equatorial Guinea, and the first amortization payment under the Facility is scheduled for March 2024. Our gas assets in Mauritania

and Senegal remain unencumbered.

Equity Offering

In addition, on October

13, 2021, the Company issued a press release to announce the commencement of an underwritten public offering of 37.5 million shares of

common stock (the “Equity Offering”), a copy of which is filed as Exhibit 99.5 hereto and incorporated herein by reference.

As part of the Equity Offering, the Company intends to grant the underwriters a 30-day option to purchase up to an additional 5,625,000

shares of common stock at the public offering price less underwriting discounts. The Company intends to use the net proceeds from the

Equity Offering to repay outstanding borrowings under the Facility, including borrowings incurred to finance a portion of the Acquisition.

The Company intends to use the remaining net proceeds from the Equity Offering, if any, for general corporate purposes. In the event

Pre-Emption Rights are exercised with respect to the Target Assets, the Company intends to use the proceeds paid to us upon such exercise

to repay outstanding indebtedness. The press release for the Equity Offering is for informational purposes only and does not constitute

an offer to sell, or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such state or jurisdiction.

This Current Report on Form 8-K contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. All statements, other than statements

of historical facts, included in this Current Report on Form 8-K that address activities, events or developments that Kosmos expects,

believes or anticipates will or may occur in the future are forward-looking statements. Kosmos’ estimates and forward-looking statements

are mainly based on its current expectations and estimates of future events and trends, which affect or may affect its businesses and

operations. Although Kosmos believes that these estimates and forward-looking statements are based upon reasonable assumptions, they are

subject to several risks and uncertainties and are made in light of information currently available to Kosmos. When used in this Current

Report on Form 8-K, the words “anticipate,” “believe,” “intend,” “expect,” “plan,”

“will” or other similar words are intended to identify forward-looking statements. Such statements are subject to a number

of assumptions, risks and uncertainties, many of which are beyond the control of Kosmos, which may cause actual results to differ materially

from those implied or expressed by the forward-looking statements. Further information on such assumptions, risks and uncertainties is

available in Kosmos’ Securities and Exchange Commission filings. Kosmos undertakes no obligation and does not intend to update or

correct these forward-looking statements to reflect events or circumstances occurring after the date of this Current Report on Form 8-K,

except as required by applicable law. You are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date of this Current Report on Form 8-K. All forward-looking statements are qualified in their entirety by this cautionary statement.

Item 9.01 Financial Statements and Exhibits.

|

(a)

|

Financial Statements of Businesses Acquired

|

|

Attached as Exhibit 99.1 hereto are the audited statements of revenues and direct operating expenses for the oil and gas assets of Anadarko WCTP Company sold to Kosmos Energy Ghana Holdings Limited, a wholly-owned subsidiary of Kosmos Energy Ltd., for the years ended December 31, 2020 and 2019

|

|

Attached as Exhibit 99.2 hereto are the unaudited statements of revenues and direct operating expenses for the oil and gas assets of Anadarko WCTP Company sold to Kosmos Energy Ghana Holdings Limited, a wholly-owned subsidiary of Kosmos Energy Ltd., for the six months ended June 30, 2021 and 2020

|

|

(b)

|

Pro Forma Financial Information

|

|

Attached as Exhibit 99.3 hereto is the unaudited pro forma condensed combined financial information of Kosmos Energy Ltd. and subsidiaries for the year ended December 31, 2020 and as of and for the six months ended June 30, 2021

|

|

(d)

|

Exhibits.

|

|

|

|

|

Exhibit No.

|

Description

|

|

1.1

|

Indenture

dated October 13, 2021 among Kosmos Energy Ltd., the guarantors named therein and Wilmington Trust, National Association, as trustee,

paying agent, transfer agent and registrar.

|

|

2.1

|

Share

Purchase Agreement dated October 13, 2021 between Kosmos Energy Ghana Holdings Limited and Anadarko Offshore Holding Company, LLC

|

|

23.1

|

Consent of KPMG LLP

|

|

99.1

|

Audited statements of revenues and direct operating expenses for the oil and gas assets of Anadarko WCTP Company sold to Kosmos Energy Ghana Holdings Limited, a wholly-owned subsidiary of Kosmos Energy Ltd., for the years ended December 31, 2020 and 2019

|

|

99.2

|

Unaudited statements of revenues and direct operating expenses for the oil and gas assets of Anadarko WCTP Company sold to Kosmos Energy Ghana Holdings Limited, a wholly-owned subsidiary of Kosmos Energy Ltd., for the six months ended June 30, 2021 and 2020

|

|

99.3

|

Unaudited pro forma condensed combined financial information of Kosmos Energy Ltd. and subsidiaries for the year ended December 31, 2020 and as of and for the six months ended June 30, 2021

|

|

99.4

|

Press

release dated October 13, 2021

|

|

99.5

|

Press

release dated October 13, 2021

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 13, 2021

|

|

KOSMOS ENERGY LTD.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ NEAL D. SHAH

|

|

|

|

Neal D. Shah

|

|

|

|

Senior Vice President and Chief Financial Officer

|

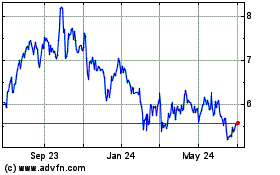

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

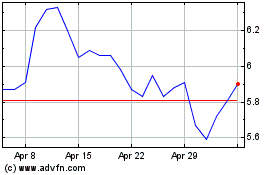

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Apr 2023 to Apr 2024