Current Report Filing (8-k)

May 14 2021 - 4:19PM

Edgar (US Regulatory)

0001506307false00015063072021-05-122021-05-120001506307kmi:ClassPMember2021-05-122021-05-120001506307kmi:KMI1.50SeniorNotesDue2022Member2021-05-122021-05-120001506307kmi:A2.25DueMarch2027NotesMember2021-05-122021-05-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 12, 2021

KINDER MORGAN, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-35081

|

80-0682103

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

1001 Louisiana Street, Suite 1000

Houston, Texas 77002

(Address of principal executive offices, including zip code)

713-369-9000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Class P Common Stock

|

KMI

|

NYSE

|

|

1.500% Senior Notes due 2022

|

KMI 22

|

NYSE

|

|

2.250% Senior Notes due 2027

|

KMI 27A

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As described in Item 5.07 below, Kinder Morgan, Inc. (“KMI”) held its 2021 Annual Meeting of Stockholders (the “Annual Meeting”) on May 12, 2021. At the Annual Meeting, KMI stockholders approved, among other items, the Kinder Morgan, Inc. 2021 Amended and Restated Stock Incentive Plan (the “2021 Stock Incentive Plan”).

2021 Stock Incentive Plan

KMI’s Board of Directors (the “Board”) adopted the 2021 Stock Incentive Plan on January 21, 2021 in order to amend and restate the Kinder Morgan, Inc. 2015 Amended and Restated Stock Incentive Plan (the “2015 Stock Incentive Plan”), which was originally adopted by the Board as the Kinder Morgan, Inc. 2011 Stock Incentive Plan, effective January 1, 2011, and amended and restated as of January 21, 2015. The 2021 Stock Incentive Plan amends and restates the 2015 Stock Incentive Plan to, among other things, increase the maximum number of shares available for grant under the 2021 Stock Incentive Plan, extend the term of the plan to May 12, 2031 (the plan was set to expire on May 7, 2025), increase the limits on the awards that can be granted to an individual during a five-year period, and, for awards granted after the 2021 Stock Incentive Plan became effective, to change the treatment of awards upon a change in control of KMI. The effective date of the 2021 Stock Incentive Plan is May 12, 2021.

The 2021 Stock Incentive Plan provides an additional 30,000,000 shares of common stock that may be issued as long-term incentive compensation to KMI’s employees and consultants. Equity-based awards to employees will now be made from the 2021 Stock Incentive Plan. Equity-based awards previously granted under the 2015 Stock Incentive Plan will remain outstanding, and the terms of the 2021 Stock Incentive Plan will apply to such awards, except with respect to the impact of a change in control, which will be governed by the terms of award agreements governing such awards.

A discussion of the 2021 Stock Incentive Plan is available under the heading “Item 2 - Approval of the 2021 Stock Incentive Plan” in KMI’s proxy statement filed with the Securities and Exchange Commission on April 1, 2021 (the “Proxy Statement”).

Item 5.07 Submission of Matters to a Vote of Security Holders.

At the Annual Meeting, a total of 1,911,246,636 shares of KMI’s common stock entitled to vote were present or represented by proxy, constituting a quorum for the transaction of business.

At the Annual Meeting, KMI stockholders voted on the following proposals: (1) election of fifteen nominated directors to the Board; (2) approval of the 2021 Stock Incentive Plan; (3) ratification of the selection of PricewaterhouseCoopers LLP as KMI’s independent registered public accounting firm for 2021; and (4) the approval, on an advisory basis, of the compensation of KMI’s named executive officers, as disclosed in the Proxy Statement.

Proposal One – Election of Directors

KMI stockholders elected fifteen directors, each to serve until KMI’s 2022 annual meeting or, if earlier, the election and qualification of his or her successor.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

Richard D. Kinder

|

|

1,514,154,479

|

|

|

89,481,593

|

|

|

2,536,338

|

|

305,074,225

|

|

|

Steven J. Kean

|

|

1,584,409,695

|

|

|

19,166,889

|

|

|

2,595,826

|

|

305,074,225

|

|

|

Kimberly A. Dang

|

|

1,571,480,515

|

|

|

32,128,697

|

|

|

2,563,197

|

|

305,074,225

|

|

|

Ted A. Gardner

|

|

1,364,089,947

|

|

|

239,301,285

|

|

|

2,781,177

|

|

305,074,225

|

|

|

Anthony W. Hall, Jr.

|

|

1,431,704,175

|

|

|

171,659,900

|

|

|

2,808,335

|

|

305,074,225

|

|

|

Gary L. Hultquist

|

|

1,575,071,764

|

|

|

28,323,086

|

|

|

2,777,560

|

|

305,074,225

|

|

|

Ronald L. Kuehn, Jr.

|

|

1,431,390,815

|

|

|

171,972,829

|

|

|

2,808,766

|

|

305,074,225

|

|

|

Deborah A. Macdonald

|

|

1,550,490,332

|

|

|

53,030,430

|

|

|

2,651,648

|

|

305,074,225

|

|

|

Michael C. Morgan

|

|

1,556,060,033

|

|

|

47,365,258

|

|

|

2,747,119

|

|

305,074,225

|

|

|

Arthur C. Reichstetter

|

|

1,577,245,583

|

|

|

26,099,933

|

|

|

2,826,894

|

|

305,074,225

|

|

|

C. Park Shaper

|

|

1,468,841,015

|

|

|

134,423,483

|

|

|

2,907,912

|

|

305,074,225

|

|

|

William A. Smith

|

|

1,572,626,699

|

|

|

30,725,109

|

|

|

2,820,602

|

|

305,074,225

|

|

|

Joel V. Staff

|

|

1,563,019,487

|

|

|

40,270,047

|

|

|

2,882,875

|

|

305,074,225

|

|

|

Robert F. Vagt

|

|

1,434,900,280

|

|

|

168,402,509

|

|

|

2,869,621

|

|

305,074,225

|

|

|

Perry M. Waughtal

|

|

1,576,764,951

|

|

|

26,557,866

|

|

|

2,849,593

|

|

305,074,225

|

|

Proposal Two – Approval of the 2021 Stock Incentive Plan

KMI stockholders approved the 2021 Stock Incentive Plan, as described above under Item 5.02.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

1,521,572,045

|

|

|

79,782,687

|

|

|

4,817,677

|

|

|

305,074,225

|

|

Proposal Three – Ratification of Selection of PricewaterhouseCoopers LLP

KMI stockholders ratified the selection of PricewaterhouseCoopers LLP as KMI’s independent registered public accounting firm for 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

1,847,416,116

|

|

|

60,424,278

|

|

|

3,406,241

|

|

|

—

|

|

Proposal Four – Advisory Vote on Executive Compensation

KMI stockholders approved, on an advisory basis, the compensation of KMI’s named executive officers, as disclosed in the Proxy Statement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

1,528,135,367

|

|

|

70,489,007

|

|

|

7,548,036

|

|

|

305,074,225

|

|

S I G N A T U R E

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: May 14, 2021

|

|

|

|

By:

|

|

/s/ David P. Michels

|

|

|

|

|

|

|

|

David P. Michels

Vice President and Chief Financial Officer

|

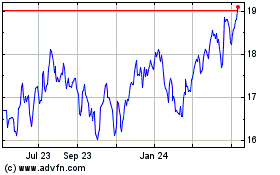

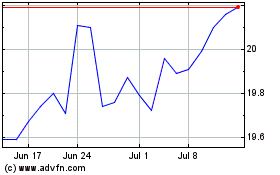

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024