Johnson & Johnson Stock Rises, Other Drug Shares Drop -- WSJ

August 28 2019 - 3:02AM

Dow Jones News

By Jared S. Hopkins

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 28, 2019).

Johnson & Johnson shares rallied Tuesday after a judge's

order that the company pay for Oklahoma's opioid crisis allayed

investors' worst fears.

While the $572 million ordered Monday by Oklahoma state court

judge Thad Balkman marked the first time a court held the drug

industry responsible for widespread opioid abuse, the amount is

limited to just one year. Judge Balkman wrote in his opinion that

the state didn't present "sufficient evidence" that justified

additional time and resources.

The amount, to pay for addiction-abatement programs, was below

expectations of more than $1 billion and significantly less than

what the state requested, analysts covering the company said in

interviews and written commentary. Several expect $572 million to

be reduced after the company appeals the decision. The analysts

said J&J's overall outlook remains promising, even with other

opioid lawsuits unresolved.

Shares of J&J closed up 1.4% at $129.64 on Tuesday.

Larry Biegelsen, an analyst at Wells Fargo & Co., wrote in a

note to clients after speaking with Johnson & Johnson

management that the verdict is a "net positive" for the New

Brunswick, N.J., company, because of how much less it was when

compared with the $17.5 billion requested by the Oklahoma attorney

general. Analysts at Raymond James Equity Research said they were

disappointed with Judge Balkman's decision, adding that if J&J

were skilled at convincing physicians to prescribe their drug, then

its market share would be higher than 1%. Both analysts rate the

company "outperform."

The amount represents a sliver of business for J&J, the

world's largest health-care company, known for households goods

like baby powder and Band-Aids. Last year's company revenue totaled

$81.6 billion.

J&J said in a statement that it disagreed with the decision

and promised an appeal, a process that could last years.

Analysts also cautioned against reading too much into how the

decision might impact the more than 2,000 lawsuits that have been

consolidated in federal court in Ohio and constitute the bulk of

legal pressure against the industry. Analysts at Morgan Stanley

said the verdict is "not definitively precedent-setting" and can't

be used to imply the outcomes of lawsuits brought by other states

or cities.

Other companies facing lawsuits nevertheless received a cold

reaction Tuesday from investors. Teva Pharmaceutical Industries

Ltd. closed down 9.6%, Endo International PLC fell about 13% and

Mallinckrodt PLC shares fell about 16%.

Teva previously agreed to an $85 million settlement with

Oklahoma. OxyContin-maker Purdue Pharma LP and its owners, the

Sackler family, agreed to pay $270 million.

Some companies that are highly leveraged will be challenged to

resolve litigation of this scale while retaining an ability to

clean up their balance sheets, said David Amsellem, an analyst at

Piper Jaffray & Co. Teva, Endo and Mallinckrodt all have large

amounts of debt to pay down.

"The stocks are reacting to that," he said in an interview. "The

challenge for these midsize companies, is how do you get any level

of confidence that they can start to chip away at their debt levels

for the foreseeable future?"

A Mallinckrodt spokesman declined to comment. Representatives

for Endo and Teva didn't respond to requests for comment.

Endo recently said it agreed to pay $10 million to avoid an

upcoming October trial in Ohio against two counties that is serving

as a bellwether for the hundreds of others brought by cities and

counties that have been consolidated in federal court. Allergan PLC

is also in negotiations for a potential $5 million deal that would

settle claims over its branded drugs but might not completely

eliminate it from the trial, The Wall Street Journal has reported.

Other companies are still slated to go to trial.

An Allergan spokeswoman said the company "hasn't yet reached a

settlement."

Mallinckrodt is one of the country's largest makers of generic

prescription opioids but it also makes raw materials for products

that it sells to other companies, a type of business that J&J

was found liable for in the Oklahoma case. Johnson & Johnson

exited the opioid-ingredients business in 2016.

Mallinckrodt, which is domiciled in Ireland but operates in the

U.S. from St. Louis, also lost a patent dispute Tuesday related to

INOmax, its nitric oxide gas product.

(END) Dow Jones Newswires

August 28, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

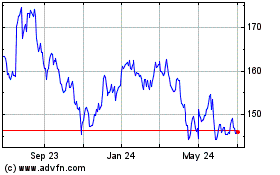

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

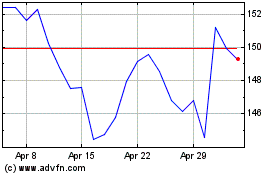

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024