ITT Corp.'s Q2 Profit Falls 26% On Company Breakup Costs

July 29 2011 - 7:29AM

Dow Jones News

ITT Corp. (ITT) second-quarter profit dropped 26% from a year

earlier, as expenses related to the breakup of the defense and

industrial conglomerate weighed on results.

The company, which raised its 2011 revenue outlook, but left its

income guidance unchanged, plans to separate into three public

companies that will spin off to ITT shareholders by the end of the

year.

In its current configuration, the White Plains, N.Y., company

reported second-quarter profit of $168 million, or 90 cents per

share, down from $226 million, or $1.22 per share a year earlier.

Excluding breakup costs, ITT's income from ongoing operations was

$220 million, or $1.18 per share, as higher income from the

company's fluid technology unit and motion and flow control unit

offset lower profit from the defense business. Revenue from the

quarter rose 10.4% from a year earlier to $3.02 billion.

Analysts expected the company to earn $1.16 a share before

special expenses on $2.84 billion of revenue.

The company said it accumulated $46 million in second-quarter

expenses related to the breakup, up from $30 million spent in the

first quarter. The company reiterated its April forecast that

one-time cash charges for the breakup will reach about $500 million

by the time the spinoff is completed.

ITT announced early this year that it would split the company to

separate ITT's defense unit from its water and industrial

businesses. Defense had been the company's best-performing business

during the economic recession, but U.S. military spending is being

significantly curtailed to help reduce U.S. budget deficits.

ITT intends to call the new defense company ITT Exelis. During

the second-quarter, operating income from the defense business

dropped 27% from a year earlier to $142 million, mostly because of

increased sales of lower margin products and services. Defense's

operating margin slipped to 9.4% from 12.95%. Revenue from the unit

was flat at $1.50 billion.

In the fluid technology unit, which largely will become a water

treatment equipment and services company called Xylem,

second-quarter operating income swelled by 24% to $161 million.

Revenue increased 26% to $1.1 billion.

ITT's motion and flow control unit, which includes most of the

company's industrial components and equipment businesses, reported

a 36% increase in operating income to $57 million. Revenue climbed

14% to $414 million. The unit's operating margin expanded to 13.8%

from 11.6%.

ITT raised its revenue outlook for the year to $11.5 billion

from $11.3 billion forecast in April. The increase was attributed

to recent defense contracts and higher revenue from fluid

technology. But the company maintained its spring earnings guidance

for 2011 at $4.70 to $4.82 per share, suggesting that ITT expects

to have difficulty expanding income even with higher sales.

Analysts polled by Thomson Reuters expect the company to earn

$4.79 per share in 2011 on revenue of $11.38 billion.

ITT's stock ended Thursday's U.S. trading session down 0.80%, or

44 cents, at $54.50 a share.

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

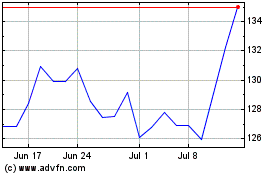

ITT (NYSE:ITT)

Historical Stock Chart

From Aug 2024 to Sep 2024

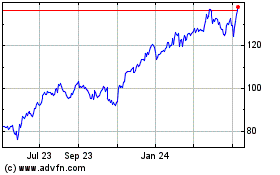

ITT (NYSE:ITT)

Historical Stock Chart

From Sep 2023 to Sep 2024