Invesco Ltd. Announces December 31, 2020 Assets Under Management

January 12 2021 - 4:20PM

PR Newswire (US)

ATLANTA, Jan. 12, 2021 /PRNewswire/ -- Invesco Ltd.

(NYSE: IVZ) today reported preliminary month-end assets under

management (AUM) of $1,349.9 billion,

an increase of 4.3% versus previous month-end. Total net inflows

were $11.9 billion. The firm achieved

net long-term inflows of $5.9 billion

this month. Non-management fee earning net inflows were

$2.1 billion and money market net

inflows were $3.9 billion. AUM was

positively impacted by favorable market returns, which increased

AUM by $27 billion. Reinvested

distributions increased AUM by $12.9

billion and FX increased AUM by $4.0

billion. Preliminary average total AUM for the quarter

through December 31 were $1,278.2 billion, and preliminary average active

AUM for the quarter through December

31 were $935.1 billion.

|

Total Assets Under

Management

|

|

(in

billions)

|

Total

|

Equity

|

Fixed

Income

|

Balanced

|

Money

Market

|

Alternatives

|

|

December 31,

2020 (a)

|

$1,349.9

|

$689.6

|

$296.4

|

$78.9

|

$108.5

|

$176.5

|

|

November 30,

2020

|

$1,294.0

|

$651.6

|

$291.2

|

$73.9

|

$104.4

|

$172.9

|

|

October 31,

2020

|

$1,206.5

|

$582.0

|

$282.9

|

$68.2

|

$102.5

|

$170.9

|

|

September 30,

2020

|

$1,218.2

|

$592.4

|

$276.4

|

$68.1

|

$109.3

|

$172.0

|

|

Active

(b)

|

|

(in

billions)

|

Total

|

Equity

|

Fixed

Income

|

Balanced

|

Money

Market

|

Alternatives

|

|

December 31,

2020 (a)

|

$979.3

|

$383.2

|

$259.4

|

$77.9

|

$108.5

|

$150.3

|

|

November 30,

2020

|

$946.7

|

$366.2

|

$254.3

|

$73.1

|

$104.4

|

$148.7

|

|

October 31,

2020

|

$891.1

|

$327.6

|

$247.5

|

$67.4

|

$102.5

|

$146.1

|

|

September 30,

2020

|

$900.2

|

$334.0

|

$242.8

|

$67.3

|

$109.3

|

$146.8

|

|

Passive

(b)

|

|

(in

billions)

|

Total

|

Equity

|

Fixed

Income

|

Balanced

|

Money

Market

|

Alternatives

|

|

December 31, 2020

(a)

|

$370.6

|

$306.4

|

$37.0

|

$1.0

|

$0.0

|

$26.2

|

|

November 30,

2020

|

$347.3

|

$285.4

|

$36.9

|

$0.8

|

$0.0

|

$24.2

|

|

October 31,

2020

|

$315.4

|

$254.4

|

$35.4

|

$0.8

|

$0.0

|

$24.8

|

|

September 30,

2020

|

$318.0

|

$258.4

|

$33.6

|

$0.8

|

$0.0

|

$25.2

|

|

a)

|

Preliminary –

subject to

adjustment.

|

|

b)

|

Passive AUM

includes index-based ETF's, UIT's, non-fee earning leverage,

foreign exchange overlays and other passive mandates. Active

AUM are total AUM less passive AUM.

|

About Invesco Ltd.

Invesco is a global independent

investment management firm dedicated to delivering an investment

experience that helps people get more out of life. With

offices in 25 countries, our distinctive investment teams

deliver a comprehensive range of active, passive and alternative

investment capabilities. For more information,

visit www.invesco.com/corporate.

Investor Relations Contact: Aimee

Partin 404-724-4248

Media Relations Contact: Graham Galt

404-439-3070

View original content to download

multimedia:http://www.prnewswire.com/news-releases/invesco-ltd-announces-december-31-2020-assets-under-management-301206863.html

View original content to download

multimedia:http://www.prnewswire.com/news-releases/invesco-ltd-announces-december-31-2020-assets-under-management-301206863.html

SOURCE Invesco Ltd.

Copyright 2021 PR Newswire

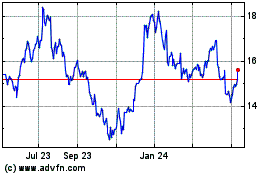

Invesco (NYSE:IVZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

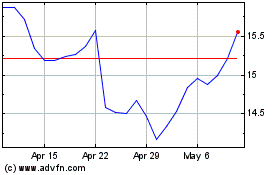

Invesco (NYSE:IVZ)

Historical Stock Chart

From Apr 2023 to Apr 2024