ICE to Launch LNG Freight Contracts as Gas Market Comes of Age

February 10 2021 - 5:29AM

Dow Jones News

By David Hodari

Intercontinental Exchange Inc., known as ICE, said Wednesday

that it will launch futures for the freight of liquefied natural

gas, in another signal that the gas market is becoming increasingly

mature.

The exchange said it will launch two U.S. dollar-settled futures

contracts on March 22 that will use price assessments from

price-assessment company Spark Commodities to reflect the shipping

of LNG.

The Spark30S Atlantic contract will cover voyages in the

Atlantic Ocean between the U.S. and Northwest Europe while the

Spark25S Pacific contract will reflect journeys in the Pacific

Ocean between Australia and East Asia. The numbers in each name

indicate the number of days it takes LNG vessels to complete return

journeys on those routes.

"LNG freight markets have become increasingly volatile,

significantly increasing demand for suitable LNG freight

risk-management tools," said Gordon Bennett, managing director of

utility markets at ICE. He added that freight futures contracts

will provide the hedging tools the market has been awaiting and

that "this is a milestone moment in the evolution and maturity of

the LNG market."

The freight price of LNG has been highly volatile in recent

years. In June last year, freight rates hit record lows of $17,750

a day--as the twin forces of warm summer weather and the heavy

economic impact of the coronavirus pandemic slammed demand. Then

they soared to record highs of $322,500 a day on Jan. 8 this year

amid a shortage of gas ships and an icy winter.

The freight futures contracts ICE is launching are aimed at

managing that risk of volatile pricing.

The popularity of trading the LNG market has also sharply

increased. As technology for shipping LNG has improved and trade of

the commodity has become increasingly common, decadeslong contracts

have become increasingly unattractive. Demand has increased for

more flexible contracts based on hedging and short-term demand.

As a result of increasingly global and flexible trading, LNG

trading volumes have shot up, ICE says. The exchange says that

natural-gas derivatives based in the Netherlands and between Japan

and South Korea had their busiest January on record in terms of

open interest and trading volumes. The open interest for both

benchmarks is up at least a third from a year ago.

Write to David Hodari at david.hodari@wsj.com

(END) Dow Jones Newswires

February 10, 2021 05:14 ET (10:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

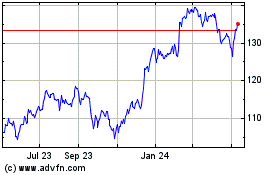

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024