By Paul Vigna and Anna Hirtenstein

Bitcoin climbed back above $18,000 last week to flirt with

record levels, a spectacular rally driven by a new group of buyers

seeking the opportunity for big profits.

The digital currency traded as high as $18,965 on Friday,

according to CoinDesk, about 4% below its all-time high of $19,783

set in December 2017. It has surged more than 50% in the past month

alone.

The rally has attracted a wide cast of characters, from the Wall

Street billionaires Paul Tudor Jones and Stanley Druckenmiller to

momentum investors who aim to ride winning assets higher and losing

markets lower.

Their participation, in turn, has fueled more buying, which

mirrors a similar dynamic playing out in stocks such as Tesla Inc.,

which investors keep pushing higher with little regard for

fundamentals. As in 2017, when bitcoin became a cultural

phenomenon, much of the hype has traveled by word-of-mouth.

Lately, bitcoin has even been a winning topic on sports radio.

Gregg Giannotti, co-host of the "Boomer & Gio" morning

sports-talk radio show on WFAN in New York, has been talking up the

cryptocurrency on the air after investing $10,000 earlier this

month.

There was a strong response to the bitcoin segments, Mr.

Giannotti said. "As soon as I brought it up on the air, it

started," he said, adding that old friends wrote to him, sales

people wanted to talk about bitcoin and listeners jammed his

Twitter feed. "It struck a nerve," he said.

Bitcoin, a form of money that exists only digitally, started in

January 2009 during the depths of the financial crisis and was

positioned as an alternative to government-backed money. It

operates across a network of linked but independent computers that

can't be controlled by any one party, such as a central bank.

It was designed to have a fixed supply that would make it

resistant to inflation. With central banks pledging this year to

push up inflation, more investors have been willing to test bitcoin

as a hedge. Its potential, however, has been difficult to gauge

because inflation hasn't reached the Federal Reserve's target of 2%

in years.

Aiding this interest has been the increasing number of

mainstream platforms that facilitate bitcoin trading. The

combination of accessible platforms and bitcoin's potential as an

inflation hedge is what is primarily driving the cryptocurrency

this year, said Dan Morehead, chief executive of Pantera Capital, a

venture fund that has been investing in the sector since 2013.

"Paper money is being debased, and bitcoin is not," he said.

The last time bitcoin attracted such attention -- in the fourth

quarter of 2017, when it nearly quadrupled to approach $20,000 --

the industry wasn't prepared. There were few outlets for trading

beyond startup exchanges, and bitcoin had little practical value.

The momentum washed out, new investors disappeared, venture capital

dried up and the industry went through a wave of retrenchment and

layoffs.

Much of that has changed, bulls argue. For one thing, the

regulatory landscape is much clearer than it was in 2017. State and

federal agencies, including the Internal Revenue Service and the

Securities and Exchange Commission, have laid out rules for the

treatment of cryptocurrencies. That has led companies such as CME

Group Inc., Intercontinental Exchange Inc. and Fidelity Investments

Inc. to offer services for buying and selling crypto assets.

There are also retail-oriented platforms catering to interest in

crypto trading. Volume has surged at Square Inc.'s Cash App, which

has allowed customers to buy and sell bitcoin since 2018. In the

third quarter, customers bought $1.6 billion of bitcoin, up from

$555 million the year before.

In October, PayPal Holdings Inc. unveiled a service that allows

its users to buy and sell bitcoin directly in their accounts. It

became available to all U.S. users on Nov. 12 and will expand to

Venmo and some international markets next year.

Grayscale Investments, a private fund manager that sells 10

over-the-counter trust funds focused on bitcoin and other

cryptocurrencies, has benefited from the new interest. The firm

reported Tuesdaythat its assets under management had risen to more

than $10 billion from $5.9 billion at the end of September.

Despite the recent growth, the bitcoin market is still tiny

compared with other assets, which contributes to its volatility.

Pantera estimated that trading volumes on PayPal and on Square's

Cash App alone would exceed the amount of new bitcoin being created

daily.

With hedge funds and other professionals also buying, supply

will become even more constrained, according to Pantera Capital's

Mr. Morehead. "The only way supply and demand equilibrates is at a

higher price," he said.

That dynamic is part of what attracted Mr. Druckenmiller. He

sees bitcoin as similar to gold, he told CNBC in an interview

earlier this month, but because of bitcoin's smaller size and

volatility, he believes it could outperform the precious metal. Mr.

Jones told the network in May that he put about 1% to 2% of his

assets in bitcoin, calling it a "great speculation" that he

believes will emerge as a new asset class.

Neither Mr. Druckenmiller nor Mr. Jones responded to requests

for comment.

Still, bitcoin's history shows exactly how volatile and risky it

can be for investors. Its price fell as low as $3,867 on March 13,

when global markets cratered, a drop of more than 60% from the

beginning of the year. Bitcoin lost about 50% of its value in

January 2018 after the spectacular 2017 run, eventually sinking to

as low as $3,122 by December 2018.

Those risks haven't deterred investors such as Wayne Sharp, a

retired investment adviser in Columbus, Ohio, who bought her first

bitcoin in September, investing $10,000. She said she was swayed by

arguments about bitcoin's value as an inflation hedge, as well as

the respectability conferred by investors including Mr. Jones.

She acknowledged the purchase was speculative but said she is

tired of watching safer, "value" investments fall behind momentum

trades. She put a small amount of her wealth into the

cryptocurrency and said she might buy more down the road.

"I figure what the heck, just go for it," she said.

Write to Paul Vigna at paul.vigna@wsj.com and Anna Hirtenstein

at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

November 23, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

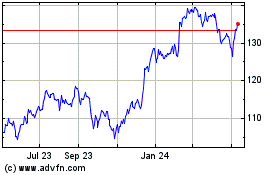

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024