Intercontinental Exchange Reports October Statistics

November 04 2020 - 8:30AM

Business Wire

Energy Open Interest +9% y/y

Intercontinental Exchange, Inc. (NYSE: ICE), a leading operator

of global exchanges and clearing houses and provider of mortgage

technology, data and listings services, today reported October 2020

trading volume and related revenue statistics, which can be viewed

on the company’s investor relations website at

https://ir.theice.com/ir-resources/supplemental-information in the

Monthly Statistics Tracking spreadsheet.

October Highlights include:

- Energy open interest (OI) up 9% y/y in October

- Gasoil OI up 3% y/y

- Other Oil OI up 2% y/y; October ADV up 42% y/y

- Heating oil OI up 24% y/y; ADV up 75% y/y

- RBOB gasoline OI up 23% y/y; ADV up 172% y/y

- Asia Refined products OI up 14%; ADV up 17% y/y

- North American natural gas OI up 17% y/y

- European natural gas OI up 25% y/y; ADV up 34% y/y

- TTF OI up 35% y/y; ADV up 47% y/y

- Other Natural Gas OI up 43% y/y; ADV up 43% y/y

- Japan-Korea Marker OI up 34%; October ADV up 30% y/y

- Emissions / Environmentals OI up 4% y/y; ADV up 22% y/y

- Sugar OI up 3% y/y; ADV up 22% y/y

- NYSE cash equities ADV up 20% y/y

- NYSE equity options ADV up 66% y/y

About Intercontinental Exchange

Intercontinental Exchange (NYSE: ICE) is a Fortune 500

company and provider of marketplace infrastructure, data services

and technology solutions to a broad range of customers including

financial institutions, corporations and government entities. We

operate regulated marketplaces, including the New York Stock

Exchange, for the listing, trading and clearing of a broad array of

derivatives contracts and financial securities across major asset

classes. Our comprehensive data services offering supports the

trading, investment, risk management and connectivity needs of

customers around the world and across asset classes. As a leading

technology provider for the U.S. residential mortgage industry,

ICE Mortgage Technology provides the technology and

infrastructure to transform and digitize U.S. residential

mortgages, from application and loan origination through to final

settlement.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located at

http://www.intercontinentalexchange.com/terms-of-use. Key

Information Documents for certain products covered by the EU

Packaged Retail and Insurance-based Investment Products Regulation

can be accessed on the relevant exchange website under the heading

“Key information Documents (KIDS)”.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2019, as

filed with the SEC on February 6, 2020.

SOURCE: Intercontinental Exchange

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201104005087/en/

ICE Investor Relations Contact: Warren Gardiner +1 770

835 0114 warren.gardiner@theice.com investors@theice.com

ICE Media Contact: Josh King +1 212 656 2490

josh.king@theice.com media@theice.com

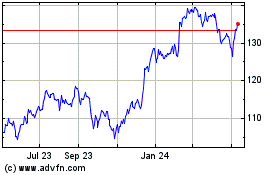

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024