NYSE Owner Abandons Potential eBay Deal -- 2nd Update

February 06 2020 - 7:11PM

Dow Jones News

By Alexander Osipovich

The parent company of the New York Stock Exchange abandoned its

pursuit of eBay Inc. in a dramatic reversal just days after its

interest in a deal became public, triggering a backlash from

investors.

Intercontinental Exchange Inc., or ICE as it is also known, said

in a statement released after markets closed Thursday that it was

giving up on its consideration of "strategic opportunities" with

eBay based on conversations with investors after its morning

earnings call.

The move followed a sharp decline in ICE shares after The Wall

Street Journal reported Tuesday that the company had made an

overture to eBay that could result in a takeover worth more than

$30 billion. ICE shares dropped 7.5% that day and almost another 3%

Thursday as investors voted against the idea by selling their

shares. The drop in the exchange operator's stock has wiped out

more than $5 billion in market value.

The shares rallied roughly 3% in Thursday's after-hours trading

following the company's statement.

The reversal is an embarrassing setback for ICE Chief Executive

Jeffrey Sprecher, who built a global exchange empire by making

audacious acquisitions such as the $8.2 billion takeover of the

NYSE's parent company in 2013. Though not a household name,

Atlanta-based ICE is a key player in the global financial markets,

running platforms that process trillions of dollars worth of

securities and derivatives trades each year.

Its shareholders have been rewarded handsomely over the years as

Mr. Sprecher built the company. ICE stock has appreciated 1,048%

since it went public in 2005, after accounting for stock splits,

and its market value is currently about $50 billion.

But news of its interest in eBay -- an e-commerce platform on

which vendors hawk everything from lawn mowers to Baby Yoda dolls

-- took ICE investors by surprise and proved to be a bridge too far

for them. ICE didn't anticipate how strongly some analysts and

shareholders had felt about eBay.

Acquiring eBay would have put ICE far outside its traditional

comfort zone of running markets for stocks, futures and other

derivatives and selling financial data to Wall Street. Analysts

questioned the strategic rationale as well as the hefty price

tag.

EBay's shares gained 2.4% Thursday on Mr. Sprecher's remarks on

the earnings call. Since Monday's close, eBay's stock was up more

than 10% on the possibility of a takeover, its market value topping

$30 billion. The shares shed some 6% after hours following ICE's

statement.

ICE has approached eBay more than once about a deal, including

most recently within the past couple of months, according to people

familiar with the matter. It indicated to the e-commerce company

that it would have financial partners for a deal, the people said.

ICE was mainly interested in eBay's core marketplace business and

not its classified-advertising unit, which has been a candidate for

possible divestiture.

Its interest became public just two days before ICE was to

report its fourth-quarter results. On Thursday morning, ICE

reported net revenue of $1.3 billion and earnings of 95 cents a

share, in line with analysts' expectations.

Speaking to analysts on a call scheduled to discuss the results,

Mr. Sprecher said no deal was imminent and that eBay had rebuffed

ICE's overtures, reiterating a statement ICE released earlier in

the week.

But departing from executives' typical aversion to talking about

private deal deliberations in public, he discussed at length why

ICE was interested in San Jose, Calif.-based eBay, outlining what

could be seen as a rationale for a transaction.

"We both match buyers and sellers," Mr. Sprecher said on the

call. "We both collect and organize data. We both work with third

parties to provide physical distribution. We both provide useful

analytics to enhance the transaction experience."

He tried to impress upon analysts that ICE's approach to eBay

was thoughtful and made strategic sense. "We didn't lose our minds

over the weekend," he said.

He reminded analysts that many investors had been dubious when

ICE agreed to buy the NYSE's parent company.

At the time, the Big Board's share of U.S. stock trading had

collapsed after regulators opened it to greater competition. Many

observers saw it as an institution in decline. But ICE rejuvenated

the 200-year-old exchange, slashing jobs, eliminating

underperforming businesses and revamping outdated technology.

ICE had considered eBay a fixer-upper not unlike the NYSE. In

the 1990s, eBay was among the pioneers of online commerce, but in

recent years has fallen behind such rivals as Amazon.com Inc.

Before news of a potential tie-up, shares of eBay had fallen 22%

from their peak in 2018. Under pressure from activist investors,

the company announced a strategic review and moved to sell assets

including its ticketing business, StubHub.

Some see eBay as a company caught in a vise, pressured on one

side by Amazon and its colossal scale and on the other by niche

e-commerce startups with devoted followings such as the

used-luxury-goods marketplace TheRealReal Inc. and the sneaker

exchange StockX.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

February 06, 2020 18:56 ET (23:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

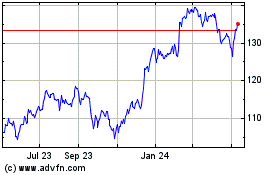

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024