UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2019

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule

101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely

to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule

101(b)(7) only permits the submission in paper of a Form 6-K if submitted to

furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the

registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the

registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already

been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes [ ]

No [ x ]

If "Yes" is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- ________

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: December 23, 2019 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Vice President, Legal and Corporate Secretary |

IAMGOLD AGREES TO SELL ITS INTEREST IN THE SADIOLA GOLD MINE

(All figures in US dollars unless otherwise indicated.)

Toronto, Ontario, December 23, 2019 - IAMGOLD Corporation ("IAMGOLD" or the "Company") announced that the Company, together with our joint venture partner, AngloGold Ashanti Limited ("AGA"), has entered into an agreement (the "Agreement") to sell our collective interests in Société d'Exploitation des Mines d'Or de Sadiola S.A. ("SEMOS") to Allied Gold Corp ("Allied Gold"). AGA and IAMGOLD each hold a 41% interest in SEMOS with the remaining 18% interest held by the Government of Mali.

Under the terms of the Agreement, IAMGOLD and AGA will sell their collective interests in SEMOS to Allied Gold (the "Transaction") for a cash consideration of US$105 million, payable as follows:

- $50 million ($25 million each to IAMGOLD and AGA) upon the fulfilment or waiver of all conditions precedent and closing of the Transaction ("Closing");

- Up to a further $5 million ($2.5 million each to IAMGOLD and AGA), payable 8 days after Closing, to the extent that the cash balance of SEMOS at Closing is greater than an agreed amount;

- $25 million ($12.5 million each to IAMGOLD and AGA) upon the production of the first 250,000 ounces from the Sadiola Sulphides Project ("SSP"); and

- $25 million ($12.5 million each to IAMGOLD and AGA) upon the production of a further 250,000 ounces from the SSP.

Gord Stothart, President and COO of IAMGOLD, commented, "This transaction reflects our continuing efforts toward self-funding and focussed capital allocation. The Sadiola mine was the founding asset of IAMGOLD, and we are pleased to have reached this agreement with Allied Gold to secure its long-term future."

The Transaction is subject to the fulfilment, or waiver, of a number of conditions precedent, including the receipt of certain approvals and releases from the Government of Mali, as well as, in the case of AGA, the approval of the South African Reserve Bank. It is anticipated that all conditions precedent will be fulfilled or waived by the end of April 2020.

In addition, upon the fulfilment or waiver of all conditions precedent to the Transaction but immediately prior to Closing, SEMOS will pay a dividend of $15 million pro rata to its shareholders. IMG and AGA will each receive a cash dividend of $6.15 million and the Government of Mali will receive a cash dividend of $2.7 million.

Financial Advisors

TD Securities acted as exclusive financial advisor to IAMGOLD in connection with the Transaction.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "prospective", "significant", "significant potential", "substantial", transformative", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, failure to meet expected, estimated or planned gold production, unexpected increases in all-in sustaining costs or other costs, unexpected increases in capital expenditures and exploration expenditures, variation in the mineral content within the material identified as Mineral Resources and Mineral Reserves from that predicted, changes in development or mining plans due to changes in logistical, technical or other factors, the possibility that future exploration results will not be consistent with the Company's expectations, changes in world gold markets and other risks disclosed in IAMGOLD's most recent Form 40-F/Annual Information Form on file with the United States Securities and Exchange Commission and Canadian securities regulatory authorities. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

About IAMGOLD

IAMGOLD (www.iamgold.com) is a mid-tier mining company with four operating gold mines on three continents. A solid base of strategic assets in North and South America and West Africa is complemented by development and exploration projects and continued assessment of accretive acquisition opportunities. IAMGOLD is in a strong financial position with extensive management and operational expertise.

For further information please contact:

Indi Gopinathan, Investor Relations Lead, IAMGOLD Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Martin Dumont, Senior Analyst, Investor Relations, IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com

Please note:

This entire news release may be accessed via fax, e-mail, IAMGOLD's website at www.iamgold.com and through Newsfile's website at www.newsfilecorp.com. All material information on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué de presse, veuillez consulter le http://www.iamgold.com/French/accueil/default.aspx.

This regulatory filing also includes additional resources:

exhibit99-1.pdf

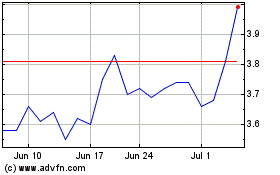

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024