Current Report Filing (8-k)

September 21 2021 - 4:13PM

Edgar (US Regulatory)

Hyatt Hotels Corp false 0001468174 0001468174 2021-09-21 2021-09-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 21, 2021

HYATT HOTELS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34521

|

|

20-1480589

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

150 North Riverside Plaza

Chicago, IL

|

|

60606

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (312) 750-1234

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Class A common stock, $0.01 par value

|

|

H

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On September 21, 2021, Hyatt Hotels Corporation (the “Company”) distributed certain information to potential investors, which is attached as Exhibit 99.1 to this Form 8-K. The information included in Exhibit 99.1 regarding the Company’s preliminary estimates of revenue, system-wide RevPAR and net rooms growth is incorporated by reference herein.

The information furnished under Item 2.02 in this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

Recent Developments

On September 21, 2021, the Company distributed certain information to potential investors, which is attached as Exhibit 99.1 to this Form 8-K and incorporated by reference herein.

The information furnished under Item 7.01 in this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act, except as set forth by specific reference in such filing.

Item 8.01. Other Events.

Information Related to the Apple Leisure Group Transaction

Supplementary Risk Factors

The Company is supplementing the risk factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, under the section titled “Risk Factors” in Part I, Item 1A, in connection with the previously announced transaction by which the Company, acting through an affiliate, agreed to acquire Casablanca Global Intermediate Holdings L.P. (doing business as Apple Leisure Group) (“ALG”) and Casablanca Global GP Limited, ALG’s general partner (together, “Apple Leisure Group”), pursuant to a definitive Securities Purchase Agreement (the “Transaction”).

Information with respect to certain material risks related to the Transaction is attached as Exhibit 99.2 hereto and incorporated by reference herein.

Financial Statements

Also included in this Current Report on Form 8-K are certain (i) audited consolidated financial statements of ALG and its subsidiaries, (ii) unaudited consolidated financial statements of ALG and its subsidiaries and (iii) unaudited pro forma condensed combined financial statements of the Company giving effect to the Transaction, each as described in Item 9.01 of this Current Report on Form 8-K.

The consent of Ernst & Young LLP, consenting to the incorporation by reference in certain of the Company’s registration statements of its report forming part of Exhibit 99.3 hereto, is attached as Exhibit 23.1 hereto and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

The consolidated financial statements of ALG and its subsidiaries as of and for the years ended December 31, 2020 and 2019, attached as Exhibit 99.3 hereto and incorporated by reference herein, have been audited by Ernst & Young LLP, independent auditors, as set forth in their report thereon, which is incorporated by reference herein (which report expresses an unqualified opinion on the financial statements).

The unaudited consolidated financial statements of ALG and its subsidiaries as of June 30, 2021 and December 31, 2020 and for the six-month periods ended June 30, 2021 and 2020 are attached as Exhibit 99.4 hereto and incorporated by reference herein.

(b) Pro forma financial information.

The Company’s unaudited pro forma condensed combined statements of income (loss) for the six months ended June 30, 2021 and the year ended December 31, 2020 and the unaudited pro forma condensed combined balance sheet as of June 30, 2021, each with related notes thereto, are attached as Exhibit 99.5 hereto and incorporated by reference herein.

(d) Exhibits.

Forward-Looking Statements

Forward-Looking Statements in this Current Report on Form 8-K, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements related to the Company’s plans, objectives, goals, expectations, beliefs, business strategies, future events and business conditions, expectations with respect to the time schedule to complete the Transaction, and involve known and unknown risks that are difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, the risks discussed in the Company’s filings with the SEC, including our annual report on Form 10-K and subsequent reports, which filings are available from the SEC. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this Current Report on Form 8-K. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Hyatt Hotels Corporation

|

|

|

|

|

|

Date: September 21, 2021

|

|

By:

|

|

/s/ Joan Bottarini

|

|

|

|

|

|

Name:

|

|

Joan Bottarini

|

|

|

|

|

|

Title:

|

|

Executive Vice President, Chief Financial Officer

|

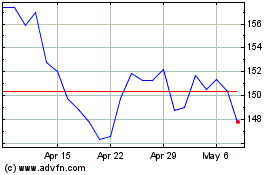

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Mar 2024 to Apr 2024

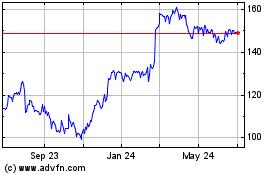

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Apr 2023 to Apr 2024