Current Report Filing (8-k)

June 01 2022 - 7:17AM

Edgar (US Regulatory)

0000049071false00000490712021-12-012021-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 1, 2022 (June 1, 2022)

Humana Inc.

| | |

| (Exact name of registrant as specified in its charter) |

|

| | | | | | | | |

| Delaware | 001-5975 | 61-0647538 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

500 West Main Street, Louisville, Kentucky 40202

(Address of principal executive offices, including zip code)

(502) 580-1000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | HUM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Members of Humana Inc.’s (the “Company”) senior management team are scheduled to meet with investors and analysts at industry conferences and various other meetings between June 1, 2022 and June 30, 2022. During these conferences and meetings, the Company intends to reaffirm its guidance of approximately $22.98 in diluted earnings per common share (“EPS”) or approximately $24.50 in adjusted earnings per common share (“Adjusted EPS”), in each case for the year ending December 31, 2022 (“FY 2022”). Humana's GAAP and Adjusted EPS guidance contemplates an explicit COVID-19 related headwind of $1.00 per diluted common share as well as the estimated dilutive impact related to the pending divestiture of the company’s 60 percent ownership of Kindred at Home’s Hospice and Personal Care divisions. This guidance is consistent with the guidance issued in Humana’s press release dated April 27, 2022. The date and time of presentations to investors are available via the Investor Relations calendar of events on the Company’s website at www.humana.com.

The Company has included Adjusted EPS in this current report, a financial measure that is not in accordance with Generally Accepted Accounting Principles (“GAAP”). Management believes that this measure, when presented in conjunction with the comparable measure of GAAP EPS, is useful to both management and its investors in analyzing the Company’s ongoing business and operating performance. Consequently, management uses Adjusted EPS as an indicator of the Company’s business performance, as well as for operational planning and decision making purposes. Adjusted EPS should be considered in addition to, but not as a substitute for, or superior to, GAAP EPS. A reconciliation of GAAP EPS to Adjusted EPS follows:

| | | | | |

| Diluted earnings per common share | FY 2022 Guidance |

| GAAP | approximately $22.98 |

| Amortization of identifiable intangibles | 0.44 |

Put/call valuation adjustments associated with Company's non-consolidating minority interest investments | (0.12) | |

Transaction and integration costs associated with the Kindred at Home acquisition | 0.54 | |

Change in fair market value of publicly-traded equity securities | 0.66 | |

| Adjusted (non-GAAP) – FY 2022 projected | approximately $24.50 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| HUMANA INC. |

| |

| BY: | /s/ Michael A. Koeberlein |

| Michael A. Koeberlein |

| Senior Vice President, Chief Accounting Officer and Controller |

| (Principal Accounting Officer) |

Dated: June 1, 2022

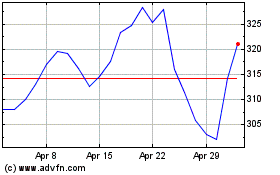

Humana (NYSE:HUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Humana (NYSE:HUM)

Historical Stock Chart

From Apr 2023 to Apr 2024