The Hershey Company (NYSE: HSY):

● Net sales increase 7.5%

● Earnings per share-diluted of $0.56 as reported and

adjusted

● Year-to-date retail takeaway up 8.1% in channels that

account for over 80% of the Company’s U.S. business

● In 2011, net sales and adjusted EPS growth to be around 6%

and 10%, respectively, greater than the previous outlook of around

the top of the Company’s 3-5% and 6-8% long-term targets

The Hershey Company (NYSE: HSY) today announced sales and

earnings for the second quarter ended July 3, 2011. Consolidated

net sales were $1,325,171,000 compared with $1,233,242,000 for the

second quarter of 2010. Reported net income for the second quarter

of 2011 was $130,019,000 or $0.56 per share-diluted, compared with

$46,723,000 or $0.20 per share-diluted for the comparable period of

2010.

As described in the Note, for the second quarter of 2011, these

results, prepared in accordance with generally accepted accounting

principles (GAAP), include credits related to the Project Next

Century program announced in June 2010. In the second quarter of

2011, results included pre-tax charges of $9.4 million, or $0.02

per share-diluted, which were more than offset by an adjustment of

$11.2 million, or $0.02 per share-diluted, resulting in a net

credit of $1.8 million due to a reduction of previous estimates. In

the second quarter of 2010, results included net pre-tax charges of

$86.2 million, or $0.31 per share-diluted, comprised of Project

Next Century costs of $41.5 million, or $0.11 per share-diluted,

and a non-cash goodwill impairment charge of $44.7 million, or

$0.20 per share-diluted, related to the Godrej Hershey Ltd. joint

venture in India. As described in the Note, adjusted net income,

which excludes these net charges, was $129,040,000 or $0.56 per

share-diluted in the second quarter of 2011, compared with

$117,047,000 or $0.51 per share-diluted in the second quarter of

2010, an increase of 9.8 percent in adjusted earnings per

share-diluted.

For the first six months of 2011, consolidated net sales were

$2,889,394,000 compared with $2,641,085,000 for the first six

months of 2010. Reported net income for the first six months of

2011 was $290,134,000 or $1.26 per share-diluted, compared with

$194,117,000 or $0.84 per share-diluted, for the first six months

of 2010.

As described in the Note, for the first six months of 2011 and

2010, these results, prepared in accordance with GAAP, include net

pre-tax charges of $7.9 million and $86.2 million, or $0.02 and

$0.31 per share-diluted, respectively. The 2011 charges were

associated with the Project Next Century program and the 2010

charges were associated with this program as well as the previously

mentioned non-cash goodwill impairment charge. As described in the

Note, adjusted net income for the first six months of 2011, which

excludes these net charges, was $295,272,000, or $1.28 per

share-diluted, compared with $264,441,000 or $1.15 per

share-diluted in 2010, an increase of 11.3 percent in adjusted

earnings per share-diluted.

The forecast for total pre-tax GAAP charges and non-recurring

project implementation costs related to the Project Next Century

program has been narrowed, due to lowering of previous estimates,

and is now expected to be $140 million to $160 million. In 2011,

reported gross margin, reported income before interest and income

taxes (EBIT) margin and reported earnings per share-diluted will be

impacted by charges associated with Project Next Century.

Therefore, we expect reported earnings per share-diluted, including

business realignment and impairment charges of $0.11 to $0.12 per

share-diluted, to be in the $2.67 to $2.71 range. The expected

timing of events and estimated costs and savings are included in

Appendix I attached to this press release.

Second Quarter Performance and

Outlook

“I’m pleased with Hershey’s second quarter results as solid

marketplace momentum continued, resulting in strong overall

financial performance,” said John P. Bilbrey, President and Chief

Executive Officer. “Our business model and strategy to invest in

core brands, disciplined innovation, Insights Driven Performance

(IDP) and consumer capabilities remains effective and is

sustainable. We’ll continue with this disciplined approach and

build on these initiatives, in both domestic and international

markets, as it will enable the Company to consistently meet its net

sales and earnings objectives in the future.

“In the second quarter, Hershey’s net sales increased 7.5

percent, somewhat greater than our initial expectations, driven by

volume growth, primarily new products, in both U.S. and

international markets, resulting in greater levels of in-store

merchandising and programming versus our estimates, and earlier

than expected shipments to customers due to a change in the timing

of their promotional calendars. Net price realization, primarily in

the U.S., was a 3 point benefit, while foreign currency exchange

rates added about a half point.

“Through the first-half of the year, the U.S. CMG – candy, mint

and gum – category and Hershey marketplace performance have

outpaced the historical category growth rate of about 3 to 4

percent. Specifically, Hershey U.S. CMG retail takeaway for the 28

weeks ended July 9, 2011, which along with the comparable period in

2010 encompasses each year’s entire Easter season results, in

channels that account for over 80 percent of our retail business,

was up 8.1 percent. In the channels measured by syndicated data,

U.S. market share increased 0.9 points. Our marketplace performance

reflects a longer Easter season and solid sell through that

resulted in a 1.0 point market share gain in this season,

successful new products launches, as well as continued momentum in

many of our everyday core chocolate and sweets and refreshment

businesses. Brand strength was attributable to increased

advertising and retail effectiveness. In the second quarter,

advertising expense increased about 8 percent versus the year ago

period, in line with the mid-single digit percentage increase

forecasted for the full year.

“Second quarter adjusted EBIT margin was in line with last year

as adjusted selling, marketing and administrative (SM&A) costs

– excluding advertising – declined as a percentage of sales versus

last year. Adjusted gross margin declined in the second quarter as

net price realization and supply chain efficiencies and

productivity were more than offset by higher input costs. As we’ve

previously stated, input costs will be higher in 2011, however,

there is no change to our full-year inflation outlook. We continue

to make good progress against our supply chain initiatives and

Project Next Century is on track. We’ll deliver meaningful cost

savings over the remainder of the year and estimate that full-year

adjusted gross margin will be about the same as last year.

“As we enter the third quarter, we are well-positioned to

continue to increase U.S. market share and deliver on our financial

objectives. In the second half of the year, consumers will begin to

see higher retail price points on our everyday instant consumable

and take-home packaged candy. Therefore, over the remainder of the

year, we expect U.S. CMG category growth to be within the

historical 3 to 4 percent growth rate. We’ll closely monitor

category performance, work with our key retail partners, and make

necessary consumer investments to ensure that the category

continues to perform well in the second half of the year and into

2012. As stated earlier, in 2011, we expect advertising expense to

increase mid-single digits on a percentage basis versus last year,

supporting new product launches and core brands in both the U.S.

and international markets. As a result, we expect 2011 net sales,

including the impact of foreign currency exchange rates, to be

greater than the Company’s long-term 3 to 5 percent objective and

increase around 6 percent. For the full year, we expect adjusted

SM&A – excluding advertising – to increase, but at a rate less

than net sales. Combined with our strong first-half performance,

solid in-store merchandising and seasonal programming, we now

expect 2011 earnings per share-diluted to be greater than the

Company’s long-term 6 to 8 percent objective and increase around 10

percent for the full year,” Bilbrey concluded.

Note: In this release,

Hershey references income measures which are not in accordance with

U.S. generally accepted accounting principles (GAAP) because they

exclude business realignment and impairment charges. These non-GAAP

financial measures are used in evaluating results of operations for

internal purposes. These non-GAAP measures are not intended to

replace the presentation of financial results in accordance with

GAAP. Rather, the Company believes exclusion of such items provides

additional information to investors to facilitate the comparison of

past and present operations. A reconciliation is provided below of

results in accordance with GAAP as presented in the Consolidated

Statements of Income to non-GAAP financial measures which exclude

business realignment and impairment charges in 2011 and 2010

associated with Project Next Century and a non-cash goodwill

impairment charge recorded in 2010.

Second Quarter Ended July 3, 2011

July 4, 2010 In thousands except per share

amounts Dollars

Percent ofNet Sales

Dollars

Percent ofNet Sales

Gross Profit/Gross Margin $ 564,320 42.6 % $ 546,538

44.3 % Charges included in cost of sales 7,023

976 Adjusted non-GAAP Gross Profit/Gross Margin $ 571,343

43.1 % $ 547,514 44.4 % EBIT/EBIT Margin $

228,354 17.2 % $ 124,424 10.1 % Charges included in cost of sales

7,023 976 Charges included in SM&A 1,138 123 Business

Realignment & Impairment (credits)/charges, net (9,952 )

85,134 Adjusted non-GAAP EBIT/EBIT Margin $ 226,563

17.1 % $ 210,657 17.1 % Net Income/Net Margin

$ 130,019 9.8 % $ 46,723 3.8 % Charges included in cost of sales

7,023 976 Charges included in SM&A 1,138 123 Business

Realignment & Impairment (credits)/charges, net (9,952 ) 85,134

Tax impact of charges 812 (15,909 ) Adjusted

non-GAAP Net Income/Net Margin $ 129,040 9.7 % $ 117,047

9.5 % EPS - Diluted $ 0.56 $ 0.20 Charges included in

cost of sales

0.02

— Charges included in SM&A — — Business Realignment &

Impairment (credits)/charges, net

(0.02

) 0.31 Adjusted non-GAAP EPS - Diluted $ 0.56

$ 0.51

Six Months Ended July 3,

2011 July 4, 2010 In thousands except per share

amounts Dollars

Percent ofNet Sales

Dollars

Percent ofNet Sales

Gross Profit/Gross Margin $ 1,220,505 42.2 % $ 1,140,518

43.2 % Charges included in cost of sales 13,882

976 Adjusted non-GAAP Gross Profit/Gross Margin $

1,234,387 42.7 % $ 1,141,494 43.2 % EBIT/EBIT

Margin $ 504,903 17.5 % $ 377,758 14.3 % Charges included in cost

of sales 13,882 976 Charges included in SM&A 2,152 123 Business

Realignment & Impairment (credits)/charges, net (8,114 )

85,134 Adjusted non-GAAP EBIT/EBIT Margin $ 512,823

17.7 % $ 463,991 17.6 % Net Income/Net Margin

$ 290,134 10.0 % $ 194,117 7.3 % Charges included in cost of sales

13,882 976 Charges included in SM&A 2,152 123 Business

Realignment & Impairment (credits)/charges, net (8,114 ) 85,134

Tax impact of charges (2,782 ) (15,909 ) Adjusted

non-GAAP Net Income/Net Margin $ 295,272 10.2 % $ 264,441

10.0 % EPS - Diluted $ 1.26 $ 0.84 Charges included

in cost of sales 0.04 — Charges included in SM&A — — Business

Realignment & Impairment (credits)/charges, net (0.02 )

0.31 Adjusted non-GAAP EPS - Diluted $ 1.28 $

1.15

In 2010, the Company recorded GAAP charges of $53.9 million, or

$0.14 per share-diluted, attributable to the Project Next Century

program. Additionally, in the second quarter of 2010, the Company

recorded a non-cash goodwill impairment charge of $44.7 million, or

$0.20 per share-diluted, related to the Godrej Hershey Ltd. joint

venture. In 2011, the Company expects to record total GAAP charges

of about $38 million to $43 million, or $0.11 to $0.12 per

share-diluted, attributable to Project Next Century. Below is a

reconciliation of GAAP and non-GAAP items to the Company’s 2010

adjusted earnings per share-diluted and projected adjusted earnings

per share-diluted for 2011:

2010

2011 (Projected)

Reported EPS-Diluted $2.21 $2.67 - $2.71 Total Business Realignment

and Impairment Charges $0.34 $0.11 - $0.12 Adjusted EPS-Diluted *

$2.55

$2.79 - $2.82

*Excludes business realignment and impairment charges.

Appendix I

The Hershey Company Project “Next Century”

Expected Timing of Costs and Savings ($m)

2011

2012

2013

2014

Realignment Charges:

Cash ~$5 $20 to $30 ~$5 - - Non-Cash $25 to $30 ~$15

- - - -

Project Management and Start-up Costs

~$8

$10

to

$15 -

-

-

Total “Next Century” Realignment Charges & Costs $38 to $43 $45

to $60 $5 to $5 - -

“Next Century” Cap-Ex $190 to $200 $40 to $55 $5 to $10 - -

“Next Century” Projected Annual

Savings:

Current Year

$10 to $15 $20 to $25 $25 to $30 $5 to $10 Cumulative $10 to $15

$30 to $40 $55 to $70 $60 to $80

Safe Harbor Statement

This release contains statements that are forward-looking. These

statements are made based upon current expectations that are

subject to risk and uncertainty. Actual results may differ

materially from those contained in the forward-looking statements.

Factors that could cause results to differ materially include, but

are not limited to: issues or concerns related to the quality and

safety of our products, ingredients or packaging; changes in raw

material and other costs; selling price increases, including volume

declines associated with pricing elasticity; market demand for our

new and existing products; increased marketplace competition;

disruption to our supply chain; failure to successfully execute

acquisitions, divestitures and joint ventures; changes in

governmental laws and regulations, including taxes; political,

economic, and/or financial market conditions; risks and

uncertainties related to our international operations; disruptions,

failures or security breaches of our information technology

infrastructure; the impact of future developments related to the

investigation by government regulators of alleged pricing practices

by members of the confectionery industry, including risks of

subsequent litigation or further government action; pension cost

factors, such as actuarial assumptions, market performance and

employee retirement decisions and funding requirements; the ability

to implement our supply chain realignment initiatives within the

anticipated timeframe in accordance with our cost estimates and our

ability to achieve the expected ongoing annual savings from these

initiatives; and such other matters as discussed in our Annual

Report on Form 10-K for 2010.

All information in this press release is as of July 26, 2011.

The Company undertakes no duty to update any forward-looking

statement to conform the statement to actual results or changes in

the Company's expectations.

Live Web Cast

As previously announced, the Company will hold a conference call

with analysts today at 8:30 a.m. Eastern Time. The conference call

will be web cast live via Hershey’s corporate website

www.thehersheycompany.com. Please go to the Investor Relations

section of the website for further details.

The Hershey Company Summary of Consolidated

Statements of Income for the periods ended July 3, 2011 and

July 4, 2010 (in thousands except per share amounts)

Second Quarter Six

Months 2011

2010 2011

2010 Net Sales $ 1,325,171 $

1,233,242 $ 2,889,394 $ 2,641,085 Costs

and Expenses: Cost of Sales 760,851 686,704 1,668,889 1,500,567

Selling, Marketing and Administrative 345,918 336,980 723,716

677,626 Business Realignment and Impairment (Credits)/Charges, net

(9,952 ) 85,134 (8,114 ) 85,134 Total Costs

and Expenses 1,096,817 1,108,818 2,384,491

2,263,327 Income Before Interest and Income Taxes

(EBIT) 228,354 124,424 504,903 377,758 Interest Expense, net 23,351

22,780 47,828 46,529 Income

Before Income Taxes 205,003 101,644 457,075 331,229 Provision for

Income Taxes 74,984 54,921 166,941 137,112

Net Income $ 130,019 $ 46,723 $ 290,134

$ 194,117

Net Income Per Share

- Basic - Common

$ 0.59 $ 0.21 $ 1.31 $ 0.87

- Basic - Class B

$ 0.53 $ 0.19 $ 1.19 $ 0.79

- Diluted - Common

$ 0.56 $ 0.20 $ 1.26 $ 0.84

Shares Outstanding

- Basic - Common

166,302 166,882 166,372 167,079

- Basic - Class B

60,632 60,708 60,657 60,708

- Diluted - Common

230,301 230,324 230,243 229,946

Key Margins: Gross Margin 42.6 % 44.3 % 42.2 % 43.2 % EBIT Margin

17.2 % 10.1 % 17.5 % 14.3 % Net Margin 9.8 % 3.8 % 10.0 % 7.3 %

The Hershey Company Consolidated Balance

Sheets as of July 3, 2011 and December 31, 2010 (in

thousands of dollars)

Assets

2011 2010 Cash and

Cash Equivalents $ 790,297 $ 884,642 Accounts Receivable - Trade

(Net) 296,946 390,061 Deferred Income Taxes 69,714 55,760

Inventories 659,224 533,622 Prepaid Expenses and Other 175,895

141,132 Total Current Assets 1,992,076 2,005,217 Net

Plant and Property 1,493,537 1,437,702 Goodwill 527,724 524,134

Other Intangibles 122,057 123,080 Deferred Income Taxes 14,202

21,387 Other Assets 163,157 161,212 Total Assets $ 4,312,753

$ 4,272,732

Liabilities and

Stockholders' Equity

Loans Payable $ 293,929 $ 285,480 Accounts Payable 399,841

410,655 Accrued Liabilities 527,742 593,308 Taxes Payable 301 9,402

Total Current Liabilities 1,221,813 1,298,845

Long-Term Debt 1,541,388 1,541,825 Other Long-Term Liabilities

503,858 494,461 Total Liabilities 3,267,059 3,335,131

Total Stockholders' Equity 1,045,694 937,601 Total

Liabilities and Stockholders' Equity $ 4,312,753 $ 4,272,732

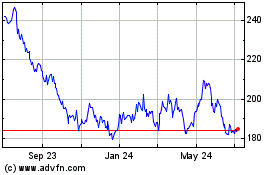

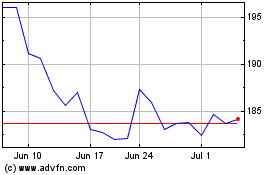

Hershey (NYSE:HSY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hershey (NYSE:HSY)

Historical Stock Chart

From Sep 2023 to Sep 2024