The Hartford announced today the consideration for each series

of notes subject to its previously announced cash tender offer (the

“Tender Offer”) for any and all of the outstanding aggregate

principal amount of (1) the 5.125% Senior Notes due 2022 (the

“Hartford Notes”) issued by The Hartford and (2) the 5.75% Senior

Notes due 2023 (the “Navigators Notes” and together with the

Hartford Notes, the “Notes”) issued by The Navigators Group, Inc.

(“Navigators”). A separate offer is being made for each of the two

series of Notes. Navigators is a wholly-owned subsidiary of The

Hartford.

The consideration for each series of Notes per each $1,000

principal amount of Notes validly tendered and accepted for payment

pursuant to the Tender Offer, which is set forth in the table

below, was determined in the manner described in the Offer to

Purchase, dated August 8, 2019 (the “Offer to Purchase”), by

reference to the applicable fixed spread specified for the series

in the table below over the yield based on the bid side price of

the applicable reference U.S. Treasury Security specified below for

such series of Notes, as calculated by the Dealer Managers (as

defined below) at 11:00 a.m., New York City time, on August 14,

2019. Holders whose Notes are purchased will also receive accrued

and unpaid interest thereon from the applicable last interest

payment date to, but not including, the settlement date. The

Hartford expects to accept and settle Notes so accepted on August

19, 2019.

Title of Security

CUSIP / ISIN Number

Principal Amount

Outstanding

Reference U.S. Treasury

Security

Bloomberg Reference

Page(3)

Reference Yield

Fixed Spread (bps)

Consideration

5.125% Senior Notes due

2022(1)

416518AB4 / US416518AB42

$800,000,000

2.250% UST due 4/15/2022

PX5

1.535%

45

$1,080.81

5.75% Senior Notes due

2023(2)

638904AB8 / US638904AB84

$265,000,000

2.875% UST due 9/30/2023

PX6

1.508%

50

$1,148.45

(1) The Hartford Notes are obligations of The

Hartford. (2) The Navigators Notes are obligations of Navigators

and are not guaranteed by any other entity, including The Hartford.

(3) The applicable page on Bloomberg from which the Dealer Managers

quoted the bid side prices of the applicable Reference U.S.

Treasury Security.

The Tender Offer is being made pursuant to the Offer to Purchase

and a related Letter of Transmittal and Notice of Guaranteed

Delivery, which set forth the terms and conditions of the Tender

Offer.

The Tender Offer is scheduled to expire at 5:00 p.m., New York

City time, on August 14, 2019, unless extended (such date and time,

as the same may be extended, the “Expiration Time”). Holders must

validly tender and not validly withdraw their Notes before the

Expiration Time to be eligible to receive the consideration for the

applicable series of Notes.

The Tender Offer is conditioned upon the satisfaction of certain

conditions, including the receipt of proceeds sufficient to fund

the aggregate consideration (excluding accrued interest) for all

Notes validly tendered and not validly withdrawn, from one or more

debt capital markets issuances by The Hartford on terms reasonably

satisfactory to The Hartford. Neither offer is conditioned upon any

minimum amount of Notes being tendered or the consummation of the

other offer. Each offer may be extended, terminated, or withdrawn

separately.

Assuming that one or more such debt capital markets issuances is

completed, The Hartford and Navigators currently intend to issue on

August 19, 2019 notices of redemption in respect of their

respective series of Notes. As of the time of this press release,

The Hartford and Navigators have the right, but not the obligation,

to redeem such Notes, and there can be no assurance that this

redemption will occur. This press release does not constitute a

notice of redemption under the respective indentures governing the

Notes. Any such notice, if made, will only be made in accordance

with the provisions of the applicable indenture.

The Hartford has retained Credit Suisse Securities (USA) LLC and

J.P. Morgan Securities LLC to serve as the dealer managers for the

Tender Offer (the “Dealer Managers”). Credit Suisse Securities

(USA) LLC may be contacted at (800) 820-1653 (toll free) or (212)

538-2147 and J.P. Morgan Securities LLC may be contacted at (866)

834-4666 (toll free) or (212) 834-8553.

The Hartford has retained D.F. King & Co., Inc. to serve as

the tender agent and information agent for the Tender Offer.

Copies of the Offer to Purchase, Letter of Transmittal and

Notice of Guaranteed Delivery may be obtained from D.F. King &

Co., Inc. by telephone at (800) 814-8954 (toll-free) or for banks

and brokers, at (212) 269-5550 (Banks and Brokers Only) or by email

at hig@dfking.com.

Copies of the Offer to Purchase, Letter of Transmittal and

Notice of Guaranteed Delivery are also available at the following

web address: www.dfking.com/hig.

This press release is neither an offer to purchase nor a

solicitation of an offer to sell any Notes in the Tender Offer. In

addition, this press release is not an offer to sell or the

solicitation of an offer to buy any securities issued in connection

with any debt capital markets issuance.

About The Hartford

The Hartford is a leader in property and casualty insurance,

group benefits and mutual funds. With more than 200 years of

expertise, The Hartford is widely recognized for its service

excellence, sustainability practices, trust and integrity.

The Hartford Financial Services Group, Inc. (NYSE: HIG) operates

through its subsidiaries under the brand name, The Hartford, and is

headquartered in Hartford, Connecticut.

Forward Looking Statements

Some of the statements in this release may be considered

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995, including statements regarding the

conduct and consummation of the Tender Offer, any debt capital

markets issuance and the potential redemption of the Notes. We

caution investors that these forward-looking statements are not

guarantees of future performance, and actual results may differ

materially. Investors should consider the important risks and

uncertainties that may cause actual results to differ. These

important risks and uncertainties include those discussed in our

2018 Annual Report on Form 10-K, subsequent Quarterly Reports on

Forms 10-Q, and the other filings we make with the Securities and

Exchange Commission. We assume no obligation to update such forward

looking statements or this release, which speaks as of the date

issued.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190814005613/en/

Media Contact: Matthew Sturdevant 860-547-8664

matthew.sturdevant@thehartford.com

Investor Contact: Sabra Purtill, CFA 860-547-8691

sabra.purtill@thehartford.com

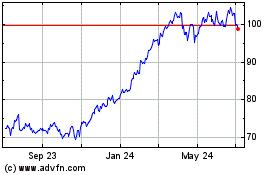

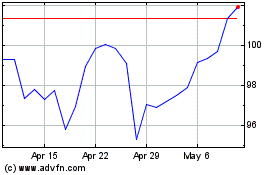

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024