UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For February 18, 2022

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

(“Harmony” and/or “the Company”)

Trading statement and operating update for the six months ended 31 December 2021

Johannesburg, Friday, 18 February 2022. In terms of paragraph 3.4(b) of the Listings Requirements of the JSE Limited ("JSE"), a company listed on the JSE is required to publish a trading statement as soon as they are satisfied that a reasonable degree of certainty exists that the financial results for the period to be reported upon next - being its interim results for the six months ended 31 December 2021 ("H1FY22") - will differ by at least 20% from the financial results for the comparable six months ended 31 December 2020 ("the previous comparable period" and/or "H1FY21").

Expected basic and headline earnings for H1FY22

Shareholders of Harmony are advised that a reasonable degree of certainty exists that basic earnings for H1FY22 will be 68-72% lower than for H1FY21 primarily due to:

•a non-recurring gain on bargain purchase recognised for the acquisition of the assets and liabilities of Mponeng operations and related assets in H1FY21;

•a decreased gross profit as result of higher production costs, which offset the increase in production and revenue;

•a translation loss on the US$ denominated debt at 31 December 2021 (compared to a gain at 31 December 2020); and

•a derivative loss recorded in H1FY22 compared to a gain in H1FY21.

The decrease in earnings were partially offset by the decrease in the taxation expense due to changes in the utilisation of unredeemed capital allowances and assessed losses period on period.

As a result of a correction of an error related to deferred taxation and the conclusion of the IFRS 3 fair value and accounting exercise related to the acquisition of Mponeng operations and related assets, the 31 December 2020 results have been restated (for details refer to Harmony’s annual financial statements for the year ended 30 June 2021, published on 28 October 2021 on www.harmony.co.za).

The expected movements in earnings for H1FY22 compared to the previous corresponding period are due mainly to:

Production costs

Production costs increased mainly due to the inclusion of six months of costs in respect of Mponeng and related assets in H1FY22 compared to three months in H1FY21. Inflationary increases also impacted on various facets such as labour and consumables costs.

Foreign exchange rate movement impact

A foreign exchange translation loss of approximately R298 million (US$20 million), compared to a R652 million gain (US$40 million) in H1FY21, is predominantly attributable to the Rand weakening against the US dollar.

Included in H1FY22 were derivative losses of close to R35 million (US$2 million) compared to gains of R902 million (US$56 million) in H1FY21. The derivative losses are primarily as a result of the weakening of the Rand exchange rate against the US Dollar.

Taxation

The factors above resulted in the increase of assessed losses and unredeemed capital expenditure resulted in a lower deferred tax expense.

Earnings per share (“EPS”) are expected be between 214 and 245 South African cents per share – which is a decrease of between 72% and 68% on the restated earnings of 763 South African cents per share for the previous comparable period. In US dollar terms, the earnings per share is expected to be between 15 and 18 US cents per share, which is a decline of between 68% and 62% on restated earnings of 47 US cents per share reported for the previous comparable period.

Headline earnings per share (“HEPS”) are expected to between 233 and 268 South African cents, which represents a decrease of between 67% and 62% from the restated headline earnings per share of 713 South African cents reported in the previous comparable period. In US dollar terms, the headline earnings per share is expected to be between 15 and 18 US cents per share, which is a decrease of between 66% and 59% on the restated headline earnings of 44 US cents per share reported for the previous comparable period. Headline earnings exclude the gain on bargain purchase (from acquisitions) recorded in H1FY21.

The financial information on which this trading statement has been based has not been reviewed or reported on by Harmony’s external auditors.

Harmony will publish its financial results for the six months ended 31 December 2021 on Monday, 28 February 2022. Please see Harmony’s website for more details: www.harmony.co.za.

For more details, contact:

Jared Coetzer

Head of Investor Relations

+27 (0) 82 746 4120

Johannesburg, South Africa

18 February 2022

Sponsor:

J.P. Morgan Equities South Africa Proprietary Limited

FORWARD-LOOKING STATEMENTS

This market release contains forward-looking statements within the meaning of the safe harbour provided by Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters.

These forward-looking statements, including, among others, those relating to our future business prospects, revenues, and the potential benefit of acquisitions (including statements regarding growth and cost savings) wherever they may occur in this market release and the exhibits, are necessarily estimates reflecting the best judgement of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward looking statements should be considered in light of various important factors, including those set forth in this market release.

Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, without limitation: overall economic and business conditions in South Africa, Papua New Guinea, Australia and elsewhere (including as a result of the coronavirus disease ("COVID-19” or “pandemic”); estimates of future earnings, and the sensitivity of earnings to gold and other metals prices; estimates of future gold and other metals production and sales; estimates of future cash costs; estimates of future cash flows, and the sensitivity of cash flows to gold and other metals prices; estimates of provision for silicosis settlement; statements regarding future debt repayments; estimates of future capital expenditures; the success of our business strategy, exploration and development activities and other initiatives; future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings and financing plans; estimates of reserves statements regarding future exploration results and the replacement of reserves; the ability to achieve anticipated efficiencies and other cost savings in connection with past and future acquisitions, as well as at existing operations; fluctuations in the market price of gold; the occurrence of hazards associated with underground and surface gold mining; the occurrence of labour disruptions related to industrial action or health and safety incidents; power cost increases as well as power stoppages, fluctuations and usage constraints; supply chain shortages and increases in the prices of production imports and the availability, terms and deployment of capital; our ability to hire and retain senior management, sufficiently technically-skilled employees, as well as our ability to achieve sufficient representation of historically disadvantaged HDSAs in management positions; our ability to comply with requirements that we operate in a sustainable manner and provide benefits to affected communities; potential liabilities related to occupational health diseases; changes in government regulation and the political environment, particularly tax and royalties, mining rights, health and safety, environmental regulation and business ownership including any interpretation thereof; court decisions affecting the South African mining industry, including, without limitation, regarding the interpretation of mining rights; our ability to protect our information technology and communication systems and the personal data we retain; risks related to the failure of internal controls; the outcome of pending or future litigation or regulatory proceedings; fluctuations in exchange rates any further downgrade of South Africa’s credit rating; and currency devaluations and other macroeconomic monetary policies; the adequacy of the Group’s insurance coverage; and socio-economic or political instability in South Africa, Papua New Guinea, Australia and other countries in which we operate.

For a more detailed discussion of such risks and other factors (such as availability of credit or other sources of financing), see the Company’s latest Integrated Annual Report and Form 20-F which is on file with the Securities and Exchange Commission, as well as the Company’s other Securities and Exchange Commission filings. The Company undertakes no obligation to update publicly or release any revisions to these forward looking statements to reflect events or circumstances after the date of this market release or to reflect the occurrence of unanticipated events, except as required by law. The foregoing factors and others described under “Risk Factors” should not be construed as exhaustive.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Harmony Gold Mining Company Limited |

| |

| Date: February 18, 2022 | By: /s/ Boipelo Lekubo |

| Name: Boipelo Lekubo |

| Title: Financial Director |

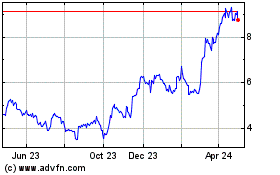

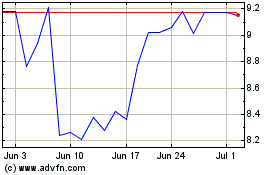

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024