Frac Holiday' Means Prolonged Pain for Oil Industry

April 27 2020 - 2:27PM

Dow Jones News

By Spencer Jakab

"Tank tops" and "holidays" may conjure up images of a relaxed

summer barbecue, but they mean something altogether less pleasant

in America's oil patch.

Last week energy speculators got roasted by the plunge in U.S.

oil futures prices to negative $40 a barrel as they were forced to

take a loss rather than accept physical delivery. Those in the

industry already were aware that a crunch was coming.

Cushing, Okla., the delivery point for U.S. crude futures, was

"nearing tank tops" in which its 80 million barrels of storage

capacity was exhausted. Producers have been responding with savage

cuts to their capital expenditures. A long-watched measure of oil

and gas activity, the Baker Hughes rotary rig count, only tells

part of the story. As of April 24 it had dropped to 465 in the

U.S., down by 526 from a year earlier and 41% lower than the

average in the first quarter.

But that rapid collapse actually understates the pullback in

activity. Analysts at Citigroup note that the active frac count

compiled by research firm Primary Vision is down by a far sharper

73% from the first quarter average. Fracking wells is the last step

in releasing oil and gas from shale formations and "frac holidays"

are awful news for oil-field service companies like Schlumberger

Ltd., Halliburton Co. and Baker Hughes Co. on two fronts.

First, it means demand for things like fracking of

already-drilled wells has dropped a lot more. For various

contractual or business reasons, it sometimes still made sense to

go ahead with drilling.

It also means that many of those drilled but uncompleted wells,

or "DUCs" will be left idle. These represent supply that could be

brought online quickly with relatively modest outlays in the future

as soon as prices and demand recover. Before that happens, of

course, the world will have to work through massive amounts of

stored crude now building up.

The U.S. will feel disproportionate pain in this global glut

because of the heavy cash needs of shale production. Service giant

Schlumberger said 10 days ago that it expects customer spending to

drop by 40% in North America this year and by 15% abroad. People

and companies in the U.S. shale patch will have plenty of unwanted

leisure time for at least the next several months.

Write to Spencer Jakab at spencer.jakab@wsj.com

(END) Dow Jones Newswires

April 27, 2020 14:12 ET (18:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

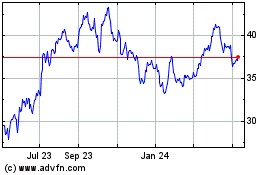

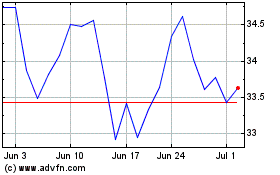

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024