Halliburton to Issue $1.0 Billion of Senior Notes

February 19 2020 - 5:32PM

Business Wire

Halliburton Company (NYSE: HAL) announced today the pricing of

an offering of $1.0 billion aggregate principal amount of 2.92%

senior notes due 2030. The offering is expected to close on March

3, 2020, subject to the satisfaction of customary closing

conditions.

Halliburton intends to use the net proceeds of the offering,

together with cash on hand, to finance concurrent cash tender

offers to purchase certain series of Halliburton’s outstanding

senior notes. If the tender offers are not consummated or the net

proceeds from the offering exceed the total consideration payable

in the tender offers, Halliburton intends to use the remaining net

proceeds from the offering for general corporate purposes, which

may include the repayment or repurchase of other indebtedness. The

offering is not conditioned upon the completion of the tender

offers, although the consummation of the tender offers is

contingent upon, among other things, the completion of the offering

on terms and conditions satisfactory to Halliburton.

The notes are being offered pursuant to an effective shelf

registration statement on Form S-3 previously filed with the

Securities and Exchange Commission. J.P. Morgan Securities LLC,

Citigroup Global Markets Inc., HSBC Securities (USA) Inc. and

Mizuho Securities USA LLC are acting as joint book-running managers

in connection with the offering of the notes. The notes are being

offered only by means of a prospectus supplement and accompanying

prospectus, copies of which may be obtained from:

J.P. Morgan Securities LLC 383 Madison Avenue, New York, NY

10179 Attn: Investment Grade Syndicate Desk Collect:

212-834-4533

Citigroup Global Markets Inc. c/o Broadridge Financial Solutions

1155 Long Island Avenue Edgewood, NY 11717 Toll-free:

1-800-831-9146 E-mail: prospectus@citi.com

HSBC Securities (USA) Inc. 452 Fifth Avenue, New York, NY

Toll-free: 1-866-811-8049

Mizuho Securities USA Inc. 1271 Avenue of the Americas, New

York, NY 10020 Attention: Debt Capital Markets Toll-free:

1-866-271-7403

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

About Halliburton

Founded in 1919, Halliburton is one of the world's largest

providers of products and services to the energy industry. With

approximately 55,000 employees, representing 140 nationalities in

more than 80 countries, the company helps its customers maximize

value throughout the lifecycle of the reservoir — from locating

hydrocarbons and managing geological data, to drilling and

formation evaluation, well construction and completion, and

optimizing production throughout the life of the asset. Visit the

company’s website at www.halliburton.com. Connect with Halliburton

on Facebook, Twitter, LinkedIn, Instagram and YouTube.

NOTE: This press release contains forward-looking

statements within the meaning of the federal securities laws,

including statements regarding the consummation of the concurrent

tender offers and the expected closing date and use of proceeds of

the offering. These statements are subject to numerous risks and

uncertainties, many of which are beyond Halliburton’s control,

which could cause actual results to differ materially from the

results expressed or implied by the statements. Halliburton’s Form

10-K for the year ended December 31, 2019, recent Current Reports

on Form 8-K, and other Securities and Exchange Commission filings

discuss some of the important risk factors identified that may

affect Halliburton’s business, results of operations, and financial

condition. Halliburton undertakes no obligation to revise or update

publicly any forward-looking statements for any reason.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200219006042/en/

For Investors: Abu

Zeya Investor

Relations investors@halliburton.com 281-871-2688

For News Media: Emily Mir Public Relations

pr@halliburton.com 281-871-2601

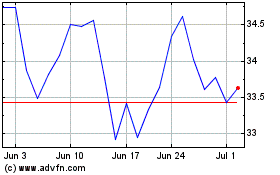

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

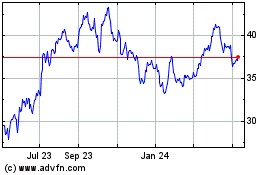

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024