Genesis Energy, L.P. (NYSE: GEL) today announced its first

quarter results.

We generated the following financial results for the first

quarter of 2020:

- Net Income Attributable to Genesis Energy, L.P. of $24.9

million for the first quarter of 2020 compared to Net Income

Attributable to Genesis Energy, L.P. of $16.0 million for the same

period in 2019.

- Cash Flows from Operating Activities of $89.6 million for the

first quarter of 2020 compared to $114.0 million for the same

period in 2019.

- Total Segment Margin in the first quarter of 2020 of $169.3

million.

- Available Cash before Reserves to common unitholders of $81.8

million for the first quarter of 2020, which provided 4.45X

coverage for the quarterly distribution of $0.15 per common unit

attributable to the first quarter.

- We declared cash distributions on our preferred units of

$0.7374 for each preferred unit, which equates to a cash

distribution of approximately $18.7 million and is reflected as a

reduction to Available Cash before Reserves to common

unitholders.

- Adjusted EBITDA of $164.4 million in the first quarter of 2020.

Our bank leverage ratio, calculated consistent with our credit

agreement, is 5.13X as of March 31, 2020 and is discussed further

in this release.

Grant Sims, CEO of Genesis Energy, said, “For the quarter, our

diversified businesses delivered financial results consistent with,

if not slightly greater than, our expectations. The results were

positively driven by solid pipeline volumes out of the Gulf of

Mexico, strong crude-by-rail volumes out of Canada and robust

demand for marine transportation across our different classes of

assets. During the quarter, however, we began to recognize the

prospective challenges from two exogenous events.

While we are not directly impacted by the price of crude oil,

when the OPEC Plus deal fell apart around March 1, the differential

between Canadian barrels at their source and the Gulf Coast

collapsed, making crude-by-rail out of Canada uneconomic. Volumes

have gone to zero as of April 1, and we would expect them to remain

so for the rest of the year. We do have certain protections to the

downside in terms of minimum take-or-pay volumes, but we expect to

experience some $15-$20 million less in terms of reported margin

than what we would have otherwise expected for the remainder of

2020.

Of more significance to us, and what should be to virtually

every other energy/industrial company, is the across the board

demand destruction resulting from shutting down substantial

economic activity worldwide as we deal with COVID-19. This demand

destruction will, in our opinion, significantly pressure crude

prices worldwide for an extended period of time, notwithstanding

the apparent production cuts that are scheduled to occur. It will

also pressure the demand for finished products for which soda ash

and sodium hydrosulfide are building blocks.

Because of the challenges presented by these events, which are

by no means unique or necessarily any more challenging to Genesis,

we made the pro-active decision to reduce our quarterly

distribution, saving approximately $200 million a year for the

foreseeable future which will be used to directly pay down debt and

manage and maintain our financial flexibility. We also amended our

senior secured revolving credit facility to give us more

flexibility in managing our total outstanding debt. Finally, we

amended our agreements with GSO Capital Partners to allow us to

delay the expenditures associated with our Granger optimization

project by as much as twelve months. We still believe in the

economics of the expansion but felt it was appropriate in the

current operating environment to somewhat delay the date of first

production. We believe these actions and lack of future capital

needs give us all the flexibility we need to manage throughout the

rest of this year and successfully into the future.

We expect volumes out of the Gulf of Mexico to remain strong and

growing through this year and in the years to come. We currently do

not know of or expect any significant production that flows on our

systems to be intentionally shut in due to the current crude oil

price environment. While certain new projects that have yet to be

sanctioned might be delayed under the current circumstances, we see

little risk to the completion of, or significant delays, in the

contracted and known/sanctioned projects in progress like Atlantis

Phase 3, Argos and King’s Quay that will flow exclusively through

our pipelines for decades to come.

In onshore facilities and transportation, for the remainder of

the year, there are contango opportunities that will help to

offset, but by no means totally make up for, lost margin from

crude-by-rail out of Canada. In addition, we expect marine

fundamentals to remain relatively consistent with the first

quarter, and any future softening, especially in the brown water

world, might lead us to redeploying our assets as floating storage

to take advantage of contango.

The second quarter for certain is going to be challenging from a

volume perspective for our sodium and sulfur businesses. Our legacy

refinery services business has experienced some short term volume

loss, especially in South America as mining activities have been

curtailed or shuttered in response to mitigating COVID-19. We

expect these volumes to come back as soon as more and more of the

activity restrictions are lifted. Volumes in the soda ash business

are challenged because of dramatic reductions in demand, including

primarily export markets. We have reacted to this demand

destruction by putting our Granger facility in “hot hold” mode,

probably through the end of September, thereby reducing our total

production by some 300,000 tons. We believe this is necessary to

balance our annual production with our total anticipated sales,

both domestically and internationally for 2020.

Looking forward for the remainder of 2020, and assuming a

challenging operating environment for the second and third

quarters, we would reasonably expect to finish the year at the

bottom end of our previous guidance for Adjusted EBITDA, if not

below, primarily due to the mitigation efforts and demand impacts

related to the COVID-19 pandemic. However, given the action we took

on our distribution in late March, it is important to point out

that our annual fixed obligations are now approximately $410-$420

million, before growth capital and ARO. Given our de minimis growth

capital requirements for the foreseeable future, outside of the

Granger expansion which can be funded through our agreements with

GSO Capital Partners, we have no need to access the capital markets

and expect to be a net payer of debt in 2020 and beyond.

Therefore, we believe we have taken all the necessary steps and

have all the tools we need in place to navigate through the

challenges ahead and manage our balance sheet, especially

compliance with our total funded debt covenant. There will be a

recovery. The only question is when and whether such recovery is

V-shaped, U-shaped or like the “Nike swoosh”. We have confidence in

the resiliency of our businesses. They have existed, survived and

thrived for many decades, across and through numerous previous

cycles. There’s no reason to doubt that they will again.

I would like to recognize our entire workforce, and specifically

our miners, mariners and offshore personnel during this time of

social distancing. I am proud to say we have safely operated all of

our assets under our own COVID-19 safety procedures with no impact

to our customers and limited confirmed cases amongst our 2,200

employees. As always, we intend to be prudent, diligent and

intelligent in achieving long-term value for all our stakeholders

without ever losing our commitment to safe, reliable and

responsible operations.”

Financial Results

Segment Margin

Variances between the first quarter of 2020 (the “2020 Quarter”)

and the first quarter of 2019 (the “2019 Quarter”) in these

components are explained below.

Segment margin results for the 2020 Quarter and 2019 Quarter

were as follows:

Three Months Ended March 31,

2020

2019

(in thousands)

Offshore pipeline transportation

$

85,246

$

76,390

Sodium minerals and sulfur services

36,941

58,639

Onshore facilities and transportation

28,099

25,603

Marine transportation

19,002

12,932

Total Segment Margin

$

169,288

$

173,564

Offshore pipeline transportation Segment Margin for the 2020

Quarter increased $8.9 million, or 12%, from the 2019 Quarter,

primarily due to higher volumes on our crude oil pipeline systems.

These increased volumes are primarily the result of first oil flow

from the Buckskin and Hadrian North production fields during the

second quarter of 2019, both of which are fully dedicated to our

SEKCO pipeline, and further downstream, our Poseidon oil pipeline

system ("Poseidon"). Additionally, during the second half of 2019,

we entered into agreements to move sixty thousand barrels per day

on either CHOPS or Poseidon that are delivered to us by a

third-party pipeline that has insufficient capacity. These

agreements contain ship-or-pay provisions, have terms as long as

five years and required no additional capital on our part.

Sodium minerals and sulfur services Segment Margin for the 2020

Quarter decreased $21.7 million, or 37%, from the 2019 Quarter.

This decrease is primarily due to lower volumes and pricing in our

Alkali Business and lower NaHS volumes in our refinery services

business. During the 2020 Quarter, we experienced lower export

pricing due to supply and demand imbalances that existed at the

time of our re-contracting phase in December 2019 and January 2020,

which is expected to continue, to some extent, for the rest of 2020

and until we re-contract such pricing at the end of the year for

2021 volumes. This was coupled with lower domestic sales of soda

ash during the 2020 Quarter. We expect to see lower soda ash sales

volumes in the next few quarters as a result of COVID-19 and until

restrictions are lifted globally. In our refinery services

business, we experienced a decline in NaHS volumes during the 2020

Quarter due to lower demand from certain of our domestic mining and

pulp and paper customers. Costs impacting the results of our sodium

minerals and sulfur services segment include costs associated with

processing and producing soda ash (and other alkali specialty

products), NaHS and marketing and selling activities. In addition,

costs include activities associated with mining and extracting

trona ore (including energy costs and employee compensation).

Onshore facilities and transportation Segment Margin for the

2020 Quarter increased $2.5 million, or 10%, from the 2019 Quarter.

This increase is primarily due to increased volumes on our Texas

and Louisiana crude oil pipeline systems, and slightly increased

overall volumes at our rail unload facilities. During the 2020

Quarter, we were able to recognize incremental margin on the

increased volumes on our Texas system as our main customer utilized

all of its prepaid transportation credits during 2019.

Additionally, our pipeline, rail and terminal assets in the Baton

Rouge corridor had significantly higher volumes during the 2020

Quarter as the 2019 Quarter was negatively impacted by production

curtailments imposed by the government of Alberta. These increases

were partially offset by lower volumes at our Raceland rail

facility during the 2020 Quarter.

Marine transportation Segment Margin for the 2020 Quarter

increased $6.1 million, or 47%, from the 2019 Quarter. During the

2020 Quarter, in our offshore barge operation, we benefited from

the continual improving rates in the spot and short term markets

along with reported utilization level of 99.4%. In our inland

business, we continued to see increased day rates throughout the

period which more than offset the slightly lower utilization

reported. We have continued to enter into short term contracts

(less than a year) in both the inland and offshore markets because

we believe the day rates currently being offered by the market have

yet to fully recover from their cyclical lows.

Other Components of Net Income

In the 2020 Quarter, we recorded Net Income Attributable to

Genesis Energy, L.P. of $24.9 million compared to Net Income

Attributable to Genesis Energy, L.P. of $16.0 million in the 2019

Quarter. Net Income Attributable to Genesis Energy, L.P. in the

2020 Quarter benefited from: (i) an unrealized gain from the

valuation of the embedded derivative associated with our Class A

Convertible Preferred Units of $32.5 million compared to an

unrealized loss of $3.0 million during the 2019 quarter recorded in

other income (expense); (ii) lower general and administrative

expenses of $2.3 million primarily due to the assumptions used to

value our long term incentive compensation plans during the 2020

Quarter; and (iii) lower depreciation, depletion and amortization

expense of $3.3 million. These increases were offset by: (i) the

transaction costs and write-off of the unamortized issuance costs

and discount associated with the extinguishment of our 2022 Notes

of $23.5 million during the 2020 Quarter included in other income

(expense); (ii) lower segment margin during the 2020 Quarter of

$4.3 million; and (iii) $4.1 million of our Net Income during the

2020 Quarter being attributed to our redeemable noncontrolling

interests.

Earnings Conference Call

We will broadcast our Earnings Conference Call on Wednesday, May

6, 2020, at 9 a.m. Central time (10 a.m. Eastern time). This call

can be accessed at www.genesisenergy.com. Choose the Investor

Relations button. For those unable to attend the live broadcast, a

replay will be available beginning approximately one hour after the

event and remain available on our website for 30 days. There is no

charge to access the event.

Genesis Energy, L.P. is a diversified midstream energy master

limited partnership headquartered in Houston, Texas. Genesis’

operations include offshore pipeline transportation, sodium

minerals and sulfur services, onshore facilities and transportation

and marine transportation. Genesis’ operations are primarily

located in Texas, Louisiana, Arkansas, Mississippi, Alabama,

Florida, Wyoming and the Gulf of Mexico.

GENESIS ENERGY, L.P.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS - UNAUDITED

(in thousands, except per unit

amounts)

Three Months Ended March 31,

2020

2019

REVENUES

$

539,923

$

620,009

COSTS AND EXPENSES: Costs of sales and operating

expenses

397,031

468,656

General and administrative expenses

9,373

11,686

Depreciation, depletion and amortization

74,357

77,638

OPERATING INCOME

59,162

62,029

Equity in earnings of equity investees

14,159

12,997

Interest expense

(54,965

)

(55,701

)

Other income (expense)

10,258

(2,976

)

INCOME BEFORE INCOME TAXES

28,614

16,349

Income tax (expense) benefit

365

(402

)

NET INCOME

28,979

15,947

Net loss attributable to noncontrolling interests

16

7

Net income attributable to redeemable noncontrolling interests

(4,086

)

-

NET INCOME ATTRIBUTABLE TO GENESIS ENERGY, L.P.

$

24,909

$

15,954

Less: Accumulated distributions attributable to Class A Convertible

Preferred Units

(18,684

)

(18,415

)

NET INCOME (LOSS) AVAILABLE TO COMMON UNITHOLDERS

$

6,225

$

(2,461

)

NET INCOME (LOSS) PER COMMON UNIT: Basic and Diluted

$

0.05

($

0.02

)

WEIGHTED AVERAGE OUTSTANDING COMMON UNITS: Basic and Diluted

122,579

122,579

GENESIS ENERGY, L.P.

OPERATING DATA - UNAUDITED

(in thousands, except number of units)

Three Months Ended March 31,

2020

2019

Offshore Pipeline Transportation Segment Crude oil

pipelines (barrels/day unless otherwise noted): CHOPS

242,182

241,754

Poseidon (1)

279,181

253,469

Odyssey (1)

149,440

151,877

GOPL

7,249

8,337

Offshore crude oil pipelines total

678,052

655,437

Natural gas transportation volumes (MMBBtus/d) (1)

416,564

419,999

Sodium Minerals and Sulfur Services Segment NaHS (dry

short tons sold)

30,082

35,743

Soda Ash volumes (short tons sold)

822,247

870,529

NaOH (caustic soda) volumes (dry short tons sold) (2)

16,303

20,802

Onshore Facilities and Transportation Segment Crude

oil pipelines (barrels/day): Texas

84,499

42,981

Jay

10,013

11,483

Mississippi

6,409

5,916

Louisiana (3)

162,736

95,824

Onshore crude oil pipelines total

263,657

156,204

Free State- CO2 Pipeline (Mcf/day)

134,834

105,991

Crude oil and petroleum products sales (barrels/day)

26,118

33,752

Rail unload volumes (barrels/day) (4)

94,040

85,090

Marine Transportation Segment Inland Fleet

Utilization Percentage(5)

93.4

%

96.6

%

Offshore Fleet Utilization Percentage(5)

99.4

%

96.3

%

(1)

Volumes for our equity method investees

are presented on a 100% basis. We own 64% of Poseidon and 29% of

Odyssey, as well as equity interests in various other entities.

(2)

Caustic soda sales volumes include volumes

sold from our Alkali and Refinery Services businesses.

(3)

Total daily volume for the three months

ended March 31, 2020 includes 44,322 barrels per day of

intermediate refined products associated with our Port of Baton

Rouge Terminal pipelines. Total daily volume for the three months

ended March 31, 2019 includes 52,302 barrels per day of

intermediate refined products associated with our Port of Baton

Rouge Terminal pipelines.

(4)

Indicates total barrels for which fees

were charged for unloading at all rail facilities.

(5)

Utilization rates are based on a 365 day

year, as adjusted for planned downtime and dry-docking.

GENESIS ENERGY, L.P.

CONDENSED CONSOLIDATED BALANCE SHEETS -

UNAUDITED

March 31,2020 December 31,2019

ASSETS Cash, cash equivalents

and restricted cash

$

41,509

$

56,405

Accounts receivable - trade, net

315,645

417,002

Inventories

70,161

65,137

Other current assets

69,565

54,530

Total current assets

496,880

593,074

Fixed assets and mineral leaseholds, net

4,811,353

4,850,300

Investment in direct financing leases, net

105,251

107,702

Equity investees

327,942

334,523

Intangible assets, net

136,071

138,927

Goodwill

301,959

301,959

Right of use assets, net

175,889

177,071

Other assets, net

79,113

94,085

Total assets

$

6,434,458

$

6,597,641

LIABILITIES AND CAPITAL Accounts payable - trade

151,868

218,737

Accrued liabilities

172,941

196,758

Total current liabilities

324,809

415,495

Senior secured credit facility

977,400

959,300

Senior unsecured notes, net of debt issuance costs

2,463,171

2,469,937

Deferred tax liabilities

12,125

12,640

Other long-term liabilities

366,281

393,850

Total liabilities

4,143,786

4,251,222

Mezzanine capital: Class A convertible preferred units

790,115

790,115

Redeemable noncontrolling interests

129,219

125,133

Partners' capital: Common unitholders

1,382,126

1,443,320

Accumulated other comprehensive loss

(8,431

)

(8,431

)

Noncontrolling interests

(2,357

)

(3,718

)

Total partners' capital

1,371,338

1,431,171

Total liabilities, mezzanine capital and partners' capital

$

6,434,458

$

6,597,641

Common Units Data: Total common units outstanding

122,579,218

122,579,218

GENESIS ENERGY, L.P.

RECONCILIATION OF NET INCOME TO SEGMENT

MARGIN - UNAUDITED

(in thousands)

Three Months Ended

March 31,

2020

2019

Net income attributable to Genesis Energy, L.P.

$

24,909

$

15,954

Corporate general and administrative expenses

6,492

11,100

Depreciation, depletion, amortization and accretion

75,978

79,937

Interest expense, net

54,965

55,701

Income tax expense (benefit)

(365

)

402

Equity compensation adjustments

-

65

Provision for leased items no longer in use

(130

)

(190

)

Redeemable noncontrolling interest redemption value adjustments (1)

4,086

-

Plus (minus) Select Items, net

3,353

10,595

Segment Margin (2)

$

169,288

$

173,564

(1)

Includes distributions paid in kind (PIK)

attributable to the period and accretion on the redemption

feature.

(2)

See definition of Segment Margin later in

this press release.

GENESIS ENERGY, L.P.

RECONCILIATIONS OF NET INCOME TO

ADJUSTED EBITDA AND AVAILABLE CASH BEFORE RESERVES-

UNAUDITED

(in thousands)

Three Months Ended March 31,

2020

2019

(in thousands)

Net income attributable to Genesis Energy, L.P.

$

24,909

$

15,954

Interest expense, net

54,965

55,701

Income tax (benefit) expense

(365

)

402

Depreciation, depletion, amortization, and accretion

75,978

79,937

EBITDA

155,487

151,994

Redeemable noncontrolling interest redemption value adjustments (1)

4,086

-

Plus (minus) Select Items, net

4,806

12,016

Adjusted EBITDA

164,379

164,010

Maintenance capital utilized(2)

(8,800

)

(6,125

)

Interest expense, net

(54,965

)

(55,701

)

Cash tax expense

(150

)

(150

)

Cash distributions to preferred unitholders(3)

(18,684

)

(6,138

)

Available Cash before Reserves(4)

$

81,780

$

95,896

(1)

Includes PIK distributions attributable to

the period and accretion on the redemption feature.

(2)

Maintenance capital expenditures in the

2020 Quarter and 2019 Quarter were $20.6 million and $18.0 million,

respectively. Our maintenance capital expenditures are principally

associated with our alkali and marine transportation

businesses.

(3)

Distributions to preferred unitholders

that is attributable to the 2020 Quarter are payable on May 15,

2020 to unitholders of record at close of business on May 1,

2020.

(4)

Represents the Available Cash before

Reserves to common unitholders.

GENESIS ENERGY, L.P.

RECONCILIATION OF NET CASH FLOWS FROM

OPERATING ACTIVITIES TO ADJUSTED EBITDA - UNAUDITED

(in thousands)

Three Months Ended March 31,

2020

2019

Cash Flows from Operating Activities

$

89,552

$

114,021

Adjustments to reconcile net cash flow provided by operating

activities to Adjusted EBITDA: Interest Expense, net

54,965

55,701

Amortization and write-off of debt issuance costs and discount

(11,527

)

(2,682

)

Effects of available cash from equity method investees not included

in operating cash flows

7,060

5,425

Net effect of changes in components of operating assets and

liabilities

(7,534

)

(3,200

)

Non-cash effect of long-term incentive compensation plans

5,027

(1,702

)

Expenses related to acquiring or constructing growth capital assets

-

117

Differences in timing of cash receipts for certain contractual

arrangements (1)

4,490

(2,287

)

Loss on debt extinguishment (2)

23,480

-

Other items, net

(1,134

)

(1,383

)

Adjusted EBITDA

$

164,379

$

164,010

(1)

Includes the difference in timing of cash

receipts from customers during the period and the revenue we

recognize in accordance with GAAP on our related contracts. For

purposes of our Non-GAAP measures, we add those amounts in the

period of payment and deduct them in the period in which GAAP

recognizes them.

(2)

Includes our transaction costs associated

with the tender of $527.9 million and redemption of $222.1 million

of our 2022 Notes in the first quarter of 2020, along with the

write-off of the unamortized issuance costs and discount associated

with these notes.

GENESIS ENERGY, L.P.

ADJUSTED DEBT-TO-ADJUSTED CONSOLIDATED

EBITDA RATIO - UNAUDITED

(in thousands)

March 31, 2020 Senior secured credit facility

$

977,400

Senior unsecured notes

2,463,171

Less: Outstanding inventory financing sublimit borrowings

(7,700

)

Less: Cash and cash equivalents

(3,983

)

Adjusted Debt (1)

$

3,428,888

Pro Forma LTM March 31, 2020 Adjusted Consolidated EBITDA

(per our senior secured credit facility) (2)

$

668,965

Adjusted Debt-to-Adjusted Consolidated EBITDA 5.13X

(1)

We define Adjusted Debt as the amounts

outstanding under our senior secured credit facility and senior

unsecured notes (including any unamortized premiums or discounts)

less the amount outstanding under our inventory financing sublimit,

less cash and cash equivalents on hand at the end of the period

from our restricted subsidiaries.

(2)

Adjusted Consolidated EBITDA for the

four-quarter period ending with the most recent quarter, as

calculated under our senior secured credit facility.

This press release includes forward-looking statements as

defined under federal law. Although we believe that our

expectations are based upon reasonable assumptions, we can give no

assurance that our goals will be achieved. Actual results may vary

materially. All statements, other than statements of historical

facts, included in this press release that address activities,

events or developments that we expect, believe or anticipate will

or may occur in the future, including but not limited to statements

relating to future financial and operating results, our

expectations regarding the potential impact of the COVID-19

pandemic, and our strategy and plans, are forward-looking

statements, and historical performance is not necessarily

indicative of future performance. Those forward-looking statements

rely on a number of assumptions concerning future events and are

subject to a number of uncertainties, factors and risks, many of

which are outside our control, that could cause results to differ

materially from those expected by management. Such risks and

uncertainties include, but are not limited to, weather, political,

economic and market conditions, including a decline in the price

and market demand for products (which may be affected by the

actions of OPEC and other oil exporting nations), the outbreak of

disease (including COVID-19), the timing and success of business

development efforts and other uncertainties, and the realized

benefits of the preferred equity investment in Alkali Holdings by

affiliates of GSO Capital Partners LP or our ability to comply with

the Granger transaction agreements and maintain control and

ownership of our Alkali Business. Those and other applicable

uncertainties, factors and risks that may affect those

forward-looking statements are described more fully in our Annual

Report on Form 10-K for the year ended December 31, 2019 filed with

the Securities and Exchange Commission and other filings, including

our Current Reports on Form 8-K and Quarterly Reports on Form 10-Q.

We undertake no obligation to publicly update or revise any

forward-looking statement.

NON-GAAP MEASURES

This press release and the accompanying schedules include

non-generally accepted accounting principle (non-GAAP) financial

measures of Adjusted EBITDA and total Available Cash before

Reserves. In this press release, we also present total Segment

Margin as if it were a non-GAAP measure. Our Non-GAAP measures may

not be comparable to similarly titled measures of other companies

because such measures may include or exclude other specified items.

The accompanying schedules provide reconciliations of these

non-GAAP financial measures to their most directly comparable

financial measures calculated in accordance with generally accepted

accounting principles in the United States of America (GAAP). Our

non-GAAP financial measures should not be considered (i) as

alternatives to GAAP measures of liquidity or financial performance

or (ii) as being singularly important in any particular context;

they should be considered in a broad context with other

quantitative and qualitative information. Our Available Cash before

Reserves, Adjusted EBITDA and total Segment Margin measures are

just three of the relevant data points considered from time to

time.

When evaluating our performance and making decisions regarding

our future direction and actions (including making discretionary

payments, such as quarterly distributions) our board of directors

and management team have access to a wide range of historical and

forecasted qualitative and quantitative information, such as our

financial statements; operational information; various non-GAAP

measures; internal forecasts; credit metrics; analyst opinions;

performance, liquidity and similar measures; income; cash flow; and

expectations for us, and certain information regarding some of our

peers. Additionally, our board of directors and management team

analyze, and place different weight on, various factors from time

to time. We believe that investors benefit from having access to

the same financial measures being utilized by management, lenders,

analysts and other market participants. We attempt to provide

adequate information to allow each individual investor and other

external user to reach her/his own conclusions regarding our

actions without providing so much information as to overwhelm or

confuse such investor or other external user.

AVAILABLE CASH BEFORE RESERVES

Purposes, Uses and Definition

Available Cash before Reserves, also referred to as

distributable cash flow, is a quantitative standard used throughout

the investment community with respect to publicly traded

partnerships and is commonly used as a supplemental financial

measure by management and by external users of financial statements

such as investors, commercial banks, research analysts and rating

agencies, to aid in assessing, among other things:

(1)

the financial performance of our

assets;

(2)

our operating performance;

(3)

the viability of potential projects,

including our cash and overall return on alternative capital

investments as compared to those of other companies in the

midstream energy industry;

(4)

the ability of our assets to generate cash

sufficient to satisfy certain non-discretionary cash requirements,

including interest payments and certain maintenance capital

requirements; and

(5)

our ability to make certain discretionary

payments, such as distributions on our preferred and common units,

growth capital expenditures, certain maintenance capital

expenditures and early payments of indebtedness.

We define Available Cash before Reserves ("Available Cash before

Reserves") as Adjusted EBITDA as adjusted for certain items, the

most significant of which in the relevant reporting periods have

been the sum of maintenance capital utilized, net cash interest

expense, cash tax expense, and cash distributions paid to our Class

A convertible preferred unitholders.

Disclosure Format Relating to Maintenance Capital

We use a modified format relating to maintenance capital

requirements because our maintenance capital expenditures vary

materially in nature (discretionary vs. non-discretionary), timing

and amount from time to time. We believe that, without such

modified disclosure, such changes in our maintenance capital

expenditures could be confusing and potentially misleading to users

of our financial information, particularly in the context of the

nature and purposes of our Available Cash before Reserves measure.

Our modified disclosure format provides those users with

information in the form of our maintenance capital utilized measure

(which we deduct to arrive at Available Cash before Reserves). Our

maintenance capital utilized measure constitutes a proxy for

non-discretionary maintenance capital expenditures and it takes

into consideration the relationship among maintenance capital

expenditures, operating expenses and depreciation from period to

period.

Maintenance Capital Requirements

Maintenance Capital Expenditures

Maintenance capital expenditures are capitalized costs that are

necessary to maintain the service capability of our existing

assets, including the replacement of any system component or

equipment which is worn out or obsolete. Maintenance capital

expenditures can be discretionary or non-discretionary, depending

on the facts and circumstances.

Initially, substantially all of our maintenance capital

expenditures were (a) related to our pipeline assets and similar

infrastructure, (b) non-discretionary in nature and (c) immaterial

in amount as compared to our Available Cash before Reserves

measure. Those historical expenditures were non-discretionary (or

mandatory) in nature because we had very little (if any) discretion

as to whether or when we incurred them. We had to incur them in

order to continue to operate the related pipelines in a safe and

reliable manner and consistently with past practices. If we had not

made those expenditures, we would not have been able to continue to

operate all or portions of those pipelines, which would not have

been economically feasible. An example of a non-discretionary (or

mandatory) maintenance capital expenditure would be replacing a

segment of an old pipeline because one can no longer operate that

pipeline safely, legally and/or economically in the absence of such

replacement.

As we exist today, a substantial amount of our maintenance

capital expenditures from time to time will be (a) related to our

assets other than pipelines, such as our marine vessels, trucks and

similar assets, (b) discretionary in nature and (c) potentially

material in amount as compared to our Available Cash before

Reserves measure. Those expenditures will be discretionary (or

non-mandatory) in nature because we will have significant

discretion as to whether or when we incur them. We will not be

forced to incur them in order to continue to operate the related

assets in a safe and reliable manner. If we chose not make those

expenditures, we would be able to continue to operate those assets

economically, although in lieu of maintenance capital expenditures,

we would incur increased operating expenses, including maintenance

expenses. An example of a discretionary (or non-mandatory)

maintenance capital expenditure would be replacing an older marine

vessel with a new marine vessel with substantially similar

specifications, even though one could continue to economically

operate the older vessel in spite of its increasing maintenance and

other operating expenses.

In summary, as we continue to expand certain non-pipeline

portions of our business, we are experiencing changes in the nature

(discretionary vs. non-discretionary), timing and amount of our

maintenance capital expenditures that merit a more detailed review

and analysis than was required historically. Management’s recently

increasing ability to determine if and when to incur certain

maintenance capital expenditures is relevant to the manner in which

we analyze aspects of our business relating to discretionary and

non-discretionary expenditures. We believe it would be

inappropriate to derive our Available Cash before Reserves measure

by deducting discretionary maintenance capital expenditures, which

we believe are similar in nature in this context to certain other

discretionary expenditures, such as growth capital expenditures,

distributions/dividends and equity buybacks. Unfortunately, not all

maintenance capital expenditures are clearly discretionary or

non-discretionary in nature. Therefore, we developed a measure,

maintenance capital utilized, that we believe is more useful in the

determination of Available Cash before Reserves. Our maintenance

capital utilized measure, which is described in more detail below,

constitutes a proxy for non-discretionary maintenance capital

expenditures and it takes into consideration the relationship among

maintenance capital expenditures, operating expenses and

depreciation from period to period.

Maintenance Capital Utilized

We believe our maintenance capital utilized measure is the most

useful quarterly maintenance capital requirements measure to use to

derive our Available Cash before Reserves measure. We define our

maintenance capital utilized measure as that portion of the amount

of previously incurred maintenance capital expenditures that we

utilize during the relevant quarter, which would be equal to the

sum of the maintenance capital expenditures we have incurred for

each project/component in prior quarters allocated ratably over the

useful lives of those projects/components.

Because we did not initially use our maintenance capital

utilized measure, our future maintenance capital utilized

calculations will reflect the utilization of solely those

maintenance capital expenditures incurred since December 31,

2013.

ADJUSTED EBITDA

Purposes, Uses and Definition

Adjusted EBITDA is commonly used as a supplemental financial

measure by management and by external users of financial statements

such as investors, commercial banks, research analysts and rating

agencies, to aid in assessing, among other things:

(1)

the financial performance of our assets

without regard to financing methods, capital structures or

historical cost basis;

(2)

our operating performance as compared to

those of other companies in the midstream energy industry, without

regard to financing and capital structure;

(3)

the viability of potential projects,

including our cash and overall return on alternative capital

investments as compared to those of other companies in the

midstream energy industry;

(4)

the ability of our assets to generate cash

sufficient to satisfy certain non-discretionary cash requirements,

including interest payments and certain maintenance capital

requirements; and

(5)

our ability to make certain discretionary

payments, such as distributions on our preferred and common units,

growth capital expenditures, certain maintenance capital

expenditures and early payments of indebtedness.

We define Adjusted EBITDA (“Adjusted EBITDA”) as earnings before

interest, taxes, depreciation and amortization (including

impairment, write-offs, accretion and similar items, often referred

to as EBITDA) after eliminating other non-cash revenues, expenses,

gains, losses and charges (including any loss on asset

dispositions), plus or minus certain other select items that we

view as not indicative of our core operating results (collectively,

"Select Items"). Although, we do not necessarily consider all of

our Select Items to be non-recurring, infrequent or unusual, we

believe that an understanding of these Select Items is important to

the evaluation of our core operating results. The most significant

Select Items in the relevant reporting periods are set forth

below.

The table below includes the Select Items discussed above as

applicable to the reconciliation of Adjusted EBITDA and Available

Cash before Reserves to net income:

Three Months Ended March 31,

2020

2019

I. Applicable to all Non-GAAP Measures Differences in timing

of cash receipts for certain contractual arrangements(1)

$

4,490

$

(2,287

)

Adjustment regarding direct financing leases(2)

2,238

2,028

Certain non-cash items: Unrealized losses (gains) on derivative

transactions excluding fair value hedges, net of changes in

inventory value(3)

(31,002

)

3,865

Loss on debt extinguishment (4)

23,480

-

Adjustment regarding equity investees(5)

6,406

4,828

Other

(2,259

)

2,161

Sub-total Select Items, net(6)

3,353

10,595

II. Applicable only to Adjusted EBITDA and Available Cash before

Reserves Certain transaction costs(7)

-

117

Equity compensation adjustments

-

(137

)

Other

1,453

1,441

Total Select Items, net(8)

$

4,806

$

12,016

(1)

Includes the difference in timing of cash

receipts from customers during the period and the revenue we

recognize in accordance with GAAP on our related contracts. For

purposes of our Non-GAAP measures, we add those amounts in the

period of payment and deduct them in the period in which GAAP

recognizes them.

(2)

Represents the net effect of adding cash

receipts from direct financing leases and deducting expenses

relating to direct financing leases.

(3)

The 2020 Quarter includes a $32.5 million

unrealized gain from the valuation of the embedded derivative

associated with our Class A Convertible Preferred units and the

2019 Quarter includes a $3.0 million unrealized loss from the

valuation of the embedded derivative.

(4)

Includes our transaction costs associated

with the tender of $527.9 million and redemption of $222.1 million

of our 2022 Notes in the first quarter of 2020, along with the

write-off of the unamortized issuance costs and discount associated

with these notes.

(5)

Represents the net effect of adding

distributions from equity investees and deducting earnings of

equity investees net to us.

(6)

Represents all Select Items applicable to

Segment Margin, Adjusted EBITDA and Available Cash before

Reserves.

(7)

Represents transaction costs relating to

certain merger, acquisition, transition, and financing transactions

incurred in acquisition activities.

(8)

Represents Select Items applicable to

Adjusted EBITDA and Available Cash before Reserves.

SEGMENT MARGIN

Our chief operating decision maker (our Chief Executive Officer)

evaluates segment performance based on a variety of measures

including Segment Margin, segment volumes where relevant and

capital investment. We define Segment Margin as revenues less

product costs, operating expenses, and segment general and

administrative expenses, after eliminating gain or loss on sale of

assets, plus or minus applicable Select Items. Although, we do not

necessarily consider all of our Select Items to be non-recurring,

infrequent or unusual, we believe that an understanding of these

Select Items is important to the evaluation of our core operating

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200506005353/en/

Genesis Energy, L.P. Ryan Sims SVP - Finance and Corporate

Development (713) 860-2521

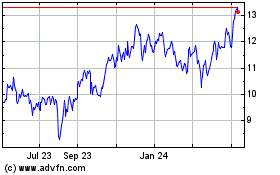

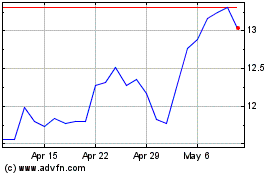

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Apr 2023 to Apr 2024