Genesis Energy, L.P. (NYSE: GEL) today announced its fourth

quarter results.

We generated the following financial results for the fourth

quarter of 2019:

- Net Income Attributable to Genesis Energy, L.P. of $22.4

million for the fourth quarter of 2019 compared to Net Loss

Attributable to Genesis Energy, L.P. of $24.8 million for the same

period in 2018.

- Cash Flows from Operating Activities of $50.6 million for the

fourth quarter of 2019 compared to $82.5 million for the same

period in 2018.

- Total Segment Margin in the fourth quarter of 2019 of $179.8

million.

- Available Cash before Reserves to common unitholders of $87.7

million for the fourth quarter of 2019, which provided 1.30X

coverage for the quarterly distribution of $0.55 per common unit

attributable to the fourth quarter.

- We declared cash distributions on our preferred units of

$0.7374 for each preferred unit, which equates to a cash

distribution of approximately $18.7 million and is reflected as a

reduction to Available Cash before Reserves to common

unitholders.

- Adjusted EBITDA of $167.6 million in the fourth quarter of

2019. Our bank leverage ratio, calculated consistent with our

credit agreement, is 5.11X as of December 31, 2019 and is discussed

further in this release.

Grant Sims, CEO of Genesis Energy, said, “For the quarter, our

diversified businesses in total performed slightly better than our

expectations, and we ended the year towards the high-end of our

revised annual guidance for Adjusted EBITDA.

In our offshore pipeline transportation segment, we saw strong

volumes across our platforms and pipelines as newer projects

continued to ramp and sub-sea tiebacks and infield drilling more

than offset any natural decline in our dedicated fields. We

continue to actively pursue and contract new developments which can

access our existing capacity and represent meaningful margin

contribution to us at minimal or no capital, such as BP’s Argos

platform, coming on in 2021, and Murphy’s King’s Quay platform,

coming on in 2022.

The offshore midstream infrastructure business is significantly

different than that in most onshore basins given, among other

things, its cost of entry. Additionally, our systems in the central

Gulf of Mexico have available capacity, and very economic capacity

expansions, that can offer new shippers firm capacity to shore with

the flexibility to go to multiple markets in either Louisiana or

Texas. Generally speaking, our rates per barrel in our new

contracts are going up, we have terms that are typically for the

life-of-lease (some 30 to 40 years), and we are able to include

annual escalators, which, due to the mechanics of compounding, tend

to flatten out the financial contributions over time, even as

volumes decline in the later contract years.

In our onshore facilities and transportation segment, we

experienced a ramp in crude-by-rail volumes throughout the quarter

as a result of curtailment relief granted in Alberta, Canada and we

exited the year averaging approximately one train a day. We have

experienced a continued ramp above that in January and February,

and would otherwise anticipate these levels at least through March.

The provincial government of Alberta is scheduled to review its

self-imposed production curtailments policies in the March/April

2020 time frame. Additionally, the practical capacity of existing

pipelines out of Canada increases in the second and third quarter

as less diluent is needed to move the same amount of bitumen due to

higher ambient temperatures. As a result of these two items, we

could possibly see a reduction in volumes mid-year before a

reasonably expected re-ramp into the end of 2020. We also saw

increased volumes in the fourth quarter on our Texas pipeline.

Otherwise, the rest of our businesses reported in onshore

facilities and transportation segment performed consistent with our

expectations.

Our marine transportation segment continued to perform as

expected and reported increased segment margin for the eighth

consecutive quarter. We experienced strong utilization and

improving day rates across our inland and offshore fleets. IMO 2020

appears to be having a positive impact on our inland, black oil

barges as refiners need to get the intermediate refined barrel to

the right location. Upwards of 90% of our barges are typically

contracted to provide services to refiners moving their

intermediate products from one location to another.

We see improving fundamentals into 2020 for both fleets. The

Army Corps of Engineers is undertaking significant repair and

maintenance of locks on the Mississippi River and its major

tributaries this summer. As a result, we anticipate a near-term

reduction in “practical supply” as movements in and out of such

region take longer and are less efficient than normal. As a result,

demand and day-rates in our brown water fleet should improve. We

are also seeing increased demand for our blue water vessels. Our

clean fleet is benefiting from certain competitive dynamics on the

East Coast as well as more required product movements because of

the closure of refining capacity in Philadelphia. Our larger

offshore vessels are benefiting from increased movements of crude

oil as more and more barrels reach the Gulf Coast, where the Gulf

Coast refiners basically have limited incremental demand for those

types of barrels.

In our sodium minerals and sulfur services segment, our legacy

refinery services business performed as expected in the quarter,

and importantly it appears most of the production and market

interruptions it faced in the second half of 2019 are largely

behind us as we move into 2020.

Turning to sodium minerals, as we mentioned on our third quarter

call, we were then seeing signs of slowdown in the demand for soda

ash globally, particularly in Asia. We believed this was tied

mainly to the ongoing economic uncertainty around the US-China

trade war, but also to decelerating GDP resulting from tightening

monetary policies by most central banks in early 2019, which

policies appear to have been reversed in the second half of last

year.

Nonetheless, this demand trend accelerated into the end of the

quarter as customers continued to have excess inventory of soda ash

and their respective finished goods, like flat glass. At the same

time, it appears that Genesis and the other domestic producers made

more soda ash for export in the fourth quarter compared to earlier

quarters. As a result, price fell in the export markets to clear

this demand/supply imbalance, and we experienced our lowest quarter

of financial contribution from our soda ash operations, of just

over $38 million, since we acquired the business in 2017.

Unfortunately, most contract prices for a subsequent year are

negotiated in the prior December and January of that year. Even

though most domestic prices are set on a multi-year basis, many

subject to caps and collars, our export contracts and negotiated

prices are much shorter in duration. Given the dynamics going into

the price negotiations described above, we expect export prices,

which represent approximately half of our total annual sales, to be

significantly lower in 2020 than they have been in the prior two

and half years since we acquired the operations. Experience has

shown, because of the nature of the mix of contracts, it can take

anywhere from 4-8 quarters for the underlying fundamentals to get

prices back on historical trend. We would point out that the

effects of the coronavirus on global demand and supply are not yet

quantifiable, and this exogenous event could impact that

historically observed time interval.

Having said that, we continue to believe in the long term

fundamentals of the business and the cost competitive advantage

natural soda ash enjoys over synthetically produced product. We

remain confident that the market will need, and we can easily and

profitably place, the incremental tons coming from our Granger

expansion beginning in mid-2022.

When we purchased this business, we analyzed the previous twelve

years of its financial history back through 2006, including how it

performed during the Great Recession. The annual EBITDA ranged from

approximately $120 million to $190 million, with an average of

approximately $160 million. Our view then was, and still is, if

around $120 million is the downside on a $1.2 billion acquisition,

net of the working capital acquired, we would make that investment

anytime, especially for a business that has over 70 years of

operating history and a remaining reserve life of potentially

300-400 years.

Looking forward into 2020, we see Adjusted EBITDA coming in a

range of $640-$680 million. This assumes the margin contribution

from our soda ash operations is some $35-$45 million below the $165

million it earned this past year.

As you can therefore surmise, we feel reasonably positive about

our other businesses and their prospects. We would reiterate we

expect the offshore pipeline transportation segment to be $20-$30

million above 2019 levels. The marine transportation segment is

budgeted to improve some $2-$6 million and our legacy refinery

services business could be up a similar amount. Finally, the

onshore facilities and transportation segment is forecasted to be

flat to up $10 million, but such improved results are primarily

dependent on the economics of crude-by-rail out of Canada staying

constructive throughout this year.

As we analyze our financials, we identify recurring cash

obligations for 2020 totaling approximately $620 million, which

includes, among others, cash taxes, interest on bank debt and

bonds, all maintenance capital spent, preferred cash distributions

at the current $0.7374 per unit quarterly payout, and common

distributions at the current $0.55 per unit quarterly payout. At

this point, we have budgeted approximately $25 million of growth

capital outside of the Granger expansion, which dollars are paid

via the redeemable preferred structure at the soda ash operational

level, which requires no cash payments from Genesis during the 36

month estimated construction period. We do have approximately $20

million of non-recurring asset retirement obligations (“ARO”)

budgeted in 2020. However, we reasonably expect to be able to

monetize one of the retired assets by the end of this year or

certainly sometime in 2021 for a multiple of these 2020 ARO

expenditures.

As we look beyond 2020, we have a very good line of sight on

significantly improving financial performance. First, we would

reasonably expect our existing soda ash operations to return to

trend and add some $40-$50 million a year by 2022 at the latest.

Argos is scheduled to come on-line in the second half of 2021,

which represents potentially $30-$40 million of incremental

annualized EBITDA. King's Quay is scheduled to come on-line in the

first half of 2022, which represents potentially $50-$60 million of

incremental annualized EBITDA. Finally, assuming a return to trend

on soda ash pricing, the Granger expansion is expected to add

potentially $60 million of incremental annualized EBITDA beginning

in mid-2022. Therefore, given a starting point of being very close

to cash flow neutral this year and taking into account the

meaningful new EBITDA discussed above, we believe we will be able

to de-lever our balance sheet and restore and maintain our

financial flexibility to capitalize on future discretionary

opportunities, without ever losing our commitment to safe, reliable

and responsible operations."

1 EBITDA and Adjusted EBITDA are non-GAAP financial

measures. We are unable to provide a reconciliation of the

forward-looking EBITDA and Adjusted EBITDA projections contained in

this press release to their respective most directly comparable

GAAP financial measure because the information necessary for

quantitative reconciliations of the EBITDA and Adjusted EBITDA

measures to their respective most directly comparable GAAP

financial measures is not available to us without unreasonable

efforts. The probable significance of providing these

forward-looking EBITDA and Adjusted EBITDA measures without the

directly comparable GAAP financial measures is that such GAAP

financial measures may be materially different from the

corresponding non-GAAP financial measures.

Financial Results

Segment Margin

Variances between the fourth quarter of 2019 (the “2019

Quarter”) and the fourth quarter of 2018 (the “2018 Quarter”) in

these components are explained below.

Segment margin results for the 2019 Quarter and 2018 Quarter

were as follows:

Three Months Ended December

31,

2019

2018

(in thousands) Offshore pipeline transportation

$

86,045

$

69,276

Sodium minerals and sulfur services

52,306

67,613

Onshore facilities and transportation

25,060

36,296

Marine transportation

16,356

12,272

Total Segment Margin

$

179,767

$

185,457

Offshore pipeline transportation Segment Margin for the 2019

Quarter increased $16.8 million, or 24%, from the 2018 Quarter,

primarily due to higher volumes on our crude oil pipeline systems.

These increased volumes are the result of (i) the ramping of

volumes from the Buckskin and Hadrian North production fields to

expected levels in the second half of 2019, both of which are fully

dedicated to our SEKCO pipeline and further downstream, to our

Poseidon oil pipeline system, and had first oil flow in 2019, and

(ii) the continued receipt of volumes on our CHOPS and Poseidon

pipeline systems due to deliveries from a third party pipeline that

has insufficient capacity to deliver its committed volumes to

shore. During the second half of 2019, we entered into agreements

to move forty thousand barrels per day on CHOPS and twenty thousand

barrels per day on Poseidon that are delivered to us by a

third-party pipeline that has insufficient capacity. The agreements

include ship-or-pay provisions, have terms as long as five years

and required no additional capital on our part.

Sodium minerals and sulfur services Segment Margin for the 2019

Quarter decreased $15.3 million, or 23%, from the 2018 Quarter.

This decrease is primarily due to lower NaHS volumes during the

2019 Quarter in our refinery services business and weakened export

pricing in our Alkali Business due to supply and demand imbalance.

The lower volumes in our refinery services business are

attributable to supply chain disruptions some of our customers

experienced during the 2019 Quarter along with production issues at

several of our host refineries. Soda ash volumes slightly increased

in the 2019 Quarter relative to the 2018 Quarter, but were offset

by the lower pricing we received on our ANSAC volumes, which

negatively impacted margin during the 2019 Quarter.

Onshore facilities and transportation Segment Margin for the

2019 Quarter decreased $11.2 million, or 31%, from the 2018

Quarter. This decrease is primarily due to lower crude oil pipeline

and rail unload volumes during the 2019 Quarter. The lower volumes

in the 2019 Quarter are primarily due to the continued effects of

production curtailments by the Canadian government during 2019

impacting our Louisiana pipeline and rail unload volumes, and our

lower rail unload volumes at our Raceland facility in the 2019

Quarter. This was partially offset by our increased volumes on our

Texas system during the 2019 Quarter, which led to increased margin

contribution as our main customer utilized all of its prepaid

transportation credits prior to December 31, 2019.

Marine transportation Segment Margin for the 2019 Quarter

increased $4.1 million, or 33%, from the 2018 Quarter. This

increase in Segment Margin is primarily attributable to higher

average day rates in the inland and offshore markets that have been

advantageous for both spot and term contracts, while our

utilization was relatively flat between the 2019 Quarter and 2018

Quarter. While we have seen a slight uptick in day rates, we have

continued to enter into short term contracts (less than a year) in

both the inland and offshore markets because we believe the day

rates currently being offered by the market are still near cyclical

lows. This was partially offset by an increase in operating costs

during the 2019 Quarter relative to the 2018 Quarter due to an

increase in dry-docking costs in both our inland and offshore

fleet.

Other Components of Net Income

In the 2019 Quarter, we recorded Net Income Attributable to

Genesis Energy, L.P. of $22.4 million compared to Net Loss

Attributable to Genesis Energy, L.P. of $24.8 million in the 2018

Quarter. The 2018 Quarter was negatively impacted by impairment

expense of $120.3 million. The 2018 Quarter also included gains on

asset sales of $38.9 million primarily due to the closing of our

Powder River Basin asset sale during the period and $5.7 million

higher segment margin than the 2019 Quarter as discussed above,

which partially offset the impairment expense recorded.

Additionally, the 2019 Quarter included an unrealized loss of $9.3

million on the valuation of the embedded derivative associated with

our Class A Convertible Preferred Units recorded in other income

(expense), compared to an unrealized gain of $8.6 million recorded

during the 2018 Quarter.

Earnings Conference Call

We will broadcast our Earnings Conference Call on Wednesday,

February 19, 2020, at 9 a.m. Central time (10 a.m. Eastern time).

This call can be accessed at www.genesisenergy.com. Choose the

Investor Relations button. For those unable to attend the live

broadcast, a replay will be available beginning approximately one

hour after the event and remain available on our website for 30

days. There is no charge to access the event.

Genesis Energy, L.P. is a diversified midstream energy master

limited partnership headquartered in Houston, Texas. Genesis’

operations include offshore pipeline transportation, sodium

minerals and sulfur services, onshore facilities and transportation

and marine transportation. Genesis’ operations are primarily

located in Texas, Louisiana, Arkansas, Mississippi, Alabama,

Florida, Wyoming and the Gulf of Mexico.

GENESIS ENERGY, L.P.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS - UNAUDITED

(in thousands, except per unit

amounts)

Three Months Ended December

31,

Year Ended December 31,

2019

2018

2019

2018

REVENUES

$

604,329

$

689,296

$

2,480,820

$

2,912,770

COSTS AND EXPENSES: Costs of sales and operating

expenses

441,507

511,931

1,835,624

2,278,416

General and administrative expenses

12,590

17,486

52,687

66,898

Depreciation, depletion and amortization

79,293

74,401

319,806

313,190

Impairment expense

-

120,260

-

126,282

Gain on sale of assets

-

(38,901

)

-

(42,264

)

OPERATING INCOME

70,939

4,119

272,703

170,248

Equity in earnings of equity investees

16,611

15,238

56,484

43,626

Interest expense

(53,559

)

(56,327

)

(219,440

)

(229,191

)

Other income (expense)

(9,332

)

8,627

(9,026

)

5,023

Net income attributable to redeemable noncontrolling interests

(1,961

)

-

(2,233

)

-

NET INCOME (LOSS) ATTRIBUTABLE TO GENESIS ENERGY, L.P.

$

22,368

$

(24,783

)

$

95,999

$

(6,075

)

Less: Accumulated distributions attributable to Class A Convertible

Preferred Units

(18,684

)

(18,021

)

(74,467

)

(69,801

)

NET INCOME (LOSS) AVAILABLE TO COMMON UNITHOLDERS

$

3,684

$

(42,804

)

$

21,532

$

(75,876

)

NET INCOME (LOSS) PER COMMON UNIT: Basic and Diluted

$

0.03

($

0.35

)

$

0.18

($

0.62

)

WEIGHTED AVERAGE OUTSTANDING COMMON UNITS: Basic and Diluted

122,579

122,579

122,579

122,579

GENESIS ENERGY, L.P.

OPERATING DATA - UNAUDITED

Three Months Ended December

31,

Year Ended December 31,

2019

2018

2019

2018

Offshore Pipeline Transportation Segment Crude oil

pipelines (barrels/day unless otherwise noted): CHOPS

234,989

202,008

234,301

202,121

Poseidon (1)

291,992

251,512

264,931

234,960

Odyssey (1)

132,441

131,088

144,785

115,239

GOPL

5,283

8,485

8,845

10,147

Offshore crude oil pipelines total

664,705

593,093

652,862

562,467

Natural gas transportation volumes (MMBBtus/d) (1)

365,424

421,104

400,770

432,261

Sodium Minerals and Sulfur Services Segment NaHS (dry

short tons sold)

29,367

36,125

126,443

150,671

Soda Ash volumes (short tons sold)

944,098

929,953

3,590,680

3,669,206

NaOH (caustic soda) volumes (dry short tons sold) (2)

18,756

22,917

78,927

110,107

Onshore Facilities and Transportation Segment Crude

oil pipelines (barrels/day): Texas

95,546

48,877

59,435

33,303

Jay

9,916

12,733

10,461

14,036

Mississippi

6,014

5,879

5,994

6,359

Louisiana (3)

125,417

165,426

117,130

159,754

Wyoming (4)

-

-

-

33,957

Onshore crude oil pipelines total

236,893

232,915

193,020

247,409

Free State- CO2 Pipeline (Mcf/day)

132,388

125,213

97,912

107,674

Crude oil and petroleum products sales (barrels/day)

28,973

37,617

31,681

45,845

Rail unload volumes (barrels/day) (5)

55,155

165,902

79,530

89,082

Marine Transportation Segment Inland Fleet

Utilization Percentage(6)

94.9

%

97.0

%

96.8

%

95.2

%

Offshore Fleet Utilization Percentage(6)

96.0

%

96.5

%

94.6

%

93.5

%

(1)

Volumes for our equity method investees

are presented on a 100% basis. We own 64% of Poseidon and 29% of

Odyssey, as well as equity interests in various other entities.

(2)

Caustic soda sales volumes include volumes

sold from our Alkali and Refinery Services businesses.

(3)

Total daily volume for the three and

twelve months ended December 31, 2019 includes 42,704 and 51,267

barrels per day, respectively, of intermediate refined products

associated with our Port of Baton Rouge Terminal pipelines. Total

daily volume for the three and twelve months ended December 31,

2018 includes 49,802 and 55,202 barrels per day, respectively, of

intermediate refined products associated with our Port of Baton

Rouge Terminal pipelines.

(4)

Our Powder River Basin midstream assets

were divested during the fourth quarter of 2018. Volumes presented

for the twelve months ended December 31, 2018 represent actual

throughput as of September 30, 2018.

(5)

Indicates total barrels for which fees

were charged for unloading at all rail facilities.

(6)

Utilization rates are based on a 365 day

year, as adjusted for planned downtime and dry-docking.

GENESIS ENERGY, L.P.

CONDENSED CONSOLIDATED BALANCE SHEETS -

UNAUDITED

(in thousands, except number of units)

December 31,2019 December 31,2018

ASSETS Cash, cash

equivalents, and restricted cash

$

56,405

$

10,300

Accounts receivable - trade, net

417,002

323,462

Inventories

65,137

73,531

Other current assets

54,530

35,986

Total current assets

593,074

443,279

Fixed assets and mineral leaseholds, net

4,850,300

4,977,514

Investment in direct financing leases, net

107,702

116,925

Equity investees

334,523

355,085

Intangible assets, net

138,927

162,602

Goodwill

301,959

301,959

Right of use assets, net

177,071

-

Other assets, net

94,085

121,707

Total assets

$

6,597,641

$

6,479,071

LIABILITIES AND CAPITAL Accounts payable - trade

218,737

127,327

Accrued liabilities

196,758

205,507

Total current liabilities

415,495

332,834

Senior secured credit facility

959,300

970,100

Senior unsecured notes, net of debt issuance costs

2,469,937

2,462,363

Deferred tax liabilities

12,640

12,576

Other long-term liabilities

393,850

259,198

Total liabilities

4,251,222

4,037,071

Mezzanine capital: Class A convertible preferred units

790,115

761,466

Redeemable noncontrolling interests

125,133

-

Partners' capital: Common unitholders

1,443,320

1,690,799

Accumulated other comprehensive income (loss)

(8,431

)

939

Noncontrolling interests

(3,718

)

(11,204

)

Total partners' capital

1,431,171

1,680,534

Total liabilities, mezzanine capital and partners' capital

$

6,597,641

$

6,479,071

Common Units Data: Total common units outstanding

122,579,218

122,579,218

GENESIS ENERGY, L.P.

RECONCILIATION OF NET INCOME(LOSS) TO

SEGMENT MARGIN - UNAUDITED

(in thousands)

Three Months Ended December

31,

2019

2018

Net income (loss) attributable to Genesis Energy, L.P.

$

22,368

$

(24,783

)

Corporate general and administrative expenses

12,877

16,997

Depreciation, depletion, amortization and accretion

74,865

70,816

Impairment expense

-

120,260

Interest expense, net

53,559

56,327

Income tax expense (benefit)

(1

)

584

Gain on sale of assets

-

(38,901

)

Equity compensation adjustments

-

(126

)

Provision for leased items no longer in use

(534

)

(434

)

Redeemable noncontrolling interest redemption value adjustments (1)

1,961

-

Plus(minus) Select Items, net

14,672

(15,283

)

Segment Margin (2)

$

179,767

$

185,457

(1)

Includes distributions paid in kind

attributable to the period and accretion on the redemption

feature.

(2)

See definition of Segment Margin later in

this press release.

GENESIS ENERGY, L.P.

RECONCILIATIONS OF NET INCOME (LOSS) TO

ADJUSTED EBITDA AND AVAILABLE CASH BEFORE RESERVES

UNAUDITED

(in thousands)

Three Months Ended December

31,

2019

2018

(in thousands)

Net income (loss) attributable to Genesis Energy, L.P.

$

22,368

$

(24,783

)

Interest expense, net

53,559

56,327

Income tax (benefit) expense

(1

)

584

Depreciation, depletion, amortization, and accretion

74,865

70,816

Impairment expense

-

120,260

EBITDA

150,791

223,204

Redeemable noncontrolling interest redemption value adjustments (1)

1,961

-

Plus (minus) Select Items, net

14,877

(10,024

)

Adjusted EBITDA, net (2)

167,629

213,180

Maintenance capital utilized(3)

(7,500

)

(5,755

)

Interest expense, net

(53,559

)

(56,327

)

Cash tax expense

(231

)

(301

)

Cash distributions to preferred unitholders(4)

(18,684

)

-

Available Cash before Reserves(5)

$

87,655

$

150,797

(1)

Includes distributions paid in kind

attributable to the period and accretion on the redemption

feature.

(2)

The 2018 Quarter includes a gain on sale

of assets of $38.9 million related to the sale of our Powder River

Basin midstream assets.

(3)

Maintenance capital expenditures in the

2019 Quarter and 2018 Quarter were $33.8 million and $27.3 million,

respectively. Our maintenance capital expenditures are principally

associated with our alkali and marine transportation

businesses.

(4)

Distributions to preferred unitholders

that is attributable to the 2019 Quarter were paid on February 14,

2020 to unitholders of record at the close of business on January

31, 2020.

(5)

Represents the Available Cash before

Reserves to common unitholders.

GENESIS ENERGY, L.P.

RECONCILIATION OF NET CASH FLOWS FROM

OPERATING ACTIVITIES TO ADJUSTED EBITDA - UNAUDITED

(in thousands)

Three Months Ended December

31,

2019

2018

Cash Flows from Operating Activities

$

50,558

$

82,475

Adjustments to reconcile net cash flow provided by operating

activities to Adjusted EBITDA: Interest Expense, net

53,559

56,327

Amortization of debt issuance costs and discount

(2,701

)

(2,676

)

Effects of available cash from equity method investees not included

in operating cash flows

2,918

2,937

Net effect of changes in components of operating assets and

liabilities

65,454

29,482

Non-cash effect of long-term incentive compensation expense

(2,198

)

(832

)

Expenses related to acquiring or constructing growth capital assets

333

2,970

Differences in timing of cash receipts for certain contractual

arrangements (1)

2,408

(1,358

)

Other items, net

(2,702

)

4,954

Gain on sale of assets

-

38,901

Adjusted EBITDA

$

167,629

$

213,180

(1)

Includes the difference in timing of cash

receipts from customers during the period and the revenue we

recognize in accordance with GAAP on our related contracts. For

purposes of our Non-GAAP measures, we add those amounts in the

period of payment and deduct them in the period in which GAAP

recognizes them.

GENESIS ENERGY, L.P.

ADJUSTED DEBT-TO-ADJUSTED CONSOLIDATED

EBITDA RATIO - UNAUDITED

(in thousands)

December 31, 2019 Senior secured credit facility

$

959,300

Senior unsecured notes

2,469,937

Less: Outstanding inventory financing sublimit borrowings

(4,300

)

Less: Cash and cash equivalents

(8,412

)

Adjusted Debt (1)

$

3,416,525

Pro Forma LTM December 31, 2019 Adjusted Consolidated EBITDA

(per our senior secured credit facility) (2)

$

668,595

Adjusted Debt-to-Adjusted Consolidated EBITDA 5.11X

(1)

We define Adjusted Debt as the amounts

outstanding under our senior secured credit facility and senior

unsecured notes (including any unamortized premiums or discounts)

less the amount outstanding under our inventory financing sublimit,

less cash and cash equivalents on hand at the end of the period

from our restricted subsidiaries.

(2)

Adjusted Consolidated EBITDA for the

four-quarter period ending with the most recent quarter, as

calculated under our senior secured credit facility.

This press release includes forward-looking statements as

defined under federal law. Although we believe that our

expectations are based upon reasonable assumptions, we can give no

assurance that our goals will be achieved. Actual results may vary

materially. All statements, other than statements of historical

facts, included in this press release that address activities,

events or developments that we expect, believe or anticipate will

or may occur in the future, including but not limited to statements

relating to future financial and operating results and our strategy

and plans, are forward-looking statements, and historical

performance is not necessarily indicative of future performance.

Those forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of

uncertainties, factors and risks, many of which are outside our

control, that could cause results to differ materially from those

expected by management. Such risks and uncertainties include, but

are not limited to, weather, political, economic and market

conditions, including a decline in the price and market demand for

products, the timing and success of business development efforts

and other uncertainties, and the realized benefits of the preferred

equity investment in Alkali Holdings by affiliates of GSO Capital

Partners LP or our ability to comply with the Granger transaction

agreements and maintain control and ownership of our Alkali

Business. Those and other applicable uncertainties, factors and

risks that may affect those forward-looking statements are

described more fully in our Annual Report on Form 10-K for the year

ended December 31, 2018 filed with the Securities and Exchange

Commission and other filings, including our Current Reports on Form

8-K and Quarterly Reports on Form 10-Q. We undertake no obligation

to publicly update or revise any forward-looking statement.

NON-GAAP MEASURES

This press release and the accompanying schedules include

non-generally accepted accounting principle (non-GAAP) financial

measures of Adjusted EBITDA and total Available Cash before

Reserves. In this press release, we also present total Segment

Margin as if it were a non-GAAP measure. Our Non-GAAP measures may

not be comparable to similarly titled measures of other companies

because such measures may include or exclude other specified items.

The accompanying schedules provide reconciliations of these

non-GAAP financial measures to their most directly comparable

financial measures calculated in accordance with generally accepted

accounting principles in the United States of America (GAAP). Our

non-GAAP financial measures should not be considered (i) as

alternatives to GAAP measures of liquidity or financial performance

or (ii) as being singularly important in any particular context;

they should be considered in a broad context with other

quantitative and qualitative information. Our Available Cash before

Reserves, Adjusted EBITDA and total Segment Margin measures are

just three of the relevant data points considered from time to

time.

When evaluating our performance and making decisions regarding

our future direction and actions (including making discretionary

payments, such as quarterly distributions) our board of directors

and management team have access to a wide range of historical and

forecasted qualitative and quantitative information, such as our

financial statements; operational information; various non-GAAP

measures; internal forecasts; credit metrics; analyst opinions;

performance, liquidity and similar measures; income; cash flow; and

expectations for us, and certain information regarding some of our

peers. Additionally, our board of directors and management team

analyze, and place different weight on, various factors from time

to time. We believe that investors benefit from having access to

the same financial measures being utilized by management, lenders,

analysts and other market participants. We attempt to provide

adequate information to allow each individual investor and other

external user to reach her/his own conclusions regarding our

actions without providing so much information as to overwhelm or

confuse such investor or other external user.

AVAILABLE CASH BEFORE RESERVES

Purposes, Uses and Definition

Available Cash before Reserves, also referred to as

distributable cash flow, is a quantitative standard used throughout

the investment community with respect to publicly traded

partnerships and is commonly used as a supplemental financial

measure by management and by external users of financial statements

such as investors, commercial banks, research analysts and rating

agencies, to aid in assessing, among other things:

(1) the financial performance of our assets;

(2) our operating performance; (3) the viability of potential

projects, including our cash and overall return on alternative

capital investments as compared to those of other companies in the

midstream energy industry; (4) the ability of our assets to

generate cash sufficient to satisfy certain non-discretionary cash

requirements, including interest payments and certain maintenance

capital requirements; and (5) our ability to make certain

discretionary payments, such as distributions on our preferred and

common units, growth capital expenditures, certain maintenance

capital expenditures and early payments of indebtedness.

We define Available Cash before Reserves ("Available Cash before

Reserves") as Adjusted EBITDA as adjusted for certain items, the

most significant of which in the relevant reporting periods have

been the sum of maintenance capital utilized, net cash interest

expense, cash tax expense, and cash distributions paid to our Class

A convertible preferred unitholders.

Disclosure Format Relating to Maintenance Capital

We use a modified format relating to maintenance capital

requirements because our maintenance capital expenditures vary

materially in nature (discretionary vs. non-discretionary), timing

and amount from time to time. We believe that, without such

modified disclosure, such changes in our maintenance capital

expenditures could be confusing and potentially misleading to users

of our financial information, particularly in the context of the

nature and purposes of our Available Cash before Reserves measure.

Our modified disclosure format provides those users with

information in the form of our maintenance capital utilized measure

(which we deduct to arrive at Available Cash before Reserves). Our

maintenance capital utilized measure constitutes a proxy for

non-discretionary maintenance capital expenditures and it takes

into consideration the relationship among maintenance capital

expenditures, operating expenses and depreciation from period to

period.

Maintenance Capital Requirements

Maintenance Capital Expenditures

Maintenance capital expenditures are capitalized costs that are

necessary to maintain the service capability of our existing

assets, including the replacement of any system component or

equipment which is worn out or obsolete. Maintenance capital

expenditures can be discretionary or non-discretionary, depending

on the facts and circumstances.

Initially, substantially all of our maintenance capital

expenditures were (a) related to our pipeline assets and similar

infrastructure, (b) non-discretionary in nature and (c) immaterial

in amount as compared to our Available Cash before Reserves

measure. Those historical expenditures were non-discretionary (or

mandatory) in nature because we had very little (if any) discretion

as to whether or when we incurred them. We had to incur them in

order to continue to operate the related pipelines in a safe and

reliable manner and consistently with past practices. If we had not

made those expenditures, we would not have been able to continue to

operate all or portions of those pipelines, which would not have

been economically feasible. An example of a non-discretionary (or

mandatory) maintenance capital expenditure would be replacing a

segment of an old pipeline because one can no longer operate that

pipeline safely, legally and/or economically in the absence of such

replacement.

As we exist today, a substantial amount of our maintenance

capital expenditures from time to time will be (a) related to our

assets other than pipelines, such as our marine vessels, trucks and

similar assets, (b) discretionary in nature and (c) potentially

material in amount as compared to our Available Cash before

Reserves measure. Those expenditures will be discretionary (or

non-mandatory) in nature because we will have significant

discretion as to whether or when we incur them. We will not be

forced to incur them in order to continue to operate the related

assets in a safe and reliable manner. If we chose not make those

expenditures, we would be able to continue to operate those assets

economically, although in lieu of maintenance capital expenditures,

we would incur increased operating expenses, including maintenance

expenses. An example of a discretionary (or non-mandatory)

maintenance capital expenditure would be replacing an older marine

vessel with a new marine vessel with substantially similar

specifications, even though one could continue to economically

operate the older vessel in spite of its increasing maintenance and

other operating expenses.

In summary, as we continue to expand certain non-pipeline

portions of our business, we are experiencing changes in the nature

(discretionary vs. non-discretionary), timing and amount of our

maintenance capital expenditures that merit a more detailed review

and analysis than was required historically. Management’s recently

increasing ability to determine if and when to incur certain

maintenance capital expenditures is relevant to the manner in which

we analyze aspects of our business relating to discretionary and

non-discretionary expenditures. We believe it would be

inappropriate to derive our Available Cash before Reserves measure

by deducting discretionary maintenance capital expenditures, which

we believe are similar in nature in this context to certain other

discretionary expenditures, such as growth capital expenditures,

distributions/dividends and equity buybacks. Unfortunately, not all

maintenance capital expenditures are clearly discretionary or

non-discretionary in nature. Therefore, we developed a measure,

maintenance capital utilized, that we believe is more useful in the

determination of Available Cash before Reserves. Our maintenance

capital utilized measure, which is described in more detail below,

constitutes a proxy for non-discretionary maintenance capital

expenditures and it takes into consideration the relationship among

maintenance capital expenditures, operating expenses and

depreciation from period to period.

Maintenance Capital Utilized

We believe our maintenance capital utilized measure is the most

useful quarterly maintenance capital requirements measure to use to

derive our Available Cash before Reserves measure. We define our

maintenance capital utilized measure as that portion of the amount

of previously incurred maintenance capital expenditures that we

utilize during the relevant quarter, which would be equal to the

sum of the maintenance capital expenditures we have incurred for

each project/component in prior quarters allocated ratably over the

useful lives of those projects/components.

Because we did not initially use our maintenance capital

utilized measure, our future maintenance capital utilized

calculations will reflect the utilization of solely those

maintenance capital expenditures incurred since December 31,

2013.

ADJUSTED EBITDA

Purposes, Uses and Definition

Adjusted EBITDA is commonly used as a supplemental financial

measure by management and by external users of financial statements

such as investors, commercial banks, research analysts and rating

agencies, to aid in assessing, among other things:

(1) the financial performance of our assets

without regard to financing methods, capital structures or

historical cost basis; (2) our operating performance as compared to

those of other companies in the midstream energy industry, without

regard to financing and capital structure; (3) the viability of

potential projects, including our cash and overall return on

alternative capital investments as compared to those of other

companies in the midstream energy industry; (4) the ability of our

assets to generate cash sufficient to satisfy certain

non-discretionary cash requirements, including interest payments

and certain maintenance capital requirements; and (5) our ability

to make certain discretionary payments, such as distributions on

our preferred and common units, growth capital expenditures,

certain maintenance capital expenditures and early payments of

indebtedness.

We define Adjusted EBITDA (“Adjusted EBITDA”) as earnings before

interest, taxes, depreciation and amortization (including

impairment, write-offs, accretion and similar items, often referred

to as EBITDA) after eliminating other non-cash revenues, expenses,

gains, losses and charges (including any loss on asset

dispositions), plus or minus certain other select items that we

view as not indicative of our core operating results (collectively,

"Select Items"). Although, we do not necessarily consider all of

our Select Items to be non-recurring, infrequent or unusual, we

believe that an understanding of these Select Items is important to

the evaluation of our core operating results. The most significant

Select Items in the relevant reporting periods are set forth

below.

The table below includes the Select Items discussed above as

applicable to the reconciliation of Adjusted EBITDA and Available

Cash before Reserves to net income(loss):

Three Months Ended December

31,

2019

2018

I.

Applicable to all Non-GAAP Measures Differences in timing of cash

receipts for certain contractual arrangements(1)

$

2,408

$

(1,358

)

Adjustment regarding direct financing leases(2)

2,183

1,979

Certain non-cash items: Unrealized losses (gains) on derivative

transactions excluding fair value hedges, net of changes in

inventory value

8,394

(11,288

)

Adjustment regarding equity investees(3)

2,662

1,442

Other

(975

)

(6,058

)

Sub-total Select Items, net(4)

14,672

(15,283

)

II.

Applicable only to Adjusted EBITDA and Available Cash before

Reserves Certain transaction costs(5)

333

2,970

Equity compensation adjustments

-

(151

)

Other

(128

)

2,440

Total Select Items, net(6)

$

14,877

$

(10,024

)

(1)

Includes the difference in timing of cash

receipts from customers during the period and the revenue we

recognize in accordance with GAAP on our related contracts. For

purposes of our Non-GAAP measures, we add those amounts in the

period of payment and deduct them in the period in which GAAP

recognizes them.

(2)

Represents the net effect of adding cash

receipts from direct financing leases and deducting expenses

relating to direct financing leases.

(3)

Represents the net effect of adding

distributions from equity investees and deducting earnings of

equity investees net to us.

(4)

Represents all Select Items applicable to

Segment Margin, Adjusted EBITDA and Available Cash before

Reserves.

(5)

Represents transaction costs relating to

certain merger, acquisition, transition, and financing transactions

incurred in acquisition activities.

(6)

Represents Select Items applicable to

Adjusted EBITDA and Available Cash before Reserves.

SEGMENT MARGIN

Our chief operating decision maker (our Chief Executive Officer)

evaluates segment performance based on a variety of measures

including Segment Margin, segment volumes where relevant and

capital investment. We define Segment Margin as revenues less

product costs, operating expenses, and segment general and

administrative expenses, after eliminating gain or loss on sale of

assets, plus or minus applicable Select Items. Although, we do not

necessarily consider all of our Select Items to be non-recurring,

infrequent or unusual, we believe that an understanding of these

Select Items is important to the evaluation of our core operating

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200219005284/en/

Genesis Energy, L.P. Ryan Sims SVP - Finance and Corporate

Development (713) 860-2521

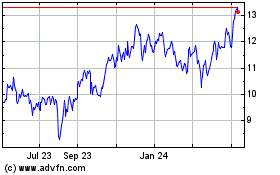

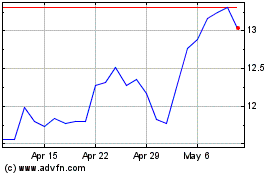

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Apr 2023 to Apr 2024