Genesis Energy, L.P. Prices Public Offering of Senior Notes

January 09 2020 - 8:53PM

Business Wire

Genesis Energy, L.P. (NYSE: GEL) today announced that it has

priced a public offering of $750,000,000 in aggregate principal

amount of 7.75% senior unsecured notes due 2028. The price to

investors will be 100% of the principal amount of the notes. The

notes will be co-issued with our subsidiary, Genesis Energy Finance

Corporation, and will be guaranteed, with certain exceptions, by

substantially all of our existing and future subsidiaries other

than our unrestricted subsidiaries. We intend to use the net

proceeds from the offering to fund the purchase price and accrued

and unpaid interest for all of our 6.750% senior unsecured notes

due 2022 that are validly tendered and accepted for payment in our

concurrent tender offer and the redemption price and accrued and

unpaid interest for any 6.750% senior unsecured notes due 2022 that

remain outstanding after the completion or termination of our

concurrent tender offer. The offering of the notes is expected to

settle and close on January 16, 2020, subject to customary closing

conditions.

BMO Capital Markets Corp., SMBC Nikko Securities America, Inc.,

Wells Fargo Securities, LLC, ABN AMRO Securities (USA) LLC, BBVA

Securities Inc., BNP Paribas Securities Corp., BofA Securities,

Capital One Securities, Inc., Citigroup Global Markets Inc., DNB

Markets, Inc., Fifth Third Securities, Inc., RBC Capital Markets,

Regions Securities LLC, and Scotia Capital (USA) Inc. are acting as

joint book-running managers for the offering. A copy of the final

prospectus supplement and accompanying base prospectus relating to

this offering, when available, may be obtained from:

BMO Capital Markets Corp. 3 Times Square New York, NY 10036

Attention: Syndicate Department Telephone: (212) 702-1882

SMBC Nikko Securities America, Inc. 277 Park Avenue New York, NY

10172 Tel: 888-868-6856 Attention: Debt Capital Markets

Wells Fargo Securities, LLC 550 S. Tryon Street, 5th Floor

Charlotte, NC 28202 Attn: Leveraged Syndicate

ABN AMRO Securities (USA) LLC 100 Park Avenue - 17th Floor New

York, NY 10017 USA Attn: Adam Lemp

BBVA Securities Inc. 1345 6th Avenue New York, NY 10105

BNP Paribas Securities Corp. 787 Seventh Avenue New York, NY

10019 Attention: Syndicate Desk Tel: 212-841-2871

BofA Securities NC1-004-03-43 200 North College Street 3rd

floor, Charlotte NC 28255-0001 Attn: Prospectus Department Email:

dg.prospectus_requests@bofa.com

Capital One Securities, Inc. 201 St. Charles Ave., Suite 1830

New Orleans, Louisiana 70170 Attention: Gabrielle Halprin

Citigroup Global Markets Inc. Broadridge Financial Solutions

1155 Long Island Avenue Edgewood, New York 11717

DNB Markets, Inc. 200 Park Avenue, 31st floor New York, NY

10166

Fifth Third Securities, Inc. 38 Fountain Square Plaza

Cincinnati, OH 45263 Attn: Syndicate Department Tel:

866-531-5353

RBC Capital Markets Attn: HY Capital Markets 200 Vesey St – 8th

Floor New York, NY 10281

Regions Securities LLC 1180 West Peachtree St. NW Suite 1400

Atlanta, GA 30309 Attention: Debt Capital Markets Telephone: (704)

940-5066

Scotia Capital (USA) Inc. 250 Vesey Street New York, New York

10281

You may also obtain these documents for free, when they are

available, by visiting the SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy any securities nor shall there be

any sale of these securities in any state or jurisdiction in which

such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction. The offer is being made only through the

prospectus supplement and accompanying base prospectus, each of

which is part of our effective shelf registration statement on Form

S-3 previously filed with the Securities and Exchange

Commission.

Genesis Energy, L.P. is a diversified midstream energy master

limited partnership headquartered in Houston, Texas. Genesis’

operations include offshore pipeline transportation, sodium

minerals and sulfur services, onshore facilities and transportation

and marine transportation. Genesis’ operations are primarily

located in the Gulf Coast region of the United States, Wyoming and

the Gulf of Mexico.

This press release includes forward-looking statements as

defined under federal law. Although we believe that our

expectations are based upon reasonable assumptions, no assurance

can be given that our goals will be achieved, including statements

regarding our ability to successfully close the offering and to use

the net proceeds as indicated above. Actual results may vary

materially. We undertake no obligation to publicly update or revise

any forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200109005886/en/

Genesis Energy, L.P. Ryan Sims SVP – Finance and Corporate

Development (713) 860-2521

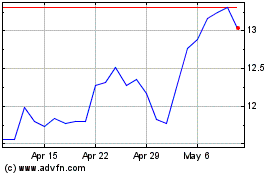

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

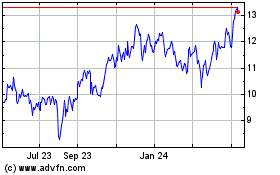

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Apr 2023 to Apr 2024