Investors Turning Up Noses at Food Companies -- Heard on the Street

December 17 2020 - 11:33AM

Dow Jones News

By Aaron Back

No matter what food companies serve up these days, investors

seem to be left unsatisfied.

General Mills reported excellent results Thursday. Net sales

during the quarter ended Nov. 29 rose 7% from a year earlier. This

was led by 18% sales growth for both its pet-food segment and North

America meals and baking, which includes brands such as Progresso

soup and Pillsbury biscuits. Earnings per share rose 17% to $1.11,

well past analyst expectations for 97 cents, according to

FactSet.

Yet shares were only slightly higher in Thursday morning

trading. Last week, Campbell Soup's stock fell after it reported

similarly strong figures. Investors are refusing to believe that

the good times can last once Americans start commuting to work

again, restaurants fully reopen, and more meals are again consumed

outside the home.

For months, food companies have presented a well-reasoned case

why at least some of the sales boost will persist. Families that

have invested in new kitchen equipment and learned new cooking

skills are likely to keep on cooking, they argue. Yet investors

remain unconvinced. General Mills is up around 10% so far this

year, compared with a 15% rise in the S&P 500. Campbell is down

by about 5%.

On Thursday's conference call, General Mills Chief Executive

Jeff Harmening bolstered the argument, pointing to real-world

evidence from two countries where the worst of the pandemic has

already passed: China and Australia. General Mills owns a Chinese

frozen dumpling brand, Wanchai Ferry, which is still seeing

double-digit sales growth five or six months after lockdowns in the

country have ended, he said.

"Consumer eating habits aren't going to go back where they were

before," he said.

Investor skepticism about food stocks is starting to make them

look like outright bargains compared with other pandemic winners

such as Clorox and Procter & Gamble, which are trading at 25

and 24 times forward earnings respectively, according to FactSet.

By contrast, General Mills goes for 16 times forward earnings, and

Campbell just 15 times. Yet it seems just as likely, if not more

so, that sales of soups and baking mixes will stay elevated after

the pandemic as disinfecting wipes and toilet paper.

For those looking for income in a zero-rate world, food stocks

offer better payouts as well. General Mills and Campbell yield 3.4%

and 3.1%, respectively, compared with 2.2% and 2.3% for Clorox and

P&G.

Food stocks are shaping up to be one of the rare value plays in

today's market. Investors should consider coming back to the

table.

Write to Aaron Back at aaron.back@wsj.com

(END) Dow Jones Newswires

December 17, 2020 11:18 ET (16:18 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

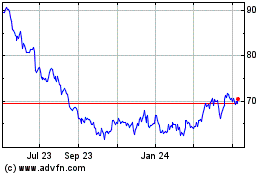

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

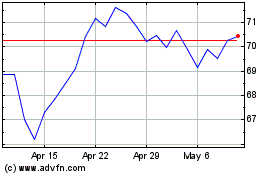

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024