Raytheon Boosts 2019 Outlook

July 25 2019 - 8:06AM

Dow Jones News

By Doug Cameron

Raytheon Co. said Thursday that export sales helped drive record

bookings as it joined U.S. defense peers in boosting full-year

profit guidance.

The missiles and missile-defense specialist said sales and

profits exceeded expectations in the June quarter as its backlog

climbed to $43.1 billion, up 8% from a year ago.

Domestic and overseas military spending has driven improved

outlooks for most of the big defense contractors, with Lockheed

Martin Corp., Northrop Grumman Corp. and General Dynamics Corp. all

boosting their 2019 outlooks.

Boeing Co. has shelved financial guidance, though the backlog at

its defense arm dropped in the June quarter.

Raytheon's outlook is notable as the company's growth outlook

underpins its plans to merge with United Technologies Corp., to

form the world's second-largest aerospace and defense company by

sales after Boeing.

The proposed deal has received a mixed reception from investors,

with some activists pushing for it to be dropped, arguing that

Raytheon's defense-focused business doesn't mix well with the more

commercially focused United Technologies aerospace business.

Raytheon's profits rose to $813 million in the June quarter from

$791 million a year earlier, with per-share earnings climbing to

$2.92 from $2.78. Sales rose 8.1% to $7.16 billion.

Full-year sales guidance was raised by $200 million to $29.05

billion at the midpoint, with lower interest expense raising its

EPS outlook by 10 cents to $11.60 at the midpoint.

Raytheon shares rose 1% in pre-open trade.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

July 25, 2019 07:51 ET (11:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

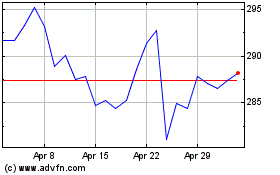

General Dynamics (NYSE:GD)

Historical Stock Chart

From Mar 2024 to Apr 2024

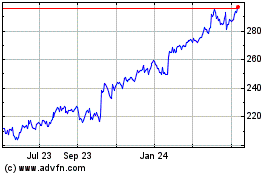

General Dynamics (NYSE:GD)

Historical Stock Chart

From Apr 2023 to Apr 2024