By Thomas Gryta

TARRYTOWN, N.Y. -- General Electric Co. shareholders approved

the company's executive compensation plans and rejected a proposal

to appoint an independent chairman, but both measures garnered high

levels of protest votes after two difficult years for the

conglomerate.

At its annual meeting, GE said about 30% of votes that were cast

voted against GE's executive compensation plans and about 27% voted

in favor of separating the roles of chairman and CEO.

In response to a retiree who called for the company to halt

supplemental pension payments to former CEO Jeff Immelt., current

Chief Executive Larry Culp said, "If serious misconduct is

uncovered clawbacks would be in order." However, Mr. Culp said the

bar for clawbacks is high, beyond just business decisions that

didn't go as anticipated.

His comments came as shareholders gathered to elect an

overhauled board. The incoming directors have an average tenure of

only 2 1/2 years and are led by a pair of outsiders who joined just

a year ago: Mr. Culp and the lead independent director, Thomas

Horton.

The new leadership is a departure for a company that was once so

cozy with its board that it had to set a 15-year term limit to

ensure directors didn't stick around too long. But GE is operating

in a much different environment than it was just a few years

ago.

The company lost $200 billion in market value over 2017 and 2018

as it faced problems in its power and financial-services divisions

that were compounded by unrealistic performance goals and spending

decisions that led to two dividend cuts. The problems raised

questions about the board's oversight when Mr. Immelt was chairman

and CEO.

Mr. Immelt left in 2017, and several of GE's longest-serving

directors said they would do the same. In October, the company put

Mr. Culp in charge just months after he joined the board.

On Wednesday, shareholders gave an ovation to Mr. Culp, who said

he is trying to increase interactions with shareholders at all

levels.

"Good words and tough questions are welcome in equal measure,"

he said.

He reviewed his priorities of paying down debt and turning

around the power business. He went through the 2019 financial

targets, including negative cash flow of up to $2 billion, which he

said is "still tough for me to say that out loud."

Mr. Culp is facing GE shareholders for the first time. He

previously led the smaller conglomerate Danaher Corp. Early

Wednesday he said that Danaher's meetings were very small and

subdued. "If we had 12 people show up, we had to order more

catering," he said.

Many retirees typically attend the annual gathering to voice

frustration with changes to their benefits. Last year, at a GE

factory near Pittsburgh, union protesters gathered outside.

GE retiree Dennis Rocheleau submitted a proposal seeking to claw

back compensation from former top executives, who he said set

unrealistic financial forecasts and misspent billions of dollars on

stock buybacks.

"Immelt needs to be held accountable," Mr. Rocheleau said before

the meeting. GE requested that his proposal be excluded from the

proxy, which the Securities and Exchange Commission granted, saying

that it was an attempt to micromanage the board's decisions.

GE's board explored naming an independent chairman when it

switched CEOs last year but opted to give both roles to Mr. Culp,

saying it would provide clarity on decision-making and

accountability.

The major proxy advisory firms, ISS and Glass Lewis, disagreed.

They recommend having an independent chairman to improve

governance, and both opposed GE's executive compensation plans. Mr.

Culp received a special stock award to join GE that the company

valued at $13.7 million. ISS, using a different method of

calculating incentive compensation, valued it at $37.8 million.

Last month, the board's compensation committee wrote a letter

encouraging shareholders to endorse the pay plans, saying they

should be considered in the context of hiring attractive

candidates.

GE, whose accounting is being investigated by federal

authorities, has promised to look into replacing KPMG LLP as its

auditor, a role it has held for more than a century. In April 2018,

35% of GE shareholders voted against KPMG remaining as GE's

auditor, an unusually high amount of opposition. Only about 11% of

votes were cast against KPMG this year.

ISS supported KPMG continuing as auditor, citing GE's planned

process to find a replacement. Glass Lewis didn't, however, saying

shareholders should send a message that change is needed.

Mr. Culp is continuing the work of his predecessor, John

Flannery, a GE lifer who sought to reshape the board after 16 years

of Mr. Immelt at the helm. The board has met 15 times in each of

the past two years, according to proxy filings, but will reduce the

number of regularly scheduled meetings in 2019 to six from eight to

"permit senior leadership to focus on management." The board will

still hold regular conference calls every few weeks.

The board is down to 10 members from 18, but two more directors

will eventually join. Six of the 10 are new since Mr. Immelt

retired, and eight joined after 2016, including Ed Garden,

co-founder of the activist investor Trian Fund Management LP.

On Wednesday, Mr. Culp highlighted the fresh perspective of the

new smaller board that "can get around a smaller table and a

smaller room."

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

May 08, 2019 13:16 ET (17:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

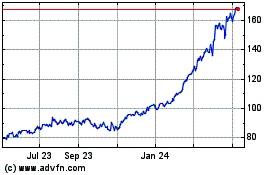

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

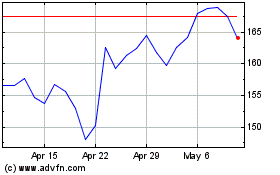

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024