By William Boston and Mike Colias

BERLIN -- Ford Motor Co. detailed plans to close factories in

Europe and cut 12,000 jobs, or more than 20% of the company's

workforce there, an effort to return to a profit in the region and

focus on technologies that are reshaping the auto industry.

The moves are part of a revamp of Ford's unprofitable European

operations announced in January and a broader cost-cutting effort

as the company pivots toward electric vehicles and autonomous

driving. Ford said it would cut its European manufacturing

footprint to 18 plants from 24 by the end of 2020.

As part of the overhaul in Europe, where auto makers are

struggling with sluggish consumer demand after years of growth, the

company aims to focus more on imported passenger cars and locally

built, higher-margin commercial vehicles.

The move is the latest example of a big U.S. car maker

retreating from Europe, which has high labor costs and is in the

process of adopting some of the strictest emissions regimes in the

world.

Ford and rival General Motors Co. for decades expanded their

factory footprints and built sales forces across far-flung regions

to build scale in a capital-intensive business. But in recent years

each has trimmed its global presence, redirecting investment to

their strengths, namely truck and sport-utility vehicles.

Ford shares rose nearly 3% in morning trading Thursday. Shares

have rallied 33% this year amid an emerging view among some

investors that Chief Executive Jim Hackett's turnaround plan is

beginning to gain traction.

Mr. Hackett has been under pressure from analysts who have

questioned whether he is moving quickly enough to boost

profitability. The company has outlined recent restructuring moves

globally that have soothed investors. The auto maker last month

said it is cutting 7,000 salaried positions and it is overhauling

its money-losing South America business.

Mr. Hackett still has a long road to recovery, though. Ford lost

money in each of its overseas businesses last year, including a

$1.5 billion loss in China, where the company had until recently

been profitable. Mr. Hackett recently installed a new management

team in China to lead the turnaround effort there.

The announcement in Europe adds key details to several

statements that Ford has made since unveiling plans for a global

restructuring last October. In January, Ford said the job cuts

would hit a "significant number of the 50,000 we employ" in Europe,

as it aimed to turn European losses into a 6% profit margin in the

next few years. Ford has since unveiled plans for deep cuts in

Germany, France, the U.K. and Russia.

"The cuts are very broad-based," Stuart Rowley, president of

Ford's European business, told reporters on a conference call.

"Ford will be a more targeted business in Europe, consistent with

the company's global redesign, generating higher returns through

our focus on customer needs and a lean structure."

The overhaul comes as the industry is under pressure from

demands by European regulators to meet tougher greenhouse-gas

emissions limits next year, waning demand as European car sales are

expected to fall for the first time in six years, and uncertainty

amid global trade tensions and a slowing economy.

The company said stepped-up imports would consist of "a niche

portfolio of iconic passenger vehicles" that would include the

Mustang, the Explorer and a new fully electric sport-utility

vehicle.

"Ford's plan may be more comprehensive than appears at first

blush," Bank of America analyst John Murphy wrote in a research

note last month, when he raised his rating on Ford shares to a

buy.

GM exited Europe in 2017 by selling its business to French car

maker PSA Group, citing the toughening regulatory environment and

its own middling position in Europe. GM has said that it wants to

compete only in markets where it can be a top-two player, leaving

it focused on North America, China and South America.

Ford is No. 6 by sales in Europe, with a 6.3% market share this

year through May. The strategy outlined Thursday is focused more on

boosting profitability than lifting sales volume. Its

commercial-van business in Europe is 14% with "great

profitability," Ford strategy chief Jim Farley told analysts

earlier this year.

The reduction in European manufacturing will result in the loss

of around 5,000 jobs in Germany, and 3,000 in the U.K., more than

2,000 in Russia and nearly 1,000 through the closure of a plant in

the Bordeaux region of France.

Ford has about 51,000 employees in Europe, and almost 200,000

world-wide as of last year.

Ford has struggled to generate consistent profits in Europe for

years. In addition to the streamlining of its European business,

Ford and Volkswagen AG recently said they would create an alliance

to produce light commercial vehicles. Mr. Rowley said the talks,

which are expected to conclude soon, were on track. He declined to

elaborate.

In addition, Ford has been negotiating with local trade unions,

which have more say over such restructuring measures than labor

representatives in the U.S., about a number of plant closures.

Ford has also agreed to sell its Kechnec transmission plant in

Slovakia to Magna International Inc., an automotive supplier.

Those talks have now been concluded and Mr. Rowley said the bulk

of the job cuts would be completed by the end of next year.

--Nathan Allen contributed to this article.

Write to William Boston at william.boston@wsj.com and Mike

Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

June 27, 2019 11:39 ET (15:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

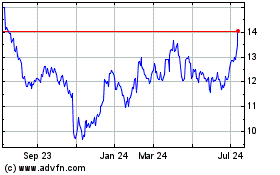

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

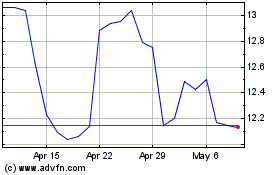

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024