UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

|

☐

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

☒

|

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2020 Commission File Number 001-34984

FIRST MAJESTIC SILVER CORP.

(Exact name of registrant as specified in its charter)

|

British Columbia, Canada

|

1041

|

Not Applicable

|

|

(Province or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification

Number)

|

925 West Georgia Street, Suite 1800

Vancouver, British Columbia V6C 3L2, Canada

(604) 688-3033

(Address and telephone number of Registrant's principal executive offices)

National Registered Agents, Inc.

1090 Vermont Avenue N.W., Suite 910

Washington D.C. 20005

(202) 371-8090

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

_____________

Securities to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

Common Shares, no par value

|

Trading Symbol

AG

|

Name of each exchange on which registered

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form.

☒ Annual information form ☒ Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. 222,804,476

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes X No ___

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes X No ___

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ___

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

___

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes X No ___

NOTE TO UNITED STATES READERS - DIFFERENCES

IN UNITED STATES AND CANADIAN REPORTING PRACTICES

First Majestic Silver Corp. (the "Company" or the "Registrant") is permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare this annual report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements (the "Audited Financial Statements") in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

The AIF filed as Exhibit 99.1 to this annual report on Form 40-F has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") -CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission ("SEC") rules and regulations applicable to domestic United States companies

Accordingly, information contained in this annual report on Form 40-F and the documents incorporated by reference herein containing descriptions of the Company's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

ANNUAL INFORMATION FORM

The AIF is filed as Exhibit 99.1 to, and incorporated by reference in, this annual report on Form 40-F.

AUDITED ANNUAL FINANCIAL STATEMENTS

The Audited Financial Statements for the year ended December 31, 2020, including the report of the independent registered public accounting firm with respect thereto, are filed as Exhibit 99.2 to, and incorporated by reference in, this annual report on Form 40-F. Such Audited Financial Statements have been amended from the version initially furnished under cover of Form 6-K on February 18, 2021, in order to correct certain typographical errors contained therein. Specifically, the corrections are changes to the Consolidated Statements of Financial Position and Note 4 to correct arithmetical errors for the 2019 total assets and total liabilities and Note 23(a) to correct typographical errors to the tabular number of shares issued and tabular net proceeds from the Company's ATM Program during the year ended December 31, 2019.

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Company's management's discussion and analysis of results of operations and financial condition for the year ended December 31, 2020 is filed as Exhibit 99.3 to, and incorporated by reference in, this annual report on Form 40-F.

CERTIFICATIONS

See Exhibits 99.4, 99.5, 99.6 and 99.7, which are included as Exhibits to this annual report on Form 40-F.

DISCLOSURE CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

At the end of the period covered by this annual report on Form 40-F, the Company's management, with the participation of its President and Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO"), has evaluated the effectiveness of the Company's disclosure controls and procedures. Based upon the results of that evaluation, the Company's CEO and CFO have concluded that, as of December 31, 2020, the Company's disclosure controls and procedures were effective to provide reasonable assurance that the information required to be disclosed by the Company in reports it files is recorded, processed, summarized and reported, within the appropriate time periods and is accumulated and communicated to management, including the CEO and CFO, as appropriate to allow timely decisions regarding required disclosure.

Internal Control over Financial Reporting

The Company's management, with the participation of its CEO and CFO, is responsible for establishing and maintaining adequate internal control over financial reporting as such term is defined in the rules of the United States Securities and Exchange Commission and the Canadian Securities Administrators. The Company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS as issued by the IASB. The Company's internal control over financial reporting includes policies and procedures that:

-

maintain records that accurately and fairly reflect, in reasonable detail, the transactions and dispositions of assets of the Company;

-

provide reasonable assurance that transactions are recorded as necessary for preparation of financial statements in accordance with IFRS as issued by the IASB;

-

provide reasonable assurance that the Company's receipts and expenditures are made only in accordance with authorizations of management and the Company's Directors; and

-

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company's assets that could have a material effect on the Company's consolidated financial statements.

The Company's internal control over financial reporting may not prevent or detect all misstatements because of inherent limitations. Additionally, projections of any evaluation of effectiveness for future periods are subject to the risk that controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with the Company's policies and procedures.

The Company's management evaluated the effectiveness of our internal control over financial reporting based upon the criteria set forth in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on management's evaluation, our CEO and CFO concluded that our ICFR was effective as of December 31, 2020.

There has been no change in the Company's internal control over financial reporting during the year ended December 31, 2020 that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

The Company's independent registered public accounting firm, Deloitte LLP, has audited the Audited Financial Statements for the year ended December 31, 2020, filed as Exhibit 99.2, and has issued an attestation report dated February 18, 2021 on the Company's internal control over financial reporting based on the criteria set forth in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

Limitations of Controls and Procedures

The Company's management, including the President and Chief Executive Officer and Chief Financial Officer, believes that any disclosure controls and procedures or internal control over financial reporting, no matter how well conceived and operated, may not prevent or detect all misstatements because of inherent limitations. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, they cannot provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been prevented or detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by unauthorized override of the control. The design of any control system also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost effective control system, misstatements due to error or fraud may occur and not be detected.

AUDIT COMMITTEE

Audit Committee

The Company's board of directors has a separately designated standing audit committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The members of the Company's audit committee are identified on page 116 of the AIF, filed as Exhibit 99.1 and incorporated by reference herein. In the opinion of the Company's board of directors, all members of the audit committee are independent (as determined under Rule 10A-3 of the Exchange Act and the rules of the New York Stock Exchange) and are financially literate.

Audit Committee Financial Expert

The Company's board of directors has determined that Douglas Penrose is an audit committee financial expert, as such term is defined in Form 40-F, in that he has an understanding of generally accepted accounting principles and financial statements; is able to assess the general application of accounting principles, including, in connection with the accounting for estimates, accruals and reserves; has experience preparing, auditing, analyzing or evaluating financial statements that entail accounting issues of equal breadth and complexity to the Company's financial statements (or actively supervising another person who did so); has an understanding of internal controls and procedures for financial reporting; and has an understanding of audit committee functions

CODE OF ETHICS

The Company has adopted a written Code of Ethical Conduct that qualifies as a "code of ethics" within the meaning of such term in Form 40-F. A copy of this code is available on the Company's website at http://www.firstmajestic.com or to any person without charge, by written request addressed to: First Majestic Silver Corp., Attention: Corporate Secretary, Suite 1800 - 925 West Georgia Street, Vancouver, British Columbia V6C 3L2 Canada (604) 688-3033, or by email (info@firstmajestic.com).

If any amendment to the Code of Ethical Conduct is made, or if any waiver from the provisions thereof is granted, the Company may elect to disclose the information about such amendment or waiver required by Form 40-F to be disclosed, by posting such disclosure on the Company's website, which may be accessed at www.firstmajestic.com.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Deloitte LLP acted as the Company's independent registered public accounting firm for the financial year ended December 31, 2020. See page 117 of the AIF, which is attached hereto as Exhibit 99.1, for the total amount billed to the Company by Deloitte LLP for services performed in the last two financial years by category of service (for audit fees, audit-related fees, tax fees and all other fees) in United States dollars.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

See Appendix "A" of the AIF filed as Exhibit 99.1 hereto and incorporated by reference herein.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors, or relationships with unconsolidated special purpose entities.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The information provided under the heading "Management's Discussion and Analysis - Management of Risks and Uncertainties - Liquidity Risk" contained in Exhibit 99.3 hereto contains the Company's disclosure of contractual obligations and is incorporated by reference herein.

NEW YORK STOCK EXCHANGE DISCLOSURE

Presiding Director at Meetings of Non-Management Directors

The Company schedules regular executive sessions in which the Company's "non-management directors" (as that term is defined in the rules of the New York Stock Exchange) meet without management participation. Douglas Penrose serves as the presiding director (the "Presiding Director") at such sessions. Each of the Company's non-management directors is "independent" within the meaning of the rules of the New York Stock Exchange.

The Company also holds executive sessions at least four times per year in which the Company's independent directors meet without participation from management or non-independent directors.

Communication with Non-Management Directors

Shareholders may send communications to the Company's non-management directors by writing to Douglas Penrose, Chairman of the board of directors, c/o Corporate Secretary, First Majestic Silver Corp., 925 West Georgia Street, Suite 1800, Vancouver, British Columbia, V6C 3L2. Communications will be referred to the Presiding Director for appropriate action. The status of all outstanding concerns addressed to the Presiding Director will be reported to the board of directors as appropriate.

Board Committee Mandates

The Charters of the Company's audit committee, compensation and nominating committee, and governance committee are each available for viewing on the Company's website at www.firstmajestic.com.

NYSE Statement of Governance Differences

As a Canadian corporation listed on the NYSE, the Company is not required to comply with most of the NYSE corporate governance standards, so long as it complies with Canadian corporate governance practices. In order to claim such an exemption, however, the Company must disclose the significant difference between its corporate governance practices and those required to be followed by U.S. domestic companies under the NYSE's corporate governance standards. The Company has included a description of such significant differences in corporate governance practices on its website, which may be accessed at www.firstmajestic.com.

UNDERTAKINGS

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file this annual report on Form 40-F arises.

EXHIBIT INDEX

|

Exhibit

|

Description

|

|

99.1

|

Annual Information Form of the Company for the year ended December 31, 2020

|

|

99.2

|

Audited consolidated financial statements of the Company and the notes thereto for the years ended December 31, 2020 and 2019, together with the reports of the independent registered public accounting firm

|

|

99.3

|

Management's Discussion and Analysis for the year ended December 31, 2020

|

|

99.4

|

CEO Certification pursuant to Rule 13a-14(a) or 15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

99.5

|

CFO Certification pursuant to Rule 13a-14(a) or 15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

99.6

|

CEO Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

99.7

|

CFO Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

99.8

|

Consent of Ramon Mendoza Reyes, P. Eng., Vice President Technical Services of First Majestic Silver Corp.

|

|

99.9

|

Consent of Gregory Kenneth Kulla, P. Geo., Vice President of Exploration of First Majestic Silver Corp.

|

|

99.10

|

Consent of Persio Rosario, P. Eng., Vice-President of Processing, Metallurgy and Innovation

|

|

99.11

|

Consent of Maria E. Vazquez, P. Geo., Geological Database Manager of First Majestic Silver Corp.

|

|

99.12

|

Consent of Phillip J. Spurgeon, P. Geo., Senior Resource Modeler of First Majestic Silver Corp.

|

|

99.13

|

Consent of Brian Boutilier, P.Eng. Manager of Technical Services

|

|

99.14

|

Consent of David Rowe, CPG, Principal Resource Geologist

|

|

99.15

|

Consent of Joaquin Merino, P. Geo.

|

|

99.16

|

Consent of Deloitte LLP, Independent Registered Public Accounting Firm

|

|

101.INS

|

XBRL Instance Document

|

|

101.SCH

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

XBRL Taxonomy Definition Linkbase Document

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: March 31, 2021

|

|

FIRST MAJESTIC SILVER CORP.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Keith Neumeyer

|

|

|

|

Keith Neumeyer

|

|

|

|

Chief Executive Officer

|

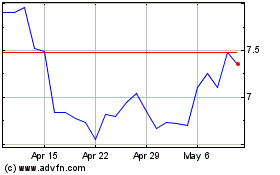

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Mar 2024 to Apr 2024

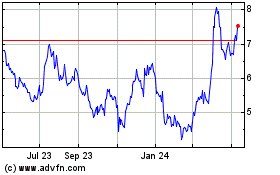

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Apr 2023 to Apr 2024