FIS, Global Payments Held Unsuccessful Talks to Merge

December 20 2020 - 1:54PM

Dow Jones News

By Cara Lombardo and Dana Cimilluca

Fidelity National Information Services Inc. and Global Payments

Inc. recently held unsuccessful talks for a merger deal that could

have been valued at around $70 billion, people familiar with the

matter said, in a sign that a wave of consolidation is still

sweeping through the payments industry.

The companies, which make technology that facilitates merchant

payments and banking, were in advanced talks and aiming to announce

a deal this coming week before the negotiations broke down in the

last few days, the people said. It couldn't be learned what

specifically caused them to falter.

Had the companies managed to strike a deal, it would have been

the biggest of the year by far, eclipsing several transactions

valued at about $40 billion, according to Dealogic. Global Payments

has a market capitalization of nearly $59 billion. Fidelity

National, widely known as FIS, has a market value of around $90

billion.

Though there is little prospect of the talks coming back to life

imminently, they could get revived later, some of the people

said.

Atlanta-based Global Payments primarily provides technology and

point-of-sale services to merchants. A combination would have

expanded FIS's merchant-facing business, which currently accounts

for roughly 20% of its revenue. The bulk of the Jacksonville, Fla.,

company's revenue last year came from serving banks, helping them

with such tasks as commercial lending and risk management.

There has been a rush of dealmaking in the sector in recent

years as established companies seek to gain economies of scale and

better compete with upstarts. Early last year, Fiserv Inc. agreed

to pay about $22 billion for First Data Corp. Then FIS struck a $35

billion deal for Worldpay Inc., the largest payments deal to date.

Months later, Global Payments did a roughly $22 billion deal for

Total Systems Services Inc., which was better known as TSYS.

FIS's deal for Worldpay, which closed in July 2019, expanded its

merchant business and brought it into more countries. Global

Payments's purchase of TSYS closed in September 2019 and was meant

to expand its e-commerce presence in the U.S. and boost market

share.

Both companies' chief executives -- FIS's Gary Norcross and

Jeffrey Sloan of Global Payments -- are experienced dealmakers and

influential figures in a sector with a shrinking number of major

players. Mr. Norcross in particular has been open about wanting to

continue to grow through acquisitions.

One question likely to have arisen had they struck a deal is

whether it would have passed muster with regulators, given it would

merge two of the largest companies in the payments industry. But

the ground is shifting given the rapid rise of newer rivals such as

Adyen NV, Square Inc. and Stripe Inc.

The abortive deal is a fitting coda to an erratic year of

dealmaking. The pandemic brought mergers and acquisitions to a

virtual halt early in 2020 that persisted through the second

quarter. But activity soon snapped back with several megadeals --

especially among sectors that weathered the crisis relatively well

such as technology and health care -- and the year's global deal

volume trails last year's by just 8%, according to Dealogic.

Together with AstraZeneca PLC's agreement to buy Alexion

Pharmaceuticals Inc. for $39 billion, the payments talks underscore

what many dealmakers have been saying for weeks -- that with stock

prices high, interest rates at rock-bottom levels and many sectors

of the economy performing well, the ground is fertile for more big

mergers heading into next year.

--Peter Rudegeair contributed to this article.

(END) Dow Jones Newswires

December 20, 2020 13:39 ET (18:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

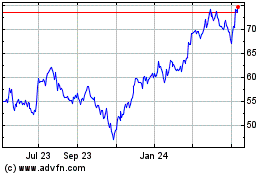

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

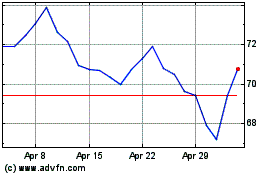

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Apr 2023 to Apr 2024