Current Report Filing (8-k)

September 23 2019 - 4:22PM

Edgar (US Regulatory)

FEDEX CORP false 0001048911 0001048911 2019-09-23 2019-09-23 0001048911 us-gaap:CommonStockMember 2019-09-23 2019-09-23 0001048911 fdx:M0.700NotesDue20224Member 2019-09-23 2019-09-23 0001048911 fdx:M1.000NotesDue20231Member 2019-09-23 2019-09-23 0001048911 fdx:SeniorUnsecuredDebtDue2025Member 2019-09-23 2019-09-23 0001048911 fdx:M1.625NotesDue20272Member 2019-09-23 2019-09-23 0001048911 fdx:M1.300NotesDue20313Member 2019-09-23 2019-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 23, 2019

FedEx Corporation

(Exact name of registrant as specified in its charter)

Commission File Number 1-15829

|

|

|

|

|

Delaware

|

|

62-1721435

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

942 South Shady Grove Road, Memphis, Tennessee

|

|

38120

|

|

(Address of principal executive offices)

|

|

(ZIP Code)

|

Registrant’s telephone number, including area code: (901) 818-7500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.10 per share

|

|

FDX

|

|

New York Stock Exchange

|

|

0.700% Notes due 2022

|

|

FDX 22B

|

|

New York Stock Exchange

|

|

1.000% Notes due 2023

|

|

FDX 23A

|

|

New York Stock Exchange

|

|

0.450% Notes due 2025

|

|

FDX 25A

|

|

New York Stock Exchange

|

|

1.625% Notes due 2027

|

|

FDX 27

|

|

New York Stock Exchange

|

|

1.300% Notes due 2031

|

|

FDX 31

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 5. CORPORATE GOVERNANCE AND MANAGEMENT.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e) At the annual meeting of FedEx’s stockholders held on September 23, 2019, FedEx’s stockholders, upon the recommendation of the Board of Directors, approved the FedEx Corporation 2019 Omnibus Stock Incentive Plan (the “Plan”).

A summary of the Plan was included as part of Proposal 3 in FedEx’s definitive proxy statement filed with the Securities and Exchange Commission on August 12, 2019. The summary of the Plan contained in the proxy statement is qualified by and subject to the full text of the Plan, which was included as Appendix D to the proxy statement and incorporated herein by reference.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

(a) FedEx’s annual meeting of stockholders was held on September 23, 2019.

(b) The stockholders took the following actions at the annual meeting:

Proposal 1: The stockholders elected twelve directors, each of whom will hold office until the annual meeting of stockholders to be held in 2020 and until his or her successor is duly elected and qualified. Each director received more votes cast “for” than votes cast “against” his or her election. The tabulation of votes with respect to each nominee for director was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

Votes

For

|

|

|

Votes

Against

|

|

|

Abstentions

|

|

|

Broker

Non-Votes

|

|

|

Frederick W. Smith

|

|

|

188,660,231

|

|

|

|

5,707,743

|

|

|

|

556,100

|

|

|

|

30,426,270

|

|

|

John A. Edwardson

|

|

|

188,171,506

|

|

|

|

6,562,155

|

|

|

|

190,412

|

|

|

|

30,426,270

|

|

|

Marvin R. Ellison

|

|

|

189,559,979

|

|

|

|

5,167,640

|

|

|

|

196,455

|

|

|

|

30,426,270

|

|

|

Susan Patricia Griffith

|

|

|

192,971,867

|

|

|

|

1,752,001

|

|

|

|

200,205

|

|

|

|

30,426,270

|

|

|

John C. (“Chris”) Inglis

|

|

|

189,984,230

|

|

|

|

4,745,840

|

|

|

|

194,004

|

|

|

|

30,426,270

|

|

|

Kimberly A. Jabal

|

|

|

192,219,635

|

|

|

|

2,517,509

|

|

|

|

186,930

|

|

|

|

30,426,270

|

|

|

Shirley Ann Jackson

|

|

|

179,770,514

|

|

|

|

14,973,418

|

|

|

|

180,142

|

|

|

|

30,426,270

|

|

|

R. Brad Martin

|

|

|

192,303,909

|

|

|

|

2,419,330

|

|

|

|

200,834

|

|

|

|

30,426,270

|

|

|

Joshua Cooper Ramo

|

|

|

192,182,069

|

|

|

|

2,547,524

|

|

|

|

194,481

|

|

|

|

30,426,270

|

|

|

Susan C. Schwab

|

|

|

189,295,699

|

|

|

|

5,442,788

|

|

|

|

185,587

|

|

|

|

30,426,270

|

|

|

David P. Steiner

|

|

|

190,909,207

|

|

|

|

3,697,073

|

|

|

|

317,793

|

|

|

|

30,426,270

|

|

|

Paul S. Walsh

|

|

|

176,231,359

|

|

|

|

18,306,940

|

|

|

|

385,775

|

|

|

|

30,426,270

|

|

Proposal 2: The compensation of FedEx’s named executive officers was approved, on an advisory basis, by stockholders. The tabulation of votes on this matter was as follows:

|

|

•

|

145,755,087 votes for (74.8% of the voted shares)

|

|

|

•

|

48,605,773 votes against (24.9% of the voted shares)

|

|

|

•

|

563,214 abstentions (0.3% of the voted shares)

|

|

|

•

|

30,426,270 broker non-votes

|

Proposal 3: The Plan was approved by stockholders. The tabulation of votes on this matter was as follows:

|

|

•

|

181,001,729 votes for (92.9% of the voted shares)

|

|

|

•

|

13,469,582 votes against (6.9% of the voted shares)

|

|

|

•

|

452,763 abstentions (0.2% of the voted shares)

|

|

|

•

|

30,426,270 broker non-votes

|

Proposal 4: The Audit Committee’s designation of Ernst & Young LLP as FedEx’s independent registered public accounting firm for the fiscal year ending May 31, 2020 was ratified by stockholders. The tabulation of votes on this matter was as follows:

|

|

•

|

221,752,796 votes for (98.4% of the voted shares)

|

|

|

•

|

3,250,962 votes against (1.4% of the voted shares)

|

|

|

•

|

346,586 abstentions (0.2% of the voted shares)

|

|

|

•

|

There were no broker non-votes for this item.

|

Proposal 5: A stockholder proposal requesting that FedEx provide a report, updated annually, disclosing information about the corporation’s lobbying activities and expenditures was not approved by stockholders. The tabulation of votes on this matter was as follows:

|

|

•

|

50,516,164 votes for (25.9% of the voted shares)

|

|

|

•

|

143,504,166 votes against (73.6% of the voted shares)

|

|

|

•

|

903,743 abstentions (0.5% of the voted shares)

|

|

|

•

|

30,426,270 broker non-votes

|

Proposal 6: A stockholder proposal requesting that the Board of Directors provide a report describing opportunities for FedEx to encourage non-management employee representation on the Board was not approved by stockholders. The tabulation of votes on this matter was as follows:

|

|

•

|

7,594,513 votes for (3.9% of the voted shares)

|

|

|

•

|

185,681,853 votes against (95.3% of the voted shares)

|

|

|

•

|

1,647,708 abstentions (0.9% of the voted shares)

|

|

|

•

|

30,426,270 broker non-votes

|

SECTION 8. OTHER EVENTS.

Attached as Exhibit 99.2 and incorporated herein by reference is a copy of FedEx Corporation’s updated compensation arrangements with outside directors.

SECTION 9. FINANCIAL STATEMENTS AND EXHIBITS.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FedEx Corporation

|

|

|

|

|

|

|

|

|

|

Date: September 23, 2019

|

|

|

|

By:

|

|

/s/ Mark R. Allen

|

|

|

|

|

|

|

|

Mark R. Allen

|

|

|

|

|

|

|

|

Executive Vice President,

|

|

|

|

|

|

|

|

General Counsel and Secretary

|

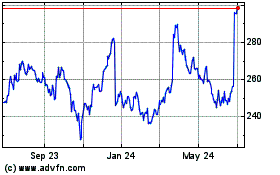

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

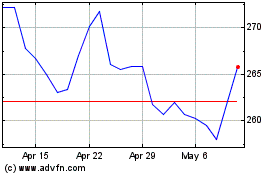

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024