FedEx Shares Plummet Following Dismal Results

September 18 2019 - 1:27PM

Dow Jones News

By Paul Ziobro

FedEx Corp. shares plunged the most in a decade after the

company's global Express business showed its vulnerability to

global trade disruptions.

The Memphis, Tenn.-based delivery giant on Tuesday cut its

earnings guidance for the fiscal year citing lower revenue

projections in its Express unit, which ferries packages and cargo

by planes around the world. With weaker macroeconomic conditions

and uncertainty stemming from trade disputes across the globe,

FedEx foresees fewer shipments moving across borders.

"The biggest impact was at Express and that was international

with a large degree of that in Europe," FedEx Chief Financial

Officer Alan Graf said on Tuesday's earnings call.

FedEx shares were down nearly 14% in midday trading Wednesday to

$149.27, on track for its largest one-day drop since 2008. The

decline wiped out more than $6 billion in market

capitalization.

FedEx reported an 11% decline in earnings for its fiscal first

quarter when excluding integration expenses tied to its acquisition

of the European carrier TNT Express. It also cut its profit and

revenue forecasts, projecting per-share earnings to fall by as much

as 29% in the current fiscal year, compared with an expectation of

a mid-single-digit percentage decline issued in June.

FedEx Chief Executive Frederick Smith said Tuesday that the

company had expected a resolution to the U.S. trade dispute with

China as it entered its current fiscal year, but the "return to

normalcy" it hoped for hasn't taken place.

The Express business, the company's largest by revenue, posted a

3% drop in revenue for the quarter, while income fell 27%.

FedEx is trying to cut costs aggressively in the business,

though that won't happen until after the holiday shipping season,

when having that extra shipping capacity is vital due to the surge

in shipments.

Though the Express business is struggling, FedEx continues to

pour money into it, buying new aircraft and modernizing some of its

aging facilities in places like Memphis and Indianapolis with more

automation. Some analysts questioned the wisdom of doing so when

the business is in a down cycle.

FedEx executives defended the spending, projected at $5.9

billion over each of the next two fiscal years, as necessary.

Upgrading the hubs will allow FedEx to process packages faster and

with fewer workers, which are becoming harder to recruit, they said

on the earnings call. Meanwhile, the new aircraft are more

efficient to operate and more reliable, they said.

"The failure to do it is very dire," Mr. Smith said.

Mr. Graf said FedEx has already trimmed its future capital

spending and would consider further cuts if the U.S. enters into a

recession. "We'll definitely cut further," he said.

FedEx's results are also being hampered by the growth of

e-commerce. That trend provides ample volume to fill planes and

trucks but comes with additional costs, like those associated with

a looming rollout of Sunday delivery year round. Online packages

also are generally lighter weight and move shorter distances, so

the revenue per shipment is lower than other shipments that move

through the company's network.

"This is a structural issue, not a cyclical issue," said Satish

Jindel, president of SJ Consulting Inc., a parcel-industry research

firm. "The supply chain is changing."

FedEx is adding new services to cater to that change. It has

started to offer ground shipments where the package only travels

locally, shipping from, say, a Target Corp. store nearby. Mr. Smith

said that while the revenue on such shipments is lower, they have

higher margins because FedEx is now delivering more packages in

neighborhoods. That increased delivery density reduces costs.

"FedEx will be the low-cost, high-service producer," Mr. Smith

said. "You can put traffic in very, very late in the night or in

the morning, and at a lower cost than anybody, and I mean

anybody."

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

September 18, 2019 13:12 ET (17:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

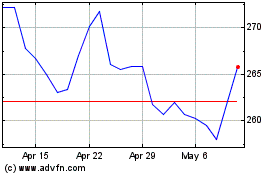

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

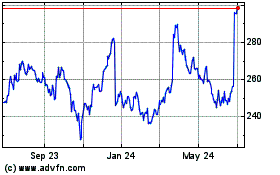

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024